Part 2: Assessing War and the State of the Global Economy

Don’t Miss the Big Picture

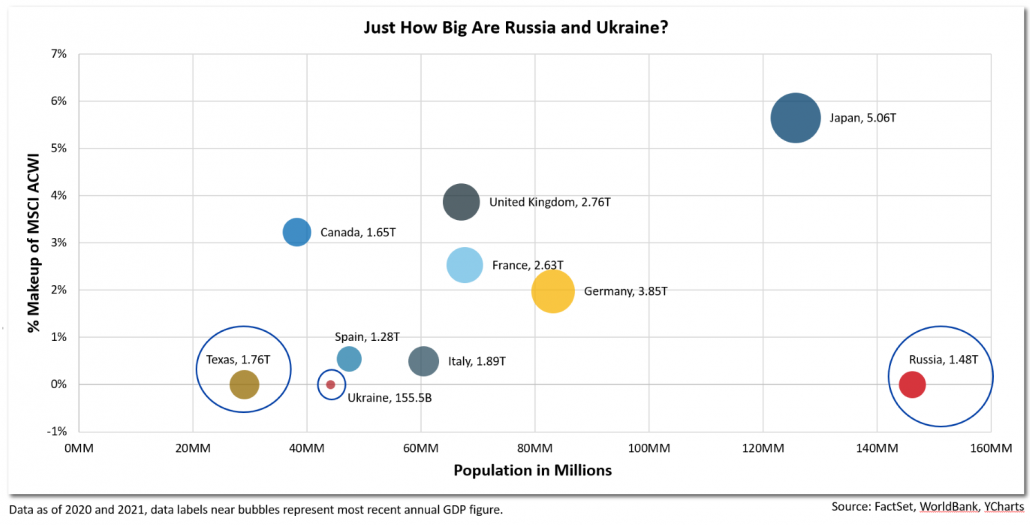

With news outlets centered on Eastern Europe, it is easy to miss the bigger economic picture both globally and domestically. For a broader assessment, it helps to understand how Russia fits into the global economy. Prior to the invasion, the Kremlin represented just 3.11% of global GDP.

To further illustrate, Exhibit A and Exhibit B portray the size of Russia’s economy, population, and percent makeup of the global stock market compared to other countries. Looking at Exhibit A, Russia has the largest population of this subset, yet its economy (the size of the bubble) is smaller than Texas. Thus, the war’s direct effect on global growth was already limited even before indices deemed Russia as “uninvestable” or before western parties imposed sanctions.

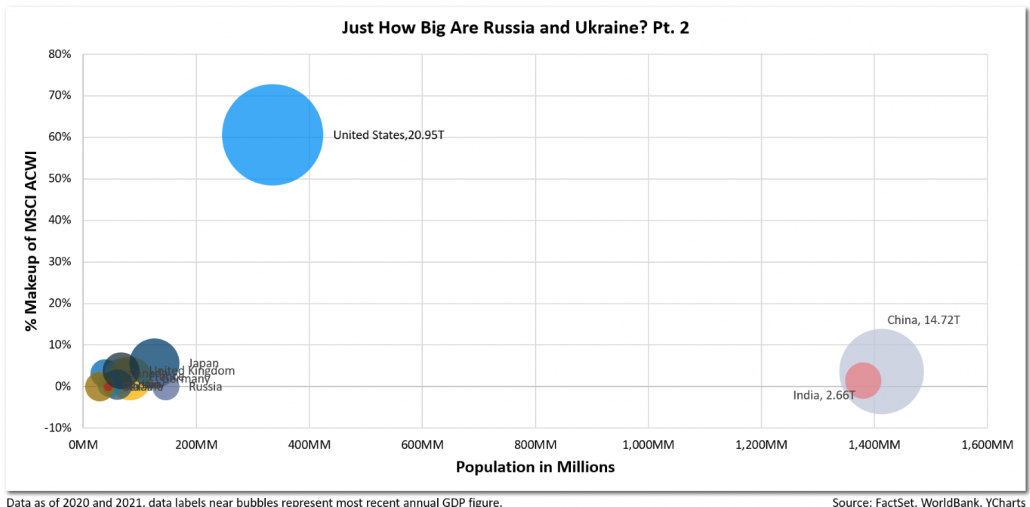

Zooming out in Exhibit B, you can assess just how small Russia is relative to the United States and its Asian neighbors China and India.

