‘Risk On’ trades take the lead in October

‘Risk On’ trades take the lead in October

Key Takeaways

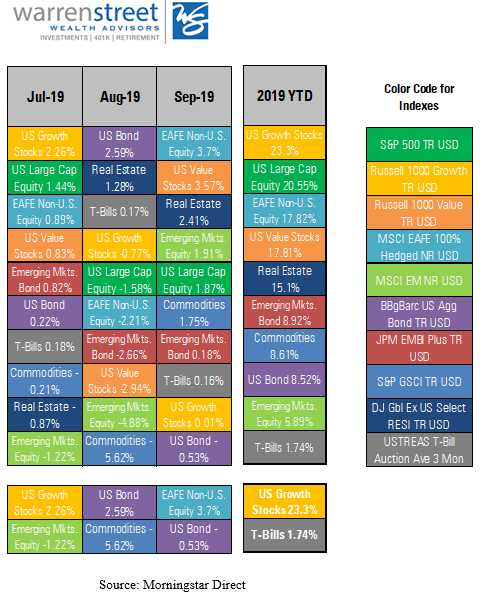

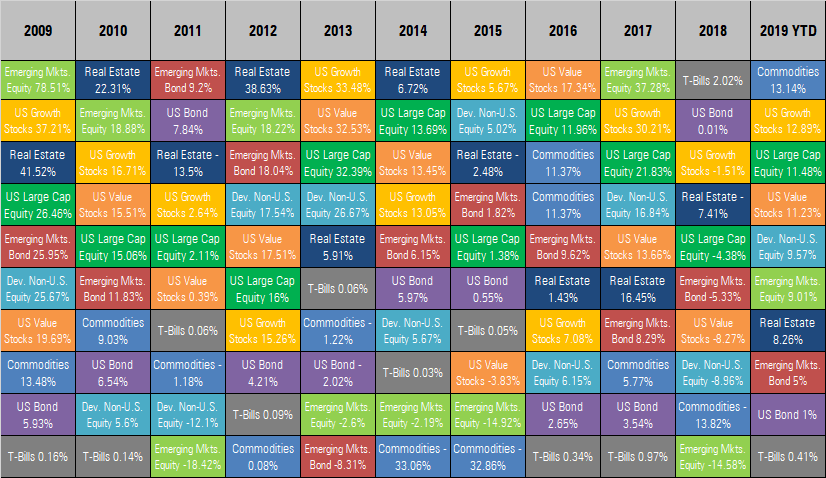

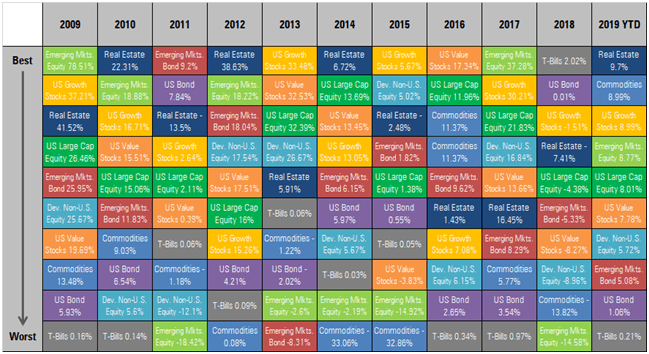

- U.S. growth stocks and emerging markets jump-started the 4th quarter with returns of 2.82% and 4.22% respectively as investors shifted away from ‘risk off’ assets such as defensive stocks and U.S. Treasury bonds

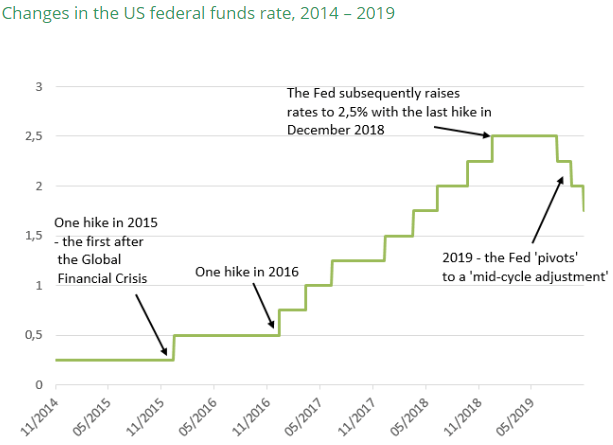

- The FOMC dropped its federal funds interest rate target for the 3rd time in 2019 to 1.5% – 1.75%. Chairman Powell indicated this cut was the last of the ‘midcycle adjustments’, causing investors to speculate about a pause in rate changes for the next few FOMC meetings.

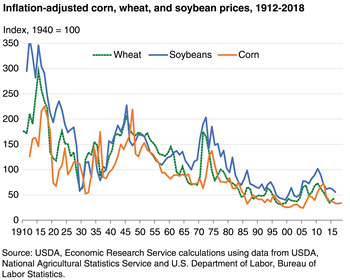

- The U.S. and China made progress toward a trade resolution, though the pace and magnitude of the agreement is unclear. Global economies seem to be successfully navigating geopolitical tensions in Hong Kong, unrest in Chile, water wars in Egypt, and the never-ending Brexit saga, among others.

- Conclusion: Barring a major geopolitical misstep, the U.S. stock market could end the year with a return in the top 25% since 1998. U.S. bonds may end with their best return since 2010.

