Part 3: A Lookback at Q1 and Portfolio Impact

If you’re talking with friends about market volatility, pessimists may say “downward is the only way forward,” but optimists like us will continue to share the sentiment that “We Will Prevail,” which is based on our assessment of history, data, and our go-forward market outlook.

For those of you who caught that subtle reference from the movie Inception, maybe you’re getting a taste for how big of a cinephile I am. For those who didn’t – no sweat; let’s wrap up this series of blog releases by assessing the first quarter’s market performance.

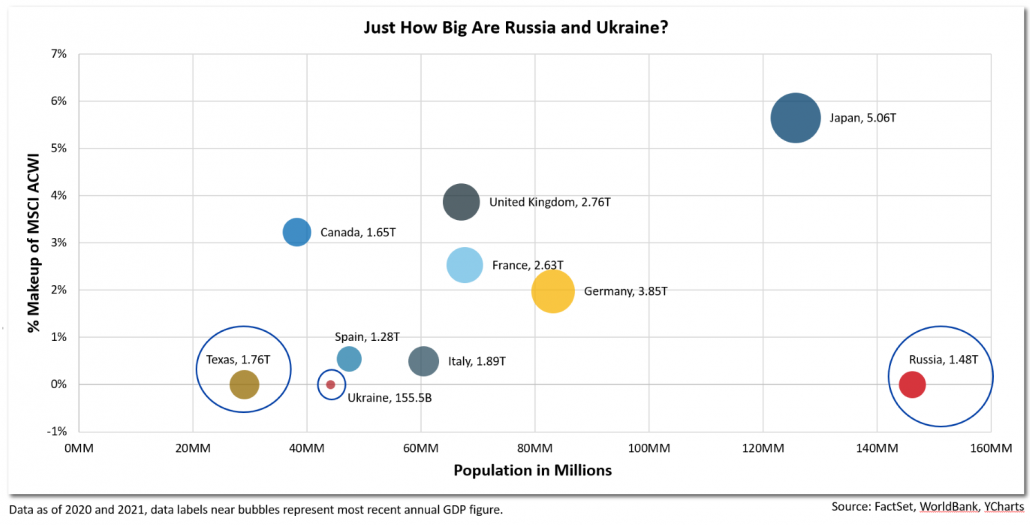

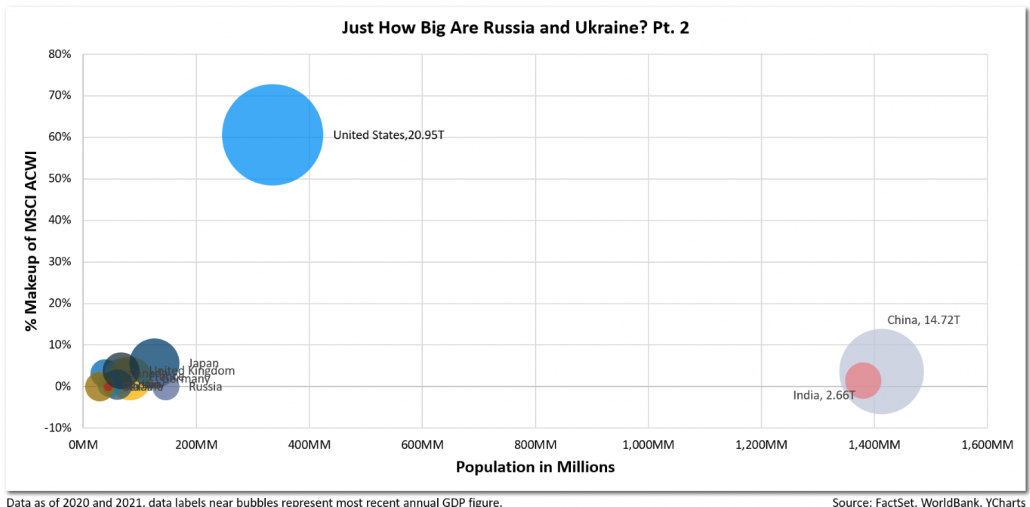

Before diving in, it’s important to note the macroeconomic trends that are primarily driving market risk: 1) the tightening of financial conditions and 2) the war in Eastern Europe. The Federal Reserve and other Central Banks are raising interest rates to calm inflation. Meanwhile, Russia’s invasion of Ukraine has had knock-on effects economically, particularly in Europe. With that in mind, see below for how markets are ending the first quarter.

Exhibit A – Asset Class Performance in 2022

The Laggards

Looking at Exhibit A, bonds, followed by US Large Growth names (i.e., AMZN, AAPL), and international stocks (i.e., emerging markets and Europe stocks) are lagging.

- Bonds Begrudgingly Behind: recent bond volatility can be attributed to inflation and rising interest rates. Inflation diminishes the purchasing power of a bond’s interest payments, while interest rate hikes apply downward price pressure on the value of a bond (you can now find a similar bond in the market yielding a higher rate).

