How Will Emerging Markets “Emerge” From 2020?

It’s no doubt that U.S. equities remain the protagonist of the past decade. The longest U.S. economic expansion, coupled with the blossoming of numerous tech stocks like Amazon and Tesla, helped the S&P 500 climb to record highs. That was soon followed by the U.S. stock market’s astounding recovery in 2020, which continues to capture the attention of global investors.

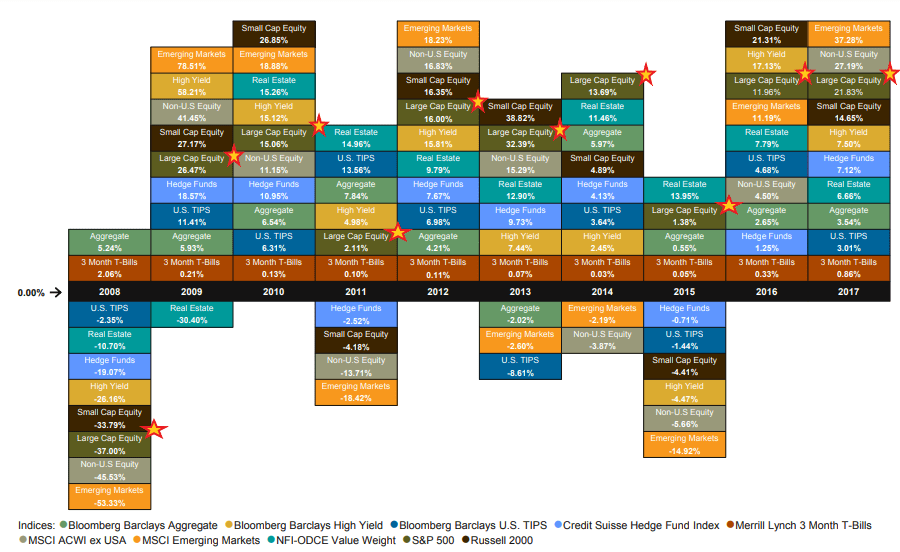

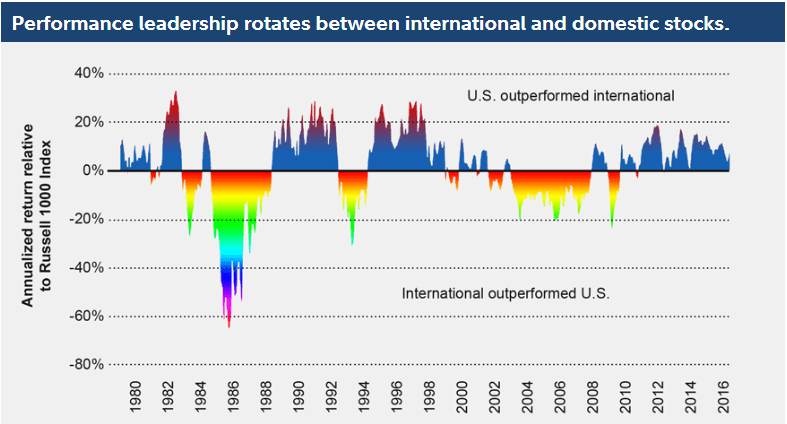

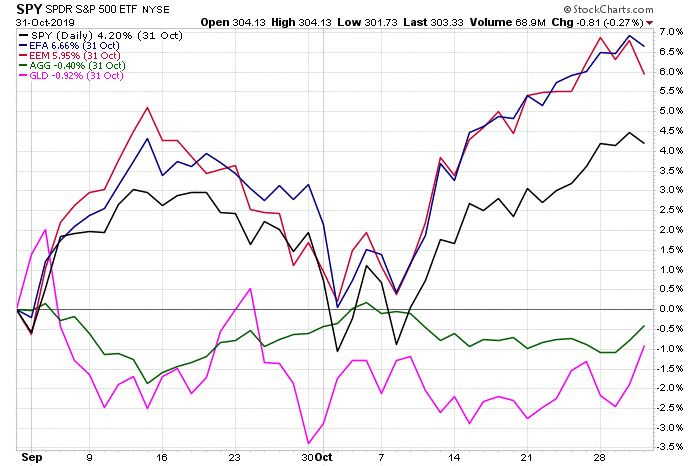

Many forget, however, that the decade before looked entirely different. Back then, we had an entirely different “darling” called emerging markets which left the S&P 500 in the dust.