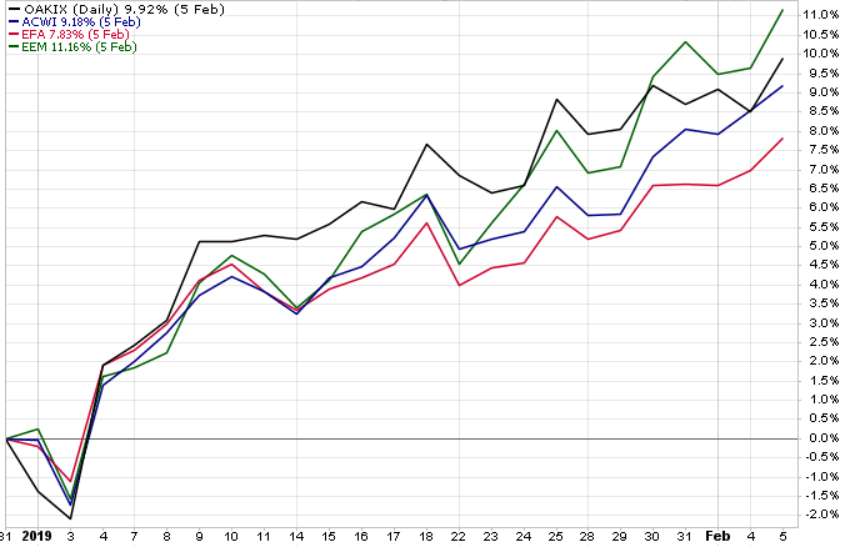

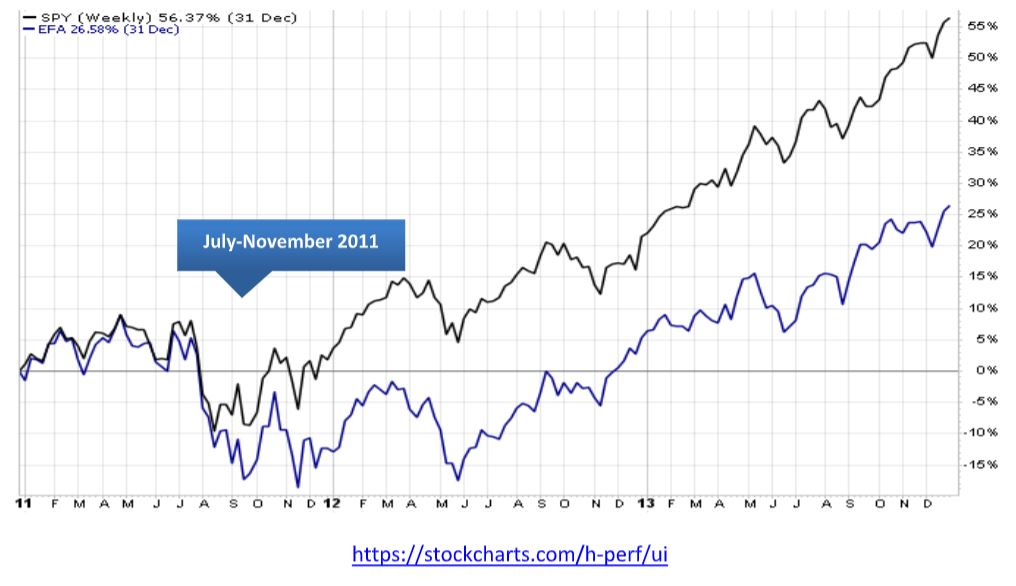

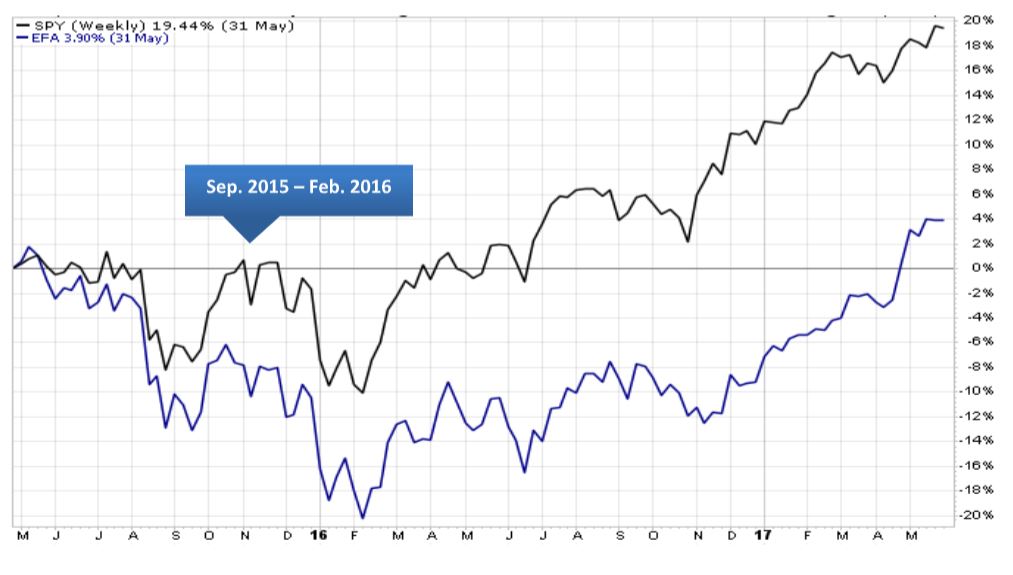

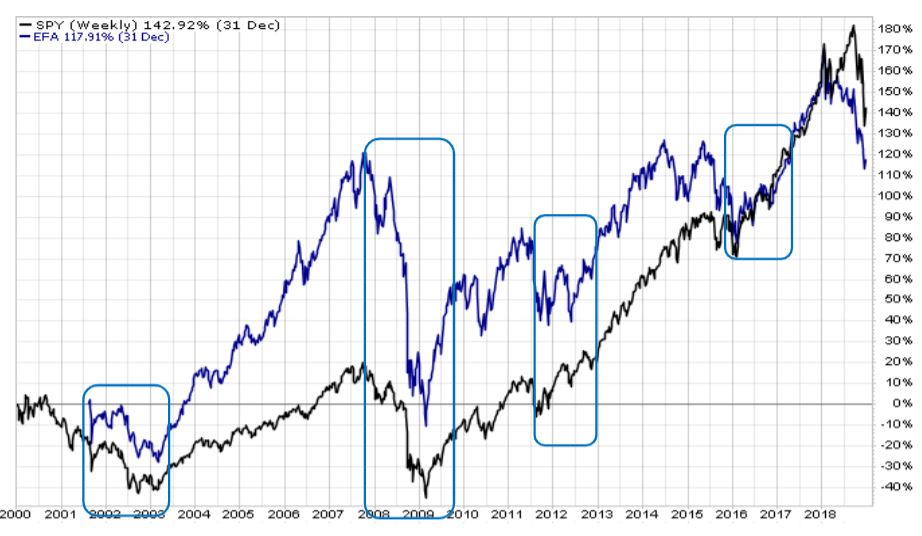

Global stocks begin to close the gap with the U.S.

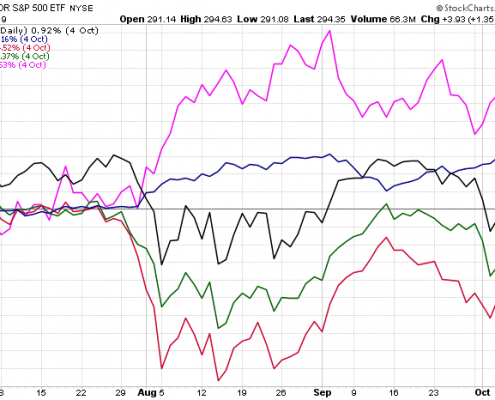

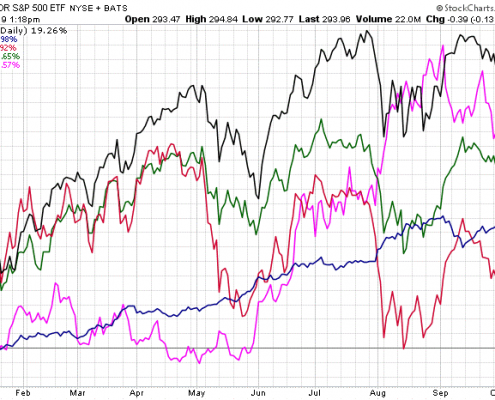

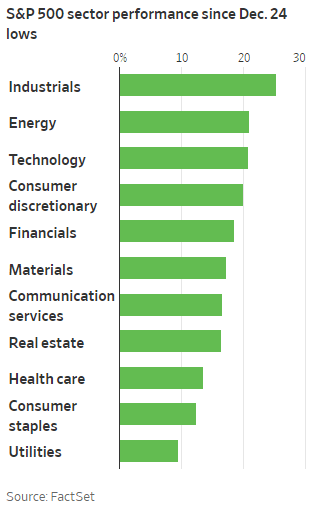

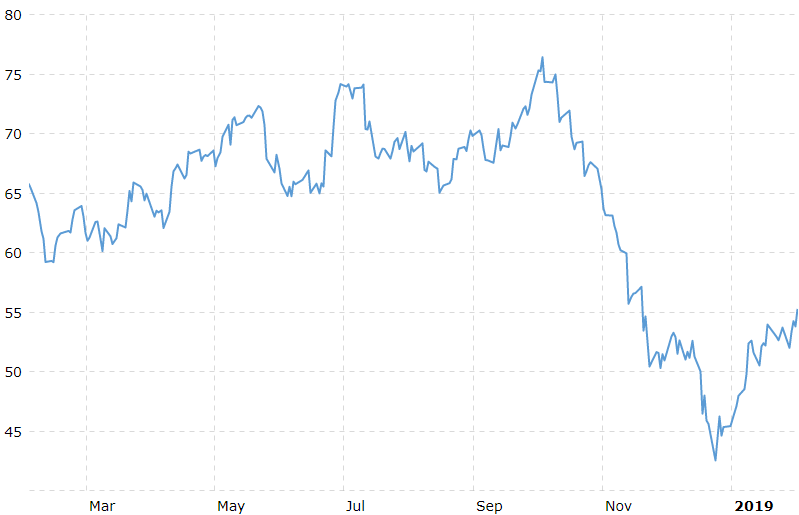

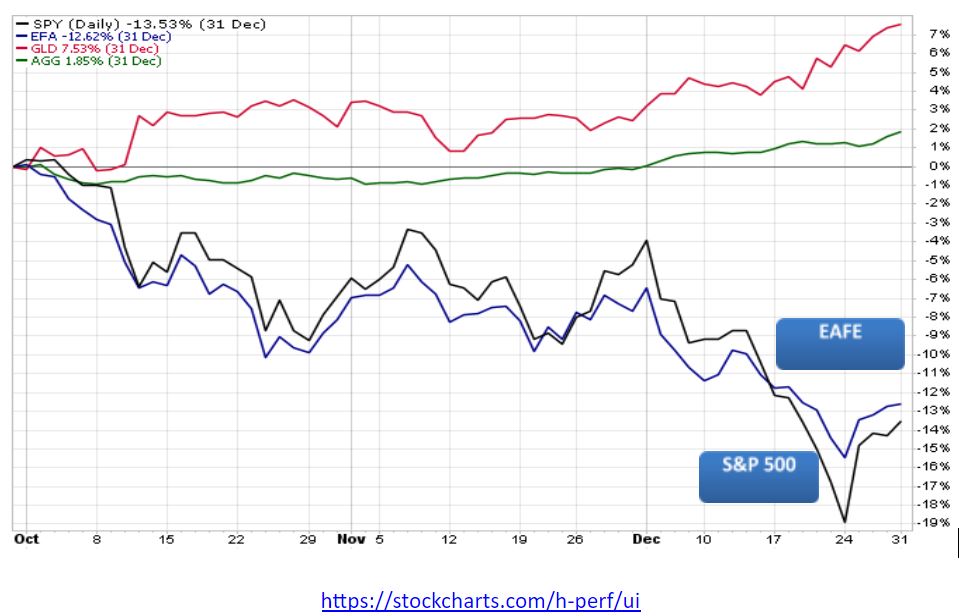

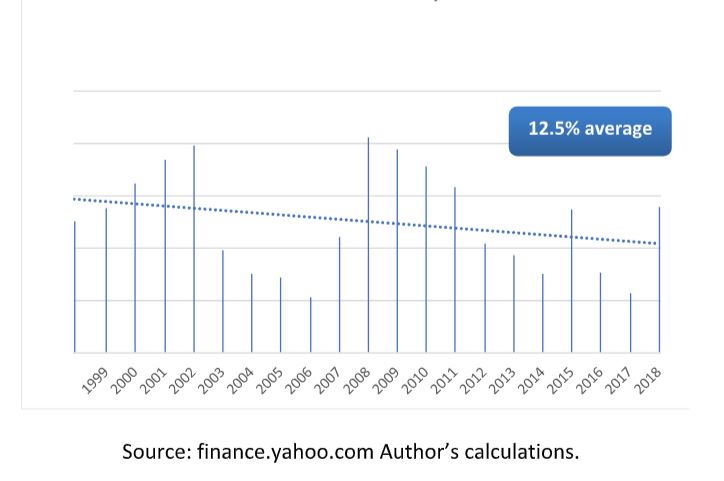

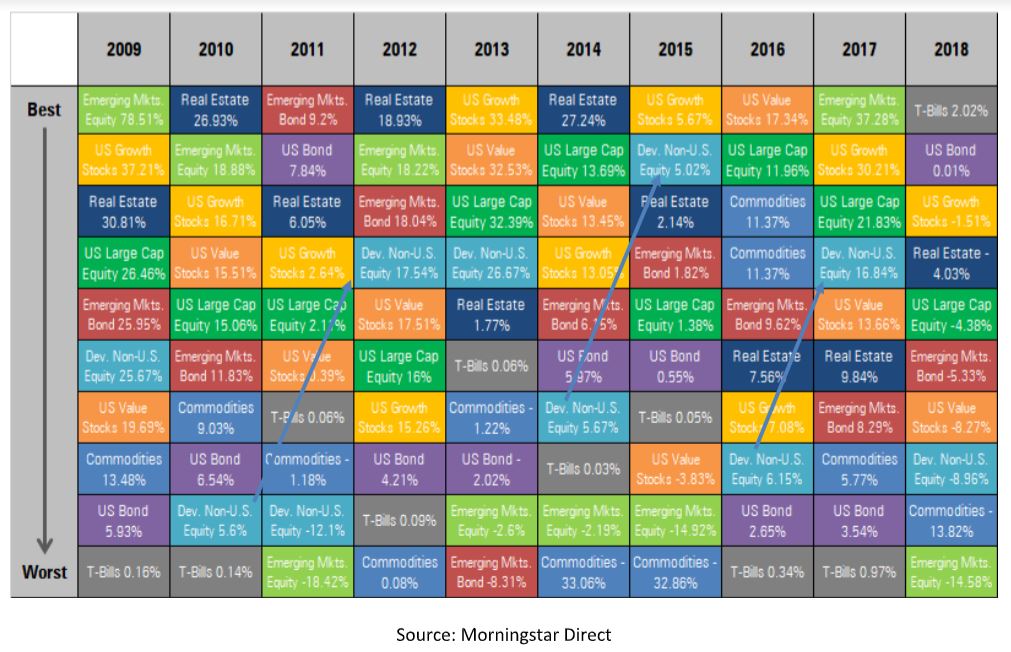

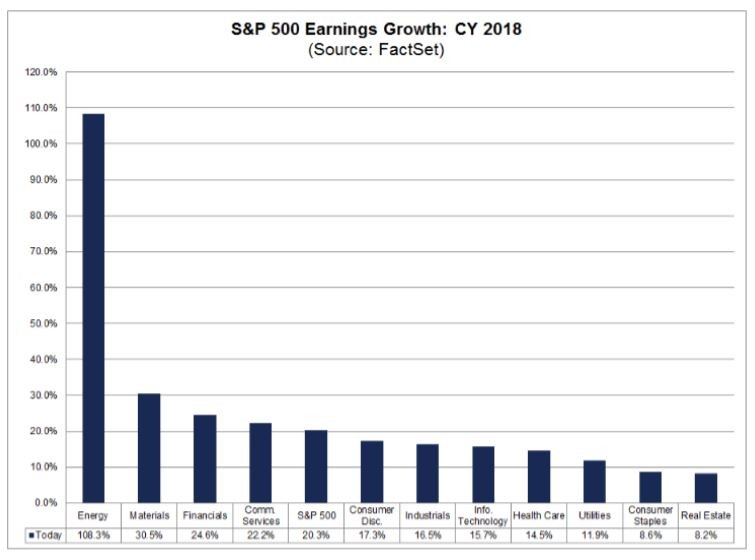

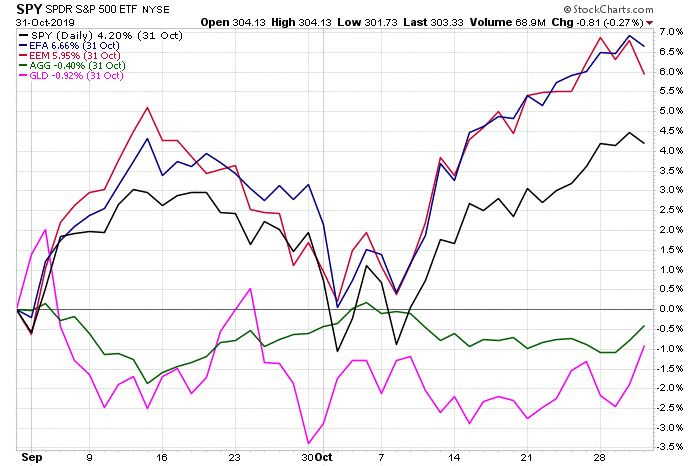

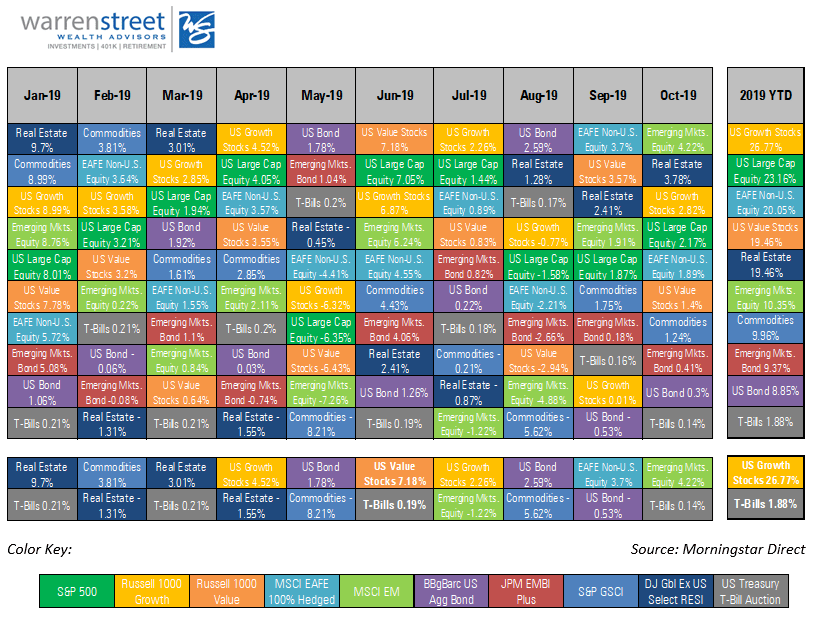

The 4th quarter is off to a great start! Despite a sharp decline the first few days of the month, global stock markets were very strong in October. Emerging Markets equity beat the S&P 500 for the second month in a row, up 4.22% versus 2.17%[1]. In typical ‘risk on’, ‘risk off’ fashion, bonds and gold lagged the field in October. Commodities stayed within sight of the leaders at +1.24% for the month, but U.S. and Emerging Markets bonds were