Posts

Gold Rush of 2020

/in Education, Intermediate, Investing /by Phillip Law

In 1848, thousands of people grabbed their shovels and crossed land and sea to Sutter’s Mill with hopes of striking gold. Almost 150 years later in 2020, a similar parallel is happening not in San Francisco, but rather in the investable market for this hot commodity.

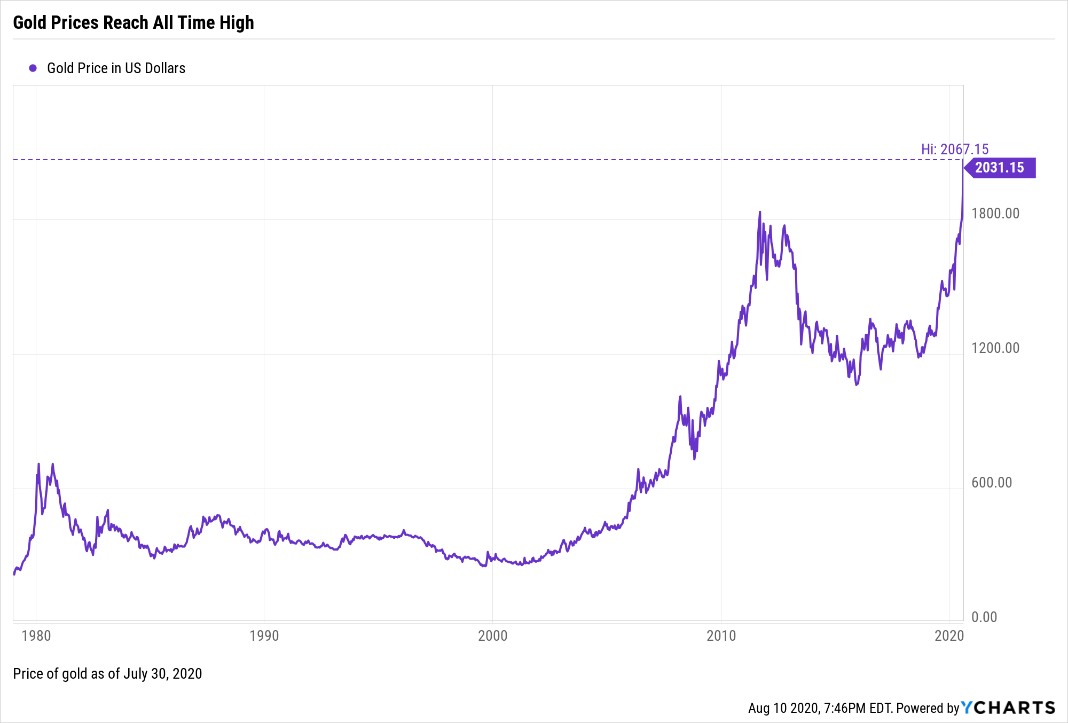

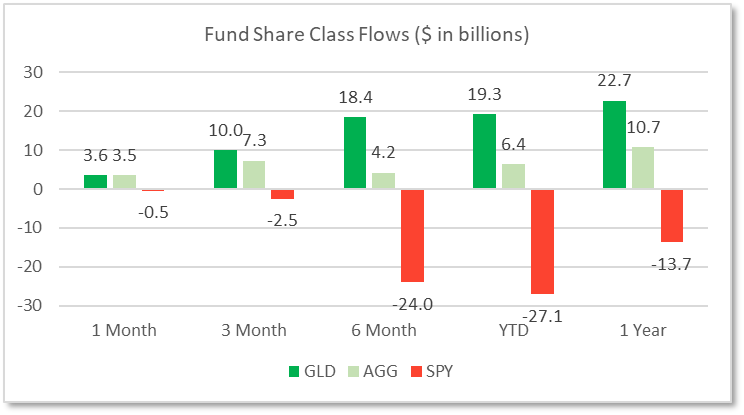

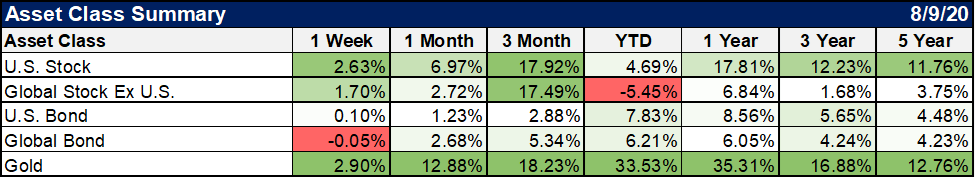

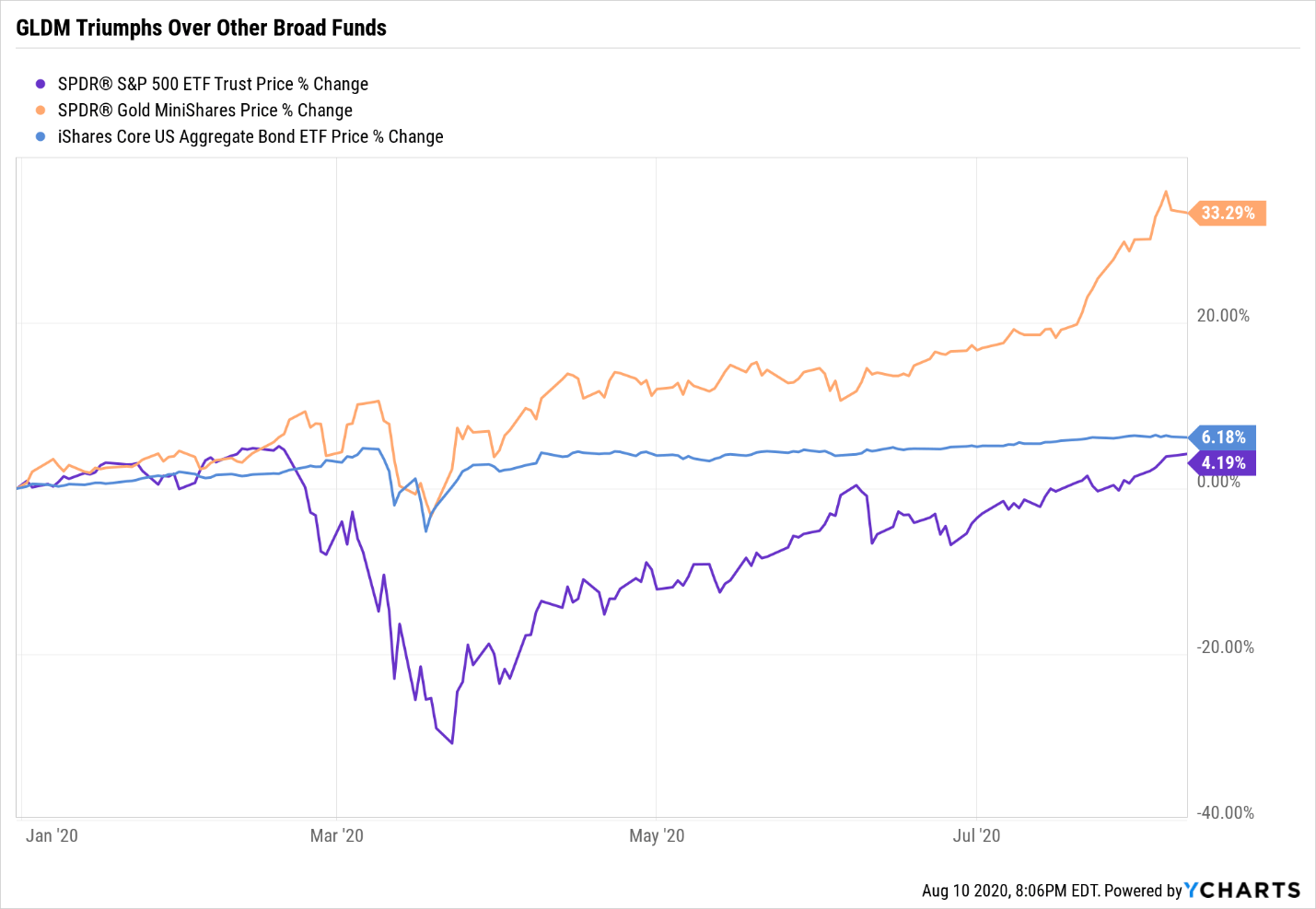

Year-to-date (YTD), gold has experienced more inflows than other broad stock and bond funds, including SPY and AGG which track the S&P 500 and Barclay’s Aggregate Bond Index, respectively. Amongst a myriad of asset classes, investors are choosing gold as their choice for safekeeping, thus driving gold prices to an all-time high. This year alone, gold is up 33.53% YTD compared to U.S. Stocks at 4.69% YTD and U.S. bonds at 7.83% YTD. But why exactly is a gold rush taking place in 2020?

