Fiscal & Monetary Policy – How Long Can They Stay Heroes?

COVID-19 is without a doubt 2020’s villain mounted on a wanted poster. This global pandemic continues to bring forth a health crisis coupled with dismal economic data around the world. However, despite COVID’s heinous crimes, financial markets – especially credit markets – continue to exhibit a healthy recovery thanks to our two heroes: fiscal and monetary policy.

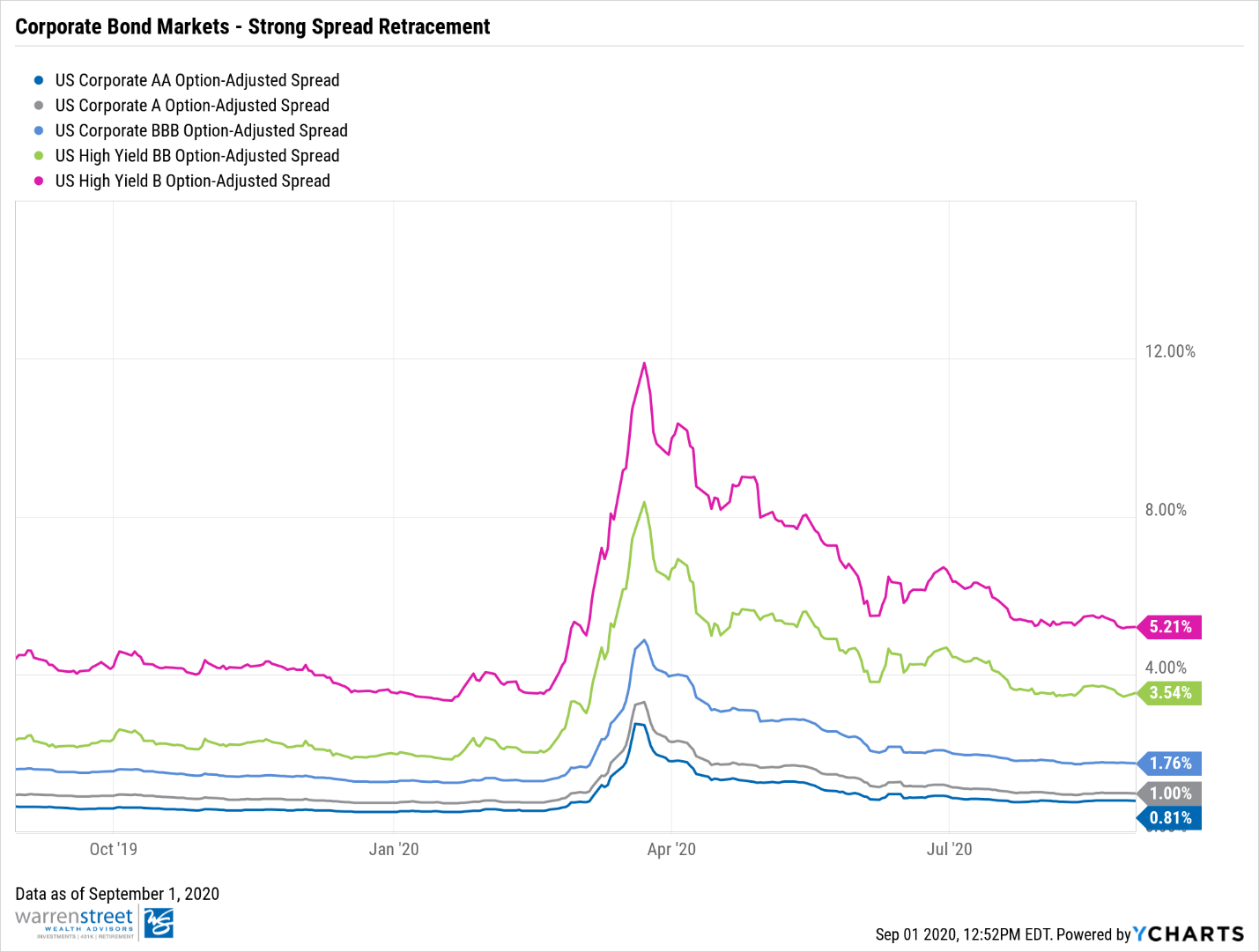

Credit spreads measure the difference in yield from a corporate bond to a treasury bond. Since low yields equate to higher bond prices, lower spreads result in price appreciation. In the chart above, corporate bond spreads show both an extreme spike and extreme tightening over the past few months alone, indicating a strong recovery in the corporate credit markets. In addition, U.S. default rates remain at about 8%, well-below the default levels in the 2008-09 financial crisis of 14.6%. Let’s take a look at how this happened.

Upon COVID-19’s arrival in the U.S., our government and our central bank suited up for battle. First, the federal reserve, led under Chairman Jerome Powell, unleashed its arsenal of monetary policy. The fed’s most notable actions included the following:

- Interest Rate Cuts: The federal reserve cut the federal funds rate to 0 to 0.25% in order to encourage credit flows and consumer spending during the 2020 recession. The effect of this rate cut trickled down into the housing and auto markets, where a V-Shaped recovery can be seen.

- Credit Facilities: During tough times, borrowers want to borrow more while lenders want to lend less. In order to help cities, states, small businesses, and corporations stay afloat and manage short-term cash needs in a risk-off environment, the federal reserve established credit facilities to purchase notes issued by vulnerable entities.

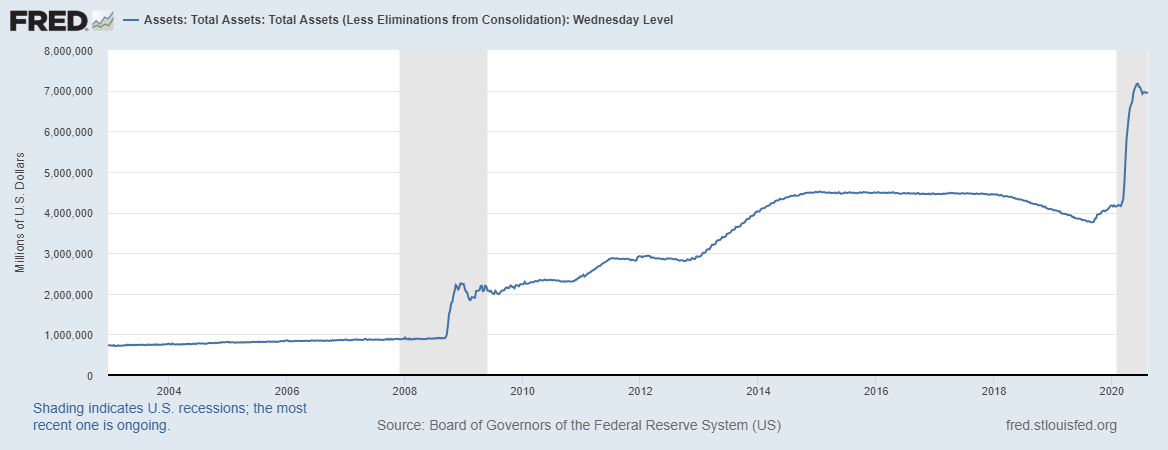

- Asset Purchases: For the first time, the Federal Reserve became both a lender and a buyer of last resort. During March, the treasury, mortgage-backed, and corporate credit markets experienced high levels of volatility. Mass selloffs dampened buyer interest, resulting in asset price fluctuations. To stabilize asset prices, the Federal Reserve engaged in unlimited quantitative easing, ballooning its balance sheet to levels never before seen.

Meanwhile, congress completed its end of the two-pronged attack through various fiscal measures. The U.S. government armed the economy and its citizens in the form of:

- Paycheck Protection Program (PPP): A loan made to keep employees on payroll, with an intention to forgive the respective loans if employee retention criteria are met.

- Economic Injury Disaster Loans (EIDL): EIDL loans are granted to small businesses and non-profit organizations to fund working capital and normal operating expenses amid the pandemic.

- Unemployment Compensation Benefits: Under the Federal Pandemic Employment Compensation (FPUC) program, a pool of $250 billion was made available for qualified unemployed individuals, in addition to an extra $600 weekly check.

- Corporate Bailouts: Industries hit hard by the pandemic leaned heavily on government assistance. The airline industry received $25 billion in direct funding and $25 billion in guaranteed loans for worker and contractor salaries. The U.S. government also granted Boeing $17 billion in loans and loan guarantees.

This unprecedentedly swift fiscal and monetary response is keeping the economy’s wheels turning, allowing certain economic indicators to experience V-shaped recoveries including retail sales, auto sales, existing home sales, and PMI. However, we can’t get comfortable just yet. Though our heroes successfully halted COVID-19’s damage in the first half, they are beginning to show signs of weakness.

The continued outbreak of Coronavirus cases in the South and West is hampering economic activity, prolonging a return to normalcy. Fiscal stimulus expired on July 31, and disagreements over a new bi-partisan stimulus package prompted President Donald Trump to take executive action in providing fiscal relief. Record levels of money printing are raising concerns for dollar weakness, potential inflation, and the erosion on bond value. Meanwhile, corporate bailouts and loans to companies on the brink of default, or “fallen angels”, are garnering criticism for adverse long-term effects on the free market.

To keep the economic engine running, more needs to be done at the state and local level in addition to ongoing support for citizens who find themselves unemployed. Yes, fiscal and monetary responses took strong initial strides in providing relief, but whether the U.S. and the global economy are up for further challenges remains to be seen. As for whether our future economy and free-market will be harmed by our heroes’ record money printing and corporate bailouts, I think Batman said it best: “You either die a hero, or you live long enough to see yourself become the villain.”

Before we conclude, we at Warren Street Wealth Advisors encourage you to ask yourselves the following:

- Given the current market environment, is your portfolio aligned with your risk tolerance?

- Do you have a question about PPP, EIDL, or fiscal relief measures?

- Do you want to learn how fiscal or monetary policy is affecting the markets?

Warren Street Wealth Advisors, a Registered Investment Advisor. The information contained herein does not involve the rendering of personalized investment advice but is limited to the dissemination of general information. A professional advisor should be consulted before implementing any of the strategies or options presented. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss.