A quick summary of economies & markets for you.

On Wall Street, the opening quarter of 2015 played out like the first quarter of 2014: gains for the Nasdaq and S&P 500, a small loss for the Dow. In another resemblance, uncertainties emerged about the strength of the economy. Hiring data and consumer confidence readings were mostly strong, yet Q1 did not see notable consumer spending or retail sales gains. Commodities suffered as the dollar rally continued. The pace of home sales wavered, but the big picture of the housing market was still very positive. While our central bank considered near-term tightening, economic signals in Asia and Europe led other central banks to ease.1

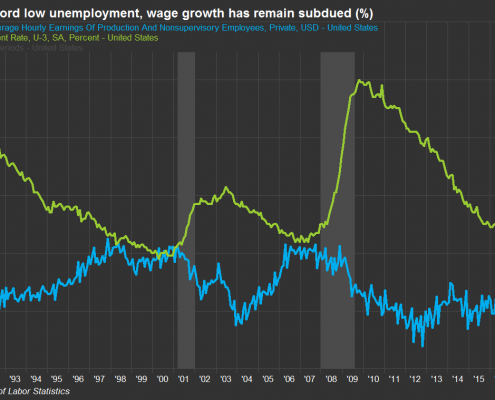

Domestic economic health. The first quarter brought some good news and some question marks. Monthly job creation reached 201,000 in January, 264,000 in February and then just 126,000 in March – a sudden drop that made some analysts conclude that the strong dollar was now eating into company profits and expansion. The unemployment rate was down to 5.5% in March; the broader U-6 rate including the underemployed with the unemployed was at 10.9%. Wages were up 2.1% on an annualized basis, but that was countered by a slight reduction in the average workweek.2

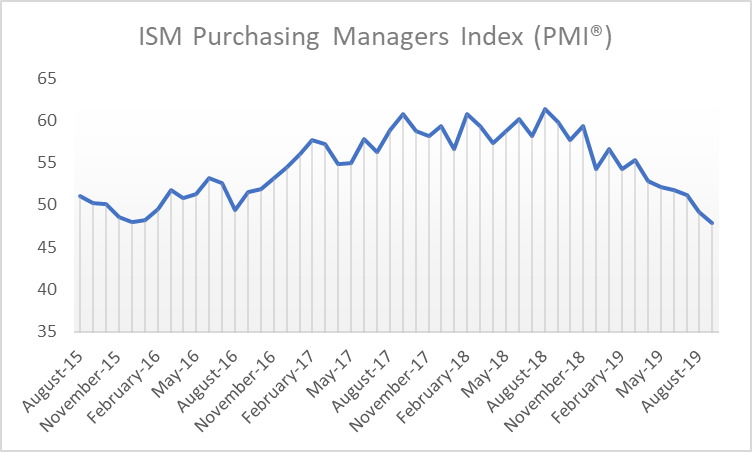

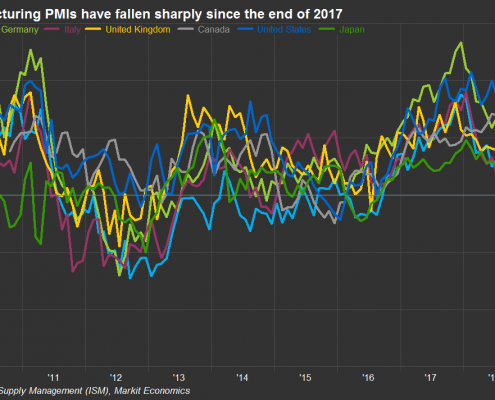

Another question mark involved the manufacturing sector. In March, the Institute for Supply Management’s respected factory PMI slipped to 51.5 – down for the fifth consecutive month. (It was at 53.5 in January, 52.9 in February.) ISM’s service sector PMI was more encouraging, coming in at 56.7 for January, 56.9 for February and 56.5 for March.3,4