The State of the West

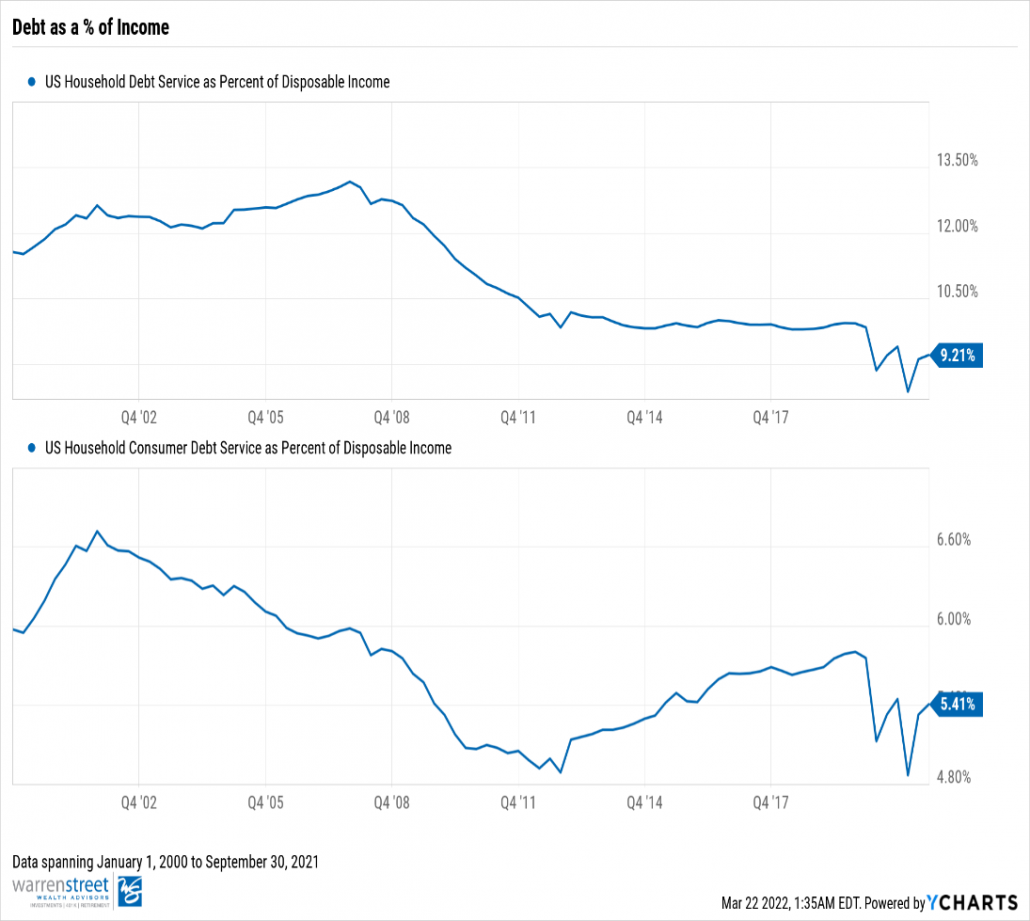

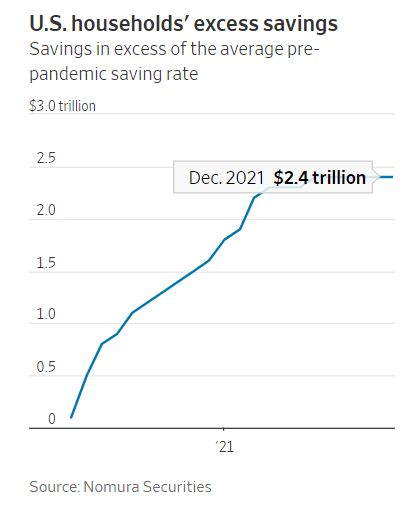

Before discussing other nations, let’s cover our home turf. Within the United States, we have successfully fended off the Omicron wave. COVID-19 data is trending in the right direction, pandemic related pressures (i.e., labor market, car prices) are slowly easing (Exhibit C), and consumer balance sheets are rock-solid (Exhibit D).

Although the threats of additional COVID-19 variants and prolonged inflation linger, our economy is expected to produce above-trend economic growth (see Exhibit E). In fact, economists remain optimistic about the US economy, with the median 2022 real gross domestic product forecast only revised 0.10% downwards after the invasion of Ukraine.