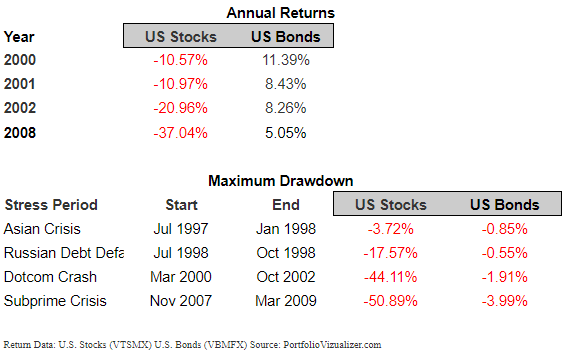

During the 2000’s, emerging market investments drastically outperformed the S&P 500 by 188.1% on a total return basis. Steadying economic data and optimistic outlooks for EM nations including Brazil, Russia, India, and China, or the BRIC nations, painted narratives of a new global convergence. Meanwhile, U.S. stocks continued limping from the aftermath of the dotcom bubble.

The Case for Emerging Markets

EM investments invest in the securities of a less developed country with improving economic conditions and increased involvement with the global economy. Aside from the BRIC nations, this includes countries such as Vietnam, Indonesia, Africa, and Argentina. EM regions are attractive for the following reasons:

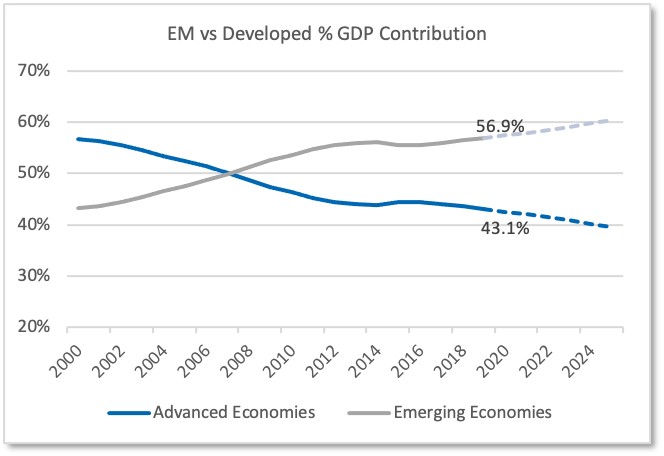

- Growing Contribution to GDP: Over the past few years, emerging economies contributed an increasingly higher percent share to global productivity. EM contribution to GDP was 56.9% in 2019, while advanced economies contributed 43.1%. The International Monetary Fund (IMF) forecasts this trend to continue into 2024, making emerging markets an attractive long-term investment opportunity.

- Favorable Demographics: 85% of the world’s population, or about 6 billion people, reside within emerging countries. Over 50% of the global population under the age of 30 live in EM nations. This will fuel a rising-middle class in years to come. Increased productivity amongst large-working populations will also uplift the region’s standard of living.

- Hot Spot for Disruptive Innovation: Emerging markets typically lack the infrastructure and technologies of developed nations. This presents ample opportunity for the region’s younger, more tech-savvy population to embrace innovation. Global leaders including the World Bank have also recognized the tech disparity and have provided funding for infrastructure enhancements.