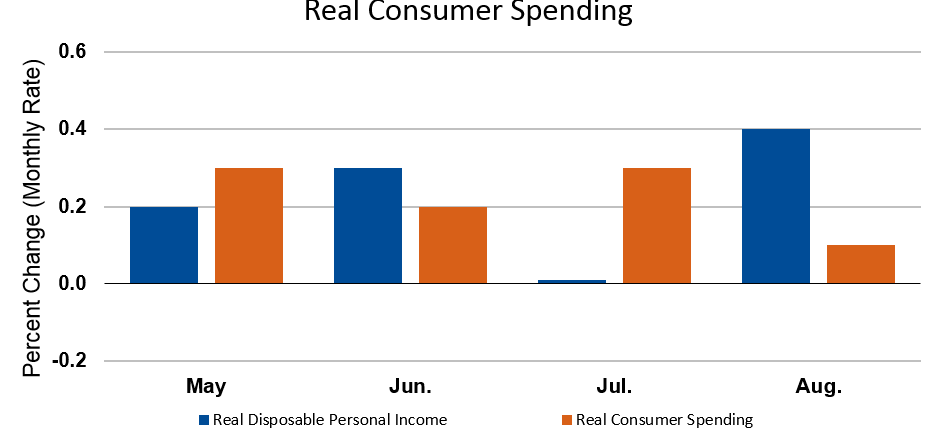

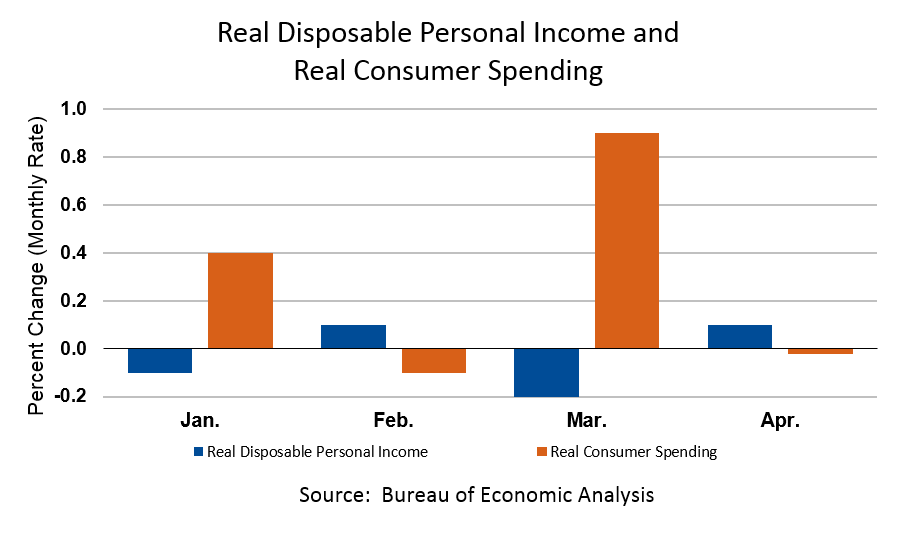

Personal spending figures were also unimpressive, and so were retail sales numbers (although lower gas prices impacted both indicators). According to the Commerce Department, household spending fell off 0.2% in the first month of 2015 and then ticked up 0.1% in February. Retail purchases were down 0.8% for January, 0.6% for February. Household incomes did rise by 0.3% in January and another 0.4% a month later. The plunge in gas prices helped send the Consumer Price Index south 0.7% in January, but then it advanced 0.2% for February.5,6

Consumers may not have spent freely in Q1, but they were upbeat. The Conference Board’s consumer confidence index came in at an impressive 103.8 in January, and rebounded to 101.3 in March after a dip to 98.8 in February. The University of Michigan’s consumer sentiment index ended the quarter at 93.0 after reaching 98.1 in January and 95.4 in February. (For both indices, readings above 90 are considered quite strong.).7,8

On the factory front, the Producer Price Index moved south like the CPI, falling 0.8% in January and 0.5% for February with the drop in fuel and energy costs as a major influence. Headline hard goods orders rose 2.0% in January, then fell 1.4% in February.5,6

