Joe Occhipinti

Wealth Advisor

Warren Street Wealth Advisors

With the posting of the July segment rate, we are one month closer to the official 2018 grandfathered pension rate announcement. The pension rate has, historically, been derived from the August third segment minimum present value segment rate which is officially announced by Edison in late September or early October.

If you have missed any of our previous month’s articles, you can find them here:

Rate Watch – April

Rate Watch – May

Rate Watch – June

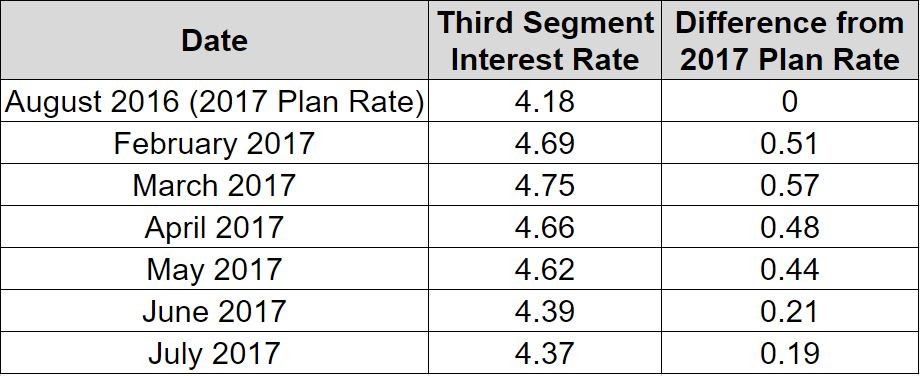

Let’s take a look at what rates have done from month-to-month:

From June to July brings us a 0.02 decrease month-to-month, and 0.19 above last year’s official rate. The change from the previous month is negligible, but the important thing to note, still, is that the rate is above the previous year’s. If the rate continues to stay higher than 4.18, this will drive 2018 grandfathered lump sum values lower, compared to 2017.

With the rate being only a few points above 2017’s number, the conversation begins to shift to whether the difference in value plays a big part in retirement. For those on the fence, delaying retirement into 2018 could prove to be favorable since the rate change could be minimal. This delay could allow you time to accomplish other financial goals such as managing debt or reducing expenses as you prepare for retirement.

If you decide to continue service with Edison, you will still accumulate credits towards your pension. These credits earned in 2018 could be enough to make up the difference between the 2017 and 2018 lump sum values, should the rate stay close. It is imperative to weigh your options and look at your whole retirement picture before deciding on when to collect the lump sum.

Would you like to find out how to retire and get the most out of your pension?

Understand your options when it comes to your pension and retirement. If you are unsure of your pension status and want to retire with confidence, then feel free to contact us for a free consultation.

*These are not current plan rates for Southern California Edison’s pension plan, they are minimum present value third segment rates from the IRS. Official plan rates are derived from the minimum present value segment rates table. Plan rate changes are made by Southern California Edison on an annual basis.

Joe Occhipinti is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. The information posted here represents his opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.