March Market Madness

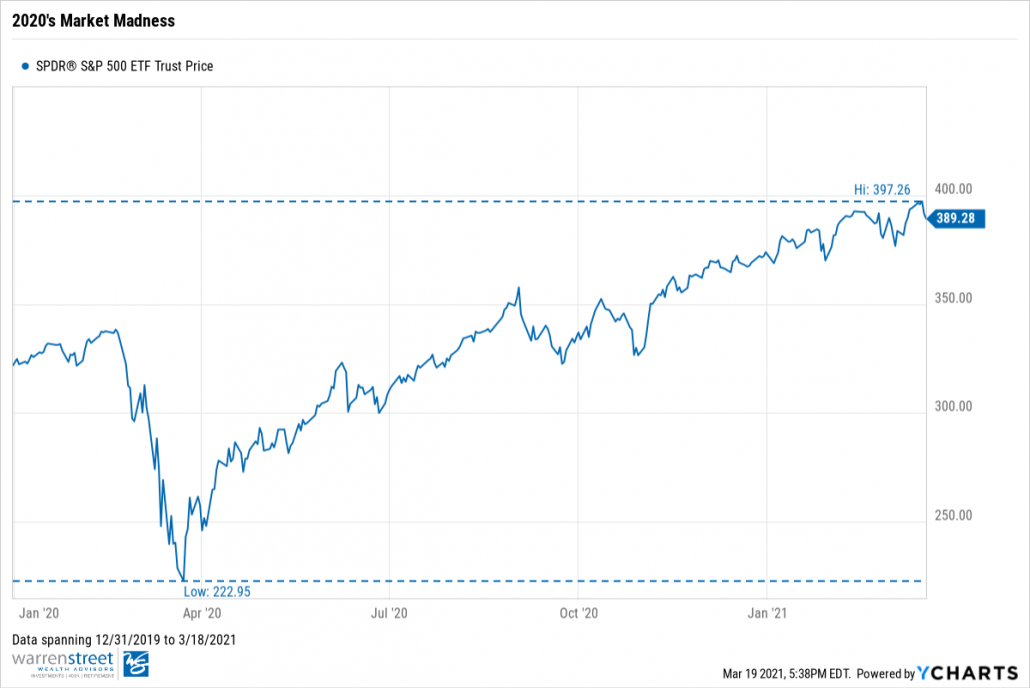

During this time last year, the NCAA canceled March Madness. With college basketball off the table, we were given a different type of madness: Market Madness. The S&P 500 drew down a total of 34% from peak to trough as COVID-19 wreaked havoc across global markets. This week marked the one year anniversary of that drawdown’s market bottom.

In September 2020, we wrote about the astounding fiscal and monetary policy action delivered by both the Federal Reserve and congressional lawmakers in response to the coronavirus. Although we complimented both the central bank and congress, the 2020 Most Valuable Player award quite honestly belongs to Jerome Powell and the Fed.