far behind at +0.41% and +0.30%, respectively. For the year-to-date, Europe, Australasia, and Far East (EAFE) is picking up the pace with a return of 20.05% versus 23.16% for the S&P 500. The year-to-date leader as of October 31st is U.S. growth stocks at 26.77%.

https://stockcharts.com/h-perf/ui

This strong start to the 4th quarter can be attributed to progress with China/U.S. trade negotiations and no significant negative news about the other international worries facing the markets: Brexit, political uncertainty in the U.S. and overseas, tensions between Hong Kong and China, and soft business confidence around the world. If none of these go terribly wrong, 2019 is on track to be in the top 25% of S&P 500 stock market returns since 1988[2].

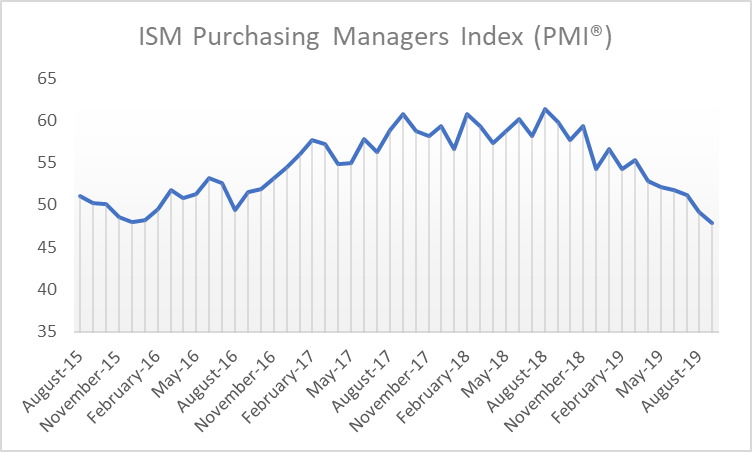

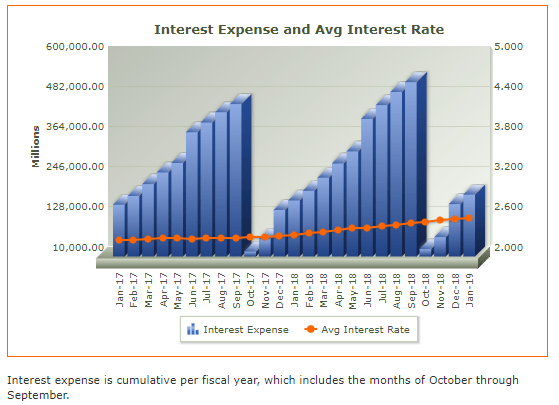

