“Happiness can be found, even in the darkest of times,

if one only remembers to turn on the light.”

-Albus Dumbledore

Pandemic-induced global economic disruption continues to dominate media headlines. It can be confusing to know how to filter through the deluge of content. What data is truly correct? Is it trustworthy? Has it been skewed for political influence?

This is especially challenging when investment markets and portfolios are already trending back close to even — and, in some cases, even above where they started pre-Covid. This simply seems too good to be true, and doesn’t reconcile well with the 11%+ unemployment rates or negative 32% GDP last quarter. Folks are having trouble reconciling those numbers with an improving stock market.

At Warren Street Wealth Advisors, we’re committed to sharing up-to-date, accurate data and our relevant insights with clients and the public alike. By filtering through the headlines for you, we want to be a resource you can trust for up-to-date, accurate information.

But What Should I Do?

We’ve heard it time and time again from clients: “What do I do? Stay invested for the long-term and keep my posture, or just run for the hills?”

Our advice, in general, is to stay the course. Here’s why.

1. Data Is Deteriorating, But Not All Is Lost.

All things considered, there’s a certain amount of triumph and optimism that should come out of the pandemic and encourage you to think long term and be comfortable with some level of risk.

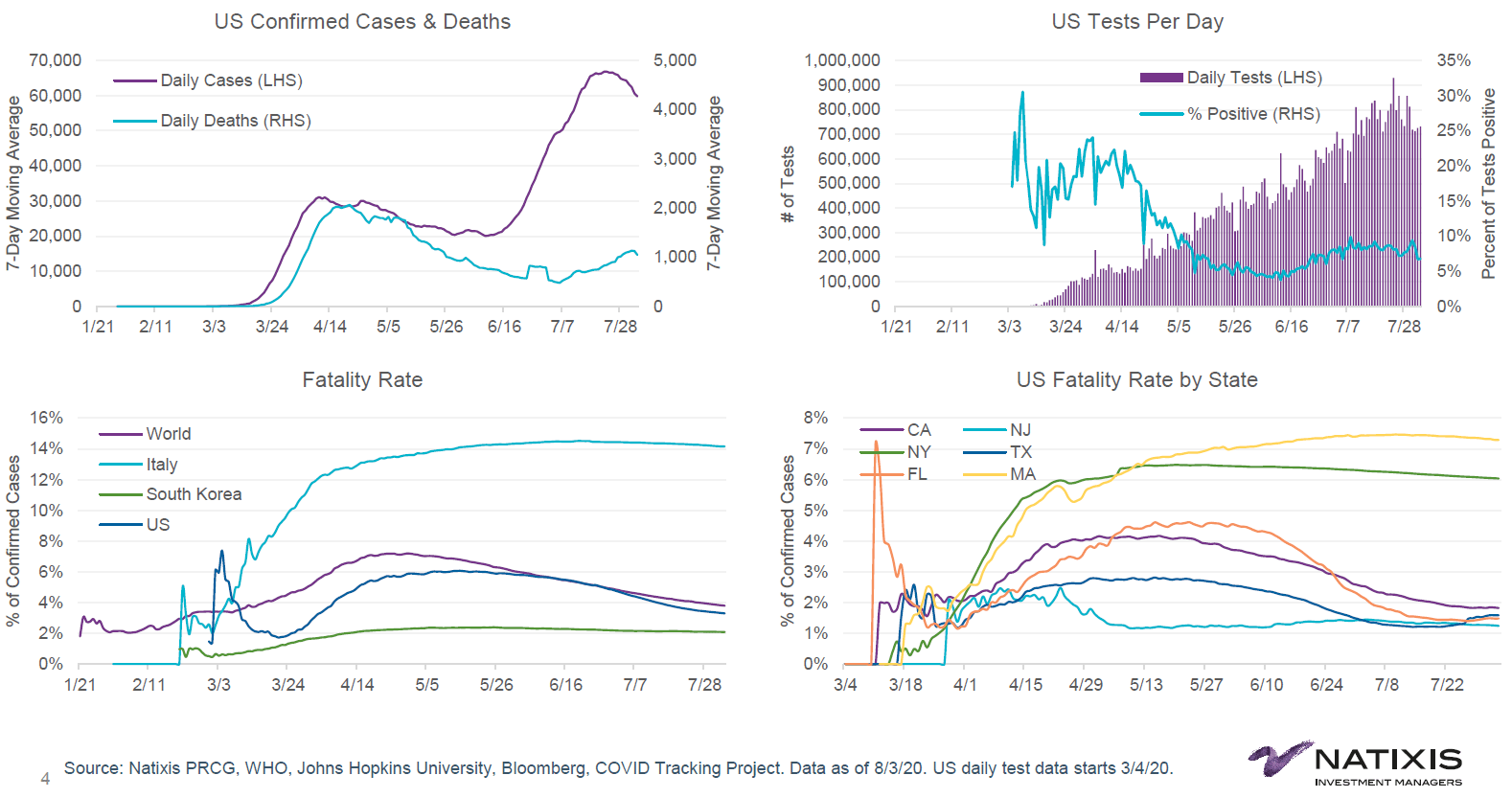

News headlines tend to lead with case counts, but it’s natural that more testing will yield more cases. Instead, let’s focus on hopistalitization and fatality rates, which are more telling.

