2026 Investment Outlook: AI, Economy, Inflation

With 2025 in the rear view mirror, we look towards the new year. What lessons did we learn and what trends deserve attention? How do we allocate portfolios based on that knowledge? In this piece, we’d like to share three areas of focus heading into 2026:

- Artificial Intelligence and Bubbleness

- The State of the US Economy

- The Biggest Risks to Asset Markets (Namely Inflation)

2025 Recap: Laughing in the Face of Di-worsification:

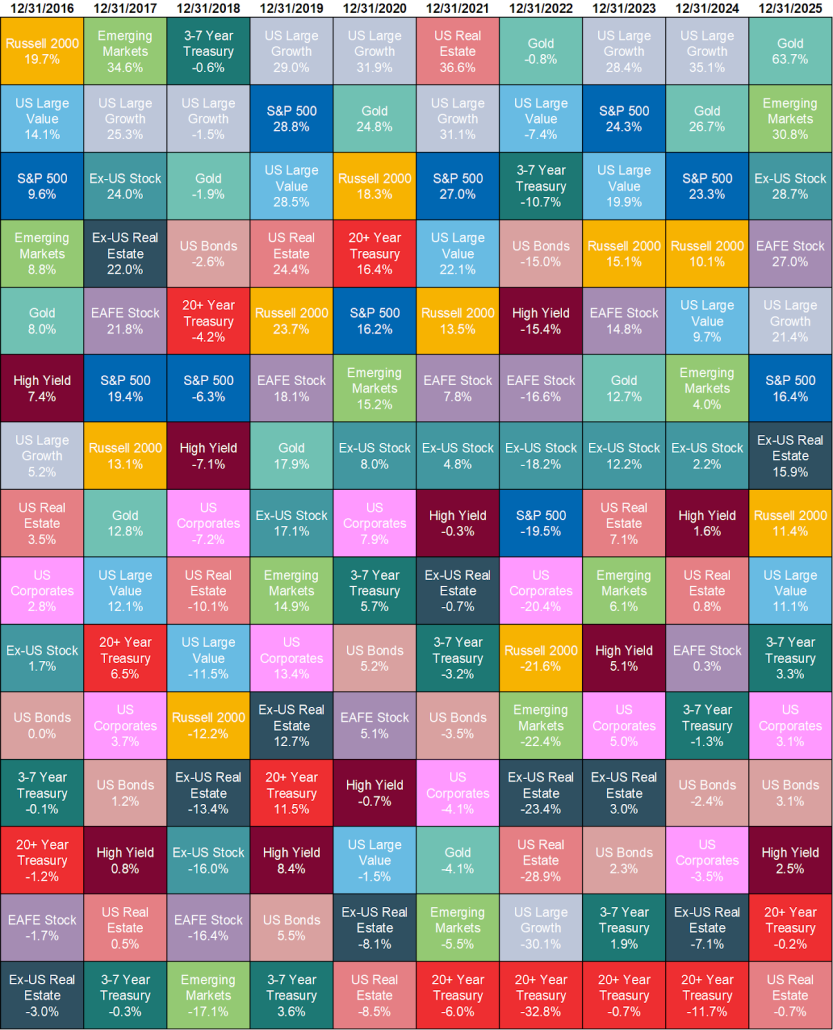

After years of US led-dominance, we saw narratives across asset classes flip on their heads. For the first time in years:

- US Stocks underperformed developed international and emerging market geographies.

- Gold, held for its diversification benefits, shined more brightly than most major asset categories.

Source: YCharts

The year reminded us that “di-worsification” – a term long used to parody the idea that diversifying into less correlated, non-US assets only made portfolios worse – isn’t a universal truth. In 2025, holding different asset segments helped weather volatile trade policy, weakening dollar, and US deficit concerns.

Ultimately, we left 2025 with a more fragmented globe where nations now emphasize national security and independence over globalized efficiencies. In this new regime where the global economy is de-synchronized, we believe diversification is more essential than ever.