Source: YCharts

Data as of 8/05/2020

You may attribute the surge in gold prices to the pandemic, but mine deeper and you will find more.

Source: YCharts

Data as of 8/05/2020

Source: YCharts

Low Yield Environment: Earlier in March, the Federal Reserve cut the federal funds rate to 0 – 0.25% to stimulate the economy amid an economic crisis. As a result, treasury yields fell drastically. The 10 Year Treasury rate started the year at 1.88% and now only yields an all-time low of 0.52%, or -1.05% adjusted for inflation. Although treasuries are often used as a safe haven during uncertain times, negative real yields alongside inflation expectations might make gold a more attractive store of value.

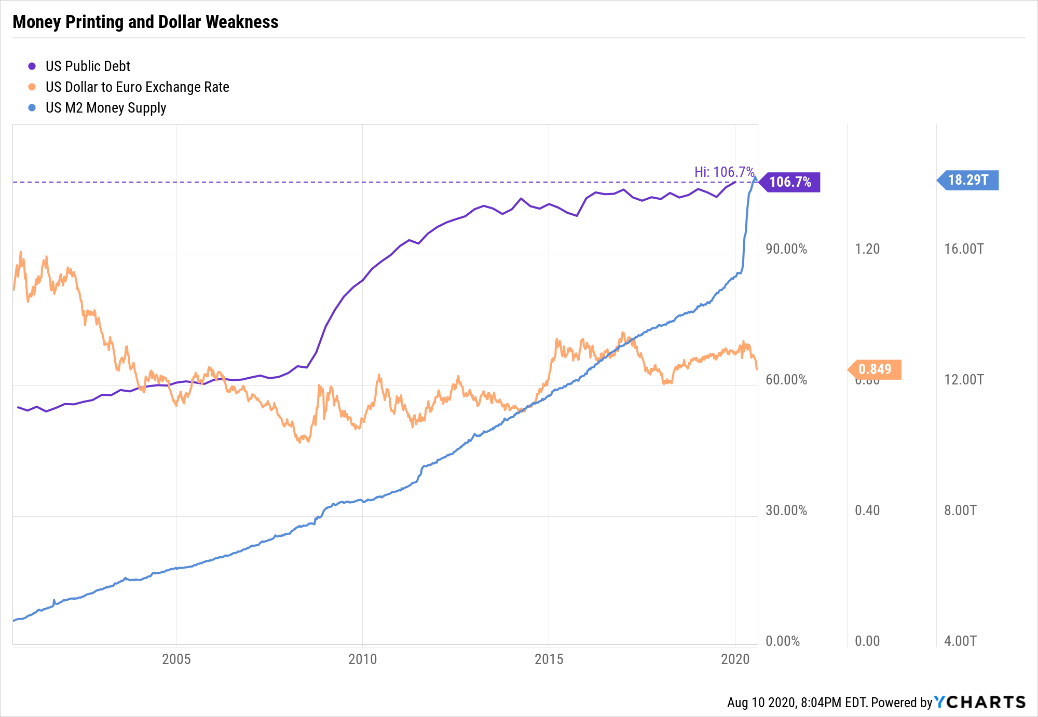

Inflation Expectations: Fiscal stimulus through a $2.2 trillion package, rapid money printing, and unprecedented quantitative easing has prompted investors to seek gold as an inflation hedge. Current levels of inflation, however, do remain low at 1.19% year-over-year relative to the Fed’s target of 2.0%, and are likely to stay low in the short term (due to aggregate demand and supply shocks). While there is no tell-all sign indicating future long-term inflation is upon us, the following is certain: whether gold investors are overreacting or whether U.S. inflation is a ticking time bomb remains to be seen.

A Weakening U.S. Dollar: With fiscal debt as a percentage of GDP and M2 Money Supply at an all-time high, confidence in the U.S. dollar is diminishing relative to other currencies including the Euro. This comes at a time where the European Union appears to maintain a tighter grasp on COVID-19 outbreaks, alongside newfound unity in the form of a centralized stimulus package and debt mutualization. Overall, supposed weakness in the U.S. dollar has turned investors towards gold to maintain the purchasing power of their greenbacks.