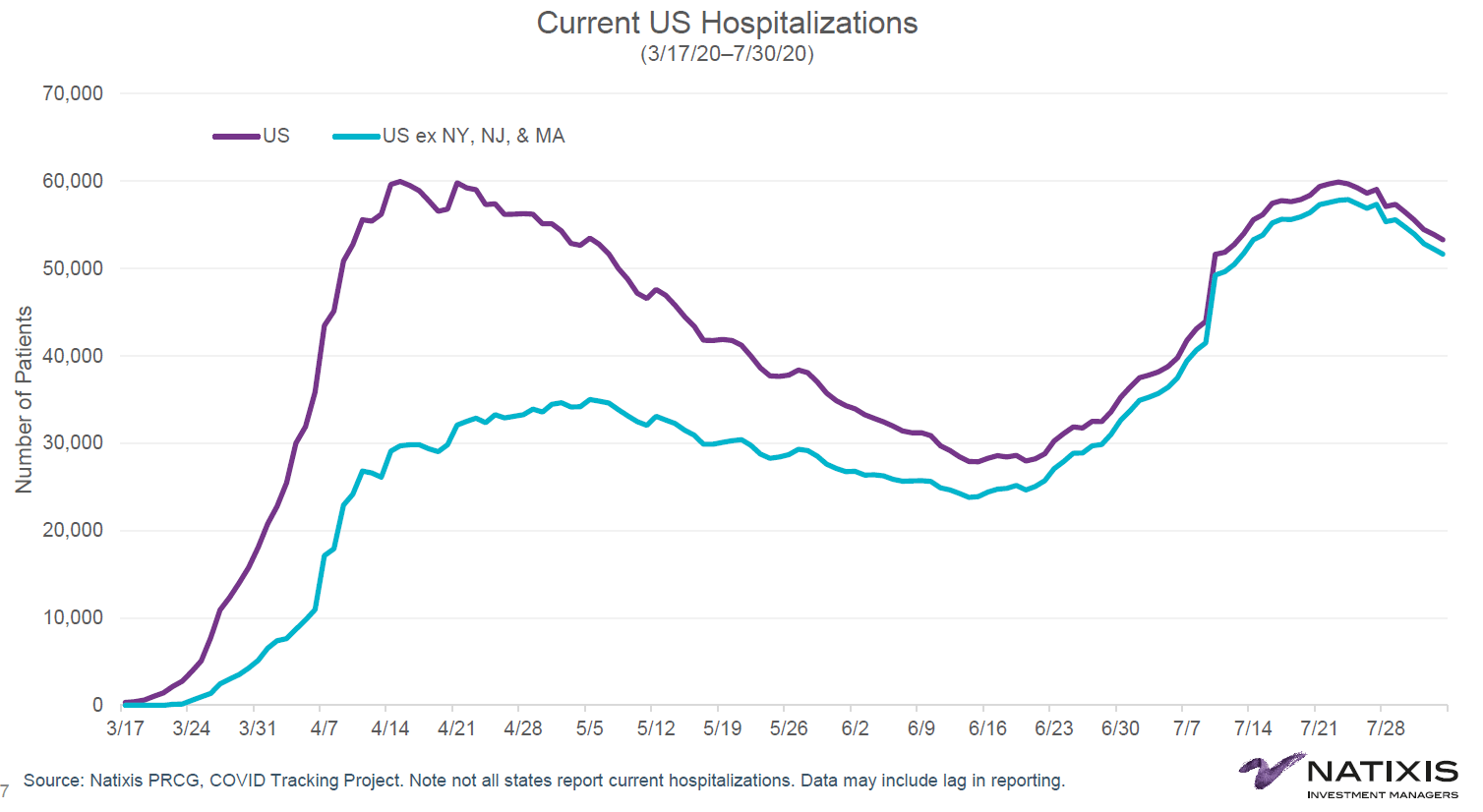

As of late July, the US was nearing peak hospitalization rates from April. Geographically speaking, cases were more spread out, given that original hotspots were dramatically skewed toward NY, NJ. Are other states prepared to respond in a way those localities did?

In order to move toward recovery, it’s imperative ICU occupancy rates don’t rise aggressively. Alabama is currently in the worst shape, with over an aggregate 80% occupancy. Hospital systems thus far have shown ability to expand ICU capacity quickly through use of suspending non-elective surgeries, repurposing beds/floors, and even setting up field hospitals.

