2026 Outlook: Beyond AI & Mega-Cap Tech

/in General, Investing/by Phillip Law, CFA“Is AI a bubble?” my uncle asked as I put my fork down mid-bite on New Year’s Eve. I’d wager that this question dominated dinner tables and family gatherings across the country this holiday season. Even my sister, whose focus lies entirely within the arts and creative pursuits, managed to put the two words “AI” and “Bubble” together.

This tells me two things: 1) Concern around AI and “bubble-ness” is virtually inescapable and 2) this question is dominating the audience’s perception of markets, perhaps even more so than the meteoric rise of silver and gold as we enter 2026.

Why Does AI Deserve So Much Attention?

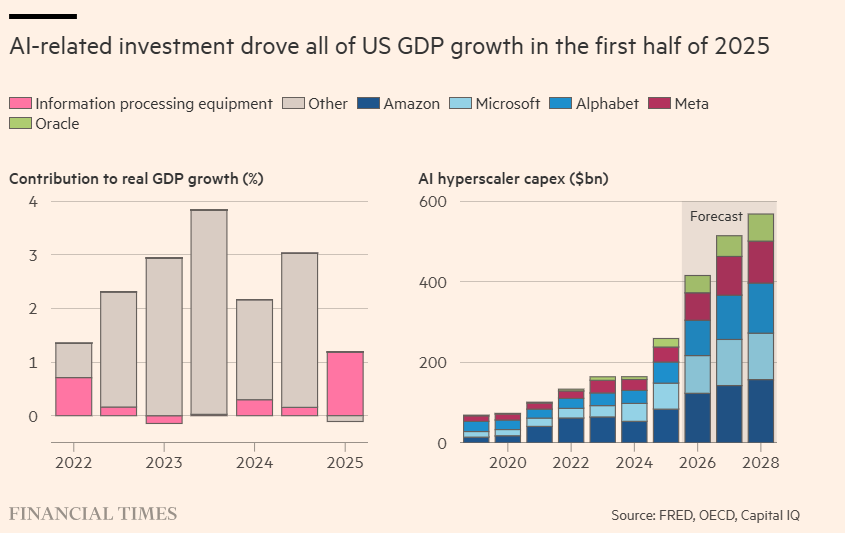

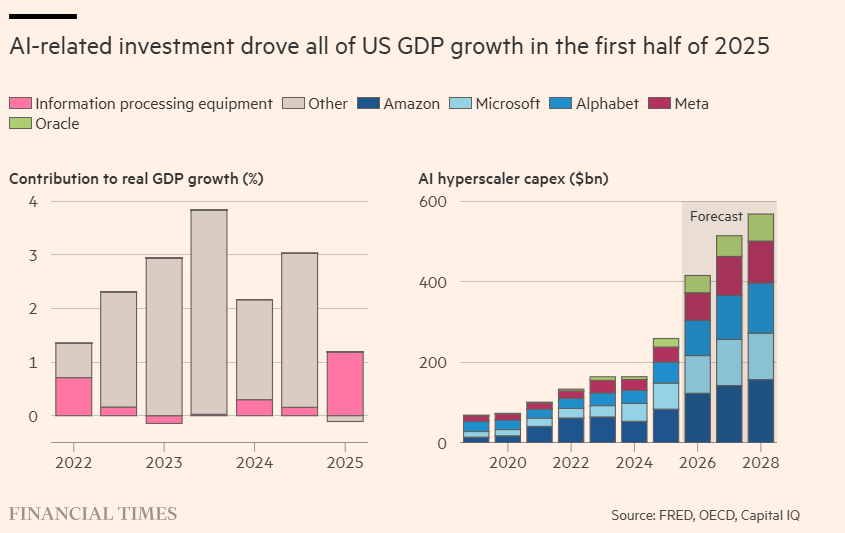

In 2025, AI-related names drove ~60% of the increase in the S&P 500’s value. Furthermore, AI spending from the “Hyperscalers” (Google, Microsoft, etc.) accounted for the lion’s share of our economy’s growth. Without the spending on data center infrastructure—servers, GPUs, and the centers themselves—some estimates suggest US GDP would have grown at a measly 0.1% in the first half of 2025. It’s safe to say that AI alone kept the economy afloat for most of last year.

The robust figures above underscore why AI rightfully commands significant attention. However, fixating on the bubble label can be a trap, much like timing the market. Instead, we should look at bubble psychology and how those excesses may be extending into the AI ecosystem.

Settling the AI Bubble Talk

It’s been over 20 years since we’ve seen such a transformative, general-purpose technology with the potential to deliver productivity gains eclipsing the internet era. This fervor has already minted a class of early winners, leaving everyone else watching with a potent mix of envy and regret. It’s the classic setup for FOMO, where the “AI train” starts looking less like a sound, technological investment and more like a high-speed shortcut to a cushy nest egg.

The danger is that the faster this train moves, the easier it is to speed right past the following flags:

- Starting Valuations: We pay prices regardless of whether reasonable returns can be generated.

- Risk/Reward Profiles: We stop asking if we’re actually being compensated for the layers of risk we’re adding to our broader portfolio.

- Lofty Narratives: AI’s newness unrestrains the imagination to justify price tags that reality can’t yet support.

Behind the Excitement: What’s Different This Time?

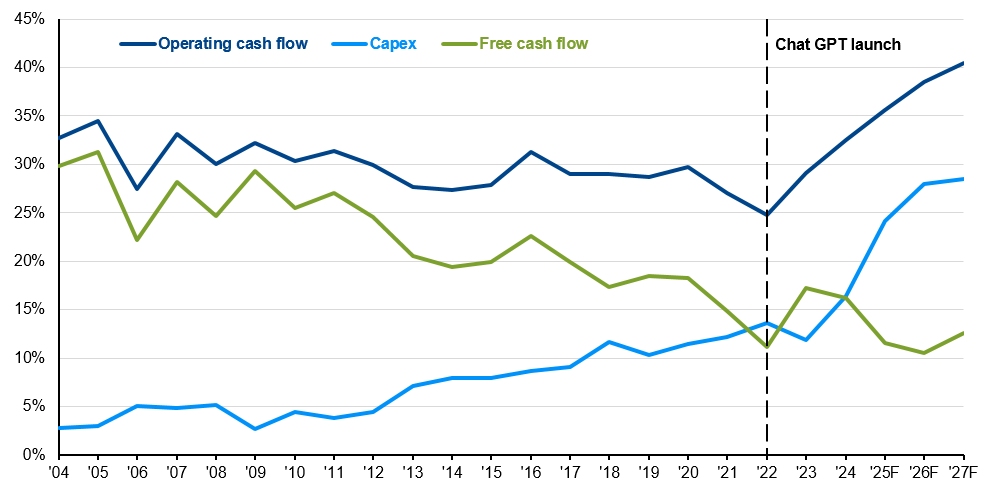

A Stronger Starting Line-Up Unlike the fragile startups of the dotcom era, today’s main AI spenders are profitable, cash-printing businesses. They are self-funding a massive AI arms race with capital expenditures set to leap by 60%, from $250bn in 2025 to over $400bn in 2026. Operating cash flows continue to outspace AI spend as a percentage of sales, allowing this historic investment to feel like a strategic augmentation of their core businesses rather than a reckless gamble.

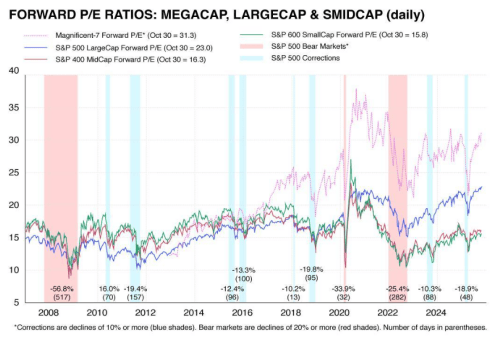

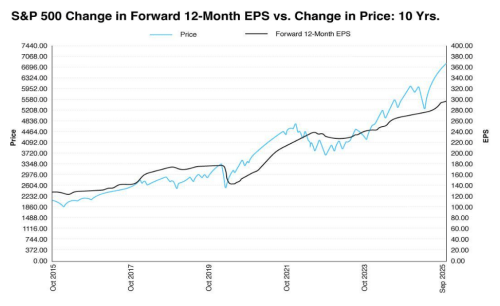

Justified Valuations While Forward P/E ratios look expensive, today’s multiples are anchored by real-world profit. Take Nvidia: its stock price increased 14x over the last five years, but earnings grew 20x. Today’s titans aren’t as frothy as the dotcom class of 2000 because they are delivering healthy bottom-line results. However, this optimism hinges on perfection. While bulls argue we are buying “cheaper” growth today than at any point in the decade, that narrative leaves a near zero margin for error if adoption slows.