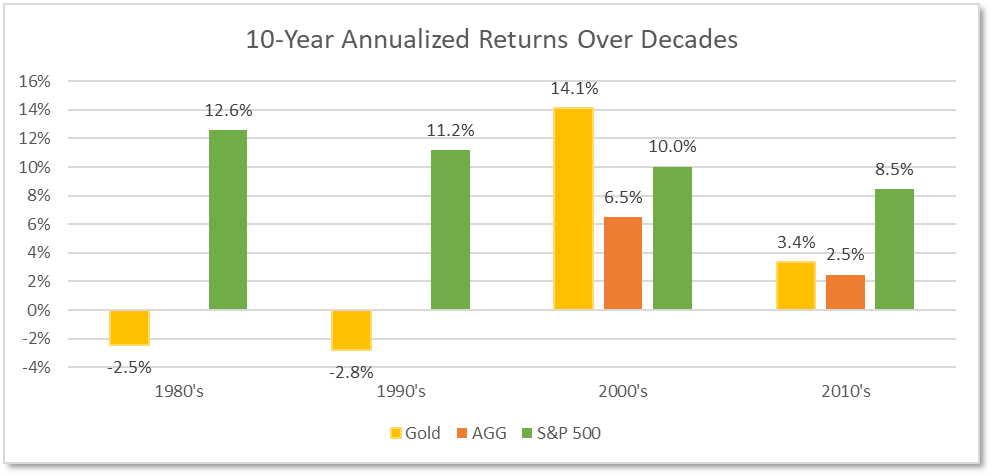

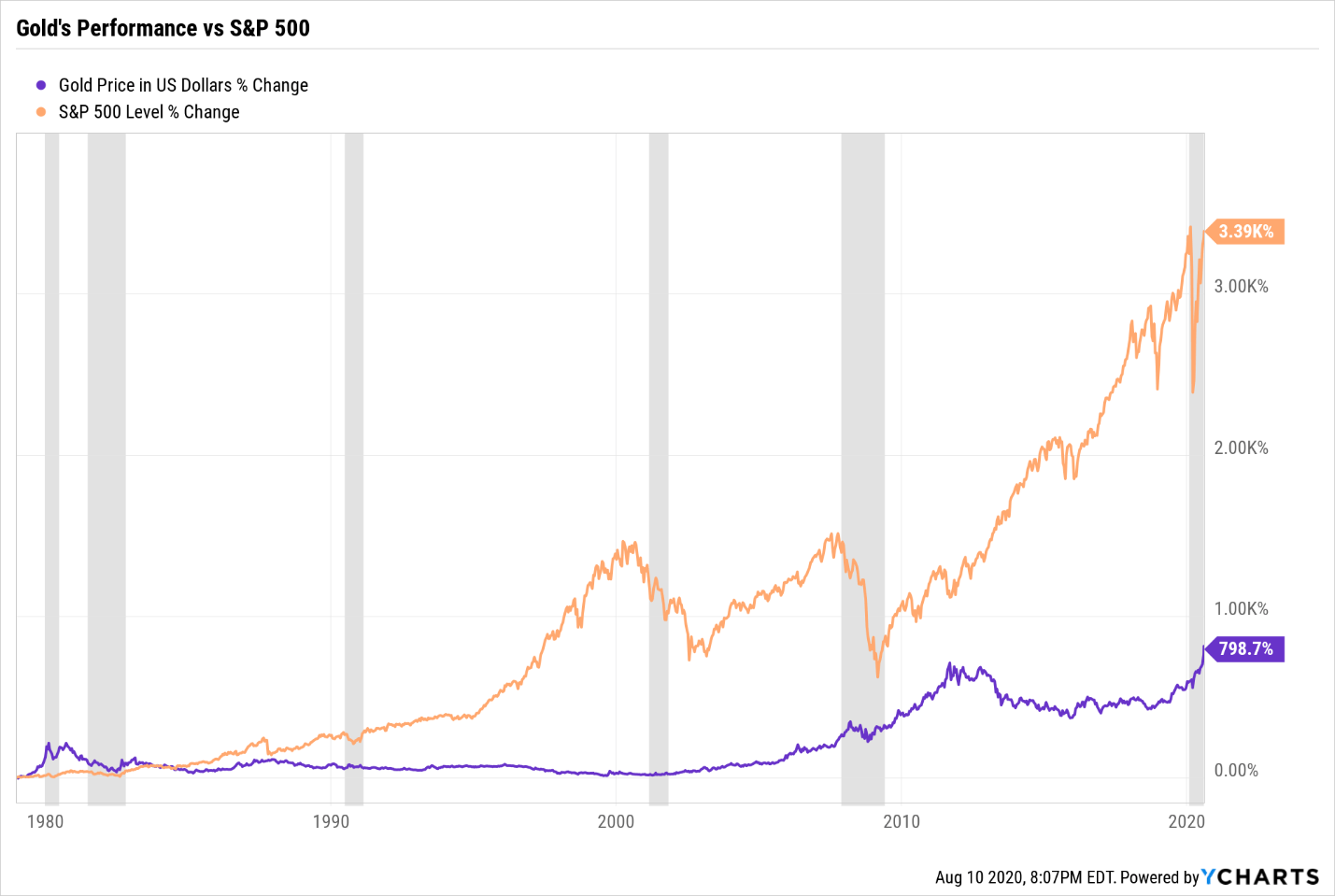

With this context, it seems like anyone would jump at the chance to own gold; but to avoid grabbing a handful of pyrite (fool’s gold), let’s evaluate gold’s performance and properties as an asset class. During the 1980’s and 1990’s, gold yielded less than ideal returns. In the late 2000’s, the metal’s performance accelerated as investor confidence faltered during the Great Recession, but subsequently dipped in the 2010’s when the U.S. economy proceeded onto its longest economic expansion.

Source: YCharts

Data spanning 1/01/1980 to 12/31/2019

Based on history, we can draw two conclusions: 1) gold’s volatile nature indicates that its current run may not be sustainable over long periods of time and 2) gold’s performance suffers when investors regain confidence and begin to adopt a risk-on posture. To see gold’s performance coming out of recessions, see Appendix A. (link)

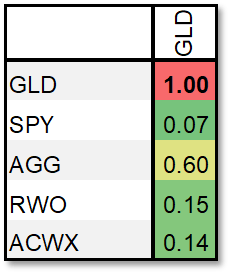

5-Year Correlation Matrix (Rolling Monthly Returns)

Data as of 8/07/2020

Source: YCharts

Gold generates zero passive income, so why do investors hold it? One reason is simply because it’s different and provides a diversification benefit. This metal exhibits less correlation compared to broader asset classes, meaning it simply behaves differently. A correlation of 1 indicates that the assets’ return behaviors are identical, while a correlation of -1 means they move in completely opposite directions. Given gold’s weaker correlations, it is likely to thrive when stocks or other asset classes experience large drawdowns. In other words, gold zigs while others zag.