COVID-19 in Emerging Markets – Some Juggle While Others Struggle

Contrary to expectations, emerging markets have weathered the pandemic better than expected. A younger population and lower obesity rates have helped certain emerging countries wither down mortality rates. Accommodative fiscal and monetary policy through asset purchases and fiscal stimulus modeled after developed nations helped keep many economies afloat.

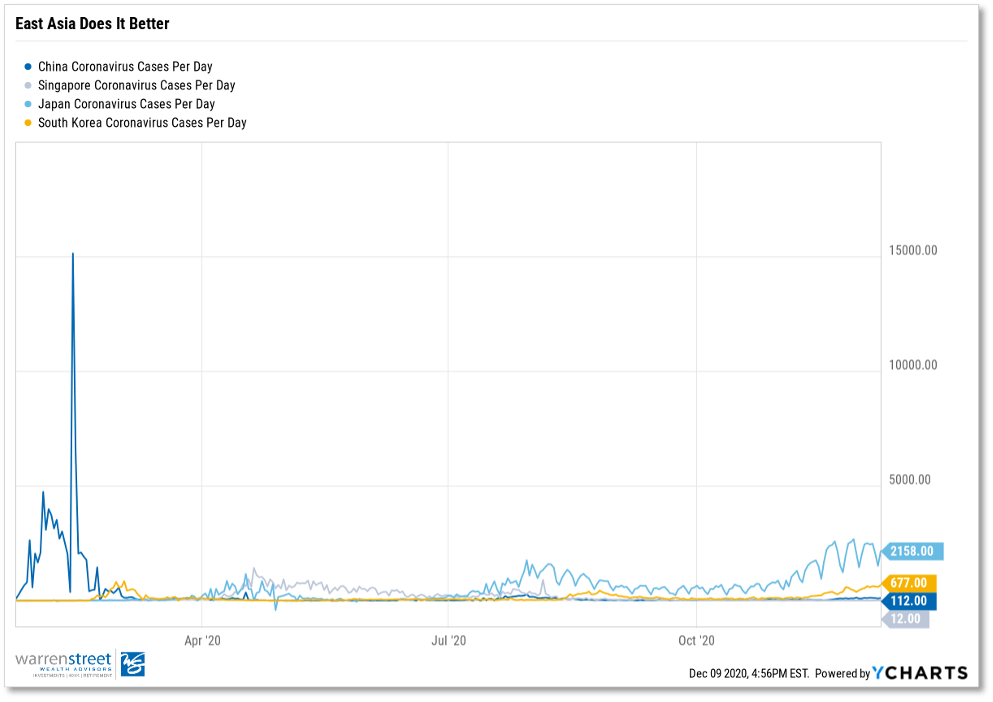

East Asian countries, China in particular, have exemplified great handling of the Coronavirus. As a result, EM has rallied 24.3% since the market bottomed (data spanning March 23 to December 8). China is also the only country expected to report positive GDP growth for 2020. Although it’s best to view Chinese data with a skeptical eye, investors cannot deny the nation’s swift return to economic activity.

Nevertheless, China’s success isn’t shared by all. Developing nations dependent on oil exports, tourism, or general commodities have and will continue to struggle as trade activity remains low. Certain EM hotspots including Russia and Brazil are also finding difficulty with containing virus spread. Highly indebted economies face risks of debt sustainability with limited room for policy enactment.