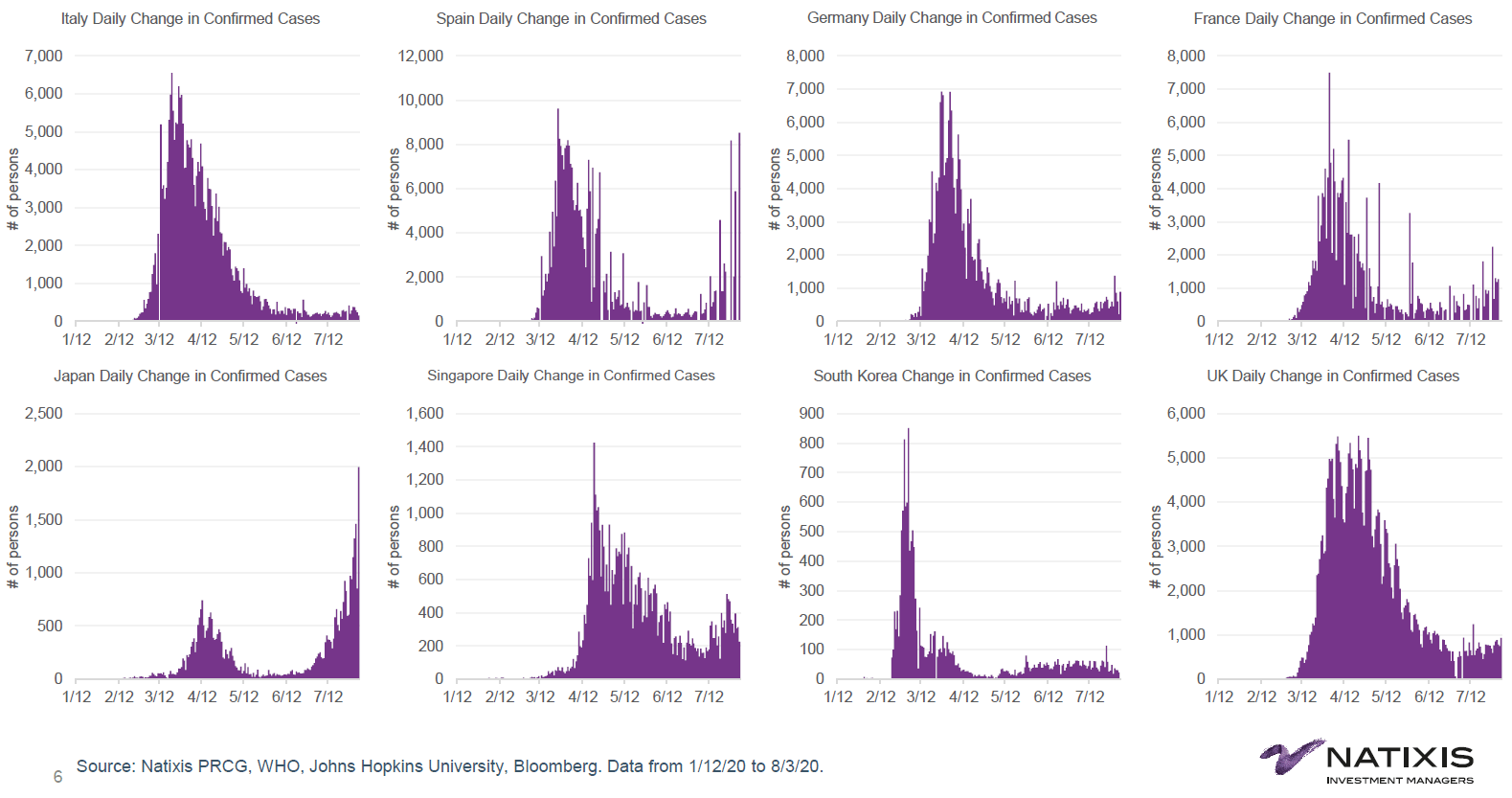

On a global scale, developed foreign countries have shown a stronger and more consistent response from early on. Likely, this edge is due to stronger testing capabilities, higher quality care, and better access to care. In addition, these countries moved more quickly on implementing proactive measures, such as masks, social distancing, shut downs, and contact tracing. Most developed economies experienced daily case growth in the hundreds, while the US daily average has been around 70,000.

From a monetary and fiscal policy perspective, developed economies are traditionally more austere than the US. While this pattern still holds true, the EU did recently move on an $800+ billion stimulus package, and Germany specifically is loosening its historically tight belt.

China’s ability to constrain the outbreak to Wuhan reflects the effectiveness of draconian shutdowns, which were widely followed in other countries. They also set the stage for contact tracing, mobile apps, and mandated preventative measures like masks and temperature checks. China represents roughly 40% of emerging market GDP and roughly 40% of the investable emerging markets. Their strong response to date is one of the reasons why emerging market equities have fared relatively well year to date. As always, data from China needs to be watched with a skeptical eye.

2. There’s Value in Global Stock Positions.

At Warren Street, we’ve always held a large allocation to international and emerging markets.

