Will your grandfathered lump sum benefit decrease in 2018?

If you have a grandfathered pension with Southern California Edison, then you may know that the value of your lump sum benefit is affected by interest rate changes. In addition, if you’ve been following the news you might have heard talk of interest rates potentially moving up across the next 2 years.While rates remain historically low, could 2017 finally be the year of more sustained rising interest rates?

You are probably targeting a specific date or age for your retirement, but there are some things that we cannot control, in this case the interest rate. Each year, Edison announces the official interest rate used for the grandfathered pension formula for the following year. In cases where the rate goes up, then the value of your lump sum payout decreases. On the other hand, if the rate drops, then your lump sum payout increases.

Let’s take this year for example, the 2016 interest rate was 4.98 and they announced the 2017 rate of 4.18, a decrease of 0.80. For someone who had been at the company for 30+ years, we have seen the lump sum benefit increased by almost $60,000. That could be a year’s worth of living expenses for some in retirement. Now, if the interest rate for 2017 would have moved in the opposite direction to 5.88, then there could have been a decrease of approximately $60,000 of lump sum value.

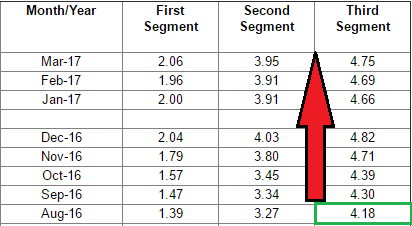

Let’s take a look at what rates have done since August 2016:

Interest rates are currently trending up across all three segments since the last official announcement. Edison uses the third segment for its pension formula which is why that 4.18 should look familiar, but how do you know when you should make the decision between taking this year’s interest rate or waiting for the next one?

To evaluate Edison’s grandfathered pension formula, we generally suggest that waiting til the end of the year is the best to retire, October to be exact. The reason for this is that the official interest rate for your pension is announced around that time and once it is announced, you get the opportunity to see which interest rate produces the more favorable lump sum benefit.

While this can be a big factor when approaching retirement, it should not be the only variable you are looking it when making the decision. Make sure you have a plan and a team behind you that knows how to navigate these waters.

Warren Street Wealth Advisors has helped 100’s of Southern California Edison employees retire with confidence. We can show you how to run a pension projection and give you a look at your options as you approach retirement.

Joe Occhipinti

714-823-3328

Joe@warrenstreetwealth.com

Joe Occhipinti is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. The information posted here represents his opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.