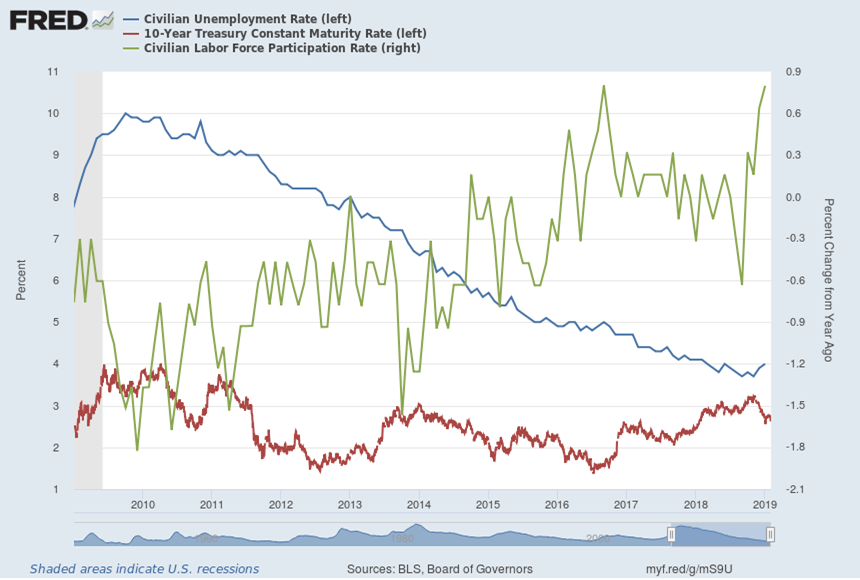

Amid this backdrop of relative stability, the Federal Open Market Committee (FOMC) lowered its short-term target interest rate for the third time in 2019 to a range of 1.5% to 1.75%[3]. Fed Chairman Jerome Powell stated that U.S. economic growth is steady despite continued weakness in business investment and exports, and core inflation is running below the Fed’s 2% target. The October rate cut was characterized as the final ‘midcycle adjustment’ to help support the maturing U.S. economic expansion. Chairman Powell indicated the FOMC will continue to monitor economic activity to determine the appropriate level of the federal funds rate going forward. His remarks did not include previous language about the Fed acting “as appropriate to sustain the expansion”, causing market watchers to expect a pause in rate changes going forward.