Looking to 2026: What of AI and Its Bubbleness?

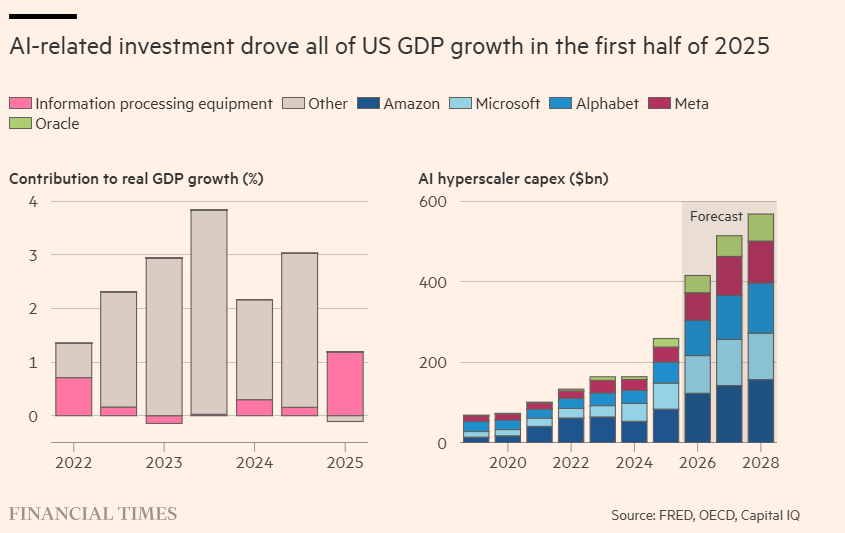

The topic of artificial intelligence being a bubble is almost inescapable. AI Hyperscalers, bolstered by massive spending commitments on AI investments, drove over 60% of the S&P 500’s growth and was a key lifeline for the economy in 2025. With AI hyperscalers and key players constituting a significant portion of the S&P 500, the ecosystem will likely continue to define US markets in 2026. So is it a bubble?

We have a separate piece that deep dives into the AI Bubble question which I’ve summarized below:

The Bull Case:

Proponents argue that this time is different compared to other speculative manias. The players here are profitable, cash-printing businesses whose valuations are not only reasonable, but also are pricing in achievable growth. Furthermore, there is ample demand for infrastructure, particularly data centers, unlike the railroad and dotcom bubbles. This all will enable revenue to follow, which has already exhibited enormous growth rates.

The Bear Case:

Despite tremendous growth, AI companies are spending way more than they’re making, (higher than past bubbles). Demand from businesses remains uncertain, with early studies showing only modest cost savings/revenue gains. Also, most revenue booked today is a result of circular investing amongst AI players. Meanwhile, AI companies are using aggressive accounting methods for their chips, which puts future earnings estimates at risk. Lastly, debt is now being used to finance spending, officially adding a shot clock for return on investment to materialize.

What to Do?

Within the deep-dive, we reach two conclusions:

1. Focusing on the “bubble” label is often unproductive. Even if excesses exist, timing the eventual “burst” is a fool’s errand—will it be in one year or five? Selling too early means potentially missing out on healthy gains.

As Peter Lynch noted, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

2. The AI dilemma is ultimately a huge collection of what-ifs, but we believe keeping a seat at the table while diversifying sources of risk and return in other parts of the portfolio such as international stocks, bonds, or gold is prudent.

How’s the US Economy?

Objectively speaking, the economy is in a healthy state heading into 2026. Let’s look at a few primary indicators:

- A Productive Economy – GDP grew at an astonishing annualized rate of 4.3% in Q3 2025 and is projected to grow ~2% (long-term average) in 2026. We expect AI spending to continue as hyperscalers add to productivity and other businesses increase adoption.

