It’s Your Stream, Your Money

As many have come to learn, taxes can be the most complicated part of being a full time content creator, streamer on Twitch or professional gamer. With some people being considered contractors or employees of a team, or both, it can be difficult to navigate your tax liability and learn how to reduce it.

However, there are solutions available. The biggest solution for those receiving a majority of their income via 1099 is the Solo 401(k) option, or “Solo(k)”. The Solo(k) is essentially a 401(k) plan but for a single person, and potentially a spouse, giving them the ability to defer their taxes and profit share themselves to help reduce tax liability come April.

So what can the Solo 401(k) do for a streamer or pro player?

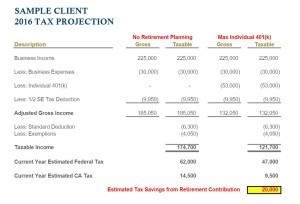

Table provided by Robert McConchie, CPA/PFS®

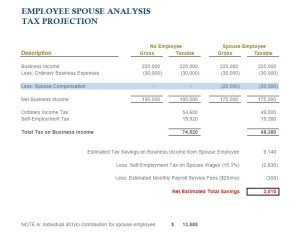

Table provided by Robert McConchie, CPA/PFS®

This example shows a streamer/player earning $225,000 in 1099 income, assumes $30,000 in business expenses across the year, a standard deduction (single person, 2016), and standard exemption (single person, 2016). Additionally, California state tax rate was used in conjunction with the Federal tax, and you can see the savings between utilizing and not utilizing the Solo 401(k), a $20,000 savings to be exact.

The savings comes from the $18,000 personal deferral then a profit share from the business of $35,000 for a max total deferral of $53,000 income within the year. Establishing a Solo 401(k) account is beneficial on multiple fronts; it allows you to set money aside for your retirement date, reduces your tax liability today, and can even be borrowed against should you find yourself in a pinch.

Now, for some streamers who are married, you have the ability to put your spouse on to your business’ payroll. How can that impact your tax savings come year end? Here’s a conservative estimate below.

Table provided by Robert McConchie, CPA/PFS®

Using the same amount of income, we can see that tax savings can also be found by correctly setting up your business to include your spouse on payroll, a 401(k) contribution for them and take advantage of additional tax savings.

Opening a Solo 401(k) is one thing you can do, but you can see the immediate impact it can make for full time content creators.

The Solo 401(k) is one of many things that every content creator should do to help minimize their tax liability into the future. Don’t wait to open one. In order to receive the tax benefit, the account must be opened within the calendar year.

Contact us today to set up a free consultation and learn what you can do to maximize your tax savings for 2016 and into 2017.

Joe@Warrenstreetwealth.com

714.823.3328

www.warrenstreetwealth.com/esports

The contents of this article are not meant to be personal or actionable tax advice. Please consult a tax professional or your personal advisor before making any decisions. IRS & DOL guidelines must be carefully considered before choosing the retirement plan or tax advantaged savings vehicle that is right for you. The illustrations above are of hypothetical scenarios and are meant strictly for informational purposes.

Joe Occhipinti is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. The information posted here represents his opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.