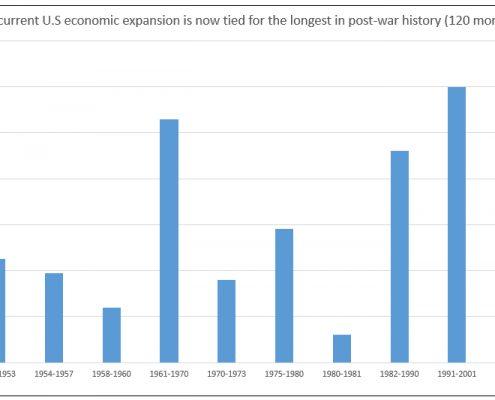

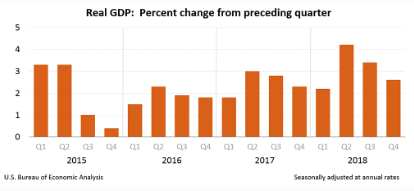

The Bureau of Economic Analysis made its third, final estimate of Q4 GDP: 2.2%, unchanged from the second estimate. By the end of the quarter, some economists thought Q1 GDP would pale in comparison. The Atlanta Fed projected Q1 growth at 0.1%, and S&P Capital IQ felt Q1 would bring a 3.0% dip in corporate profits.2,5