Having understood the nuances of gold as investable asset and its diversification benefit over a long-time horizon, Warren Street Wealth Advisors previously made the decision to maintain gold exposure through Gold Minishares (GLDM) in our Diversifiers sleeve. Our investment strategies are now reaping the benefits of gold’s recent rally and allow for different courses of action. For example, with current gold prices bid up relative to historical levels, we can trim profits to invest in cheaper assets classes with higher potential for appreciation. This in essence, is buying low and selling high.

Gold prices will likely stay in the headlines and continue to gain traction in coming months. Regardless, we encourage you to start with your long-term asset allocation in mind and refrain from overthinking market entry/exit timing on any specific asset class. Preventing permanent capital impairment and building portfolios for your short term and long-term needs remains our top priority. We will diligently tax loss harvest and perform recurring rebalances along the way to take advantage of tactical long-term opportunities we see appropriate. That to us, is striking gold in 2020.

Appendix A:

Phillip Law

Portfolio Analyst, Warren Street Wealth Advisors

Warren Street Wealth Advisors, a Registered Investment Advisor. The information contained herein does not involve the rendering of personalized investment advice but is limited to the dissemination of general information. A professional advisor should be consulted before implementing any of the strategies or options presented. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss.

The Value of Double-Checking Your Retirement Strategy

/in Investing, Retirement /by Cary Facer As you approach your “third act,” does it need to be adjusted?

As you approach your “third act,” does it need to be adjusted?