The Emerging Markets Story…to be Valued

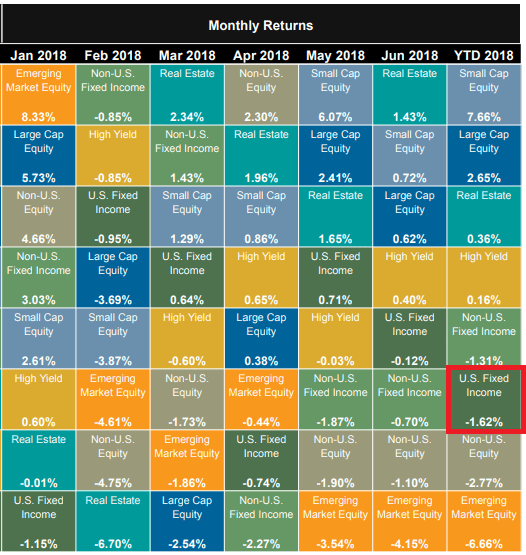

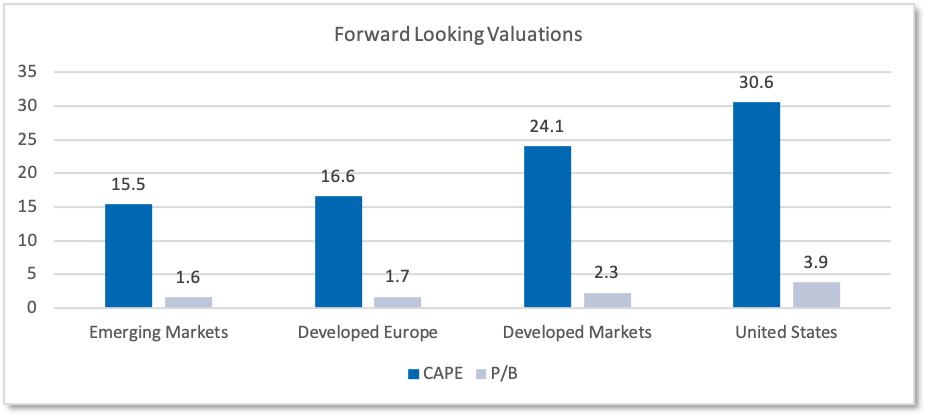

EM equities experienced a mass exodus in March as investors questioned whether the infrastructure and economic inexperience of developing countries could properly combat the Coronavirus. Fund flows faced pressures until investors began acknowledging fruitful economic and health responses to COVID-19. Even after rallying this year, the long-term valuations for emerging markets look attractive.

According to StarCapital research, emerging markets have the cheapest cyclically adjusted price to earnings ratio (CAPE) and price-to-book (P/B) ratio relative to developed countries over the next 10-15 years. Factor in the expected structural improvements, emerging markets exhibit ample opportunity for value appreciation should the demographic and technological trends fall in line. You may also find comfort in knowing that emerging markets are expected to have the sharpest recovery post COVID-19.

What Will the Next Decade Look Like?

Despite some commendable pandemic responses and attractive valuations over the next decade, it is imperative to consider COVID-19’s impact on the region’s secular trends. Take China’s “Great Rebalancing,” for example. After years of export-driven GDP growth, the country adopted a “Great Rebalancing” plan to generate their economic prowess from organic consumer-driven activity rather than overseas trade.

When the Coronavirus struck, both Chinese businesses and consumers halted activity. Unwilling consumers, shocked by the events in Wuhan, emptied the streets as factories shut down. Once a recovery was en-route, business activity quickly climbed back to pre-pandemic levels, but scarred consumers left their homes thrift-conscious and hesitant. This led some to believe that China’s “Great Rebalancing” plan was at stake.

The Chinese customer today, has regained confidence, mainly from the government’s ability to eliminate almost any possibility of second wave. As we said earlier, China’s success is not shared by all, and whether or not secular trends will hold in other emerging nations — who have varying health and economic conditions – will be a mixed bag.

Bringing It All Home

Although prudent investors can exploit opportunities in countries that have exhibited short-term resiliency, the ability to maintain a long-term perspective and understand the landscape of your investments is keen. Here at Warren Street Wealth Advisers, our focus is not only to avoid home-country bias and to uncover the next areas of outperformance, but also to educate our clients about our long-term decision making.

For any questions regarding international investments, emerging markets, or wealth management, please call 714-876-6200 or email phillip@warrenstreetwealth.com.

Phillip Law, Portfolio Analyst

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Marcia Clark, CFA, MBA

Marcia Clark, CFA, MBA

Cary Warren Facer

Cary Warren Facer