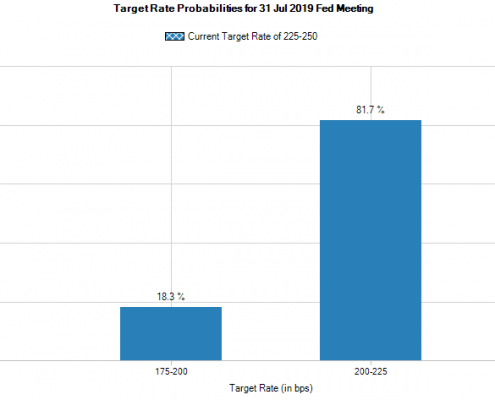

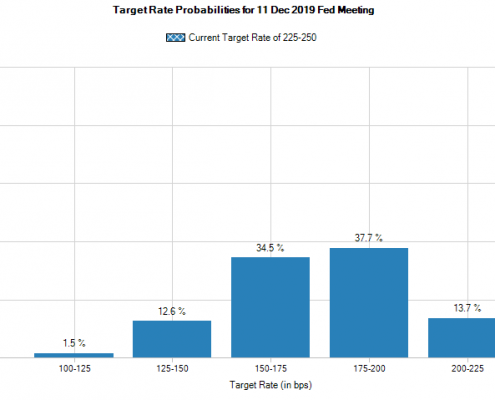

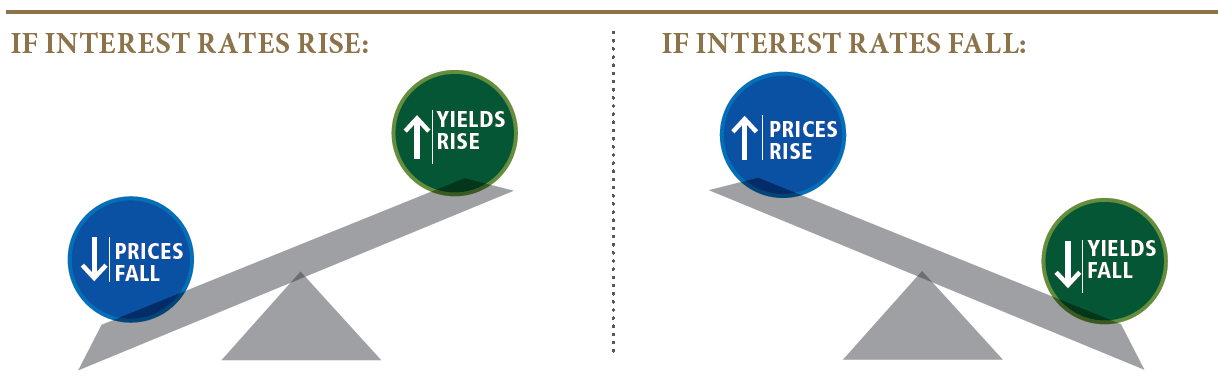

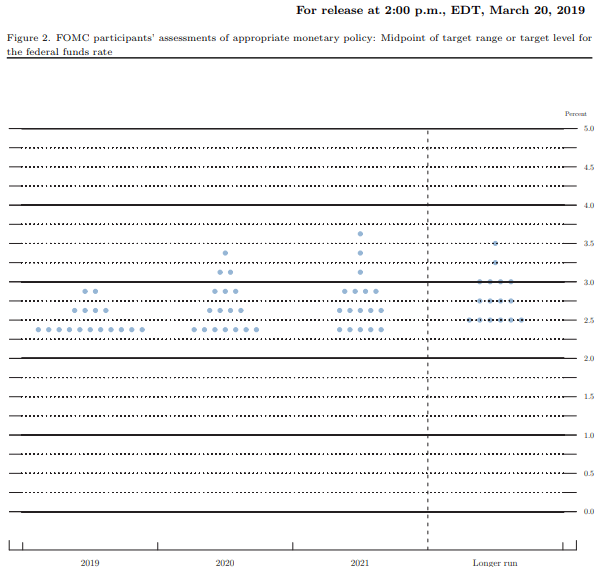

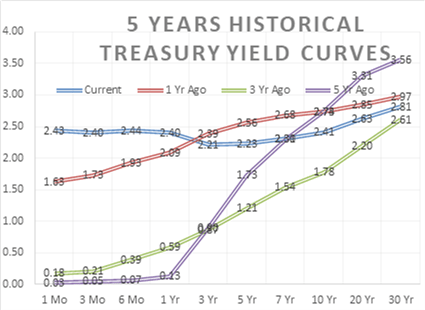

The Federal Reserve found a new way to say what it had actually been saying for the past few quarters – and the subtle change in wording in its March policy statement seemed reassuring. It removed the word “patient” from its statement (as Wall Street analysts thought it would), but it also cut its 2015 GDP forecast to 2.3-2.7% and its 2015 inflation projection to 0.6-0.8%, an indication that any notions of raising interest rates in spring or summer may have subsided.9

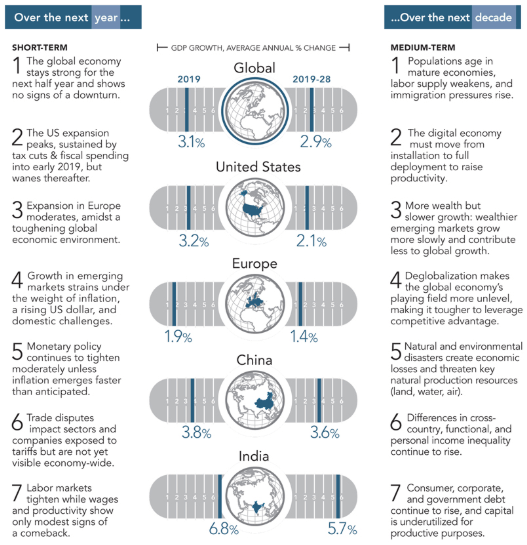

Global economic health. Outside our borders, the quarter was notable for two developments: the European Central Bank’s new quantitative easing effort and a wave of interest rate cuts.