Infrastructure Demand In contrast to the fiber-optic mania of the 90s, the demand for AI build-outs can’t seem to catch a break. Data center vacancy rates are at a record low of 1.6%, and ~75% of pre-construction builds are already pre-leased. Additionally, past infrastructure bubbles saw spending peak between 2% and 5% of GDP, whereas today’s AI investment sits at roughly 1%. This suggests the build-out still has room to run.

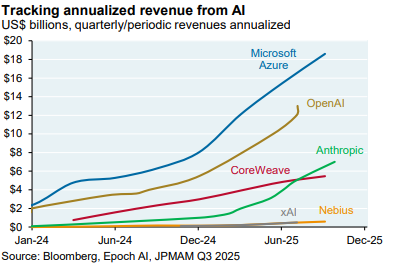

Show Me the Money Revenues are skyrocketing. Alphabet’s Q3 2025 results proved that AI-driven features are accelerating search and ads, with generative AI product revenue surging into the triple-digit percentage range year-over-year. Beyond the titans, some industry participants have grown revenues nearly ninefold since ChatGPT launched. For now, the receipts are keeping the optimism alive.

AI Is Running Fast… But Will it Trip a Wire?

We are in a high-stakes arms race on both a micro level (hyperscalers) and a macro level (US vs. China). Businesses are pouring trillions into this effort to secure US leadership in a technology that will change the fabric of society. But in this race to the top, it’s easy to overlook the blind spots.

Revenues & Profits: Can We Reach the Promised Land? Despite the growth, there is a staggering gap between spending and earning. Analyst Azeem Azhar points out that AI companies are projected to generate $60bn in revenue against $400bn in spending for 2025. That’s a 6-7x gap—far wider than the dotcom bubble (4x) or the railroad boom (2x). Even if revenue catches up, will it translate to profit, or will we see a “race to the bottom” where large language models (LLMs) become commoditized?

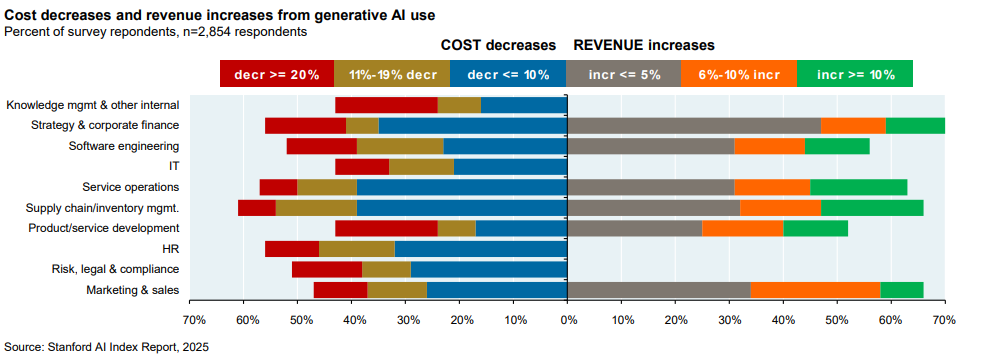

Is Demand Real? Adoption is still in its awkward early stages. Only roughly 10% of firms are using AI to produce goods, though 45% pay for LLM subscriptions. According to the Stanford AI Index and McKinsey, the majority of firms are seeing only modest cost savings (≤10%) and negligible revenue gains (≤5%). Will AI adoption ever truly scale into broad, durable profit expansion?

How Long is Your (Useful) Life? Hyperscalers like Microsoft and Google have boosted profits by extending the “useful life” of their AI assets in their books. If innovation renders chips obsolete in 24 months, these companies will face massive write-downs. More importantly, they are funding this short-lived hardware with 30-year debt, leaving investors holding the bag for “obsolete” infrastructure that won’t be paid off for decades.

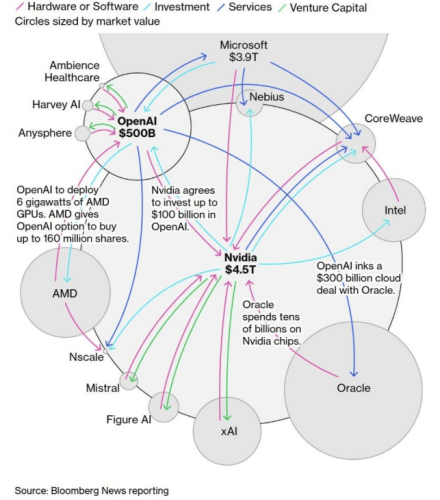

The AI Ouroboros There is an increasingly circular dance where Microsoft invests in OpenAI and then books cloud revenue from them. Nvidia buys stakes in the startups they sell chips to. This means a chunk of today’s “booming” revenue is an internal recycling of capital where true economic profit from external customers remains hypothetical.

Cloudy with a Chance of IOUs: While the biggest players usually use cash, we’re seeing a pivot toward the bond market. Oracle and Meta have emerged as outliers, using long-term bonds and project finance to bankroll their data centers. As free cash flow wilts under the weight of AI spend, their stock prices are feeling the gravity. Furthermore, the industry is using Special Purpose Vehicles (SPVs) to hide this leverage off-balance sheet, adding a layer of obscurity to the trillions being spent.

Conclusion: A Massive Collection of What-Ifs

Ultimately, the AI story comes down to “what-ifs.” What if AGI finally shows up and productivity explodes? Or, what if demand never materializes and the hyperscalers finally blink? With cracks showing—like OpenAI’s recent “Code Red”—it’s impossible to say if we’re headed for a minor correction or a systemic burst.

Our 2026 Recommendations:

- Keep a seat at the table: Exposure to market-cap weighted indices allows you to benefit if the “promised land” materializes.

- Diversify your sources of risk: Anchor beyond US tech. Gold, international markets, and bonds offer a necessary buffer if signs of excess turn into a choppy ride.

Rebalance systematically: Rebalancing is a controllable hedge. When sector weights become excessive, returning to target allocations helps lock in gains and reduce concentration risk.

Phillip Law, CFA

Senior Portfolio Manager, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

2026 Investment Outlook: AI, Economy, Inflation

/in General, Investing/by Phillip Law, CFAWith 2025 in the rear view mirror, we look towards the new year. What lessons did we learn and what trends deserve attention? How do we allocate portfolios based on that knowledge? In this piece, we’d like to share three areas of focus heading into 2026:

- Artificial Intelligence and Bubbleness

- The State of the US Economy

- The Biggest Risks to Asset Markets (Namely Inflation)

