Posts

Gold Rush of 2020

/in Education, Intermediate, Investing /by Phillip Law

In 1848, thousands of people grabbed their shovels and crossed land and sea to Sutter’s Mill with hopes of striking gold. Almost 150 years later in 2020, a similar parallel is happening not in San Francisco, but rather in the investable market for this hot commodity.

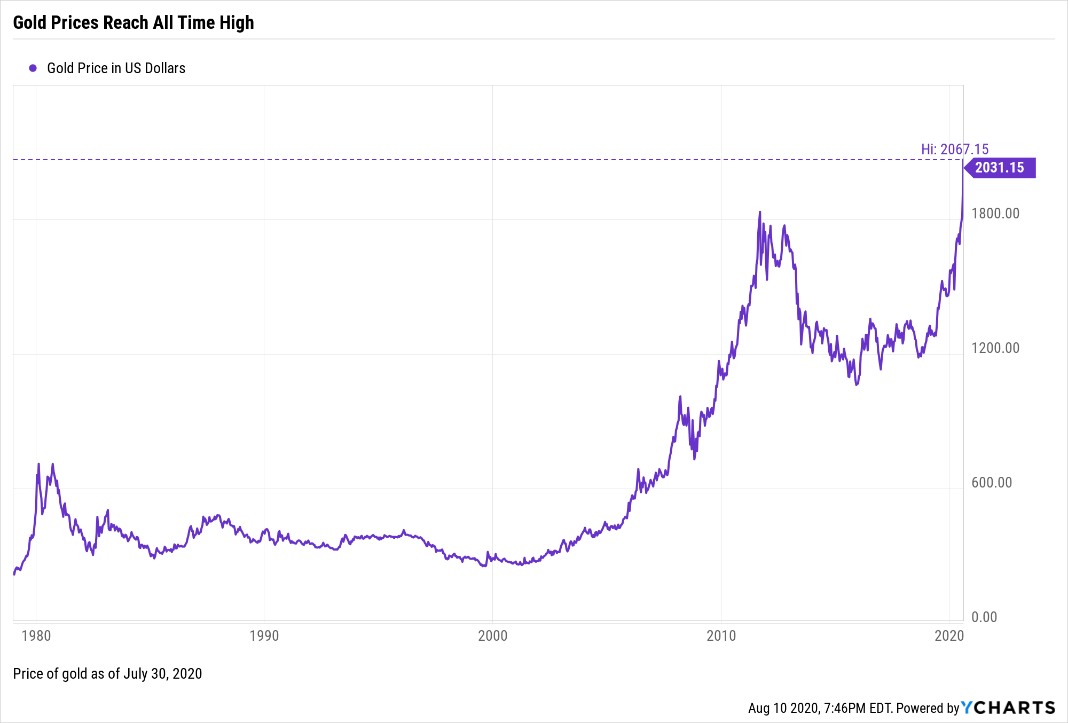

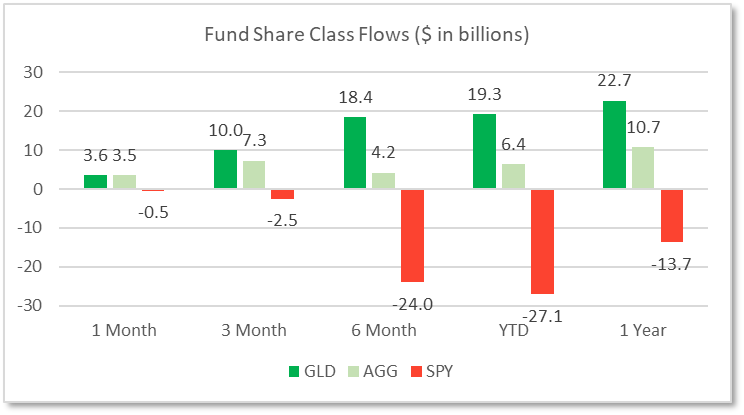

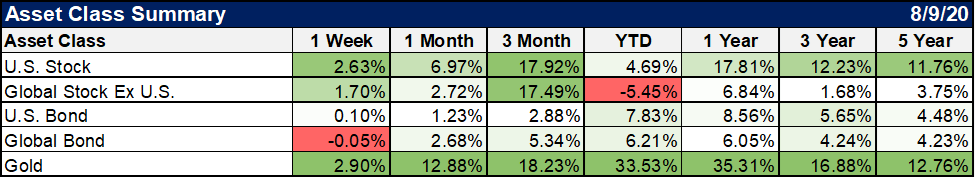

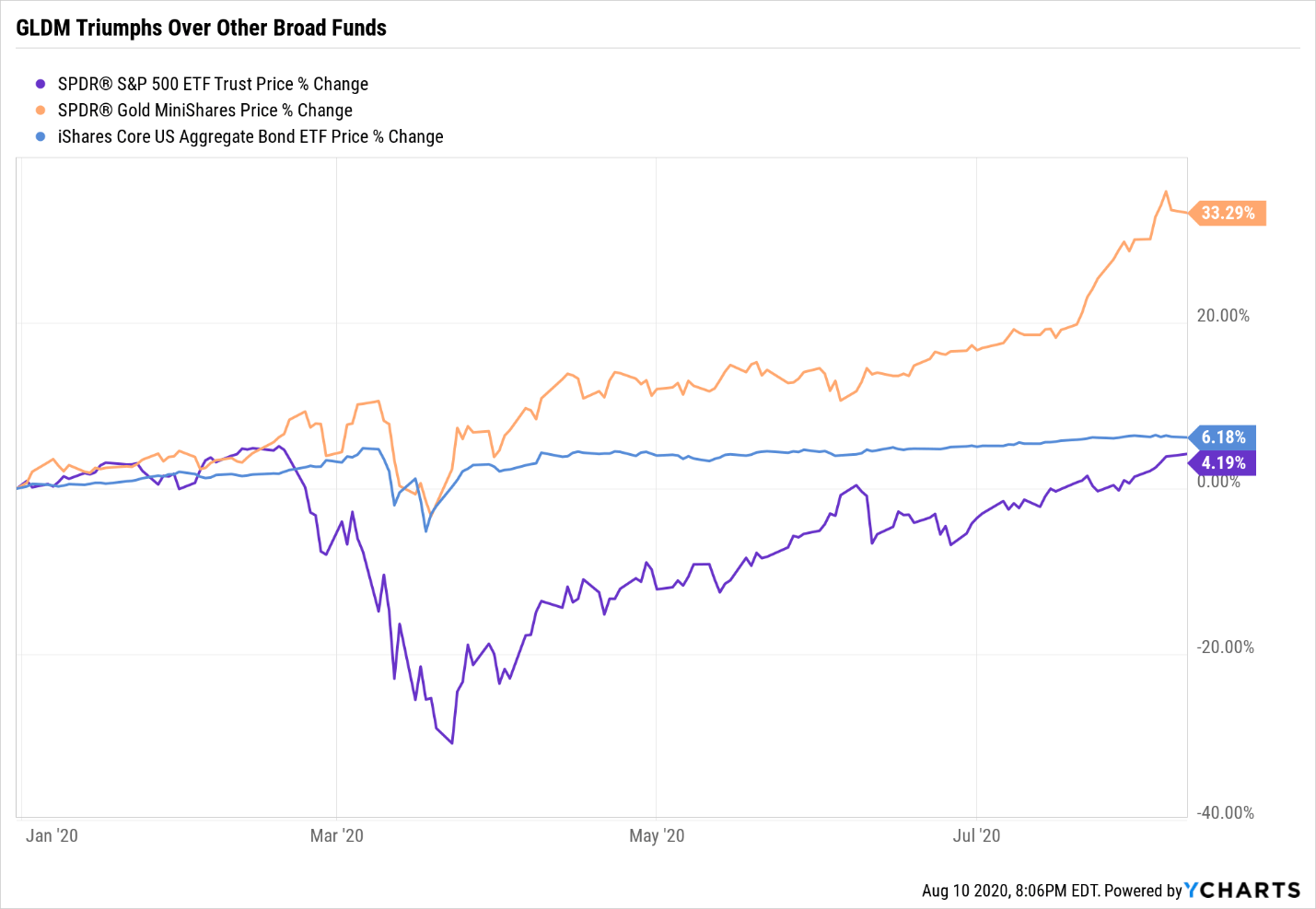

Year-to-date (YTD), gold has experienced more inflows than other broad stock and bond funds, including SPY and AGG which track the S&P 500 and Barclay’s Aggregate Bond Index, respectively. Amongst a myriad of asset classes, investors are choosing gold as their choice for safekeeping, thus driving gold prices to an all-time high. This year alone, gold is up 33.53% YTD compared to U.S. Stocks at 4.69% YTD and U.S. bonds at 7.83% YTD. But why exactly is a gold rush taking place in 2020?

