Your Year-End Financial Planning Checklist

As the year draws to a close, it’s the perfect time to review your financial situation and set yourself up for a strong start in the new year. Year-end financial planning can help you optimize your tax situation, review your investment performance, and make sure you’re on track to meet your long-term goals.

Here’s a checklist to guide you through the process:

1. Maximize Your Retirement Contributions:

- 401(k) or 403(b): If you haven’t already, now is the time to max out your employer-sponsored retirement plan. For 2025, the contribution limit is $23,500, with an additional $7,500 catch-up contribution for those age 50 and over. For those aged 60 to 63, you can contribute up to $11,250 as a “super catch-up”, for a total of $34,750.

- IRA: Contribute to your traditional or Roth IRA. The 2025 limit is $7,000, with a $1,000 catch-up contribution for those age 50 and over. Remember, you have until the tax-filing deadline in April 2026 to make these contributions.

- Solo 401(k) or SEP IRA: If you’re a small business owner or self-employed, consider making contributions to these plans to reduce your taxable income.

2. Review Your Investment Portfolio:

- Rebalance: Check your asset allocation to ensure it aligns with your risk tolerance and financial goals. If one asset class has significantly outperformed, you may need to sell some of it and buy into an underperforming one to get back to your target allocation.

- Tax-Loss Harvesting: This is a strategy that involves selling investments at a loss to offset capital gains and up to $3,000 of ordinary income. This can be a great way to reduce your tax bill, but be mindful of the wash-sale rule. If you are a client of ours, we do this automatically.

3. Optimize Your Tax Situation:

- Charitable Giving: Donations to qualified charities are tax-deductible. Consider making year-end contributions, or even donating appreciated stock to avoid capital gains tax.

- Flexible Spending Account (FSA): Use up the funds in your FSA before the year-end deadline. You could lose any money left in the account.

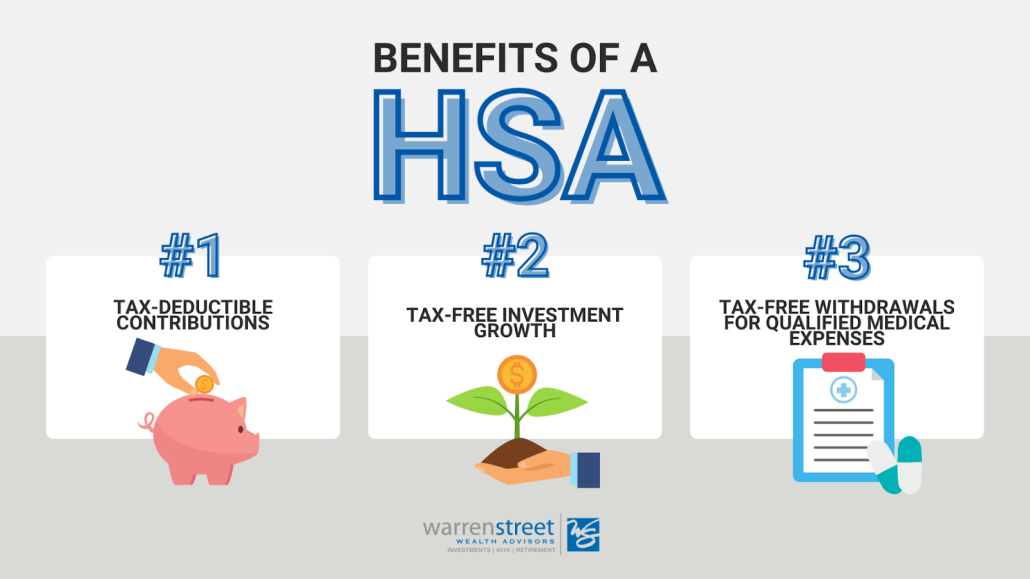

- Health Savings Account (HSA): If you have an HSA, you can contribute up to $4,300 for an individual or $8,550 for a family in 2025. HSAs offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- Deductible Expenses: Gather receipts and documentation for potential tax deductions, such as property taxes, mortgage interest, and medical expenses.

4. Review Your Estate Plan:

- Wills and Trusts: Ensure your will and trust documents are up to date and reflect your current wishes.

- Beneficiaries: Check the beneficiary designations on your retirement accounts, life insurance policies, and annuities. These designations supersede your will, so it’s crucial to make sure they’re accurate.

- Power of Attorney: Confirm that you have a durable power of attorney and a healthcare proxy in place.

5. Look Ahead to the New Year:

- Budget Review: Analyze your spending from the past year to identify areas where you can save more.

- Financial Goals: Revisit your short-term and long-term financial goals and make a plan to achieve them.

- Meet with Your Financial Advisor: A comprehensive year-end review is the perfect opportunity to discuss your progress and make any necessary adjustments with your financial advisor.

By taking the time to review these key areas, you’ll not only gain a clearer picture of your current financial health but also lay the groundwork for a successful and prosperous new year.

Veronica Cabral

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.