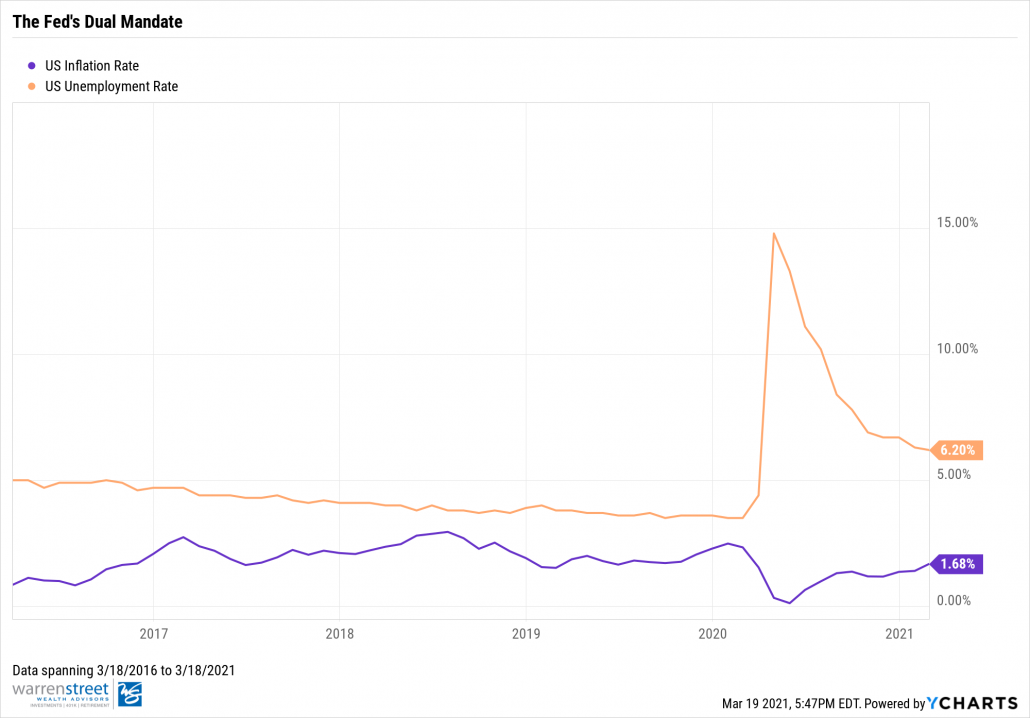

Today, after fending off last March’s Market Madness, the ball is no longer in the Fed’s court. Instead, The Fed is embodying a more reactive approach, awaiting signs of inflation to cross their 2% target before considering rate hikes or tools such as yield-curve control. Now, it’s our congressional leaders’ turn to play offense using fiscal policy. Their most recent time-out play is the $1.9 trillion stimulus package with embedded $1,400 stimulus payments expected to boost inflation.

Is Inflation Bad?

Let’s take a step back and consider why the Fed is setting a target with inflation. It’s important to distinguish that inflation isn’t as daunting as what’s ingrained in our history books. Sure, the inflationary tales of Zimbabwe and the Weimar Republic might seem scary, but the truth is such situations are rare and due to mismanaged policy in less-developed nations. Typically, mild inflation is a sign of rising consumption and increased demand. Today, this type of inflation can be recognized as reflation1; and in our case, reflation would signify that a return to normalcy is en route.