Provided by: Warren Street Wealth Advisors

Motivational speaker Denis Waitley once remarked, “You must stick to your conviction, but be ready to abandon your assumptions.” That statement certainly applies to retirement planning. Your effort must not waver, yet you must also examine it from time to time.1

For example, the level of risk you chose to tolerate at 35 or 40 may not be worth tolerating at 55 or 60. Additionally, you may realize that you will need more retirement income than previously assumed. With those factors and others in mind, here are some signs that you may need to double-check your retirement strategy.

Your portfolio lacks significant diversification. Many baby boomers are approaching retirement with portfolios heavily weighted in equities. As many of them will have long retirements and a sustained need for growth investing, you could argue that this is entirely appropriate. If your retirement is near at hand, however, you might want to consider the length of this bull market and the possibility of irrational exuberance.

The current bull has lasted about twice as long as the average one and brought appreciation in excess of 200%. It could rise higher: as InvesTech Research notes, two-thirds of the bull markets since 1955 have gained 20% or more in their final phase. Few analysts think a “megabear” will follow this historic rally, but even a typical bear market brings a reality check. The lesser bear markets since 1929 have brought an average 27.5% reversal for the S&P 500 and lasted an average of 12 months.2

A poor quarter makes you anxious. You start watching the market like a hawk and check up on your investments more frequently than you once did. Some of this vigilance is only natural as you near retirement; after all, you have far more at stake than a millennial investor. Even so, this is a sign that you may be uncomfortable with the amount of risk in your portfolio. A portfolio review with a financial professional could be in order. A semi-annual or annual review is reasonable. One bad quarter should not tempt you to abandon a strategy that has worked for years, only to examine it in the face of sudden headwinds.

You find yourself listening to friends & pundits. Your tennis partner has an opinion about when you should claim Social Security. So does your dentist. So does a noted radio personality or columnist. Their viewpoints may be well-informed, but they are likely expressing what they would do as they share what they feel you should do. If you seem increasingly interested in the financial opinions of friends, acquaintances and even total strangers, or the latest “hot tip” on the market, this hints at anxiety or restlessness about your financial strategy. Perhaps it is warranted, perhaps not. It may be time to reexamine some assumptions.

You wonder about the demands your lifestyle may make on your finances. You want to travel, golf, and have fun when you retire, and those potential lifestyle expenses now seem larger than they once were. Here is another instance where you may want to double-check your retirement savings and income strategy.

You see what were once “what-ifs” becoming probabilities. You sense that you or your spouse might face a serious health issue in the not-so-distant future. It looks as if you may end up raising one of your grandchildren. It seems likely that you will provide eldercare for a sibling who may move in with you. These life events (and others) may prompt a new look at your financial assumptions.

You think you will retire to another state. Say you retire to Florida. There is no state income tax in Florida. So your retirement tax burden may decrease with such a move (though some states have higher property taxes to offset the lack of state taxes). To what degree will geographic considerations affect your retirement income, or need for income? Such geographic factors are worth considering.3

You wonder how deeply inflation will impact your retirement income. A recent Morningstar analysis of retiree spending data compiled by the federal government noticed something interesting: for the typical retiree, spending declines in inflation-adjusted terms between age 65 and age 90. So the assumption that retirees increase household spending over time in light of inflation may be flawed. Of course, inflation has been mild for the past several years. If inflation spikes, however, that assumption might prove wholly valid.3

Looking at your retirement strategy anew has merit. As the years go by, priorities change and needs arise. New questions call for appraisals of old assumptions. Reviewing your approach to investing and saving at mid-life is only rational, for your retirement strategy must suit the objectives you now have before you rather than those you set in your past.

Warren Street Wealth Advisors

190 S. Glassell St., Suite 209

Orange, CA 92866

714-876-6200 – office

714-876-6202 – fax

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

Citations.

1 – quotes.lifehack.org/quote/denis-waitley/you-must-stick-to-your-conviction-but/ [4/16/15]

2 – fortune.com/2015/04/16/taming-the-bear-market/ [4/16/15]

3 – tinyurl.com/odyle9s [12/25/13]

Contact Us

As a Registered Investment Advisor, Warren Street Wealth Advisors, LLC is required to file form ADV to report our business practices and conflicts of interest. Please call to request a copy at 714-876-6200.