Handling ESOP Shares & Taxes

Cary Facer

Wealth Advisor

Warren Street Wealth Advisors

Sometimes an employer’s benefits program can include an employee stock ownership plan, commonly referred to as an ESOP plan. An ESOP plan is an employee benefit that allows its company’s participants to purchase the common stock of their company. Those who participate often receive tax benefits for purchasing these shares, and companies believe that allowing their employees to purchase shares of the company will incentivize employees to perform well and boost the share price.

This is an excellent program to take advantage of if your company provides it, but there is something to be mindful of, which is: How can these shares impact my tax liability?

Well, the tax issue doesn’t become relevant until you approach retirement and begin to think about taking your balance out of the plan. When you become ready to do this, you are presented with two options on how to handle the balance.

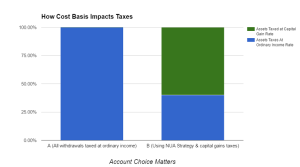

Option 1 is to take the shares from the ESOP program and roll them into an IRA. Taxes do not come due, but you will be liable for the taxes when you take a withdrawal from the account. The amount will be taxed at your current ordinary income rates.

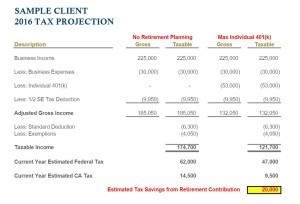

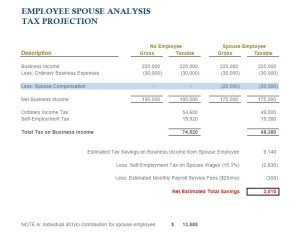

Option 2 is to move the shares into a non-retirement account. In this method, the ESOP shares are moved in-kind and you pay ordinary income tax rates on the average cost basis of the shares, which is the average price you paid for all the shares you own and typically below market value. Then when the shares are sold within the account, the amount in excess of cost basis is taxed at long term capital gains rates.

It may seem like you’re paying taxes twice in the second option, but by taking advantage of net unrealized appreciation (or NUA), you might be able to save yourself on taxes in the long run. You see, long term capital gains rates are typically lower than a person’s income tax rates with capital gains being 0, 15, or 20%, so a person would be paying ordinary income tax on a portion, then long term capital gains on the remainder, again assuming the shares have been held for 1 year or longer.

This can be a tricky process, and most employee benefits programs only allow you to execute this process once. Make sure you have it right.

Warren Street Wealth Advisors has worked with employee ESOP shares before and executed NUA strategies. Contact Us today and schedule a free consultation on how to best handle your ESOP shares.

- This item is only used as an illustration of the strategy. The illustration does not indicate how all tax liabilities could play out. All investments carry specific risks and please consult your financial professional before making investment decisions.

Warren Street Wealth Advisors are not Certified Public Accountants (CPA), and this is not considered personal or actionable advice. Please consult with your accountant or financial professional for further guidance on whether an NUA strategy is right for you.

Disclosure: Cary Facer is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. The information posted here represents his opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.