Marketing the Safety Out of It

A growing theme in investing is to target and invest only in the least volatile stocks in the market. One simple example of this is take the S&P500, which is a representation of the 500 largest publicly traded stocks in the United States, and only invest in the 10% of companies with the lowest standard deviation of the 500. This would produce names such as AT&T, Coca-Cola, and Johnson & Johnson.

This simple concept traditionally would result in an investor owning a lot more safety, blue chip, and high dividend yielding stocks. Not a bad bet in a historic context. Looking forward however, we have an accelerating concern over the price of these types of companies, which may lead to them not being as safe as one would expect.

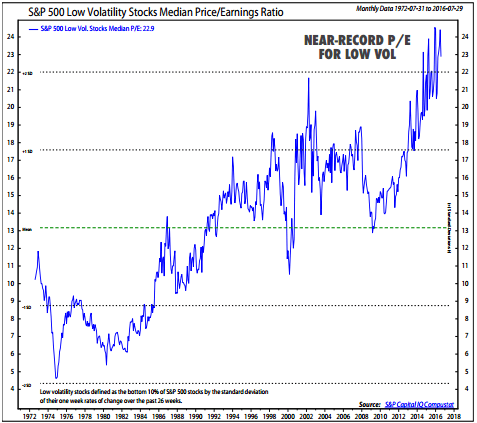

One metric we look at to value stocks is the Price to Earnings ratio, the easiest way to describe this is what price is an investor willing to pay for every dollar a company earns in profit? A higher P/E ratio implies more expensive, a lower one implies cheap. Comparing a stock, or an index, such as the S&P500 to its historical average P/E can give you a relative idea of whether something is expensive or cheap compared to historical standards.

Historically, going back to 1972, the companies in the lowest 10% volatility bucket in the S&P500 (as measured by standard deviation) produce a historical median P/E ratio of roughly 13. As is stands today that same low volatility class of stocks trades between a P/E ratio of 23 to 24.

Chart provided by Ned Davis Research, Inc.

Chart provided by Ned Davis Research, Inc.

Why is this troubling? Well, when prices revert to the mean, and investors are willing to pay less for those same dollars of earnings, it spells trouble for those who hold these assets, especially those who have been chasing the stability and dividends these stocks were expected to provide.

What is causing this? Let’s take a look at the major contributors:

Fed policy. While artificially low interest rate policy is intended to push investors into riskier assets, some investors still want safer assets. Low volatility stocks have higher dividend yields, making them bond proxies.

Sector attribution. The low volatility group is concentrated in Utilities, Financials, and Consumer Staples, which have high dividend yields and P/E ratios that are above their long-term averages.

High valuations for the broad market. The median P/E for the S&P 500 is 24.0, well above its historical norm, which has pushed investors into “safer” stocks.

Secular trends. Fear is a stronger emotion than greed, so investors have flocked to “safer” assets.

Industry innovation. ETFs have enabled investors to more easily buy themes like low volatility.

The first three factors are the most likely the first ones to threaten this crowded trade. The one that has me the most troubled is the fifth factor. Industry innovation has led to specialized investment products that make it very simple for retail investors to buy into this wave of low or minimum volatility assets. We’re seeing these assets recommended in droves to competitor’s clients, with little to no consideration given to how crowded or expensive the trade may be.

These assets in the broad context of a well diversified portfolio may make sense, but from my perspective every asset has a time and a place. Currently, I would not be overpaying for safety by using these low volatility factors we’ve explored above. There are other ways. Like always, when assets deviate from a historical valuation range, it can take quite awhile to be proven right and see them correct. We’re not yelling fire in a crowded theater but would like to see investors better educated on the risks ahead.

Thank you for reading!

Written by: Blake Street, CFA®, CFP®, Chief Investment Officer

Blake Street is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. The information posted here represents his opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.