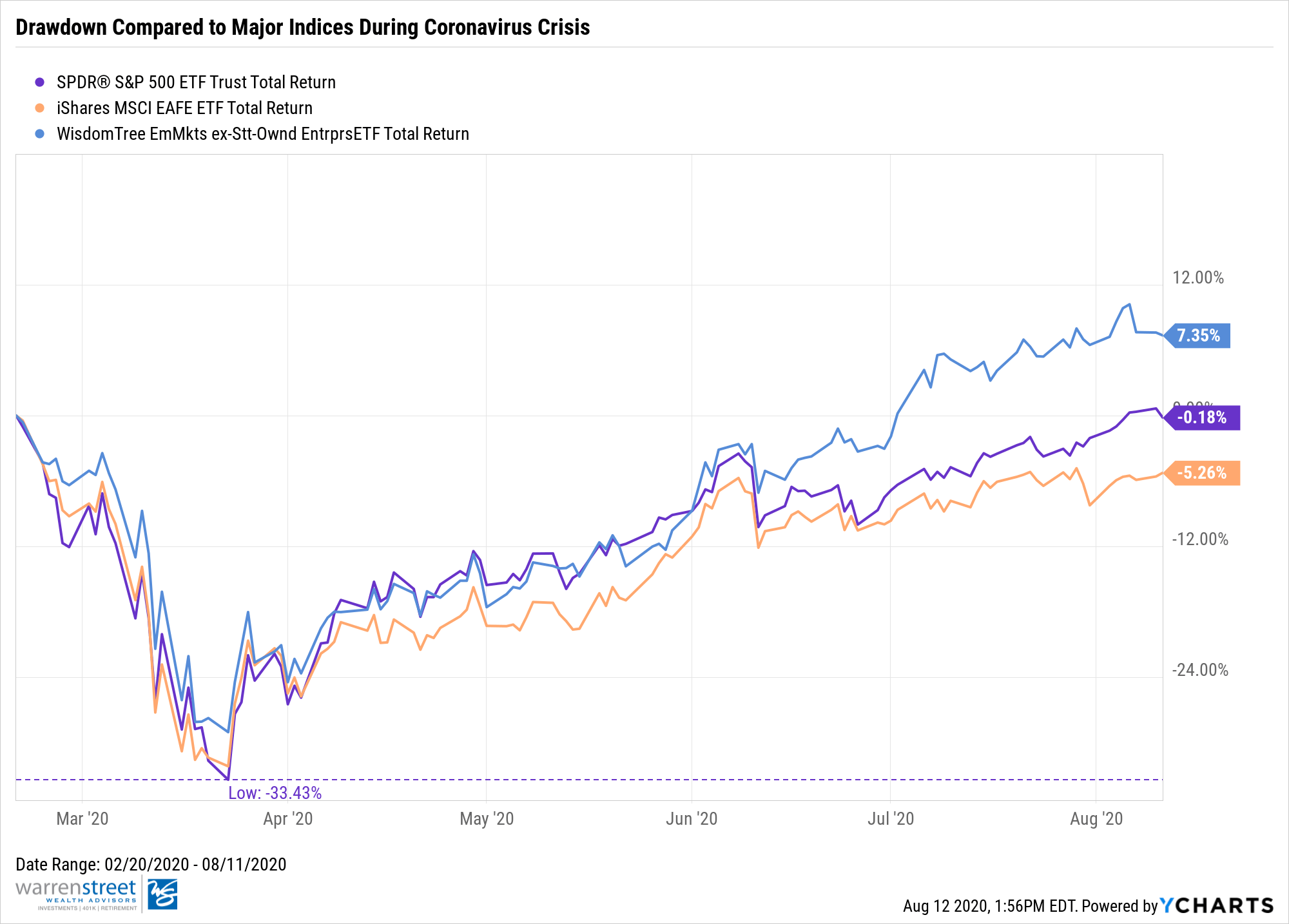

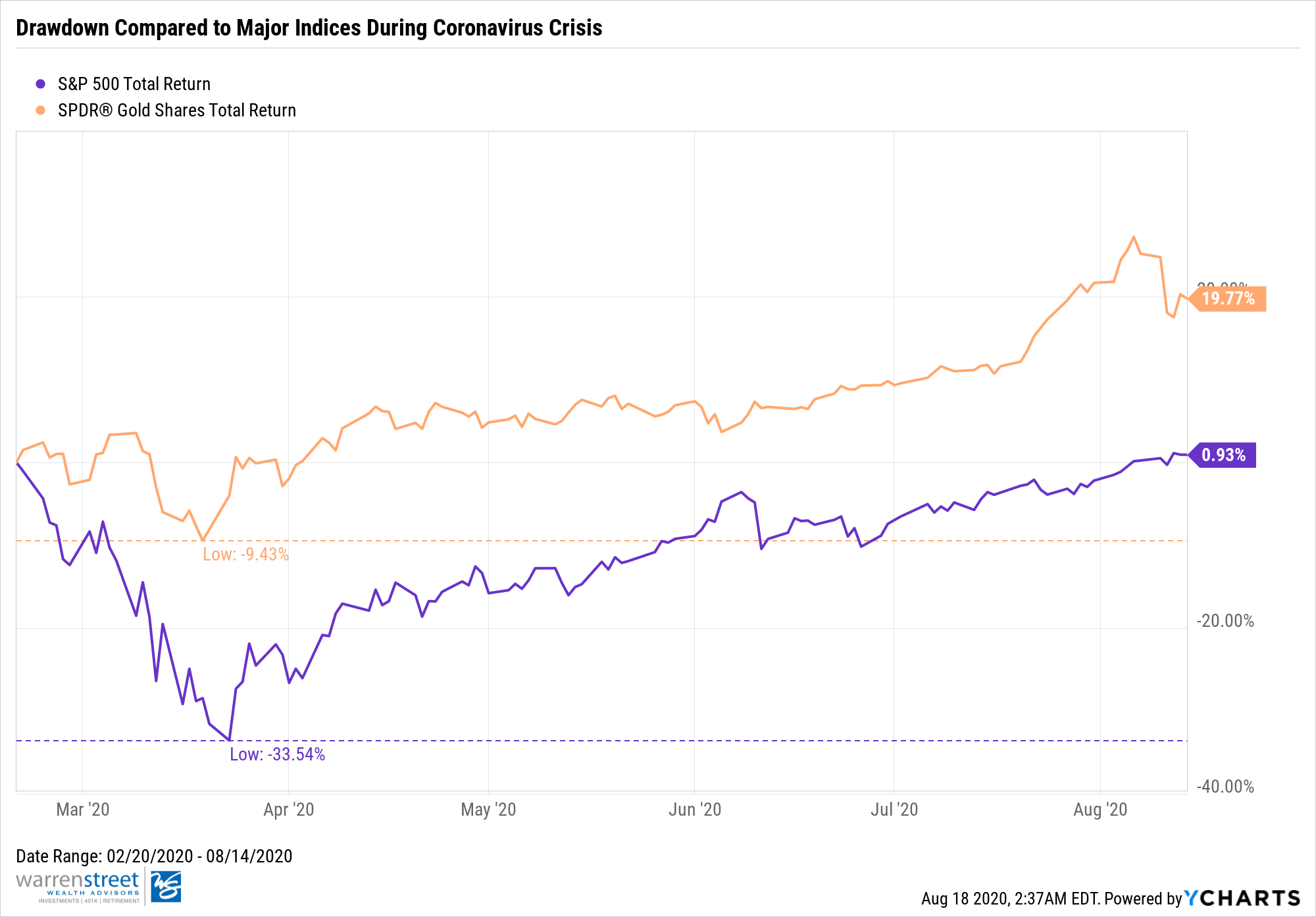

The graph above shows investment returns for most major market asset classes at the start of the coronavirus drawdown to early August. The takeaway is that the US market in aggregate bottomed at down -33% and is now near flat. Emerging markets are positive: 6-7% as of 8/11 depending on the metric or manager you use. Developed Foreign Markets are still negative roughly -5% as of 8/11 as measured by EFA.The pain has been felt worldwide, but we have an eye to the emerging world, which has in some cases bounced back from the pandemic much more quickly than the US.