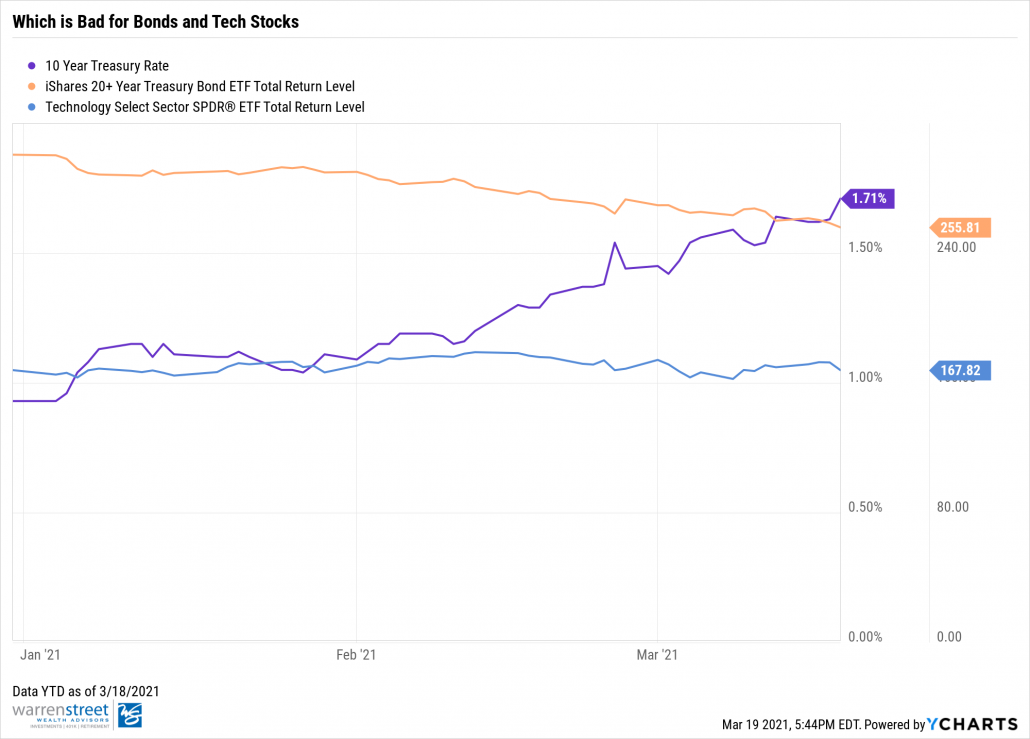

Market expectations for inflation are no laughing matter. A re-opening is expected to usher in increased spending in the form of pent-up demand. Input prices such as lumber and copper are already soaring. The five year breakeven treasury rate, which measures investor expectations for inflation, rose to its highest over point ever since 2014. Bonds, whose kryptonite is inflation, witnessed a sell-off that trickled into tech stocks.

But are markets correct to expect this much inflation? Or are markets overshooting their expectations by falling for this inflation pump fake? Perhaps our stay-at-home habits will prevail in the long-run and spending will not stay elevated, resulting in lower inflationary pressures. If so, we could see a rebound in bond prices and tech names. Nevertheless, this is the hotly debated topic among investors at the moment.

Run The Play

This brings us back to the analogy with our administration’s most recent time-out-play. The $1.9 trillion relief bill is bringing hope to the workers, businesses, institutions, and communities that have struggled throughout this pandemic. As you can see in the chart below, the $1,400 stimulus payments represent a large percent of the package totalling $422 billion. It makes sense for investors to expect increased inflation as consumers now have higher disposable incomes and propensity to consume – but there is a catch.

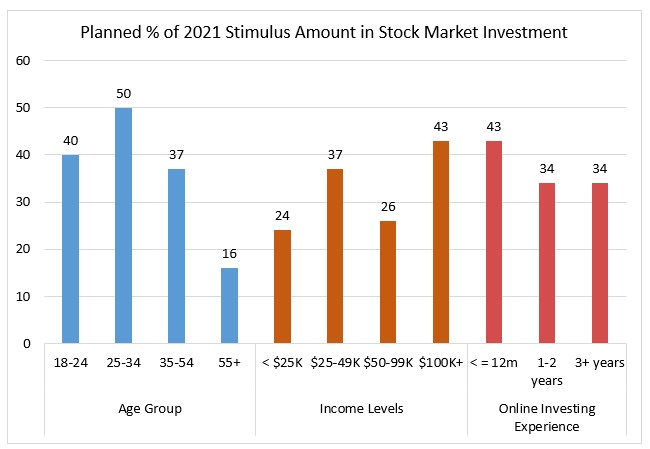

What will happen to actual inflation if these stimulus payments don’t make it back into the economy, but instead find their way into the stock market? A survey by Deutsche Bank revealed that individuals between the ages of 25 to 34 intend on placing 50% of the received payment into the stock market. Ultimately, the survey found that younger and high income earners eyed the stock market as the targeted destination for this income.