- Growth Names Falter: This asset class includes larger companies that are typically more expensive (e.g., Amazon, Apple), with stock prices that are highly dependent on future earnings growth. However, rising interest rates are raising the cost of borrowing, which depletes the value of a company’s future cash flows and are skewing growth names to the downside.

Exhibit B – How Are Big Tech Stocks Doing?

- International Stocks Give Up Ground: At the start of the year, international stocks including European, Australian, and Far East (EAFE) and Emerging Markets (e.g., China, Brazil) equities outperformed domestic markets. US markets were being punished for an overweight to growthier names amid interest rate hikes. Most recently, the Russian invasion of Ukraine has dampened investor appetite for the international scene, overturning the region’s initial outperformance.

Exhibit C – The Race Between International and the US

Leaders

- Gold Shines Bright: After a lackluster 2021, gold regained its shine this past quarter. Geopolitical uncertainty, coupled with a distrust of central banks to tame inflation, has resulted in sizable outperformance from the precious metal.

- Value Names Triumph: While US Large Growth suffers from tighter financial conditions, investors are paying more attention to company profitability. US Large Value typically consists of companies that are larger, have a long-standing business model, and proven profitability. Examples include Target, Walmart, and Disney.

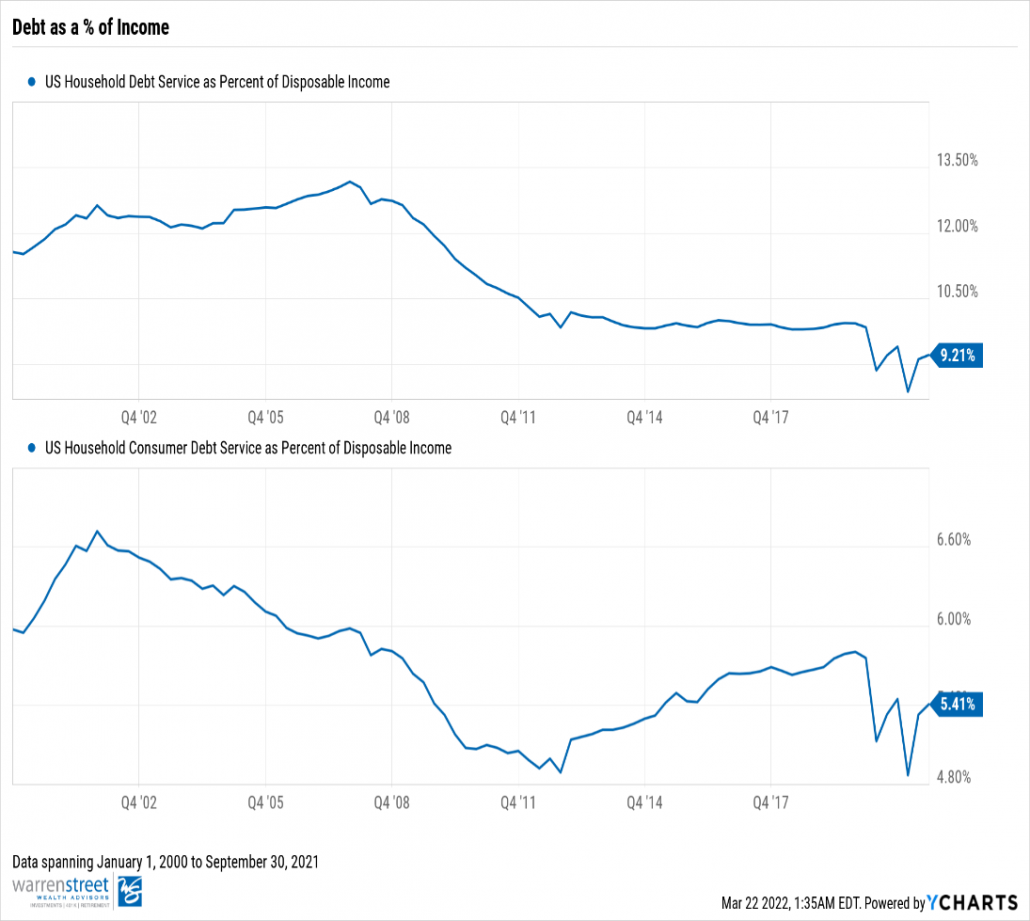

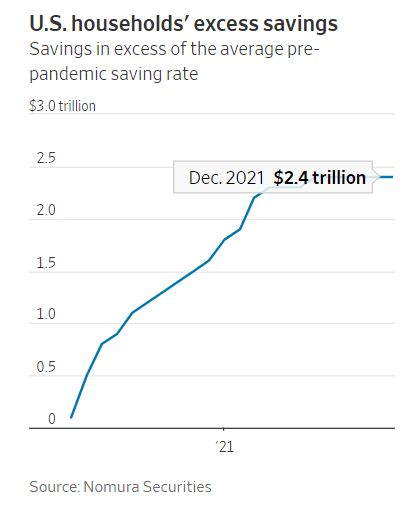

- S&P 500 Recovers: After a weak start to the year (at one point being down 12% year-to-date), the S&P 500 has largely regained lost ground. Although the expectation of rate hikes remains a risk to the broader index, domestic markets have been favorable given a relatively unthreatening economic impact from the Eastern European war.

