April showers bring May flowers?…or thunderstorms??

Key Takeaways

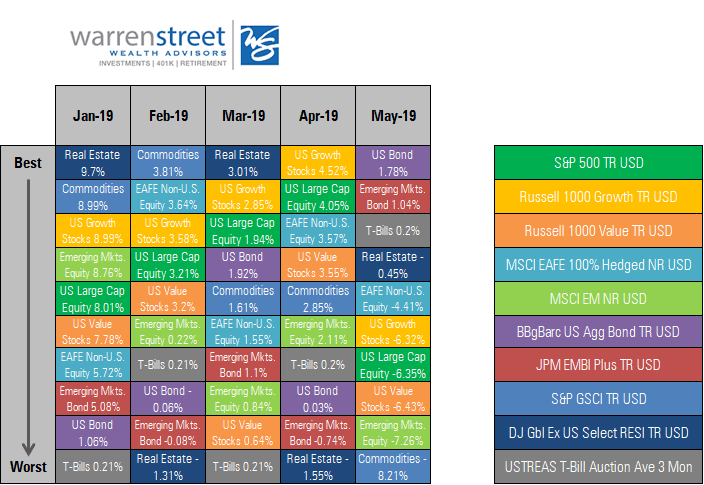

- The stock market stumbled in May after strong performance in April. The decline was likely due to concerns over the impact of proposed tariffs on Mexican goods, especially given that Chinese trade negotiations are still unresolved.

- Treasury yields hit new lows in May as investors fled stock market volatility. However, a 10-year Treasury yield of 2.1% is not sustainable when inflation is hovering around the same level. We expect Treasury rates to increase rather than decrease from here.

- Futures contracts indicate an 80% chance of the FOMC decreasing interest rates in July. This expectation is not supported by the economic data nor the plentiful level of liquidity already in the system. Futures investors are inferring more into dovish Fed comments than they should.

- Despite pockets of weakness, the U.S. economy is still on track to grow by about 2% in 2019.

- Conclusion: Stock market recoveries based on expectations of falling interest rates are vulnerable to ‘headline risk’, but the underlying economic fundamentals remain modestly positive.

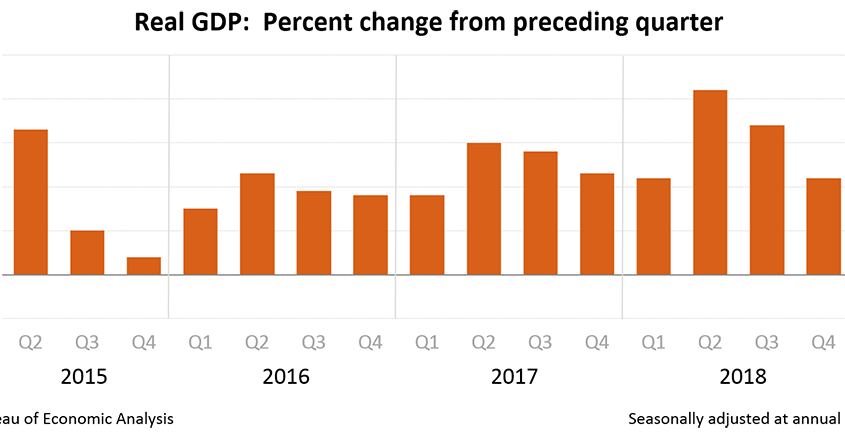

When 1st quarter GDP came in at 3.2% many commentators expected an adjustment downward. That revision came in May…to 3.1%

1st quarter GDP adjusted by a scant -0.1%

Despite persistent pessimism about the imminent demise of the U.S. economy, we at Warren Street Wealth stand by our assessment that the economy will continue to grow at a modestly positive pace. Even with the drag on growth from increasing trade tariffs, the International Monetary Fund forecasts U.S. GDP to end 2019 at 2.3%, which is about average for the past few years.