2025 Recap: Laughing in the Face of Di-worsification:

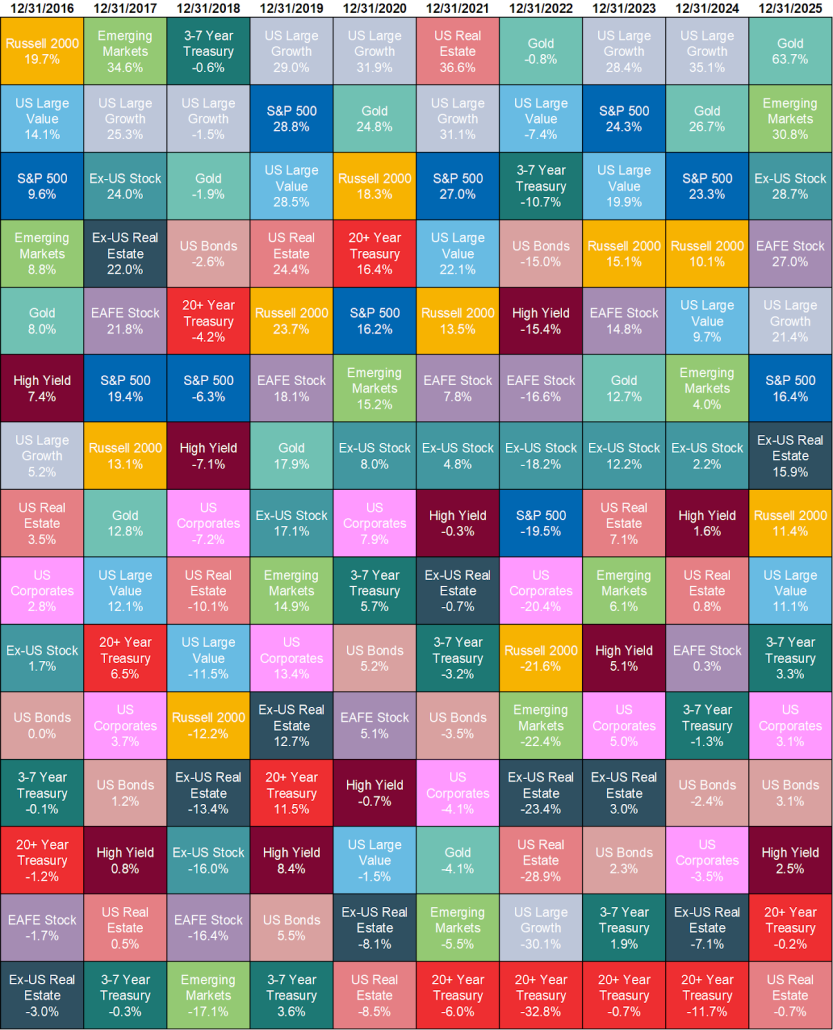

After years of US led-dominance, we saw narratives across asset classes flip on their heads. For the first time in years:

- US Stocks underperformed developed international and emerging market geographies.

- Gold, held for its diversification benefits, shined more brightly than most major asset categories.

Source: YCharts

The year reminded us that “di-worsification” – a term long used to parody the idea that diversifying into less correlated, non-US assets only made portfolios worse – isn’t a universal truth. In 2025, holding different asset segments helped weather volatile trade policy, weakening dollar, and US deficit concerns.

Ultimately, we left 2025 with a more fragmented globe where nations now emphasize national security and independence over globalized efficiencies. In this new regime where the global economy is de-synchronized, we believe diversification is more essential than ever.

Looking to 2026: What of AI and Its Bubbleness?

The topic of artificial intelligence being a bubble is almost inescapable. AI Hyperscalers, bolstered by massive spending commitments on AI investments, drove over 60% of the S&P 500’s growth and was a key lifeline for the economy in 2025. With AI hyperscalers and key players constituting a significant portion of the S&P 500, the ecosystem will likely continue to define US markets in 2026. So is it a bubble?

We have a separate piece that deep dives into the AI Bubble question which I’ve summarized below:

The Bull Case:

Proponents argue that this time is different compared to other speculative manias. The players here are profitable, cash-printing businesses whose valuations are not only reasonable, but also are pricing in achievable growth. Furthermore, there is ample demand for infrastructure, particularly data centers, unlike the railroad and dotcom bubbles. This all will enable revenue to follow, which has already exhibited enormous growth rates.

The Bear Case:

Despite tremendous growth, AI companies are spending way more than they’re making, (higher than past bubbles). Demand from businesses remains uncertain, with early studies showing only modest cost savings/revenue gains. Also, most revenue booked today is a result of circular investing amongst AI players. Meanwhile, AI companies are using aggressive accounting methods for their chips, which puts future earnings estimates at risk. Lastly, debt is now being used to finance spending, officially adding a shot clock for return on investment to materialize.

What to Do?

Within the deep-dive, we reach two conclusions:

1. Focusing on the “bubble” label is often unproductive. Even if excesses exist, timing the eventual “burst” is a fool’s errand—will it be in one year or five? Selling too early means potentially missing out on healthy gains.

As Peter Lynch noted, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

2. The AI dilemma is ultimately a huge collection of what-ifs, but we believe keeping a seat at the table while diversifying sources of risk and return in other parts of the portfolio such as international stocks, bonds, or gold is prudent.

How’s the US Economy?

Objectively speaking, the economy is in a healthy state heading into 2026. Let’s look at a few primary indicators:

- A Productive Economy – GDP grew at an astonishing annualized rate of 4.3% in Q3 2025 and is projected to grow ~2% (long-term average) in 2026. We expect AI spending to continue as hyperscalers add to productivity and other businesses increase adoption.

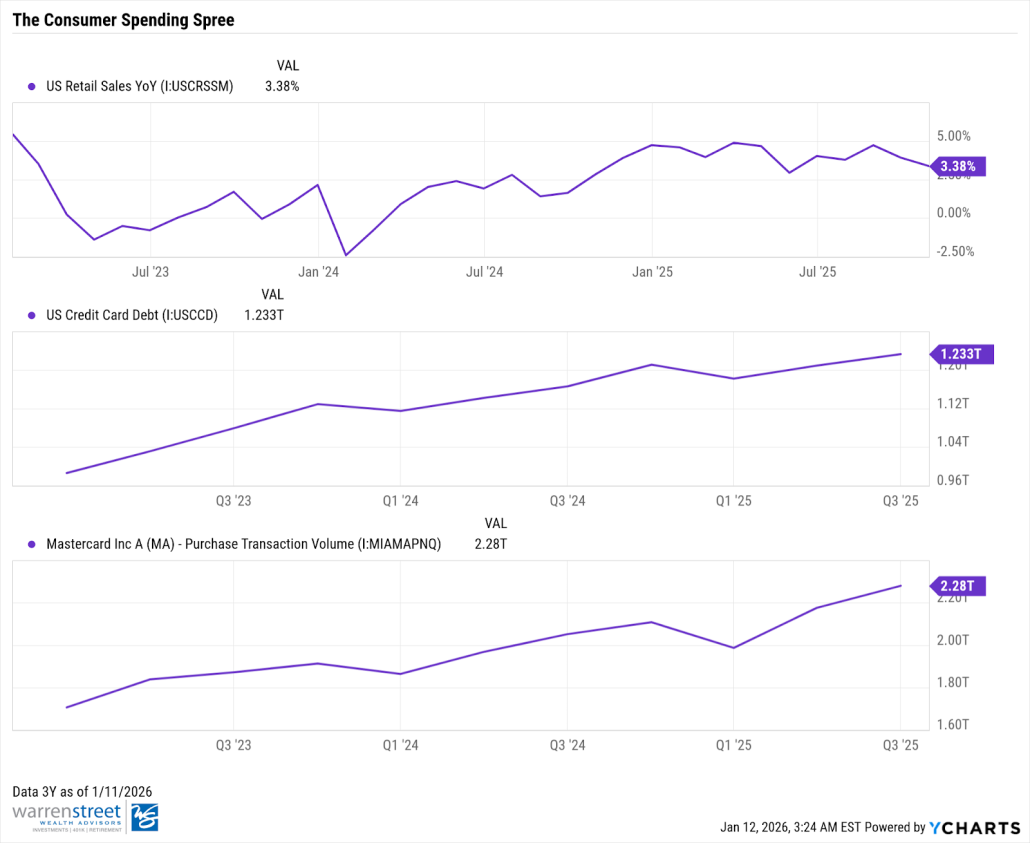

- The Spending Surprise – Despite rising concerns around job security and waning sentiment, Americans are still spending. In late 2025, retail sales surged 3.5% year-over-year and we observed a healthy uptick in credit card balances.

- Fiscal & Monetary Stimulus:

- Heading into 2026, we’ve unlocked tax credits from the One Big Beautiful Bill (OBBB). We take estimates with a grain of salt, but if $100bn in total tax refunds and a $3,750 average tax cut per filer could further stimulate consumer spending.

- The market currently anticipates two rate cuts, which will lower the cost of borrowing for both businesses and consumers (maybe more, pending Federal Reserve politics).

With a solid launching pad to start the year followed by additional liquidity in consumers pockets, we believe the US economy is well-equipped heading into 2026.

What About the Risks?

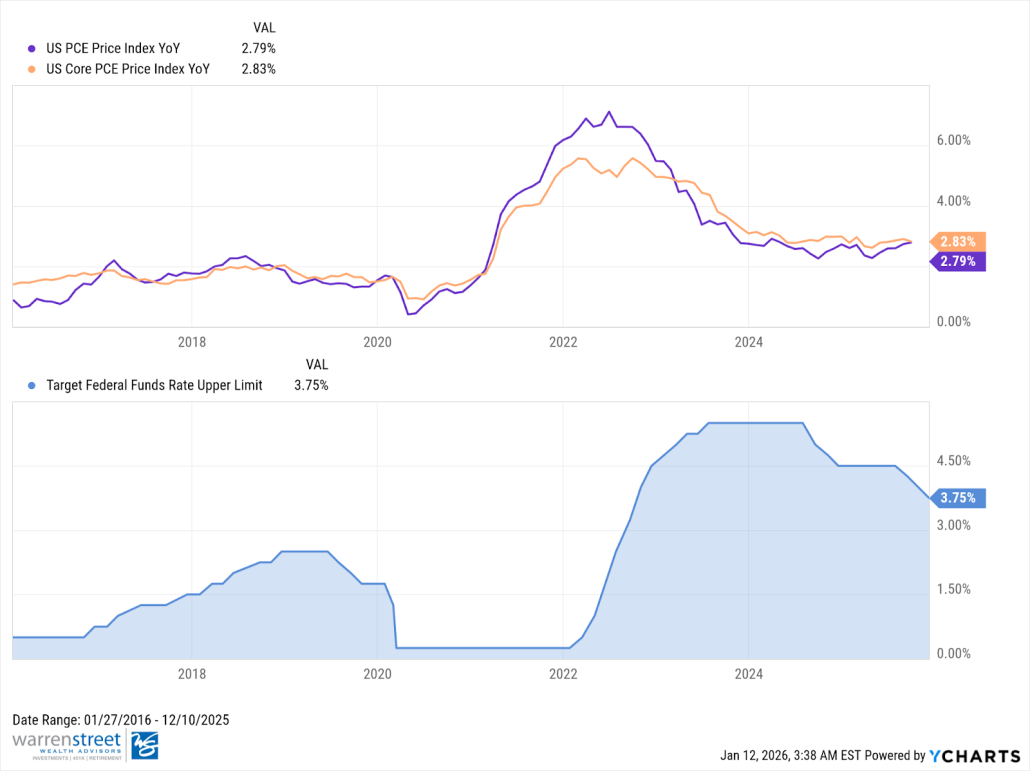

We believe the primary, non-wildcard risk to asset markets is inflation. Although inflation has stabilized from recent years, it remains sticky compared to pre-pandemic levels (around 2%), with the Fed’s preferred measure recently estimated at 2.8%.

The current economic backdrop does allow more sensitivities to a spike in inflation.

- Trade fragmentation and tariffs – while most businesses seemingly absorbed the price increases of tariffs in 2025, we’ve begun to see some price hikes passed to consumers in recent inflation prints.

- Is Stimulus a Double-Edged Sword? – While increased liquidity for consumers can be helpful, it may also fuel inflation. The prior stimulus checks led to double-digit drops in equities and bonds (2022) as we raised rates to fight policy-driven inflation.

- Financial Repression – With US Debt-to-GDP approaching 120%, there is a risk that policymakers resort to “financial repression” – intentionally allowing higher inflation to “inflate away” the real value of government debt.

With US equities trading expensively and bonds vulnerable to inflation, I’d park this risk in the low probability, but high impact camp. To mitigate this risk, owning a portion of your portfolio to hedges (gold, commodities, natural resources) can cushion against a potential 2022 repeat.

Conclusion:

Ultimately, the backdrop seems favorable for US equity markets heading into 2026. Even if markets are frothy, the solution to managing potential excesses and drawdowns is not in timing them, but instead: a) building adequately diversified portfolios b) aligning allocations with your risk tolerance and financial objective and c) rebalancing into weakness to harness the long-term growth of capital markets at more advantageous price levels.

That’s our 2026 outlook. Our advice remains: use these investing principles as your foundation. This will allow 2026 to be less about watching tickers and more about the life you’re building. Hit that PR, read those books, or learn to cook—aim to achieve your best self. While we can recommend investments and share outlooks, there’s no substitute for investing in your own growth and happiness.

Phillip Law, CFA

Senior Portfolio Manager, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Introducing Warren Street Global Equity ETF (WSGE) – An Informed Approach to Diversification

/in General, Investing/by Phillip Law, CFAWe’re thrilled to announce a major milestone for our firm and our clients: the launch of the Warren Street Global Equity ETF (NASDAQ: WSGE)!

This new Exchange-Traded Fund (ETF) is now available, bringing our disciplined investment philosophy to the public in a convenient, accessible format. This is an exciting step forward as we continue to provide sophisticated investment solutions while delivering on our fiduciary commitment.

What is WSGE and Why Did We Create It?

The Warren Street Global Equity ETF (WSGE) is designed to be a smarter way to invest in the global stock market. The traditional choice has always been either a simple, broad index fund or a complicated, expensive actively managed fund. We created WSGE to give you the best of both worlds: global diversification with a smart strategy built to enhance returns.

Focus on You: The Key Client Benefits

While the investment strategy is robust, the most important reason we created WSGE is to provide direct, tangible benefits to you, our clients, and to uphold our fiduciary standard:

- Embedded Tax Efficiencies: As an ETF, WSGE is structured to minimize capital gains distributions compared to traditional mutual funds. This powerful tax efficiency helps you keep more of your investment returns, making your portfolio work harder over the long term.

- Economies of Scale: By bundling diverse global exposures and our proprietary strategy into a single vehicle, we achieve significant economies of scale. This approach reduces complexity and overall costs, effectively providing you with institutional-quality management at a lower expense.

- Uniformity Across Clients: WSGE ensures every client benefits from the exact same research-driven exposure and proprietary factor tilts. This uniformity across clients leads to greater consistency, streamlined execution, and clearer reporting, regardless of account size.

- Time Savings & Simplicity: The single-fund structure drastically simplifies trade execution, rebalancing, and overall portfolio maintenance. This provides time savings for both our advisory team and you, the client, allowing us to focus more on your comprehensive financial plan, retirement goals, and tax strategies.

Learn More

When you invest in WSGE, you’re accessing the same level of rigorous due diligence that defines Warren Street Wealth Advisors. We meticulously select the fund’s underlying investments, focusing on quality management, low cost, and alignment with our goals.

We are proud to bring this innovative solution to market and look forward to partnering with you on your journey toward long-term capital appreciation.

To learn more about the fund, view the prospectus, and review important disclosures, please visit warrenstreetetf.com.

Phillip Law, CFA

Senior Portfolio Manager, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Important Information

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. This and other important information is contained in the prospectus, which may be obtained by following the links Prospectus and Summary Prospectus or by calling +1.714.876.6200. Please read the prospectus carefully before investing.

The Fund is actively-managed and is subject to the risk that the strategy may not produce the intended results. The Fund is new and has a limited operating history to evaluate.

Median 30 Day Spread: is a calculation of Fund’s median bid-ask spread, expressed as a percentage rounded to the nearest hundredth, computed by: identifying the Fund’s national best bid and national best offer as of the end of each 10 second interval during each trading day of the last 30 calendar days; dividing the difference between each such bid and offer by the midpoint of the national best bid and national best offer; and identifying the median of those values.

Basis Points (bps): A unit of measure used in quoting yields, changes in yields or differences between yields. One basis point is equal to 0.01%, or one one-hundredth of a percent of yield and 100 basis points equals 1%.

Equity Investing Risk. An investment in the Fund involves risks similar to those of investing in any fund holding equity securities, such as market fluctuations, changes in interest rates and perceived trends in stock prices. The values of equity securities could decline generally or could underperform other investments. In addition, securities may decline in value due to factors affecting a specific issuer, market or securities markets generally.

Fixed-Income Risk. The market value of fixed-income securities will change in response to interest rate changes and other factors, such as changes in the effective maturities and credit ratings of fixed-income investments. During periods of falling interest rates, the values of outstanding fixed-income securities and related financial instruments generally rise. Conversely, during periods of rising interest rates, the values of such securities and related financial instruments generally decline. Fixed-income investments are also subject to credit risk.

Large-Capitalization Companies Risk. Large-capitalization companies may trail the returns of the overall stock market. Large-capitalization stocks tend to go through cycles of doing better – or worse – than the stock market in general. These periods have, in the past, lasted for as long as several years.

Mid-Capitalization Companies Risk. Investing in securities of mid-capitalization companies involves greater risk than customarily is associated with investing in larger, more established companies. These companies’ securities may be more volatile and less liquid than those of more established companies. Often mid-capitalization companies and the industries in which they focus are still evolving and, as a result, they may be more sensitive to changing market conditions.

Depositary Receipt Risk. ADRs and GDRs are generally subject to the risks of investing directly in foreign securities and, in some cases, there may be less information available about the underlying issuers than would be the case with a direct investment in the foreign issuer. ADRs are U.S. dollar-denominated receipts representing shares of foreign-based corporations. GDRs are similar to ADRs but are shares of foreign-based corporations generally issued by international banks in one or more markets around the world.

Risk of Investing in Other ETFs. Because the Fund may invest in Underlying ETFs, the Fund’s investment performance is impacted by the investment performance of the selected Underlying ETFs. An investment in the Fund is subject to the risks associated with the Underlying ETFs that then-currently comprise the Fund’s portfolio. At times, certain of the segments of the market represented by the Fund’s Underlying ETFs may be out of favor and underperform other segments.

Focus Investing Risk. The Fund seeks to hold the stocks of approximately 40 companies. As a result, the Fund invests a high percentage of its assets in a small number of companies, which may add to Fund volatility.

Foreign Investment Risk. Returns on investments in foreign securities could be more volatile than, or trail the returns on U.S. securities. Investments in or exposures to foreign securities are subject to special risks, including differences in information available about issuers of securities and investor protection standards. In addition, foreign securities denominated in other currencies could decline due to changes in local currency.

Factor-Based Investing Risk. There can be no assurance that the factor-based investment selection process employed by the Sub-Adviser will enhance the Fund’s performance. Exposure to the different investment cycles identified by the Sub-Adviser may detract from the Fund’s performance in some market environments.

ETFs may trade at a premium or discount to their net asset value. ETF shares may only be redeemed at NAV by authorized participants in large creation units. There can be no guarantee that an active trading market for shares will exist. The trading of shares may incur brokerage.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. We make no representation or warranty as to the accuracy or completeness of the information contained herein including third-party data sources. The views expressed are as of the publication date and subject to change at any time. No part of this material may be reproduced in any form, or referred to in any other publication without express written permission. References to other funds should not to be interpreted as an offer or recommendation of these securities.

An investment in the Fund involves risk, including possible loss of principal. Exchange-traded funds (ETFs) trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value (NAV), and are not individually redeemable directly with the ETF. Brokerage commissions and ETF expenses will reduce returns. ETFs are subject to specific risks, depending on the nature of the underlying strategy of the Fund, which should be considered carefully when making investment decisions. For a complete description of the Fund’s principal investment risks, please refer to the prospectus.

Shares of the Funds Are Not FDIC Insured, May Lose Value, and Have No Bank Guarantee.

The Fund is distributed by PINE Distributors LLC. The Fund’s investment adviser is Empowered Funds, LLC, which is doing business as ETF Architect. Warren Street Wealth Advisors, LLC serve as the Sub-advisers to the Fund. PINE Distributors LLC is not affiliated with ETF Architect or Warren Street Wealth Advisors, LLC. Learn more about PINE Distributors LLC at FINRA’s BrokerCheck.

ETFAC-4941235-10/25

Decoding the AI Hype: How Today’s Market Compares to the Dot-Com Bubble

/in General, Intermediate, Investing/by Phillip Law, CFAYou’ve likely seen headlines comparing today’s AI-driven market to the late-1990s dot-com era. We take those comparisons seriously. This note outlines what’s different today, what still deserves caution, and, most importantly, how we’re positioning your strategy to hold up across a range of outcomes.1

Where Valuations Stand

Stock prices have climbed, and by simple measures of “price versus earnings,” the market looks more expensive than its long-term average. That’s a reason for discipline. However, it’s also true that the broad market remains below the most extreme levels reached in the late 1990s. You can see this in the valuation charts that track the relationship between prices and earnings over time.2

What’s Different From Dot‑Com Era

Back then, Barron’s magazine cover story in March 2000, called “Burning Up,” reported that 74% of 207 publicly traded internet companies had “negative cash flows” and at least 51 of those companies were projected to run out of money in the next 12 months. In contrast, today the largest parts of the market are producing real earnings, and overall profit margins across the major U.S. index remain above their five-year average. That doesn’t remove risk, but it does mean prices are supported by business results that we didn’t see from some companies in the dot-com cycle. FactSet’s latest quarterly review provides a good snapshot.3

AI Isn’t Just a Story—There’s Heavy Investment Behind It

A big reason certain companies have led is the build-out of the “plumbing” for AI: data centers, chips, software, and power. You can see this in government data, which shows manufacturing construction near record highs, much of it related to chip facilities, and in rising business spending on information-processing equipment and software. Those are dollars going into real plants, servers, and tools that support future productivity.4,5

Real Fundamentals – But Are AI Profits a Distant Dream?

Today’s AI landscape, where players boast robust business models and real fundamentals stemming from their core businesses, still is not without questions. While fortress balance sheets, resilient revenue, and strong earnings growth remain in place, the central point becomes: does the uncertain return on investment for AI justify the existing valuation levels, even if they aren’t as extreme as the Dotcom era?

We have to remember that many of today’s leading AI companies still look expensive based on profits they made last year. Meanwhile, the forward looking bull-argument rests entirely on whether their earnings will grow to meet the evergrowing mountain of expectations.

Intertwining Illusions of Growth

Beyond the frothy valuations, the AI hyperscaler ecosystem can feel like an Ouroboros (i.e., a snake that eats its own head). Okay, maybe that’s a bit extreme. However, it doesn’t take away from the increasingly circular dance of chipmakers, cloud providers, and foundational AI companies increasingly investing in one another.

Take for example, Microsoft’s $13billion investment in OpenAi in exchange for OpenAI agreeing to purchase $250 billion in Azure cloud services over the next decade. Microsoft is relying on OpenAI to find real, external customers to honor commitments in due time.

However, readers should ask – even if OpenAI succeeds in building an Artificial Generative Intelligence (AGI), will there be enough downstream demand for its products and services (especially if AI is displacing jobs)? Or will the primary customer base for AGI simply be the same tech giants who funded its creation? With more interdependence, one setback amongst one of these players could ripple across the entire industry.

Put simply, today’s “booming” AI revenue isn’t necessarily from new, organic customers with demand for AI services – it’s an internal recycling of investment capital that creates an illusion of growth where economic profit from external customers remains largely hypothetical. While long-term prospects for AI remain strong and we aren’t predicting a bubble, does being invested in an “expensive,” concentrated space predicated on nascent technologies warrant a closer look? We think it does.

How We’re Managing Your Strategy

That brings us to AI and concentration levels in US Markets. While we’re not sounding alarm bells or declaring an “AI Bubble,” we do recognize concentrated exposure in US Markets (and especially to AI) presents vulnerabilities. That’s why we continue to build adequately diversified portfolios that not only invest around the globe, but also across asset classes such as bonds, gold, and commodities. Recently, we’ve performed a partial rebalance of our market-cap weighted S&P 500 holdings (heavily concentrated to AI) towards US companies with stronger balance sheets and profitability (i.e., “quality” characteristics). Ultimately, we believe we’re in a state where diversifying our client’s sources of “risk” will be prudent for meeting their long-term goals.

If you’d like to meet and discuss how your portfolio is positioned for both stronger and more challenging environments, please give us a call to schedule a meeting.9,10

Bottom line, your portfolio is being actively managed with vigilance and care, and we’re always here if you’d like to discuss further.

Phillip Law, CFA

Senior Portfolio Manager, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Sources:

1. Insights.com, October 08, 2025. “This Is How the AI Bubble Bursts” https://insights.som.yale.edu/insights/this-is-how-the-ai-bubble-bursts Yale Insights

2. Yardeni.com, 2025. “Stock Market P/E Ratios“ https://yardeni.com/charts/stock-market-p-e-ratios/ Yardeni Research

The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

The term “Magnificent 7” refers to a group of seven influential companies in the S&P 500, including Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Tesla, and Meta Platforms.

The S&P MidCap 400 is a benchmark for mid-sized companies. The index is designed to measure the performance of 400 mid-sized companies,

The S&P SmallCap 600 is a benchmark for small-cap companies. The index is designed to track companies that meet inclusion criteria, which include liquidity and financial viability.

3. FactSet.com, October 31, 2025. “Earnings Insight” https://www.factset.com/earningsinsight factset.com

4. Fred.StLouisFed.org, September 25, 2025. “Total Construction Spending: Manufacturing (TLMFGCONS) (manufacturing construction near record highs)” https://fred.stlouisfed.org/series/TLMFGCONS FRED

5. Fred.StLouisFed.org, September 25, 2025. “Private fixed investment in information processing equipment and software” https://fred.stlouisfed.org/series/A679RC1Q027SBEA FRED

6. FederalReserve.gov, October 29, 2025. “Statement” https://www.federalreserve.gov/newsevents/pressreleases/monetary20251029a.htm Federal Reserve

7. Reuters.com, October 29, 2025. “Fed to end balance-sheet reduction on Dec 1, 2025; cuts rates by 0.25%” https://www.reuters.com/business/finance/fed-end-balance-sheet-reduction-december-1-2025-10-29/ Reuters

8. Bloomberg.com, September 30, 2025. “What a US Government Shutdown Means for Markets” https://www.bloomberg.com/news/newsletters/2025-09-30/what-a-us-government-shutdown-means-for-markets Bloomberg

9. Corporate.Vanguard.com, 2025. “Vanguard’s Principles for Investing Success” https://corporate.vanguard.com/content/dam/corp/research/pdf/vanguards_principles_for_investing_success.pdf Vanguard

10. Morningstar.com, April 1, 2025. “Q1’s Biggest Lesson for Investors: Diversification Works” https://www.morningstar.com/markets/q1s-biggest-lesson-investors-diversification-works

Business Exit Strategies on Your Terms

/in Education, Intermediate, Investing, Retirement/by Emily Balmages, CFP®If you’re a business owner, you’ll eventually step away from the company you’ve built. You might cash out to the highest bidder or work out a deal to sell the business to the next generation of your family or even to employees. The question is will you be able to make this transition on your own terms? The reality is that most business owners don’t have a clear, documented exit plan. And if you find yourself among them, you could find it leaves you in a tight spot when it’s time for you to step down.

Delaying planning your exit risks settling for a below-market sale price, losing control of choosing your successor or rushing into choices that don’t reflect your vision. Delays also leave you with little time to take steps to boost the business’s valuation and ensure business continuity. A clear exit plan helps maximize options and value. If you haven’t mapped out yours yet, there’s no time like the present. Consider these steps:

Put a Price on Your Business

Proper valuation of your business is the first step in exit planning. Some back-of-the-envelope math can provide a decent starting point. But to really understand what your business is worth, meet with a valuation expert. Besides a healthy dose of objectivity, these professionals bring market expertise and a knowledge of valuation standards. They can identify intangible sources of value you may have overlooked and help ensure your valuation passes muster with potential buyers and the IRS.

There are three main approaches to determining value:

- The asset approach adds up the value of your company’s tangible and intangible assets, then subtracts liabilities.

- The income approach calculates value according to your business’s expected future cash flows.

- The market approach compares your business to recent sales of similar companies.

You may find one approach is more apt than another for the type of business you own, but a comprehensive valuation is likely to incorporate all three in one way or another. Bear in mind that valuation isn’t a one-time event. As your business grows and market conditions change, you’ll likely want to update your valuation.

Clarify Your Vision

Before you can build an effective exit plan, it’s necessary to clarify your goals. Be as specific as possible as you define what a successful transition looks like to you.

Some questions to keep in mind: Do you want to maximize the sale price, selling at the highest price possible? Do you intend to keep the business within your family or pass it to a handpicked successor? What are your obligations to employees? Is it important that your business maintains a consistent set of values when you’re gone? What timeline makes sense for you? How involved—if at all—do you want to be with the business after you exit?

The answers to these questions will guide the decisions that follow. They can be deeply personal, and we’re here to be a resource as you consider what’s truly important to you.

Shape Your Exit

With valuation and goals in hand, there are a range of steps you can take to support your transition. What you do will depend largely on the type of exit you’re planning. For some owners, you might make strategic adjustments to boost the value of your business, such as reducing unnecessary expenses or diversifying revenue streams to make your company more attractive to buyers.

If your plan involves transferring the business to a family member or a long-time employee, the sooner you identify them, the better. That way you’ll have plenty of lead time to train them in the leadership skills necessary to provide a smooth handoff. Depending on your situation, you might consider a sale, a gift or a combination of the two. Be aware that gifts to family members above the lifetime gift and estate tax exemption ($15 million for individuals in 2026) might trigger gift taxes. Meanwhile, sales to employees could trigger capital gains taxes. If your business is structured as an S corp or C corp, you might consider an employee stock ownership plan (ESOP), which could defer or even eliminate capital gain taxes if structured properly.

Seeking an external buyer? Preparation is equally as important. In addition to boosting your valuation, you’ll need to organize your financial records, legal documents, contracts, employee agreements and operational procedures. One thing to consider is the type of deal structure that works best for you: Would you like to be paid over time or in one lump sum? And would you like to exit the company immediately or would you be open to staying on in an advisory capacity to help the new owner learn the ropes?

Begin the process of finding and vetting buyers early. These could be industry competitors, investment groups or individual entrepreneurs who may be a good fit. A business broker can help you identify potential buyers and spread the word through their network.

Charting the Future

For many business owners, exit planning rarely tops the to-do list. After all, there are plenty of day-to-day demands competing for attention, let alone the fact that it can be difficult for owners to think about the day they’ll no longer lead the company they built. Yet the most successful exits are those planned in advance, allowing owners to optimize value, identify an ideal buyer or successor, and prepare their employees for a smooth transition.

If you’d like to start a conversation about exit planning, we’d be happy to help you explore your options, develop a strategy that meets your financial goals and protects your legacy. here to help ensure your financial strategy stays aligned with your goals.

Emily Balmages, CFP®

Director of Financial Planning, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Rate Cut vs. Reality: Making Sense of Powell’s Mixed Signals

/in General, Intermediate, Investing/by Phillip Law, CFAInvestors finally got the interest rate cut they were waiting for last month, but comments from the Federal Reserve Chair have some of them scratching their heads. Let’s see if we can make sense of these mixed signals.

Jerome Powell Brings Investors Up Short

The Fed reduced its target federal funds rate by 0.25% on September 17. Rate cuts tend to make equity investors optimistic: They figure lower interest rates will reduce borrowing costs, goosing economic activity and hopefully boosting corporate earnings and stock prices. This time around, investors may think the Fed cut helps validate the S&P 500’s nearly 35% gain since it bottomed in early April.

Then, a week after cutting rates, Fed Chair Jerome Powell uttered these words:

“By many measures…equity prices are fairly highly valued.”

Powell’s seemingly innocuous statement sounded like a loud needle scratch to some investors. Fed chairs don’t often comment on stock prices, so the fact that he chose this moment to highlight steep valuations raised questions.

Is Powell—a renowned economist with more and better information than just about anybody—saying stocks are too highly valued? Are prices about to drop? Should you sell before it’s too late?

Are Stocks Expensive Right Now?

On the surface, it’s hard to quibble with Powell’s take. The most common way to gauge the broad stock market’s valuation is to look at the price-to-earnings (P/E) ratio of the S&P 500. And it’s high: As of September 26, the S&P 500’s P/E was 20% above the average of the past 10 years.1

But the topic deserves a little more context. Certain parts of the stock market are driving up the average, so it’s probably more accurate to say that some equity prices are fairly highly valued.

Specifically, tech stocks have risen on investor optimism about the potential for AI to drive future earnings. The tech sector had a P/E ratio over 30 as of October 1, compared to about 23 for the S&P 500 as a whole. By contrast, the energy, financials, health care, materials and utilities sectors all had P/Es in the teens.2

Should You Sell When Stocks Are Pricey?

Everybody knows the investing adage “Buy low, sell high.” However, applying this in practice isn’t always straightforward. Fact is, pricey stocks can get more expensive, such that exiting stock positions solely based on valuations can materially harm portfolio outcomes in the short-term. In fact, a study by LPL Financial comparing historical stock market valuation to returns over the next 12 months found “no relationship whatsoever.”3

Just ask another renowned Fed Chair, Alan Greenspan. Almost 30 years ago, he famously described “irrational exuberance” in the stock market—and the S&P 500 surged more than 100% over the following four years.4

While valuations are a poor short-term timing tool, it’s true that high valuations can temper future returns.5 To address this, we have recently implemented a rebalancing strategy across our client accounts. This essential process automatically takes profits from assets that have become highly valued and redirects those funds to areas we believe have better forward-looking potential, ensuring your allocation stays on target.

Run-ups in the prices of some investments can throw off your asset allocation—the percentage of your portfolio you have devoted to specific investment types. That’s why we periodically rebalance your portfolio, resetting your allocations to your long-term targets. This process automatically reduces how much you have in assets that have gained the most and redirects those resources toward assets that have lagged.

Your financial plan is designed to weather the short term so you can focus on the long term. But if there’s ever a news story that gives you pause, you can always reach out to us to help put it into perspective.

Phillip Law, CFA

Senior Portfolio Manager, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Sources:

- FactSet Earnings Insight, September 26, 2025. P/E based on forward earnings.

- Yardeni Research, October 2, 2025. P/Es based on forward earnings.

- LPL Financial, “Valuations Aren’t Great Timing Tools,” March 6, 2024.

- “Back in the ‘90s a Fed chief warned about ‘irrational exuberance’ in the markets. Stocks rose 105% over the next four years.” Fortune, September 30, 2025

- LSEG, “Do valuations correlate to long-term returns?” January 23, 2025

Counterintuitive Money Advice: Investing Against the Grain

/in General, Intermediate, Investing/by Phillip Law, CFAThere are a lot of things in life where the right move is pretty intuitive. Avoid the top rung of a ladder when you’re changing a lightbulb. Don’t click on that suspicious link in your email inbox.

But when it comes to your money, making smart decisions isn’t always so easy. In fact, there are a lot of times in investing where the intuitive move isn’t the best. A stand-out example is risk: For the most part, our brains and bodies tell us to avoid it. While it may seem smart to dial down risk in your investment portfolio, taking a too-conservative approach might leave you far short of your long-term goals. Making sound financial decisions often involves embracing counterintuitive strategies. Let’s explore a few more.

Less Action Often Leads to Better Results

Scenario: All too frequently, news headlines scream about stocks soaring or plummeting. When alarm bells like these ring, your impulse may be to take action. Zoom out and you’ll realize that a doom-and-gloom news cycle is practically a given. Buying and selling investments based on it is not a good idea.

Counterintuitive advice: The urge to act on market movements can be hard to resist. However, investing is a long-term endeavor, and often the best move is to do nothing at all.

Consider the story of the Voya Corporate Leaders Trust highlighted by Jason Zweig of The Wall Street Journal a few years back. Established in 1935, this fund was designed to counteract the speculative excesses that contributed to the 1929 market crash. Its approach was radical: The fund purchased equal shares of 30 stocks and committed to holding them indefinitely. No new stocks could be added, and existing ones could only be sold under extraordinary circumstances, such as bankruptcy or mergers.

Despite being on “permanent autopilot” for nearly a century, the Voya fund has outperformed many actively managed funds—and even the S&P 500 at times. Patience and a hands-off approach can pay off over time.

Your Portfolio Shouldn’t Match the S&P 500

Scenario: When the S&P 500 has had a bang-up year, as it did in 2024—and 2023—you may be tempted to wonder why your portfolio didn’t keep up. In fact, it might lead to what’s known as “tracking error regret,” which occurs when investors second-guess their diversified approach because their returns don’t match a popular benchmark.

Counterintuitive advice: Your portfolio is not built to match the S&P 500, which represents just one slice of the market—the 500 largest U.S. companies.

Instead, it’s designed for reasons that are unique to you, whether it’s funding retirement, paying for kids’ college education or leaving your wealth for the next generation. A well-diversified portfolio is a powerful tool to help you meet those goals. Consider the classic 60/40 portfolio, which allocates 60% to equities and 40% to bonds. While it’s not likely to outperform an all-equity portfolio over the long run, it is structured to provide a buffer during periods of market turmoil.

Remember, it’s not the S&P 500’s performance that matters. What really matters is sticking with the right plan that will help you meet your financial goals.

Embrace the Bear

Scenario: When bear markets happen, it certainly doesn’t feel good. In fact, it may feel like you’re watching your wealth evaporate before your eyes. The impulse might be to cut your losses and sell. But bear markets have a tendency to change course. (In fact, they historically always have.)

Counterintuitive advice: Market downturns provide an opportunity to rebalance your portfolio. Bear markets can be prime buying opportunities. When prices are low, you are essentially given the chance to buy shares of a company or a fund when they’re on sale. You may consider trimming positions in asset classes that have grown and buying more shares in those whose valuations have dropped.

Rebalancing in this way helps you stick closer to the asset allocation strategy that’s at the center of your financial plan.

Putting It All Together

Whether it’s sticking to a diversified portfolio, viewing market downturns as opportunities or making smart spending decisions, counterintuitive strategies can help you stay on track toward your financial goals.

As you reflect on your investments this year, remember that your portfolio is unique to you. It’s designed to meet your specific needs and long-term objectives. And sometimes, the best move is simply to trust your plan and let time do the heavy lifting. We’re here to field any questions you may have along the way.

Phillip Law, CFA

Senior Portfolio Manager, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

The “Big Beautiful Bill”: What It Means for Your Finances

/in Education, Financial Planning, General, Intermediate, Investing/by Justin D. Rucci, CFP®The “One Big Beautiful Bill Act” (OBBBA), signed July 4, 2025, is poised to significantly impact nearly every aspect of your financial life. From your tax bill to your healthcare and your children’s future savings, understanding the nuances of this bill is crucial for effective financial planning.

Here’s a breakdown of what the OBBB means for you:

Tax Planning: More in Your Pocket, But Mind the Details

The OBBB makes permanent many of the individual income tax rates and brackets from the 2017 Tax Cuts and Jobs Act (TCJA), providing long-term clarity. But there’s more:

- Expanded Standard Deduction: The standard deduction sees a permanent expansion, making tax filing simpler for many and potentially reducing the need to itemize.

- Temporary Deductions (2025-2028): Get ready for some new, but temporary, tax breaks.

- No Tax on Tips/Overtime: If you earn qualified tip income (up to $25,000) or overtime premium pay (up to $12,500 for individuals, $25,000 for joint filers), you may be able to deduct it. Keep an eye on income phase-outs.