Source: YCharts

Data as of 8/05/2020

You may attribute the surge in gold prices to the pandemic, but mine deeper and you will find more.

Source: YCharts

Data as of 8/05/2020

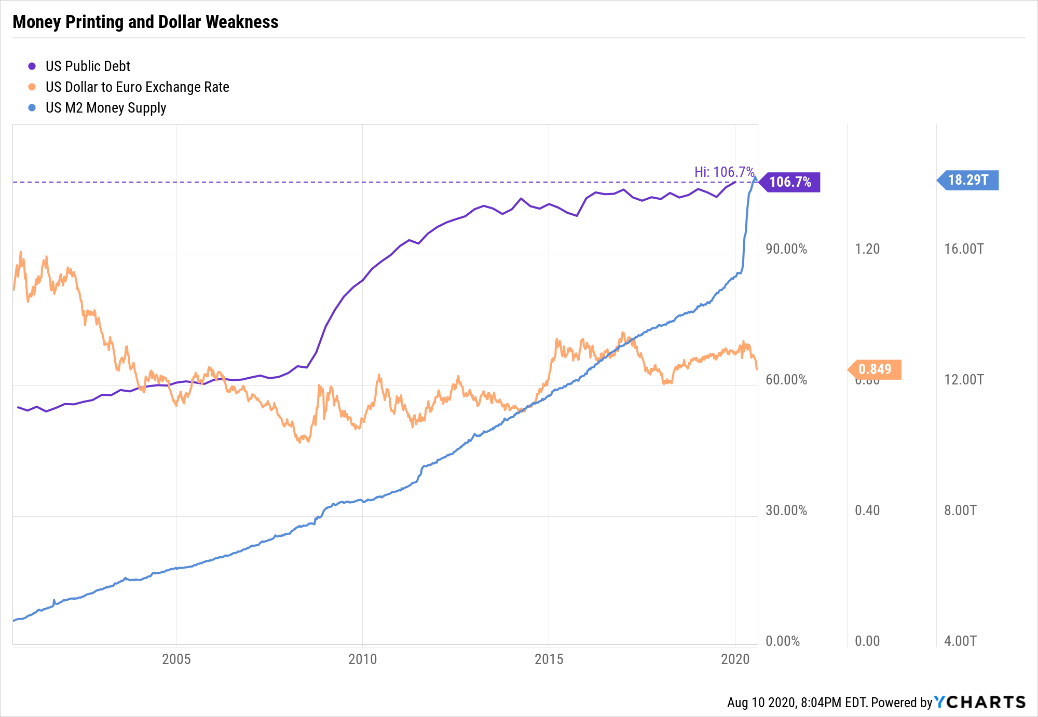

Source: YCharts

Low Yield Environment: Earlier in March, the Federal Reserve cut the federal funds rate to 0 – 0.25% to stimulate the economy amid an economic crisis. As a result, treasury yields fell drastically. The 10 Year Treasury rate started the year at 1.88% and now only yields an all-time low of 0.52%, or -1.05% adjusted for inflation. Although treasuries are often used as a safe haven during uncertain times, negative real yields alongside inflation expectations might make gold a more attractive store of value.

Inflation Expectations: Fiscal stimulus through a $2.2 trillion package, rapid money printing, and unprecedented quantitative easing has prompted investors to seek gold as an inflation hedge. Current levels of inflation, however, do remain low at 1.19% year-over-year relative to the Fed’s target of 2.0%, and are likely to stay low in the short term (due to aggregate demand and supply shocks). While there is no tell-all sign indicating future long-term inflation is upon us, the following is certain: whether gold investors are overreacting or whether U.S. inflation is a ticking time bomb remains to be seen.

A Weakening U.S. Dollar: With fiscal debt as a percentage of GDP and M2 Money Supply at an all-time high, confidence in the U.S. dollar is diminishing relative to other currencies including the Euro. This comes at a time where the European Union appears to maintain a tighter grasp on COVID-19 outbreaks, alongside newfound unity in the form of a centralized stimulus package and debt mutualization. Overall, supposed weakness in the U.S. dollar has turned investors towards gold to maintain the purchasing power of their greenbacks.