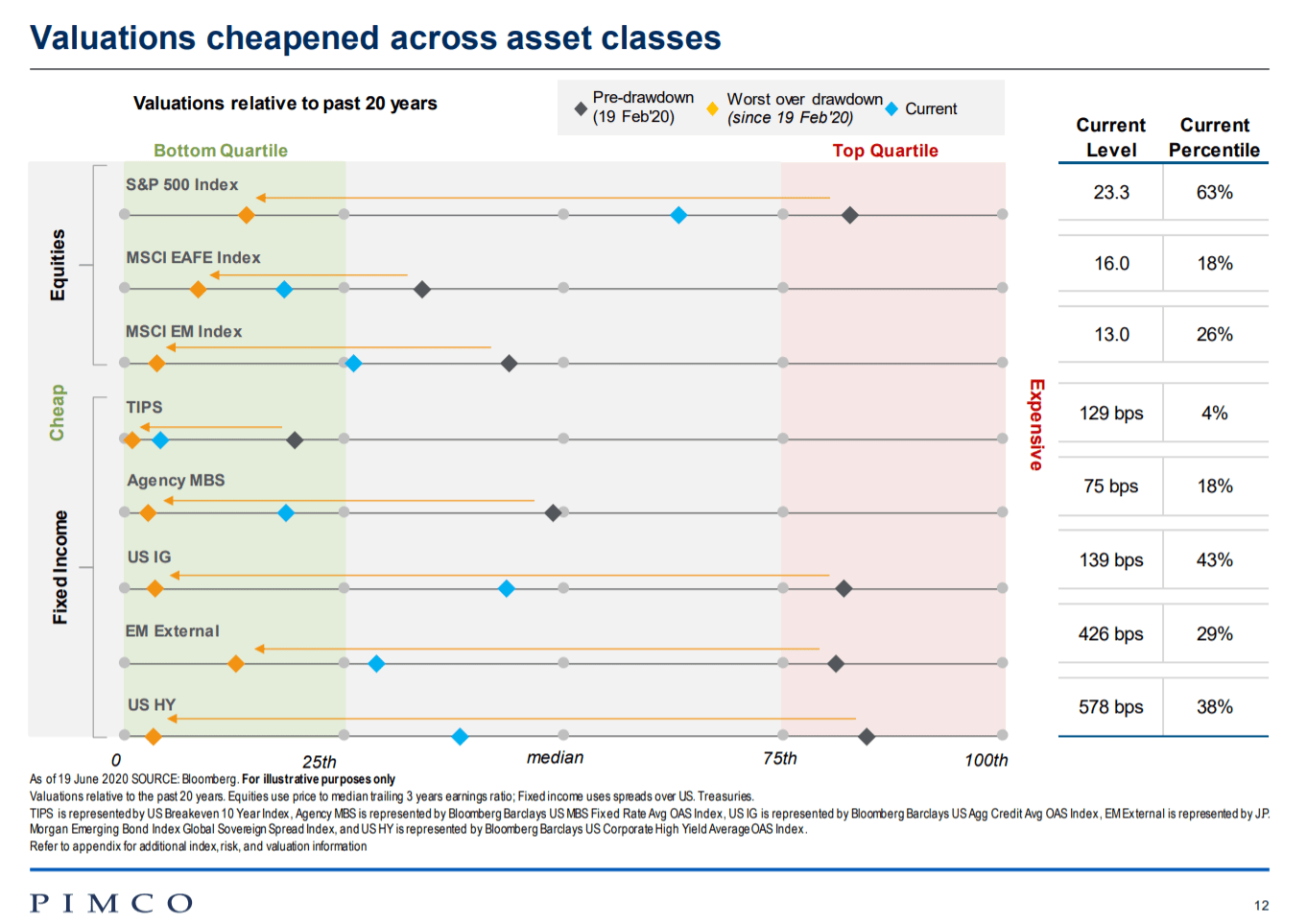

Below that you can actually see valuations for those different major market asset classes:

- S&P for US stocks

- EFA – developed country non-US stocks

- EM index – emerging market economies

The chart above highlights how, before Covid, the US was very expensive. Whether you used price to earnings, price to book or the CAPE ratio, any valuation came to the same conclusion: pricey! The same was not true overseas. Emerging market assets have been cheap for a long time and are still cheap to this day.

You can cook this up a number of different ways. Economic output and corporate earnings in the emerging world haven’t been impacted the same way US data has been, generally because the pandemic has been handled better abroad. To boot, foreign markets were cheaper to begin with.

3. The Belle of the Ball Is Actually Gold.

We’ve gotten a lot of questions from clients over the years for why we own gold and why we believe in it. The answer is, simply, “It’s different.” It offers a diversification benefit you can’t find in other asset classes.

Most clients own some percentage of gold in their portfolios, and gold was up 20% in the drawdown. This supports the fact that gold behaves like a crisis commodity.

You can read more about the merits and risks of owning gold in our blog post Gold Rush of 2020.

A Light at the End of the Tunnel

Of course, there is no silver bullet to cure COVID-19. But there are things we can do to protect the transmission curve and the most vulnerable, which will in turn protect your portfolio and the markets. It’s tough not to cave to the headlines, but if you’re investing appropriately to your risk tolerance at the outset, you’re better off staying the course.

If you have any questions or would like to chat with a member of our team, please reach out to us; we would love to chat with you.

Blake Street, CFA, CFP ®

Founding Partner

Chief Investment Officer

Warren Street Wealth Advisors

Warren Street Wealth Advisors, a Registered Investment Advisor. The information contained herein does not involve the rendering of personalized investment advice but is limited to the dissemination of general information. A professional advisor should be consulted before implementing any of the strategies or options presented. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss.