Handling ESOP Shares & Taxes

/in Education, Financial Planning, Retirement, Taxes /by Cary FacerCary Facer

Wealth Advisor

Warren Street Wealth Advisors

Sometimes an employer’s benefits program can include an employee stock ownership plan, commonly referred to as an ESOP plan. An ESOP plan is an employee benefit that allows its company’s participants to purchase the common stock of their company. Those who participate often receive tax benefits for purchasing these shares, and companies believe that allowing their employees to purchase shares of the company will incentivize employees to perform well and boost the share price.

This is an excellent program to take advantage of if your company provides it, but there is something to be mindful of, which is: How can these shares impact my tax liability?

Well, the tax issue doesn’t become relevant until you approach retirement and begin to think about taking your balance out of the plan. When you become ready to do this, you are presented with two options on how to handle the balance.

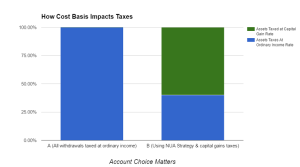

Option 1 is to take the shares from the ESOP program and roll them into an IRA. Taxes do not come due, but you will be liable for the taxes when you take a withdrawal from the account. The amount will be taxed at your current ordinary income rates.

Option 2 is to move the shares into a non-retirement account. In this method, the ESOP shares are moved in-kind and you pay ordinary income tax rates on the average cost basis of the shares, which is the average price you paid for all the shares you own and typically below market value. Then when the shares are sold within the account, the amount in excess of cost basis is taxed at long term capital gains rates.

It may seem like you’re paying taxes twice in the second option, but by taking advantage of net unrealized appreciation (or NUA), you might be able to save yourself on taxes in the long run. You see, long term capital gains rates are typically lower than a person’s income tax rates with capital gains being 0, 15, or 20%, so a person would be paying ordinary income tax on a portion, then long term capital gains on the remainder, again assuming the shares have been held for 1 year or longer.

This can be a tricky process, and most employee benefits programs only allow you to execute this process once. Make sure you have it right.

Warren Street Wealth Advisors has worked with employee ESOP shares before and executed NUA strategies. Contact Us today and schedule a free consultation on how to best handle your ESOP shares.

- This item is only used as an illustration of the strategy. The illustration does not indicate how all tax liabilities could play out. All investments carry specific risks and please consult your financial professional before making investment decisions.

Warren Street Wealth Advisors are not Certified Public Accountants (CPA), and this is not considered personal or actionable advice. Please consult with your accountant or financial professional for further guidance on whether an NUA strategy is right for you.

Disclosure: Cary Facer is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. The information posted here represents his opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.

It’s Your Stream, Your Money

/in Education, Financial Planning, Retirement, Taxes /by Cary FacerAs many have come to learn, taxes can be the most complicated part of being a full time content creator, streamer on Twitch or professional gamer. With some people being considered contractors or employees of a team, or both, it can be difficult to navigate your tax liability and learn how to reduce it.

However, there are solutions available. The biggest solution for those receiving a majority of their income via 1099 is the Solo 401(k) option, or “Solo(k)”. The Solo(k) is essentially a 401(k) plan but for a single person, and potentially a spouse, giving them the ability to defer their taxes and profit share themselves to help reduce tax liability come April.

So what can the Solo 401(k) do for a streamer or pro player?

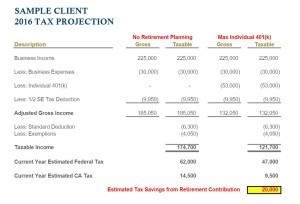

Table provided by Robert McConchie, CPA/PFS®

Table provided by Robert McConchie, CPA/PFS®

This example shows a streamer/player earning $225,000 in 1099 income, assumes $30,000 in business expenses across the year, a standard deduction (single person, 2016), and standard exemption (single person, 2016). Additionally, California state tax rate was used in conjunction with the Federal tax, and you can see the savings between utilizing and not utilizing the Solo 401(k), a $20,000 savings to be exact.