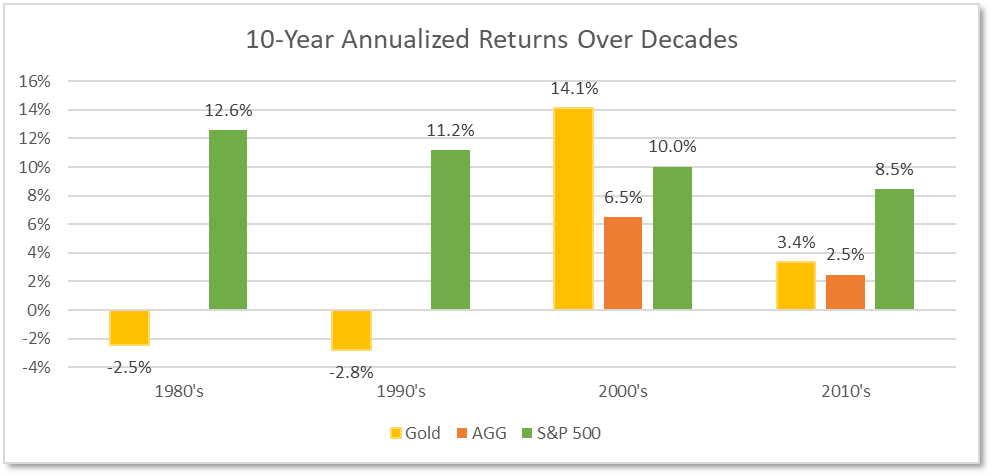

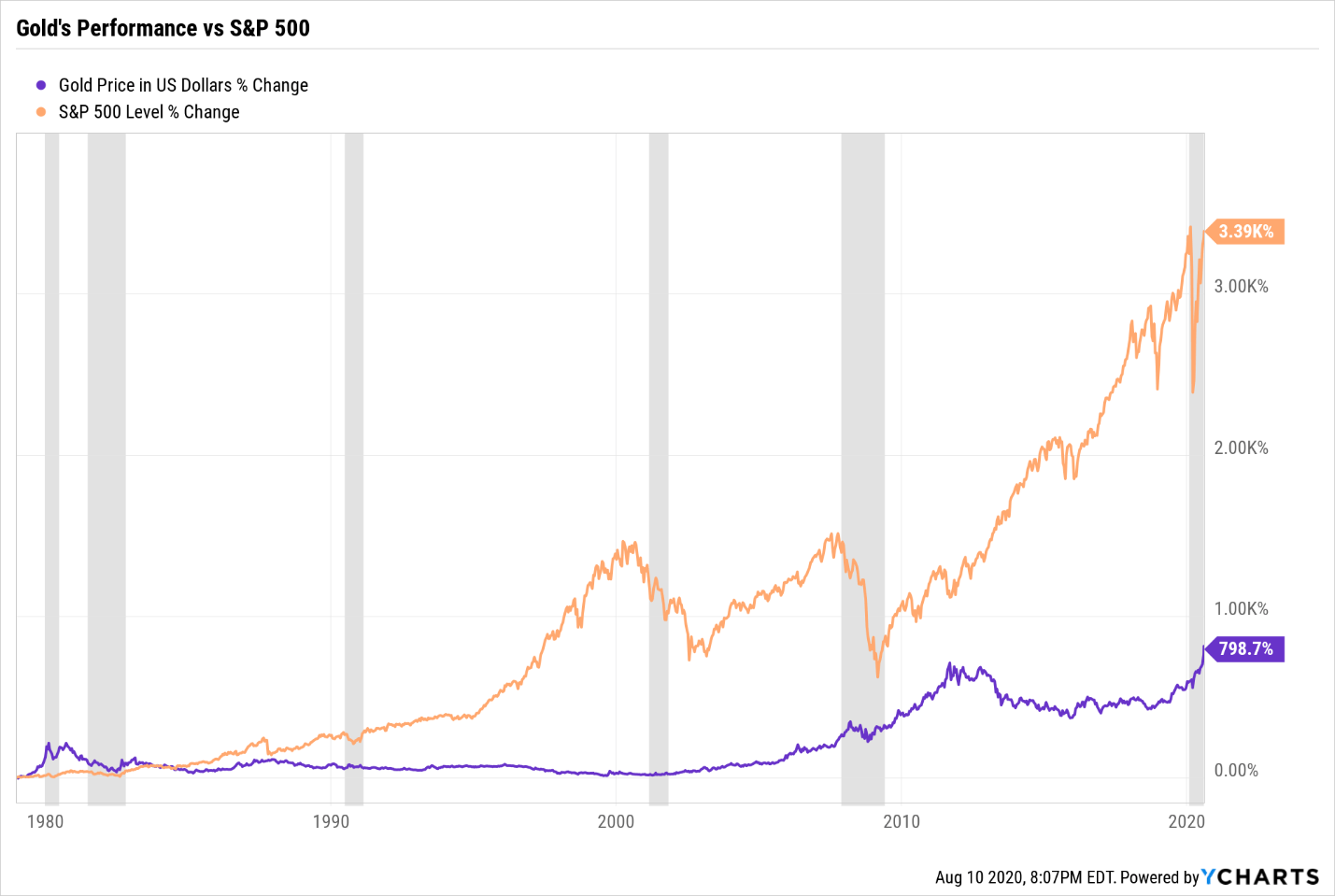

With this context, it seems like anyone would jump at the chance to own gold; but to avoid grabbing a handful of pyrite (fool’s gold), let’s evaluate gold’s performance and properties as an asset class. During the 1980’s and 1990’s, gold yielded less than ideal returns. In the late 2000’s, the metal’s performance accelerated as investor confidence faltered during the Great Recession, but subsequently dipped in the 2010’s when the U.S. economy proceeded onto its longest economic expansion.

Source: YCharts

Data spanning 1/01/1980 to 12/31/2019

Based on history, we can draw two conclusions: 1) gold’s volatile nature indicates that its current run may not be sustainable over long periods of time and 2) gold’s performance suffers when investors regain confidence and begin to adopt a risk-on posture. To see gold’s performance coming out of recessions, see Appendix A. (link)

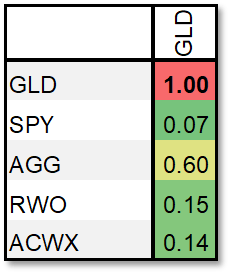

5-Year Correlation Matrix (Rolling Monthly Returns)

Data as of 8/07/2020

Source: YCharts

Gold generates zero passive income, so why do investors hold it? One reason is simply because it’s different and provides a diversification benefit. This metal exhibits less correlation compared to broader asset classes, meaning it simply behaves differently. A correlation of 1 indicates that the assets’ return behaviors are identical, while a correlation of -1 means they move in completely opposite directions. Given gold’s weaker correlations, it is likely to thrive when stocks or other asset classes experience large drawdowns. In other words, gold zigs while others zag.

Having understood the nuances of gold as investable asset and its diversification benefit over a long-time horizon, Warren Street Wealth Advisors previously made the decision to maintain gold exposure through Gold Minishares (GLDM) in our Diversifiers sleeve. Our investment strategies are now reaping the benefits of gold’s recent rally and allow for different courses of action. For example, with current gold prices bid up relative to historical levels, we can trim profits to invest in cheaper assets classes with higher potential for appreciation. This in essence, is buying low and selling high.