Source: BNP Paribas Asset Management, Bloomberg as of 11/4/2019

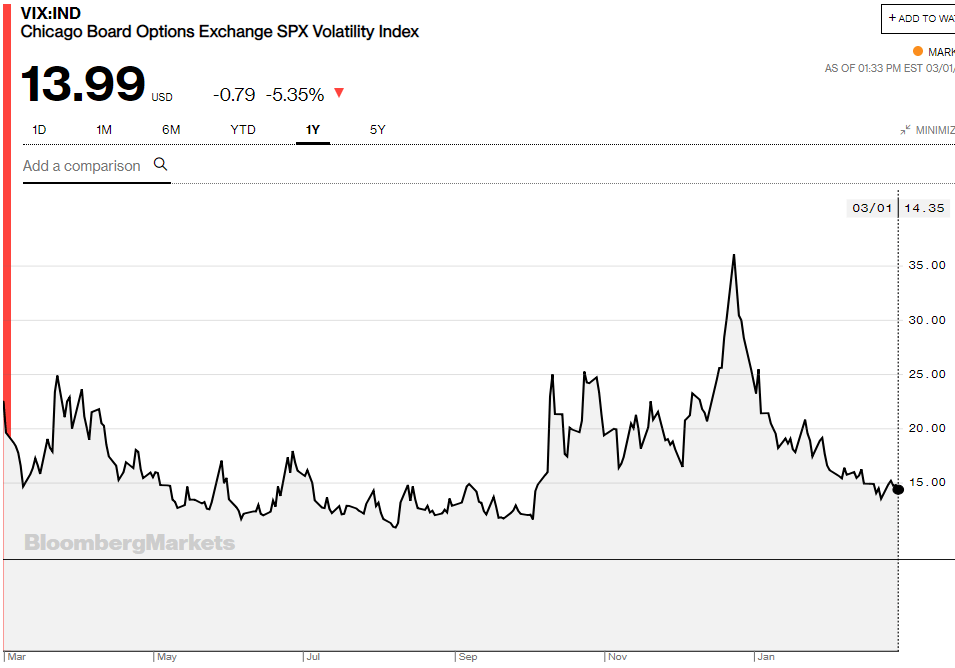

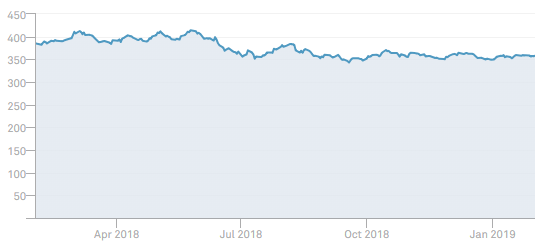

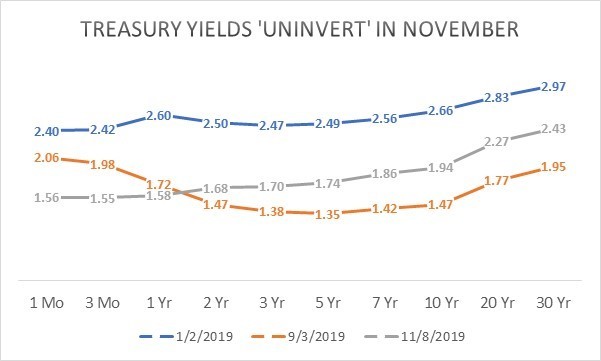

In the days following the rate cut, intermediate and longer-term Treasury yields rose, reversing the yield curve inversion seen for much of 2019 and signaling diminishing investor expectations for a near-term recession.

The return to an upwardly-sloping yield curve is a relief to market watchers. A healthy banking system requires short term rates to be lower than long term rates for banks to maintain consistent profit margins. Higher long-term yields encourage investors to take a longer-term perspective and make more strategic investments. Institutions such as pension plans also have a better chance of satisfying their obligations to future retirees. In general, financial markets do a much better job allocating capital when short-term interest rates are lower than long term rates.