Strong measures were clearly needed to try and improve the euro area economy. In February, the region’s consumer prices were down 0.3% year-over-year while its jobless rate was twice that of the United States (11.3%). So on January 22, the ECB stated that it would by €60 billion worth of eurozone bonds per month through September 2016, in imitation of the Federal Reserve’s QE programs.10,11

By quarter’s end, some signs of an economic pickup had emerged: Europe’s stock markets were lifted, and indicators showed improved money supply credit, household confidence and retail sales (which had improved 3.7% annually).12

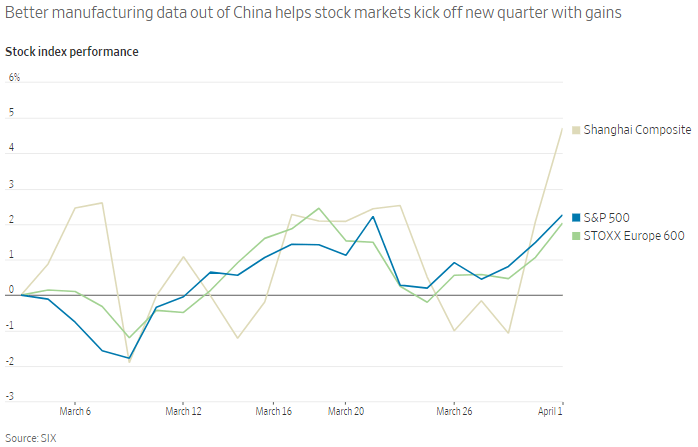

Fading oil prices meant reduced inflation in emerging market economies. Several took swift action against deflation risks: India and China cut their benchmark interest rates twice in Q1, and easing also occurred in Indonesia, Thailand, Australia, South Korea and Singapore. Asia Pacific factories were not exactly humming: China’s official manufacturing PMI barely showed growth in March at a reading of 50.1, and there were significant drops in factory orders in Japan and Indonesia and exports in South Korea by March.13

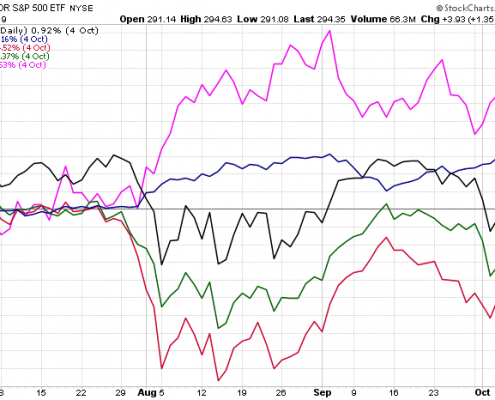

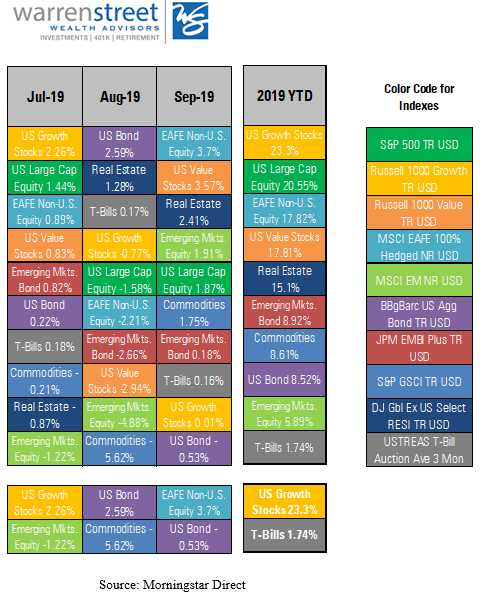

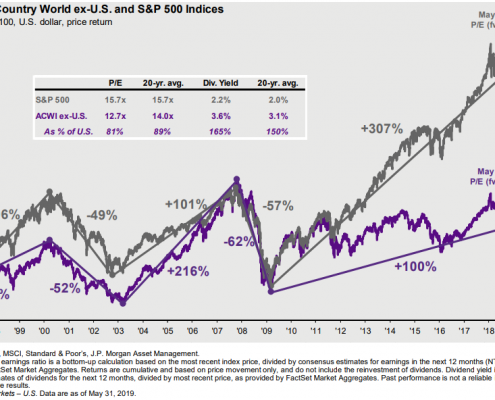

World markets. The first quarter brought some sizable stock market gains – just not in the United States. The onset of quantitative easing in the eurozone sent that region’s indices soaring – the DAX jumped 22.03% for the quarter, the FTSE MIB 21.80%, the STOXX 600 15.99% and the CAC 40 17.91%. In addition, England’s FTSE 100 advanced 3.15%.14