The savings comes from the $18,000 personal deferral then a profit share from the business of $35,000 for a max total deferral of $53,000 income within the year. Establishing a Solo 401(k) account is beneficial on multiple fronts; it allows you to set money aside for your retirement date, reduces your tax liability today, and can even be borrowed against should you find yourself in a pinch.

Now, for some streamers who are married, you have the ability to put your spouse on to your business’ payroll. How can that impact your tax savings come year end? Here’s a conservative estimate below.

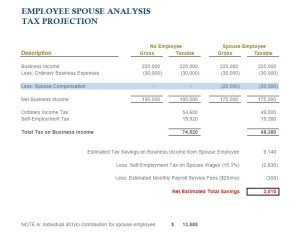

Table provided by Robert McConchie, CPA/PFS®

Using the same amount of income, we can see that tax savings can also be found by correctly setting up your business to include your spouse on payroll, a 401(k) contribution for them and take advantage of additional tax savings.

Opening a Solo 401(k) is one thing you can do, but you can see the immediate impact it can make for full time content creators.

The Solo 401(k) is one of many things that every content creator should do to help minimize their tax liability into the future. Don’t wait to open one. In order to receive the tax benefit, the account must be opened within the calendar year.

Contact us today to set up a free consultation and learn what you can do to maximize your tax savings for 2016 and into 2017.

Joe@Warrenstreetwealth.com

714.823.3328

www.warrenstreetwealth.com/esports

The contents of this article are not meant to be personal or actionable tax advice. Please consult a tax professional or your personal advisor before making any decisions. IRS & DOL guidelines must be carefully considered before choosing the retirement plan or tax advantaged savings vehicle that is right for you. The illustrations above are of hypothetical scenarios and are meant strictly for informational purposes.

Joe Occhipinti is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. The information posted here represents his opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.

Your Pension – Lump Sum vs Annuity

/in Education, Financial Planning, General, Investing, Retirement, Taxes /by Cary Facer12 Keys To Retiring From SCE With Confidence

/in Retirement /by Cary FacerRetirement is coming soon, and you know you should be excited. But some of us have so many questions and concerns about retirement that we’re more nervous than anything else.

We understand.

At Warren Street Wealth Advisors, we’ve helped hundreds of Southern California Edison retirees navigate this crucial but confusing time. In the process, we’ve learned SCE’s retirement programs and employee benefits inside and out. So we put together a list of our top 12 keys to retiring from SCE confidently and stress-free.

1. Have A Plan

Nothing else in this post matters if you don’t have a personalized financial plan. We believe this so strongly that building a personalized financial plan is the first thing we do with every one of our clients.

A personalized financial plan is the roadmap to your comfortable, stress-free retirement. You can know your benefits inside-out and be clever about taxes and investments. But if you don’t have a map for navigating your retirement, you’ll never feel confident along the way.

And if you don’t have a map, who knows where you’ll end up?

2. Seriously: Have A Plan

I wrote that twice because I wanted to be certain you see how important this is.

Having a plan is essential for any major life decision, and navigating your retirement with wisdom and confidence is certainly part of a major life decision!

Plus, if you’re confused about any of the information below, then setting up a plan with a CERTIFIED FINANCIAL PLANNER™ (like our very own Justin D. Rucci, CFP®) is the easiest way to walk through all of it in terms you’ll understand. Perhaps your next step is to contact us schedule a free consultation and talk about how you can get started.

OK, let’s move on…

3. Plan to Retire Around October

If you are grandfathered into the old SCE pension plan formula and are interested in the lump sum option then you should plan to retire around October. This will allow you to choose which interest rate you want for your grandfathered formula. You can choose whichever gives you the larger lump sum payout: the current year or the next one during this small window of time (learn more HERE).

The main takeaways are to know that you have a choice, weigh the benefits, then decide to retire on December 1st or January 1st–whichever projection pays the higher lump sum benefit.