- Senior Tax Deduction: Individuals 65 and older meeting income thresholds ($75,000 single, $150,000 joint) can claim an additional $6,000 deduction, aiming to offset federal taxes on Social Security.

- Auto Loan Interest Deduction: A temporary deduction of up to $10,000 for interest on loans for U.S.-assembled vehicles is available, subject to income phase-outs.

- Increased SALT Deduction Cap: For five years, the State and Local Tax (SALT) deduction cap temporarily increases to $40,000 (from $10,000), with income-based phase-outs. This is a win for residents of high-tax states.

- Enhanced Child Tax Credit: The Child Tax Credit permanently increases to $2,200 per child and will be indexed for inflation.

- Business Tax Incentives: Businesses will see the reinstatement of 100% bonus depreciation and permanent Section 199A (Qualified Business Income) deduction, encouraging investment.

- Estate and Gift Tax Relief: The unified credit and Generation-Skipping Transfer Tax (GSTT) exemption thresholds are permanently increased to $15 million per individual, offering substantial relief for high-net-worth individuals.

Your Action Plan: Review your current tax strategies with a financial advisor to maximize these new permanent and temporary provisions. Consider whether itemizing still makes sense for you.

Healthcare & Social Programs: A Shifting Landscape

The OBBB includes significant cuts to federal funding for vital social programs:

- Medicaid Changes: Expect cuts to Medicaid funding and new work requirements for many adult beneficiaries. If you or your loved ones rely on Medicaid, be aware of potential reduced coverage or new eligibility hurdles.

- SNAP (Food Assistance) Adjustments: The Supplemental Nutrition Assistance Program (SNAP) also faces federal funding cuts and expanded work requirements.

- Affordable Care Act (ACA) Implications: New eligibility verification requirements are imposed for ACA marketplace coverage, and enhanced tax credits for ACA coverage are set to expire. This could lead to higher out-of-pocket premium payments for many, particularly older adults. The CBO estimates these changes could lead to a significant increase in the uninsured population.

Your Action Plan: Reassess your healthcare and benefits planning. Explore alternative options if you’re impacted by changes to Medicaid or ACA, and adjust your budget accordingly.

Retirement & Savings: New Avenues and Program Shifts

The bill introduces both opportunities and challenges for your long-term financial goals:

- “Trump Accounts” for Children: A brand-new savings option for newborns. These “Trump Accounts” receive an initial federal contribution of $1,000, with parents able to contribute up to $5,000 annually. Classified as IRAs, gains are tax-deferred until age 18. This is a new consideration for long-term savings for your children.

- Student Loan Program Overhaul: Federal student loan programs are undergoing significant alterations, potentially ending subsidized and income-driven repayment options. Limits are also placed on Pell Grant eligibility. Current and future students will need to adjust their education financial planning.

- HSA and 529 Expansion: Good news for healthcare and education savings. Eligible uses for Health Savings Accounts (HSAs) and 529 education savings plans are expanded, offering more flexibility.

- Social Security Outlook: While the bill provides some temporary tax relief for seniors, its overall impact on the national debt could accelerate the insolvency of Social Security. This is a long-term consideration for retirement planning.

Your Action Plan: Evaluate “Trump Accounts” alongside existing savings vehicles like 529 plans. If you have student loans or are planning for higher education, understand the new repayment and eligibility rules. Review how you leverage your HSA and 529 plans for maximum benefit.

Investment & Business Considerations: Adapting to Policy Shifts

The OBBB also brings changes that could influence your investment portfolio:

- Clean Energy Tax Credits: Many clean energy tax credits from the Inflation Reduction Act are being phased out, which may impact investments in renewable energy and electric vehicles.

- Fossil Fuel Promotion: The bill promotes increased domestic oil and gas production, which could influence investment strategies in the energy sector.

Your Action Plan: Consider how these policy shifts might affect your investment portfolio. Diversification and a long-term perspective remain key.

Overall Financial Planning Implications: A Holistic Approach

The “Big Beautiful Bill” is a game-changer. It necessitates a comprehensive review of your financial strategy.

- Review Tax Strategies: Don’t miss out on new deductions!

- Reassess Healthcare and Benefits Planning: Understand potential impacts on coverage and eligibility.

- Evaluate Savings Options: Explore new opportunities like “Trump Accounts” and expanded HSA/529 uses.

- Update Estate Plans: High-net-worth individuals should revisit their estate plans due to increased exemptions.

- Adjust Investment Portfolios: Align your investments with the new economic realities. If you’re a client of ours, we’ve already done this for you.

The “One Big Beautiful Bill” is far-reaching. Given its complexity, consulting with a qualified financial advisor and tax professional is highly recommended to understand how these provisions specifically impact your unique financial situation and to adjust your plans accordingly. Schedule time with a Warren Street advisor today. .

Justin D. Rucci, CFP®

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Sources:

https://apnews.com/article/what-is-republican-trump-tax-bill-f65be44e1050431a601320197322551b

https://dart.deloitte.com/USDART/home/news/all-news/2025/jul/obbb-signed

https://blog.zencare.co/obbba-bill-medicaid-therapy-cuts

https://www.investopedia.com/parents-and-the-big-beautiful-bill-11767091

https://www.crfb.org/blogs/obbba-would-accelerate-social-security-medicare-insolvency

https://budgetlab.yale.edu/research/long-term-impacts-one-big-beautiful-bill-act

I’ve Got a Lump Sum in Cash, Should I Invest It Right Away?

/in Education, Financial Planning, Investing/by Justin D. Rucci, CFP®What should you do if you’ve just received a big bonus at work, inherited some money, sold a business, or come into a financial windfall? Should you invest it all at once, even if the market feels high or low, or take a gradual approach by investing in smaller increments over time?

This is a common question we hear from clients and investors alike. It’s no surprise—deciding how to invest a significant sum of money can feel overwhelming. What if you invest it now and the market drops? Or, what if you wait and the market takes off? It’s natural to worry about making the wrong choice or missing out on potential gains.

Both investing a lump sum immediately and spreading it out over time come with their pros and cons. Let’s explore some key factors to help guide your decision.

Start with Your Goals

Before making any investment decisions, consider your financial goals.

If you need the money for short-term purposes, like upcoming college tuition, the market’s volatility could be a concern. In this case, conservative options like short-term bonds, bond funds, or CDs might be better suited to protect your funds.

For long-term goals, such as retirement, investing in the stock market may be a better choice. Despite short-term fluctuations, the market has historically trended upward over time.

Compare Lump-Sum Investing vs. Dollar-Cost Averaging

Investing a lump sum means your money is fully exposed to the market immediately, allowing you to benefit from any immediate gains if the market is rising. However, since markets are unpredictable, a downturn could occur soon after you invest.

If the risk of short-term losses makes you uneasy, dollar-cost averaging (DCA)—where you invest a fixed amount at regular intervals—might be a more comfortable approach. For instance, you could invest $12,000 by putting in $1,000 monthly over a year. This way, you buy more shares when prices are low and fewer when they’re high, helping you manage the average cost over time.

Keep in mind, though, that research shows lump-sum investing outperforms DCA 68% of the time. If maximizing returns is your main goal, lump-sum investing could be the better option. However, if you’re worried about losses and potential emotional reactions, DCA may be worth the slight reduction in expected returns.

Don’t Wait to Invest

Historically, stocks and bonds outperform cash over the long term, so it’s important to start investing as soon as possible. Holding off is essentially an attempt to time the market, which is notoriously difficult. In 2023, equity fund investor returns trailed the S&P 500 by 5.5%, largely due to market timing efforts.

Both lump-sum investing and DCA help you avoid this pitfall, letting you benefit from the market’s long-term growth. The key is choosing the strategy that aligns with your risk tolerance and long-term plan.

If you’re unsure which strategy is best for you, reach out—we’d be happy to help you decide.

Justin D. Rucci, CFP®

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Contact Us

As a Registered Investment Advisor, Warren Street Wealth Advisors, LLC is required to file form ADV to report our business practices and conflicts of interest. Please call to request a copy at 714-876-6200.