Every consequential Asia Pacific benchmark posted a Q1 gain except Pakistan’s KSE 100, which retreated 5.91%. The Shanghai Composite advanced 15.87%, the Sensex 1.67%, the Nikkei 225 10.06%, the Jakarta Composite 5.58%, the Kospi 6.55%, the Hang Seng 5.49% and the S&P/ASX 200 8.88%. In the Americas, Argentina’s MERVAL rose 26.32%, Mexico’s IPC All-Share 1.34%, Canada’s TSX Composite 1.85% and Brazil’s Bovespa 2.29%.14

As for the key Dow Jones and MSCI indices, the Europe Dow went +1.22%, the Global Dow +0.66%, the Asia Dow +7.02% and the Dow Jones Americas +0.31%. The MSCI World Index rose 1.82%; the MSCI Emerging Markets Index gained 1.91%.14,15

Commodities markets. The quarter saw a 7.9% fall for the broad Thomson Reuters/Jefferies CRB Index and an 8.97% rise for the U.S. Dollar Index. So Q1 gains were rare.16,17

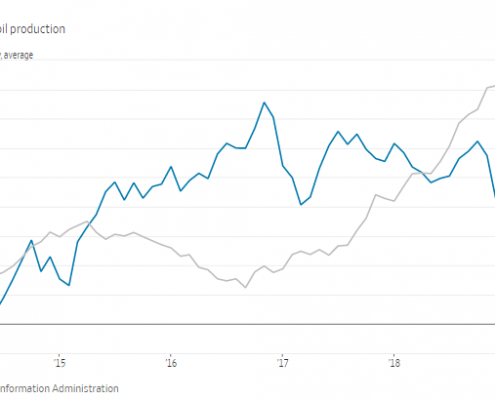

Looking at the performance of CRB components, we see unleaded gas way out in front of other energy futures – ahead of everything else, in fact, with a 7.6% Q1 advance. Oil slipped another 10.6%, natural gas 12.7% and heating oil 8.1%. Light sweet crude ended Q1 at a NYMEX price of $47.60.16,18

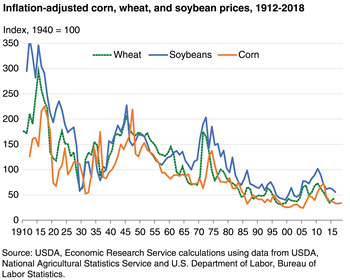

Amid crops, cotton posted a 3.5% quarterly improvement. Elsewhere, losses abounded: corn declined 3.9%, soybeans 4.8%, cocoa 5.9%, oats 10.9%, wheat 14.0%, sugar 14.2% and coffee 19.6%.16

Gold ended Q1 just $0.90 lower on the COMEX, going -0.1% for the quarter to settle at $1,183.20 an ounce on March 31. That same day, silver settled at $16.60 an ounce. Silver had a much better Q1, going +6.4%. Palladium futures fell 7.9% in the quarter, platinum futures 5.5%.19

Real estate. By quarter’s end, the annual change in new and existing home sales was nicely positive. The year-over-year difference is what matters most, and the latest available reports from the Census Bureau and National Association of Realtors showed new home sales up 24.8% on an annualized basis and resales up 4.7% in the past 12 months.20,21

The housing industry also closely watches a markedly lagging indicator as well as an indicator of future sales activity. In March, the latest available S&P/Case-Shiller home price index (January) had an overall year-over-year gain of 4.5% versus 4.6% in December. NAR’s pending home sales index rose 1.2% in January, and then another 3.2% in February. A look at construction activity in February (as recorded by the Census Bureau) reveals building permits up 7.7% annually but housing starts decreased 3.3% in year, with a 17.0% drop in February putting the pace of new projects at a 13-month low.5,22