Source: www.treasury.gov

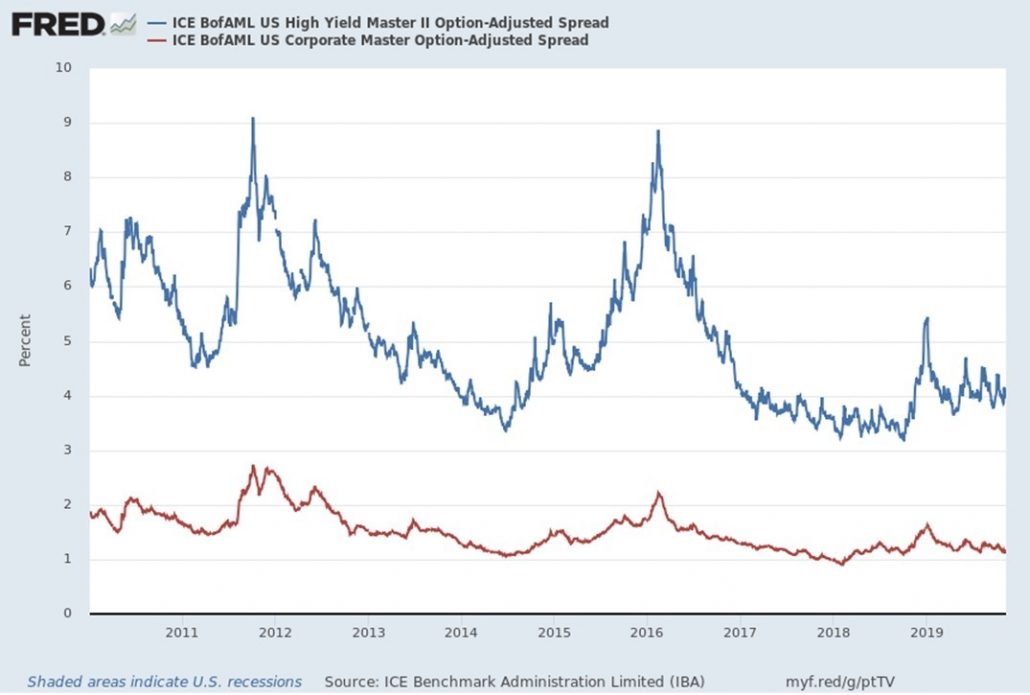

Looking beyond Treasuries, corporate bond yield spreads have drifted back toward the extremely low levels seen in early 2018. This is another indication that investors are comfortable taking risk right now. At Warren Street Wealth Advisors, we’re watching for excessive risk taking which could mean an asset price ‘bubble’ and potentially the end of the stock and bond rally. The occasional drops in market prices we see from time to time are a healthy sign that investors are making rational decisions rather than reckless speculation.