Other major economies (particularly in Europe) are more at risk for an economic slowdown attributed to higher energy prices (i.e., over $120/barrel for Brent Crude driven), or what we call “pain –at –the– pump.”

Although Europe derives 40%+ of its natural gas from Russia and Ukraine, we expect that new measures targeting energy independence and militaristic efforts will have positive long-standing effects on European growth despite interim road bumps. For some near-term perspective, European nations are still expected to grow GDP above their long-term forecasts in 2022 (see Exhibit E).

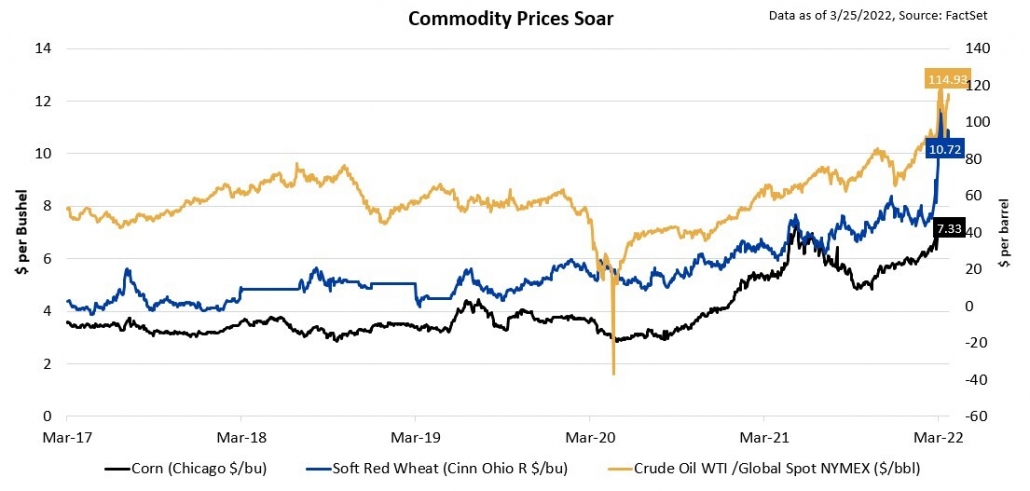

Commodity Chaos – Not to be Overlooked

Although the war’s direct effect on global growth is likely to be meager, indirect pressures on commodity prices are a larger concern, as they may diminish the purchasing power of disposable incomes. Russia is the world’s second largest oil producer behind the US, and accounts for 12% of global production. Also, Russia and Ukraine make –up 25% of global wheat exports, 33% of global corn trade, and 80% of sunflower oil production.

What happens if sanctions are imposed, or if nations surrender agricultural practices to fight on the battlefield? The price of electricity in your factories will rise. Middle eastern nations reliant on wheat imports (i.e., Egypt and Lebanon) must ration appropriately. Chinese-grown hogs – which feed on corn – are more expensive to raise. Lastly, the price of that bag of Ruffles (made from sunflower oil) is expected to increase.

Where Do We Go from Here?

Could this lead to inflation? Yes – we have already seen commodity prices surge exponentially. Does this mean that the US economy will fall to its knees? The probability of that is very low.

After all, two-thirds of our nation’s economy is consumption-driven, and with consumers looking healthy and a central bank easing the economy into a higher rate environment, it is hard to envision a full-scale economic disaster unfolding. Even if we run into a recession, perhaps it will be much smaller than our recent lived experiences of the Great Recession and the Great Lockdown (2020 COVID-19 Pandemic).

Our European neighbors will be more vulnerable over the next three months, especially with an energy embargo on Russia still on the table. However, between German Chancellor Olaf Scholz mobilizing its military (for the first time in 20 years), renewed sentiment on energy independence, and a newfound unity amongst the entire West, the European economy is exuberating a different luster and willingness to grow than it did in previous years. Should this war abate, we believe Europe could resume course towards full recovery and investors with allocations will be rewarded.

A Stronger West, Once the War is Put to Rest

Ultimately, our sentiment from part 1 of this series that “We Will Prevail” has not changed. We have endured many instances of short-term pain and come out victorious. This time is no different. I am confident that our economies – particularly the West — will emerge stronger and more united after this war is put to rest.

Stay tuned in part 3 where we discuss asset class performance and portfolio impact!

Phillip Law, Portfolio Analyst

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.