Interest rates descended on most mortgage types during the quarter. The average rate on the 1-year ARM moved north 0.06% to 2.46% between Freddie Mac’s December 31 and March 26 Primary Mortgage Market Surveys, but the average interest on 30-year and 15-year fixed rate loans lessened 0.18% (to 3.69% and 2.97%, respectively). Interest on a 5/1-year adjustable rate mortgage averaged 3.01% in the December 31 survey and 2.92% in the March 26 survey.23

Looking back … looking forward. Small caps rallied in Q1: the Russell 2000 gained 3.99%, wrapping up the quarter at 1,252.77. Other end-of-quarter settlements were as follows: S&P 500, 2,067.89; Dow, 17,776.12; Nasdaq, 4,900.88. The CBOE VIX “fear index” closed the third month of 2015 at -20.36%. The hottest stateside equities index in Q1 was the NYSE Arca Biotechnology Index, which gained 15.95%; the VIX was the coldest. The Nasdaq and S&P 500 both logged their ninth straight winning quarters.1,14

| % CHANGE |

Q1 CHG |

Q4 CHG |

1-YR CHG |

10-YR AVG |

| DJIA |

-0.26 |

+4.58 |

+8.01 |

+6.92 |

| NASDAQ |

+3.48 |

+5.40 |

+16.72 |

+14.51 |

| S&P 500 |

+0.44 |

+4.39 |

+10.44 |

+7.52 |

| REAL YIELD |

3/31 RATE |

1 YR AGO |

5 YRS AGO |

10 YRS AGO |

| 10 YR TIPS |

0.18% |

0.60% |

1.60% |

1.79% |

Sources: online.wsj.com, bigcharts.com, treasury.gov – 3/31/1514,24,25,26

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly.

These returns do not include dividends.

Stock market analysts were not very bullish about Q1 when it began, and the Dow and S&P essentially treaded (rough) water in the first three months of the year. Given the powerful dollar and low oil prices, the outlook for Q2 is similar. If America’s growth is in fact moderating in 2015, it may slow the bulls but not quite halt them – and fundamental economic indicators could surprise to the upside this spring even if earnings are lackluster. With any luck, 2015 could end up mimicking 2014 on Wall Street – a slow start, but a nice finish and a solid year for the market with hiring, consumer confidence, wage growth and consumer spending figures encouraging investors. Perhaps this quarter is when momentum resumes.

At the beginning of July, I’ll review Q2 2015. Between now and then, you may of course call me at «representativephone» or email me at «representativeemail» if you have questions, thoughts or concerns about your progress toward your financial objectives. I look forward to hearing from you.

Sincerely yours,

Warren Street Wealth Advisors

190 S. Glassell St., Suite 209

Orange, CA 92866

714-876-6200 – office

714-876-6202 – fax

Investment Advisor Representative, Warren Street Wealth Advisor, LLC., a Registered Investment Advisor.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. MarketingPro, Inc. is not affiliated with any broker or brokerage firm that may be providing this information to you. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The DAX 30 is a Blue Chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The FTSE MIB (Milano Italia Borsa) is the benchmark stock market index for the Borsa Italiana, the Italian national stock exchange. The Dow Jones STOXX 600 Index captures more than 90% of the aggregate market cap of European-based companies. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The FTSE 100 Index is a share index of the 100 most highly capitalized companies listed on the London Stock Exchange. Karachi Stock Exchange 100 Index (KSE-100 Index) is a stock index acting as a benchmark to compare prices on the Karachi Stock Exchange (KSE) over a period. The SSE Composite Index is an index of all stocks (A and B shares) that are traded at the Shanghai Stock Exchange. BSE Sensex or Bombay Stock Exchange Sensitivity Index is a value-weighted index composed of 30 stocks that started January 1, 1986. Nikkei 225 (Ticker: ^N225) is a stock market index for the Tokyo Stock Exchange (TSE). The Nikkei average is the most watched index of Asian stocks. The IDX Composite or Jakarta Composite Index is an index of all stocks that are traded on the Indonesia Stock Exchange (IDX). The Korea Composite Stock Price Index or KOSPI is the major stock market index of South Korea, representing all common stocks traded on the Korea Exchange. The Hang Seng Index is a freefloat-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The S&P/ASX 200 is Australia’s “premier” share market index. The MERVAL Index (MERcado de VALores, literally Stock Exchange) is the most important index of the Buenos Aires Stock Exchange. The Mexican IPC index (Indice de Precios y Cotizaciones) is a capitalization-weighted index of the leading stocks traded on the Mexican Stock Exchange. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The Bovespa Index is a gross total return index weighted by traded volume & is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange. The Europe Dow measures the European equity markets by tracking 30 leading blue-chip companies in the region. The Global Dow (GDOW) is a 150-stock index of corporations from around the world, created by Dow Jones & Company. The Asia Dow measures the Asia equity markets by tracking 30 leading blue-chip companies in the region. The Dow Jones Americas Index measures the Latin American equity markets by tracking 30 leading blue-chip companies in the region. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging markets. The MSCI Emerging Markets Index is a float-adjusted market capitalization index consisting of indices in more than 25 emerging economies. The US Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – dailyfinance.com/2015/03/31/market-wrap-stocks-retreat-sandp-nasdaq-post-quarterly-gains/ [3/31/15]

