Rate Watch 2018 – April

Welcome to another edition of Rate Watch as we track the interest rate that is vital to the grandfathered pension at Southern California Edison. If you’ve missed any of our previous articles, you can find them here:

Rate Watch 2018 – March

Rate Watch 2018 – February

Rate Watch 2018 – January

Rate Watch 2017 – August

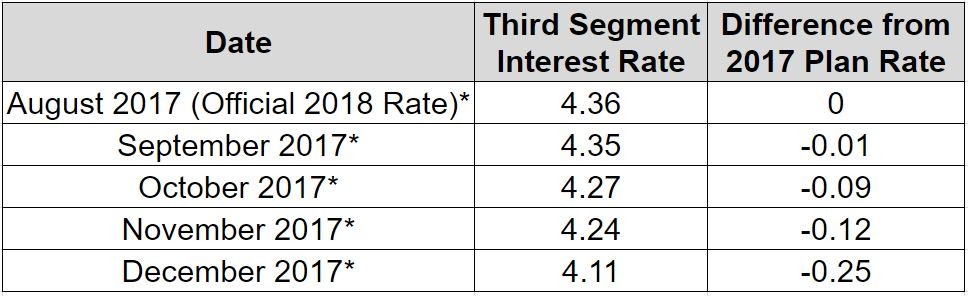

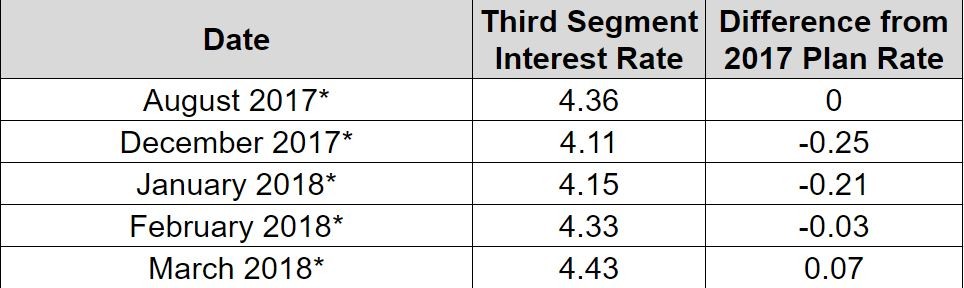

The third rate of 2018 begins to paint a new picture of where rates have the potential to go in the fall of 2018. The latest comes after increased Fed conversations on future rate hikes and an increase in March. Let’s take a look at the most recent numbers:

*These are not current plan rates for Southern California Edison’s pension plan, they are minimum present value third segment rates from the IRS. Official plan rates are derived from the minimum present value segment rates table (https://www.irs.gov/retirement-plans/minimum-present-value-segment-rates) . Plan rate changes are made by Southern California Edison on an annual basis.

March’s value of 4.43 gives us the first reading higher than the current official plan rate of 4.36, a 0.07% change. With the Fed announcing an increase in rates by 0.25% to a range of 1.50-1.75%, the sixth rate hike since 2015, is said to be one of many by the Fed in 2018. They continue to point to strong economic outlooks and labor conditions as reasons to pencil in future hikes, but we will have to see how the market reacts.

This also brings some new thinking for grandfathered pension holders because this could produce a situation where the following year’s interest rate will be higher than the current value, and increases in interest rates will produce a smaller lump sum payout for grandfathered pension holders. The inverse is true for rate decreases; however, it looks like that could be a less likely scenario should this trend continue.

Remember, if you are planning on retiring as a grandfathered pension holder, then you have a choice on when you want to set your commencement date and pick which rate produces a more favorable outcome.

I think we’ve become a broken record at this point by saying this, but it is still a tad early to make any huge decisions, but the fall will soon be upon us. As always, this is only one metric to look at as you think about retirement, but it is an important one.

Developing a financial plan on how to approach retirement and maximize your benefits is important, so make sure you are working with someone who is familiar with Edison’s benefits and knows how they work.

Worried about your retirement plans? Concerned with how to handle your pension or 401(k)? Maybe you’re just unsure on how the transition to retirement works. We’ve helped countless Southern California Edison employees plan for retirement. Contact us for a free retirement planning session or portfolio analysis.

Joe Occhipinti

Joe Occhipinti

Wealth Advisor

Warren Street Wealth Advisors

Joe Occhipinti is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information. A professional advisor should be consulted before implementing any of the strategies or options presented.

Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance, strategy, and results of your portfolio.Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results.Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.