Corporate bond risk premiums drift near historic lows

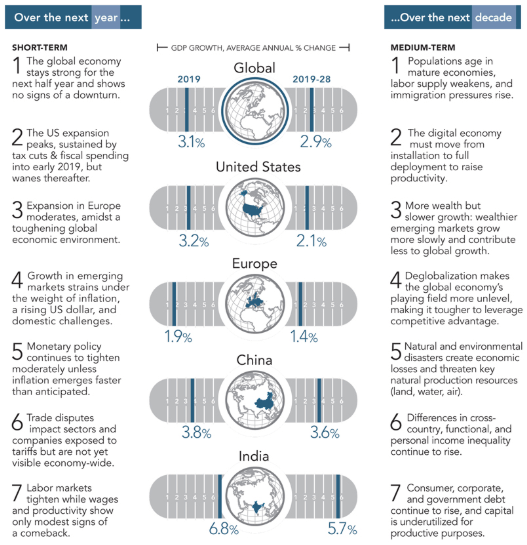

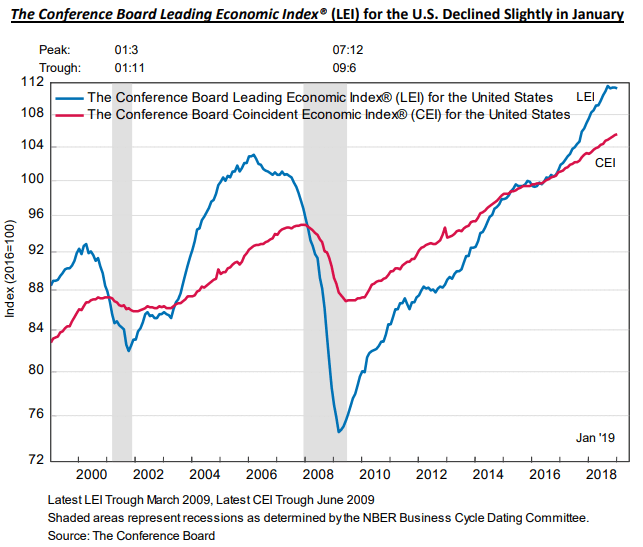

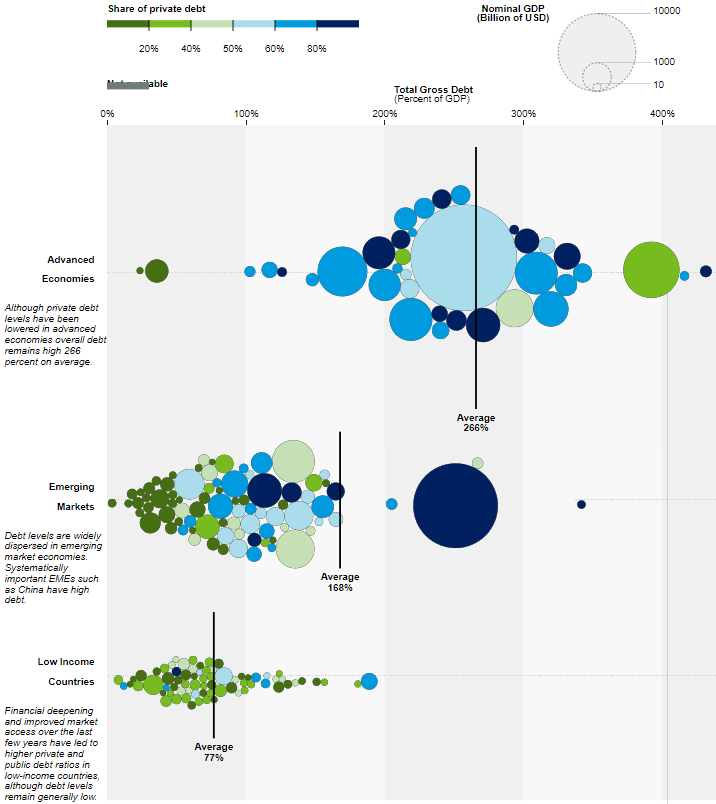

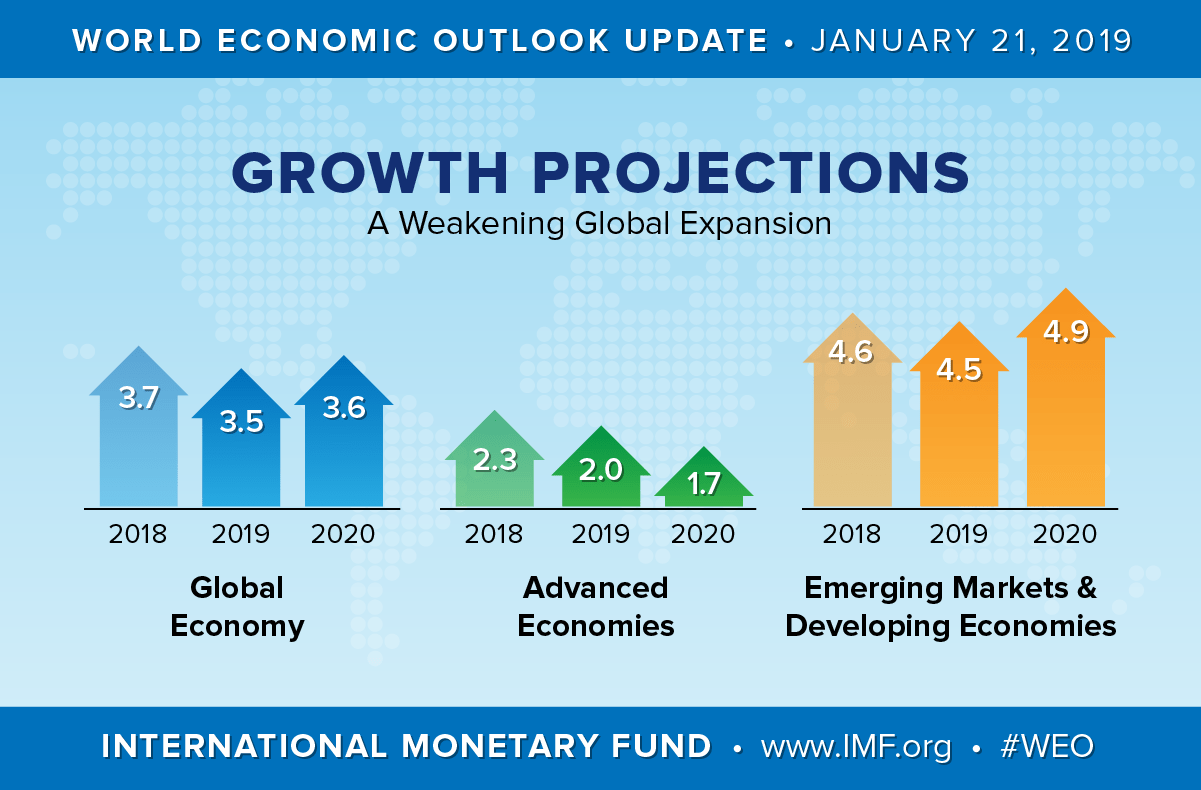

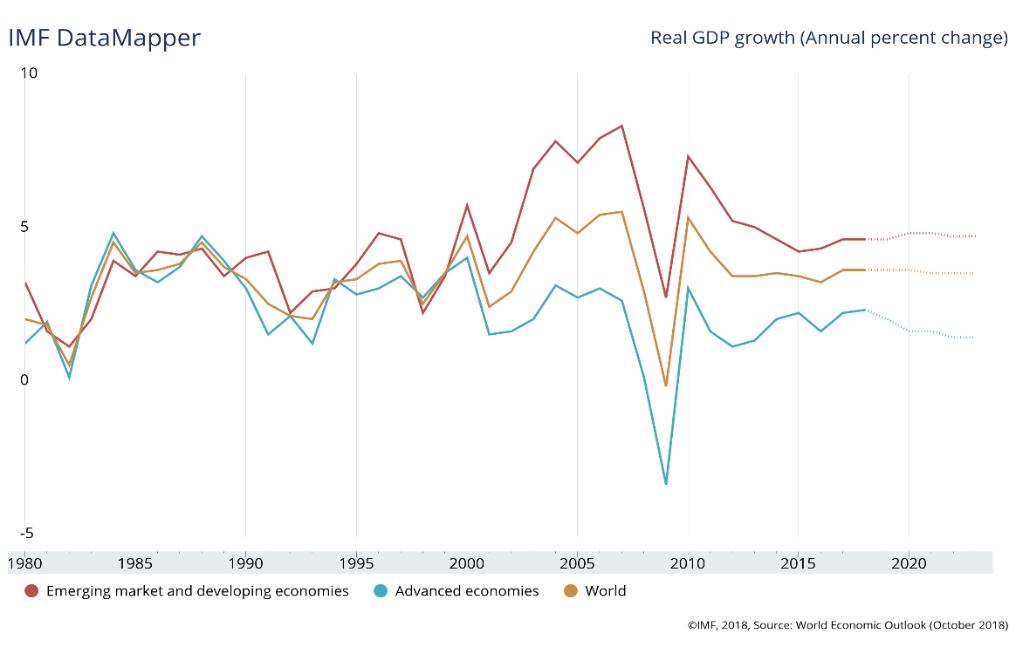

Let’s not forget the global economy, which the Fed has often mentioned as one reason for reducing interest rates this year. Though the data remains mixed, the International Monetary Fund is forecasting global GDP to close 2019 up 3%, with the U.S. at 1.7% and Emerging and Developing Economies up nearly 4%[4]. The IMF expects global growth to improve in 2020 to 3.4% as Europe adjusts to the new tariff landscape and political uncertainties diminish.

Global GDP projected to remain low but positive

A global recession is highly unlikely through the end of 2020 and probably longer, but there are significant risks to this outlook! The IMF is urging political leaders to defuse trade tensions and reinvigorate multilateral cooperation, rather than focus solely on accommodative monetary policy to keep the world economy afloat.

Bottom line: The U.S. economic expansion remains on track and should end the year well, barring significant missteps in the global economic and political landscape. Though it’s been a bumpy ride, investors are likely to close the books on 2019 with healthy profits from both stocks and bonds, and meaningful progress toward achieving their financial goals.

Marcia Clark, CFA, MBA

Marcia Clark, CFA, MBA

Senior Research Analyst, Warren Street Wealth Advisors

DISCLOSURES

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications.

Form ADV available upon request 714-876-6200

Growth stocks take the lead year-to-date

[1] Performance represented by ETFs designed to track various market segments: SPY (S&P 500), AGG (Barclay’s Aggregate Bond index), EEM (emerging markets equity), EFA (developed international equity), GLD (gold prices)

[2] Source: www.stockcharts.com

[3] https://www.federalreserve.gov/monetarypolicy/files/monetary20191030a1.pdf

[4] https://www.imf.org/en/Publications/WEO/Issues/2019/10/01/world-economic-outlook-october-2019