2 – tinyurl.com/n668drr [4/3/15]

3 – tradingeconomics.com/united-states/business-confidence [4/1/15]

4 – tradingeconomics.com/united-states/non-manufacturing-pmi [3/4/15]

5 – marketwatch.com/economy-politics/calendars/economic [4/1/15]

6- briefing.com/investor/calendars/economic/2015/03/09-13 [3/13/15]

7 – briefing.com/Investor/Calendars/Economic/Releases/conf.htm [3/31/15]

8 – briefing.com/Investor/Calendars/Economic/Releases/mich.htm [3/27/15]

9 – thestreet.com/story/13084714/1/meaning-of-fed-policy-statement-depends-on-definition-of-is–surprising-market-reaction.html [3/19/15]

10 – ec.europa.eu/eurostat [4/1/15]

11 – finances.com/news/forex/81165-forex-news-quarterly-review-us-dollar-yen-post-strong-gains-as-euro-lags-in-q1.htm [4/2/15]

12 – bloombergview.com/articles/2015-03-24/five-charts-show-europe-s-economy-is-all-right [3/24/15]

13 – reuters.com/article/2015/04/01/global-economy-idUSL3N0WX25L20150401 [4/1/15]

14 – online.wsj.com/mdc/public/page/2_3022-quarterly_gblstkidx.html [3/31/15]

15 – msci.com/products/indexes/country_and_regional/em/performance.html [3/31/15]

16 – blog.runnymede.com/first-quarter-2015-in-review-international-markets-melt-up [3/31/15]

17 – online.wsj.com/mdc/public/npage/2_3050.html?mod=mdc_curr_dtabnk&symb=DXY [4/2/15]

18 – marketwatch.com/story/oil-futures-settle-with-a-loss-for-the-month-and-quarter-2015-03-31 [3/31/15]

19 – coinnews.net/2015/03/31/gold-silver-mixed-in-march-and-quarter-us-mint-coins-solid/ [3/31/15]

20 – ycharts.com/indicators/existing_home_sales [4/5/15]

21 – ycharts.com/indicators/new_homes_sold_in_the_us [4/5/15]

22 – tradingeconomics.com/united-states/housing-starts [3/17/15]

23 – freddiemac.com/pmms/archive.html [4/5/15]

24 – online.wsj.com/mdc/public/page/2_3022-quarterly_gblstkidx.html [12/31/14]

25 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F31%2F14&x=0&y=0 [3/31/15]

25 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F31%2F14&x=0&y=0 [3/31/15]

25 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F31%2F14&x=0&y=0 [3/31/15]

25 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F31%2F05&x=0&y=0 [3/31/15]

25 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F31%2F05&x=0&y=0 [3/31/15]

25 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F31%2F05&x=0&y=0 [3/31/15]

26 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [4/5/15]