Data presented on 3/08/2021

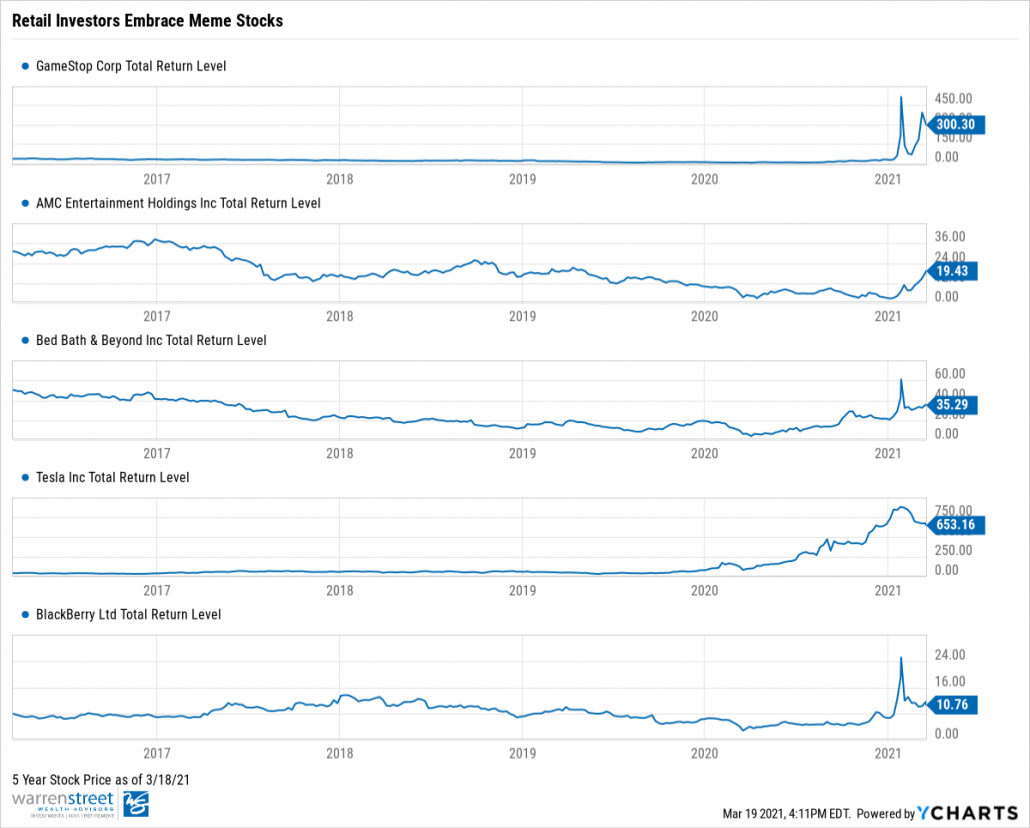

The Deutsche Bank survey, like any other, is going to be scrutinized for sampling error, but we don’t see something like the above being too far-fetched. The recent retail frenzy with “meme stocks2” like GameStop, Blackberry, and AMC has given rise to retail investing. Popular communities like r/WallStreetBets on Reddit have become a breeding ground for investors to commingle. Even more likely are your neighbors, who watched people get rich on the market’s 2020 rally, itching to pummel some of their stimulus money into the S&P 500.

These $1,400 payments are intended to increase demand for goods and prompt businesses to hire more workers, eventually raising wages. If these payments seek risk-assets instead, we could see a halt in the reflation narrative and a prolonged unemployment recovery.

Another risk to consider is the risk of financial stability. We’re seeing speculative behavior, especially from retail investors piling into stocks with less regard for the underlying fundamentals. At the end of the day, it’s quite possible to see a lack of wage growth in the economy while management teams of inefficient and highly-indebted companies get rewarded for little to no profitability.

The Bottom Line

We aren’t here to debate whether or not you should save or spend the money, let’s leave that to Reddit and Twitter. However, should a substantial portion of stimulus payments see capital markets as a more attractive destination than the underlying economy, the risks to reflation and financial stability must not be overlooked.

We’ll see whether or not the $1.9 trillion time-out play will win the economic recovery game and prevent further Market Madness… if not, let’s hope it at least takes us into overtime.

Footnotes:

- Reflation represents increased price levels as a result of monetary or fiscal policy as a means to combat deflation.

- “Meme stocks” are stocks that have gained traction from retail audiences such as Reddit or investment communities. GameStop and AMC are just a few of the many names with this retail comradery, earning these stocks the nickname “meme stocks” and causing a surge in prices throughout early 2021.

Sources:

Committee For a Responsible Congressional Budget

YCharts

Phillip Law, Portfolio Analyst

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.