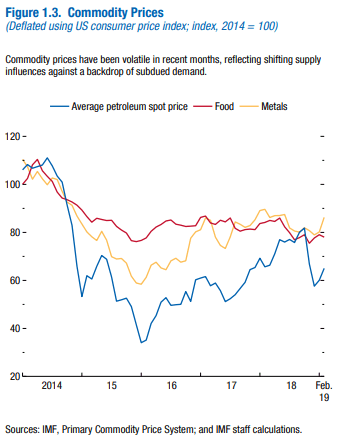

We should be ready for a bumpy ride along the way, however! With global growth clearly slowing – Eurozone GDP is forecast to be only 1.3% this year and China is slowing to about 6.3% – major factors such as oil prices and other commodities are struggling to find a new equilibrium between global supply and demand.

Some market watchers see falling oil prices as a sign of recession, but we believe the energy market will find the proper balance once the long-term impact of current geopolitical tensions is better understood.

Oil prices add to market volatility

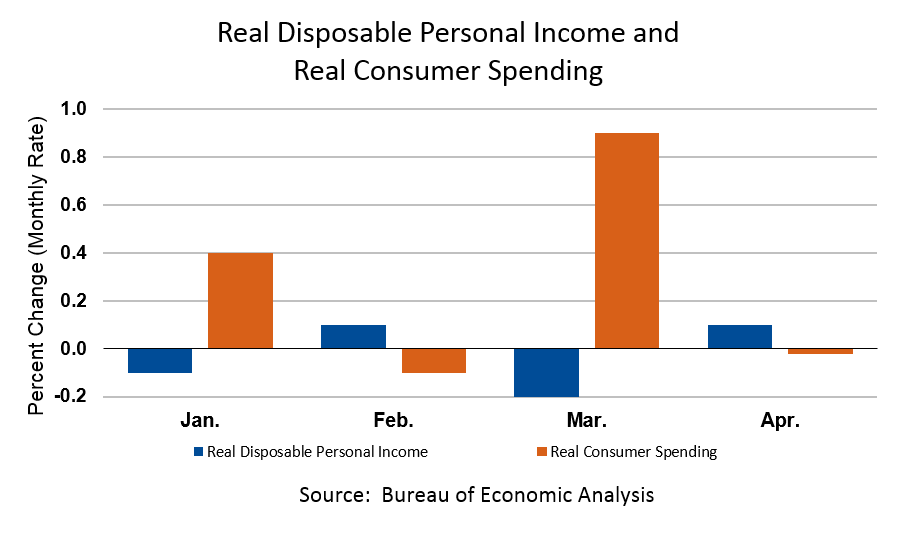

Though consumer spending was down in April, spending was strong in March. April’s decline is most likely due to consumers taking a breath after enjoying some extra purchases in March when wages began rising, rather than the beginning of a downward trend.

And don’t overlook the increase in disposal income in April. It isn’t huge, only +0.1%, but to quote one of our clients: “up is up, and up feels good!”

Consumer spending takes a breath after spiking in April

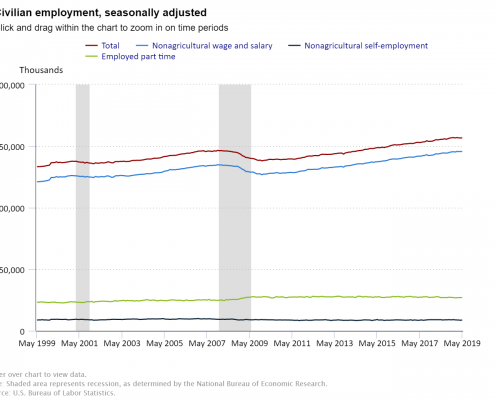

Another area which disappointed investors in May was job growth, which came in much lower than expected at +75,000. The unemployment rate remained steady at 3.6%, however.

Job growth slows, but is still trending higher

So is the economic glass half full or half empty? We’re going with half full. Patient investors who can withstand the market zigging and zagging based on startling headlines or surprising Twitter posts should be OK in the end.

If consumers are still buying and people are still working, where is the real pain in the economy?

Businesses who rely on global trade, either for inputs into their manufacturing process or to sell their finished goods, are feeling the pinch of rising tariffs. Manufacturers who need raw materials such as steel and aluminum are paying higher prices. Farmers growing soy beans and corn can barely make enough money to cover their expenses as the price of labor and farm equipment goes up while demand for their crops goes down.

As reported in the Wall Street Journal, manufacturers in the U.S. and China are still in growth territory with the Purchasing Managers Index slightly above 50, but Europe is clearly struggling.

We’re keeping a close eye on international markets in case weakness there begins to put more pressure on the U.S. economy.

European manufacturing dips into recession

The final factor we’re watching is the level of interest rates.

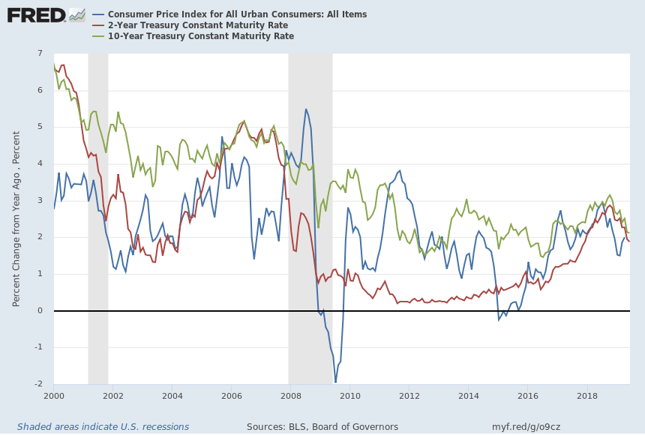

Without getting into a debate about whether the current inversion of short-term Treasury rates is forecasting a recession or not – see ‘A Few Minutes with Marcia’ video on inverted yield curves – 10-year Treasury rates at around 2.1% are simply not sustainable.

Negative interest rates in other developed countries and instability in our own stock market have led to high demand for ‘safe’ assets. But with Treasury yields barely keeping up with inflation, at some point U.S. investors will be forced to look elsewhere to preserve purchasing power.

When they do, selling pressure will push Treasury prices down and yields up.

2 yr. and 10 yr. Treasury rates hover near inflation

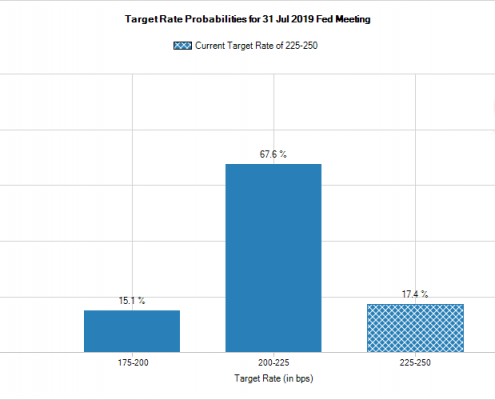

Because of mixed economic data and a slightly inverted yield curve, pessimists are expressing their opinion through Federal Funds futures contracts.

As reported by the Chicago Mercantile Exchange ‘Countdown to FOMC’, as of June 10 over 80% of futures contracts were betting on the Fed decreasing short-term rates when the FOMC meets in July. We don’t agree.

Despite Fed chairman Jerome Powell’s accommodating tone in recent weeks, there is already more than enough liquidity in the financial system to support growth. A decrease in rates would just put upward pressure on inflation, potentially above the Fed’s target rate of 2%.

Fed Funds futures investors bet on falling rates

If we’re correct and the Fed does not decrease rates in July, we may see another dip in the stock market as investors re-calibrate their expectations. For now, just hold tight, watch the data, and wait for spring rains to bring summer sunshine…eventually…

Marcia Clark, CFA, MBA

Senior Research Analyst, Warren Street Wealth Advisors

DISCLOSURES

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications.

Form ADV available upon request 714-876-6200