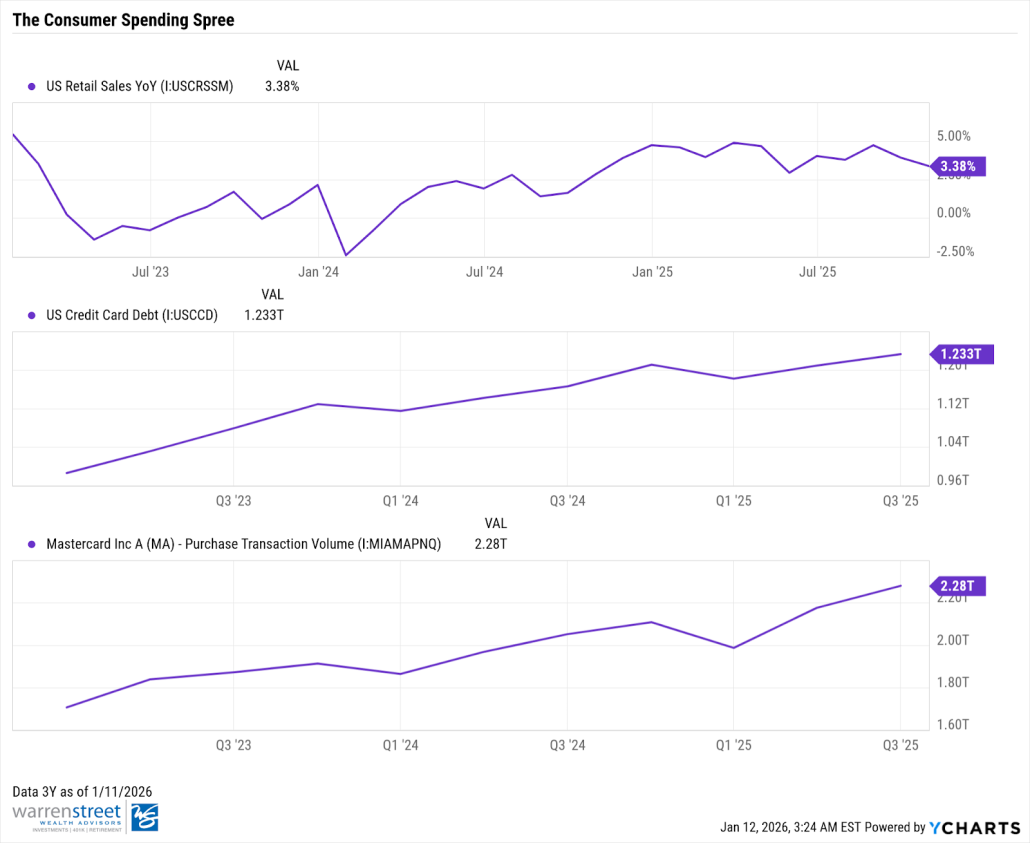

- The Spending Surprise – Despite rising concerns around job security and waning sentiment, Americans are still spending. In late 2025, retail sales surged 3.5% year-over-year and we observed a healthy uptick in credit card balances.

- Fiscal & Monetary Stimulus:

- Heading into 2026, we’ve unlocked tax credits from the One Big Beautiful Bill (OBBB). We take estimates with a grain of salt, but if $100bn in total tax refunds and a $3,750 average tax cut per filer could further stimulate consumer spending.

- The market currently anticipates two rate cuts, which will lower the cost of borrowing for both businesses and consumers (maybe more, pending Federal Reserve politics).

With a solid launching pad to start the year followed by additional liquidity in consumers pockets, we believe the US economy is well-equipped heading into 2026.

What About the Risks?

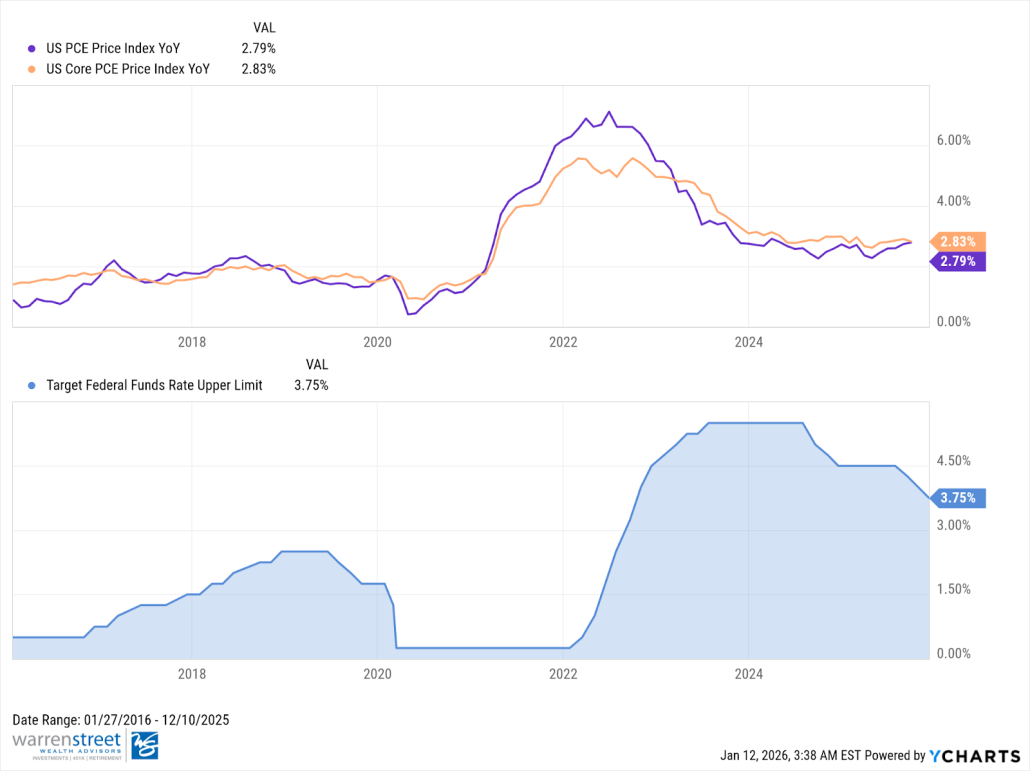

We believe the primary, non-wildcard risk to asset markets is inflation. Although inflation has stabilized from recent years, it remains sticky compared to pre-pandemic levels (around 2%), with the Fed’s preferred measure recently estimated at 2.8%.

The current economic backdrop does allow more sensitivities to a spike in inflation.

- Trade fragmentation and tariffs – while most businesses seemingly absorbed the price increases of tariffs in 2025, we’ve begun to see some price hikes passed to consumers in recent inflation prints.

- Is Stimulus a Double-Edged Sword? – While increased liquidity for consumers can be helpful, it may also fuel inflation. The prior stimulus checks led to double-digit drops in equities and bonds (2022) as we raised rates to fight policy-driven inflation.

- Financial Repression – With US Debt-to-GDP approaching 120%, there is a risk that policymakers resort to “financial repression” – intentionally allowing higher inflation to “inflate away” the real value of government debt.

With US equities trading expensively and bonds vulnerable to inflation, I’d park this risk in the low probability, but high impact camp. To mitigate this risk, owning a portion of your portfolio to hedges (gold, commodities, natural resources) can cushion against a potential 2022 repeat.

Conclusion:

Ultimately, the backdrop seems favorable for US equity markets heading into 2026. Even if markets are frothy, the solution to managing potential excesses and drawdowns is not in timing them, but instead: a) building adequately diversified portfolios b) aligning allocations with your risk tolerance and financial objective and c) rebalancing into weakness to harness the long-term growth of capital markets at more advantageous price levels.

That’s our 2026 outlook. Our advice remains: use these investing principles as your foundation. This will allow 2026 to be less about watching tickers and more about the life you’re building. Hit that PR, read those books, or learn to cook—aim to achieve your best self. While we can recommend investments and share outlooks, there’s no substitute for investing in your own growth and happiness.

Phillip Law, CFA

Senior Portfolio Manager, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.