Takeaways, Portfolio Impact and Our Game Plan

Takeaways – Is the 60/40 Portfolio Dead? A 60/40 portfolio has long been coveted as the standard for a “moderate” risk investor, with a 60% allocation to stocks and a 40% allocation to bonds. The bond allocation is meant to mitigate volatility during downturns, but with today’s largely challenged bond environment, the asset class has not cushioned investors during this recent equity sell-off.

Exhibit C includes the annual returns of a 60/40 portfolio, the global stock index (Ticker: ACWI), and the passive bond index (Ticker: AGG). Over the years, bonds have served as a protector against equity volatility, capturing a fraction of an equity market drawdown. However, thus far in 2022, bonds are selling off more than equities. Therefore, investors should not expect to receive similar risk-adjusted returns they did in the past for a traditional 60/40 portfolio – at least in the near term.

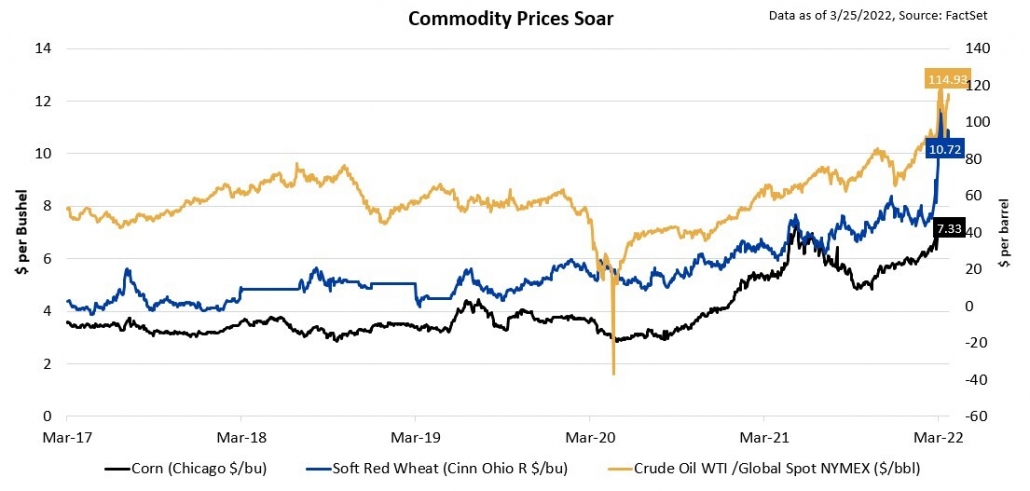

Portfolio Impact – Thinking Outside the Box: With the 60/40 structure in jeopardy and bonds to endure some short-term pain, a different approach should be considered. Enter Warren Street’s Real Assets sleeve – or what we like to call “Diversifiers” – which consist of real assets that typically benefit from inflation (i.e., gold, natural resources, and real estate).

Last summer, after acknowledging the adverse circumstances of the bond realm, Warren Street proceeded to underweight bonds and overweight diversifiers within blended models on top of initiating a position in a commodities fund. This trade has rewarded our portfolios and cushioned the bond and equity sleeves amid the most recent 2022 sell-off.

Our Game Plan – An International Resurgence: With Diversifiers outpacing stocks, our team rebalanced real assets into equity weakness, effectively selling high and buying low. We will continue to monitor momentum within Diversifiers and the bond landscape before returning to our neutral weights.

The looming question remains on our equity strategy, which incurred relative underperformance attributed to our overseas exposures. Although Russia’s military invasion overturned initial outperformance against domestic markets (see Exhibit C), we believe there is significant headroom for an international equity resurgence should the war abate.

Albeit still unpredictable, Ukrainian resistance is increasing the probability for a ceasefire. Couple that with the pandemic transitioning to an endemic, a US market that is more sensitive to central bank reserve tightening and attractive valuations overseas, we continue to remain optimistic about our clients being rewarded for their patience and for avoiding home-country bias.

Conclusion

You’ll hear us say it time and time again: control what you can control. Throughout this quarter, our team has tax-loss harvested in accounts amid sell-offs, rebalanced diversifiers into equity weakness, and thoroughly assessed the impact of conditions #1 and #2 mentioned above in our portfolios.

Outside of portfolio strategy, we’ve made strides in uploading more content on socials, blogs, and video formats to upkeep communications beyond our client meetings. We encourage you to read recent blog releases pertaining to the war in Ukraine and to give us a follow on social media.

Ultimately, the movie inception is about planting an idea and allowing it to grow. I’m no extractor or architect of dreams, but let me attempt to fortify my parting idea once more: “We Will Prevail.”

Phillip Law, Portfolio Analyst

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.