Joe Occhipinti

Wealth Advisor

Warren Street Wealth Advisors

Concerned about your grandfathered pension lump sum value? Worried you may be leaving some money on the table as you go to retire?

As May comes to a close, a topic of continued conversation for soon-to-be Edison retirees is the grandfathered pension interest rate.

For those who are grandfathered, this interest rate can dictate what the lump sum value of your pension could be when you go to take it at retirement. The rate is published by the IRS, and the new rate is then officially announced by Edison in late September/early October.

While this is not the only factor to look at when it comes to retirement, it can be a significant one when it comes to correctly timing your retirement.

An increasing rate, relative to the previous year, means that the value of your lump sum value will decrease and a decreasing rate means that your lump sum value will increase. Think of a see-saw, as one goes up, the other goes down.

The IRS publishes monthly rates that can be examined to see which way the rate is trending. While is it not the official rate of the pension plan, it can be a vital piece of data when it comes to planning your retirement.

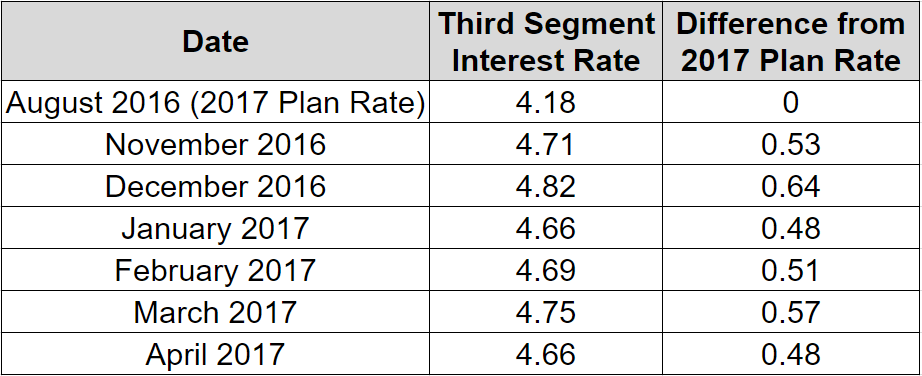

Let’s take a look at what the rate as done since the last official Edison announcement:

Warren Street Wealth Advisors has helped 100’s of SCE employees plan for and transition into a successful retirement. Make sure you are working with an advisor who is going to make sure you get the retirement you want.Tracking the last 6 months, you can see that the rate has risen nearly half a percent from the 2017 plan rate. If you wait until 2018 to elect your grandfathered lump sum benefit, and the rate is higher, then you could cost yourself some additional money for retirement.

Contact us today for a free consultation over the phone.

714-876-6200

Watch our Southern California Edison retirement webinar to hear more about what we do for our clients.

*These are not current plan rates for Southern California Edison’s pension plan, they are minimum present value third segment rates from the IRS. Official plan rates are derived from the minimum present value segment rates table. Plan rate changes are made by Southern California Edison on an annual basis.

Joe Occhipinti is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. The information posted here represents his opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.