4. Retire After 55 But Before 59½ Without Paying Penalties

Here’s a scenario we see all the time: you’re 57. You want to retire. You don’t want to wait until you’re 59½ to do it. But you know that there’s a 10% federal tax penalty and a 2.5% California state tax penalty if you take money out of your 401k before then. So are you stuck?

Nope.

This is what you do: use a 72t Distribution, the “Age 55” IRS Rule, or a combination of the two, to keep you from paying penalties. Very simply, these rules allow you to access a portion of your 401k penalty-free that can sustain you until you get to age 59 1/2.

There are a lot of moving parts here, but at WSWA, we use these rules to make certain that none of our clients pay penalties. Ever.

5. Take Advantage of Your Medical Subsidy

Did you know that you’re eligible for retiree medical subsidy? Call HR and ask them how much you get. 50% or 85% are the most common. This means that when you retire, Edison will pay 50-85% of your retiree medical insurance premium. This is one new cost you’ll have in retirement that you’ll want to budget for.

6. Say “Goodbye” To Credit Card Debt

If you have significant credit card debt, then it’s time for a plan (there it is again!), a budget, and some hard work.

Credit card debt can be intimidating, but you can pay it off! At WSWA, one of our favorite things to see is a client freeing himself or herself from the stress of mounting credit card debt. You may just need some help and a plan.

7. Plan For Your Sick Time Payout

Sick time payout can help you tremendously, especially if you’re not yet 59½. You can run a pension projection online and it will include a calculation of your accrued sick time payout value. That gives you more clarity about how much money you’ll start with when you retire.

8. Build Up 6 Months Worth Of Emergency Savings

We’re always optimistic about the future, but sometimes life takes surprising and difficult turns. Wise financial planning means being prepared for those situations.

We recommend that you save at least 6 months worth of living expenses in case of an emergency. So if you need $4,000/month to live, then have around $24,000 saved in savings and checking. That way, you’re prepared for all of the ups and downs that can happen.

9. Build And Keep A Budget

We get it: it’s no fun to build a budget. But writing down all your income and expenses will help you identify where you can save.

Building a budget doesn’t mean eliminating all of your fun, either. Get rid of the stuff you don’t use, but keep what makes you happy! Do shop your auto insurance around for a better rate. Do call your phone company and cut your bill in half. But don’t quit your bowling league if you love to bowl and bowling makes you happy.

Not sure where to start with your budget? No problem. Use our free budget builder to make it easy.

10. Wait Until Full Retirement Age To Take Social Security

There is all kinds of information out there about what to do about your social security. Let me boil it all down to one simple point for you: you don’t have to take it at 62! When we build a financial plan for a client, we use a tool that calculates all options for optimizing social security. And no matter how many times we do it and how many ways we look at it, one thing becomes clear every time: it’s usually best to wait until your full retirement age (66-67) to take social security.

There is also plenty of evidence to support waiting until age 70 too as the 32% increase in benefit can prove worth the wait. These decisions are typically based around your health at age 62 when deciding to collect or to continue to defer. It’s ultimately your decision, and we suggest weighing your options before committing to collecting the 25% reduced benefit at age 62.

11. Use Your 401k Efficiently

Max it out. Diversify your investments. Hire a pro (like us!) if you don’t love following the markets. Take advantage of the Tier 3 option (it’s called your “Personal Choice Retirement Account”) with Charles Schwab.

Plus, hiring a pro means you’ll have more time for bowling.

12. Have A Plan

You didn’t think this was going to end without one more reminder, did you?

If you’re not sure where to start with your financial plan, that’s OK: we can help. Schedule a free consultation to talk through your finances and take the first step toward building a plan.

You can retire comfortably and confidently. Take the first step to get the help you need today.

————–

If you have any other questions, we’d love to help. Give us a call today at 714-876-6200 or email us at info@warrenstreetwealth.com. For more helpful financial advice, sign up for our mailing list below!

Contact Us

As a Registered Investment Advisor, Warren Street Wealth Advisors, LLC is required to file form ADV to report our business practices and conflicts of interest. Please call to request a copy at 714-876-6200.