Gold prices will likely stay in the headlines and continue to gain traction in coming months. Regardless, we encourage you to start with your long-term asset allocation in mind and refrain from overthinking market entry/exit timing on any specific asset class. Preventing permanent capital impairment and building portfolios for your short term and long-term needs remains our top priority. We will diligently tax loss harvest and perform recurring rebalances along the way to take advantage of tactical long-term opportunities we see appropriate. That to us, is striking gold in 2020.

Appendix A:

Phillip Law

Portfolio Analyst, Warren Street Wealth Advisors

Warren Street Wealth Advisors, a Registered Investment Advisor. The information contained herein does not involve the rendering of personalized investment advice but is limited to the dissemination of general information. A professional advisor should be consulted before implementing any of the strategies or options presented. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss.

Periodic Table of Investing

/in Education, Investing /by Blake StreetPeriodic Table of Investing

Dust off your memories of high school chemistry and think of your investment returns and your investment risks as two separate and distinct members of the periodic table. Certain elements (in this case, securities) are prone to interact when mixed, while others may remain neutral. Each element (security) will always have its own separate and unique profile and characteristics.

Starting with carbon, one of the world’s most important elements, I’d equate carbon to U.S. stocks. Regardless of age, every investor we work with has likely benefited from or utilized this element and will continue to do so in some capacity going forward.

Argon, the world’s least reactive element, tends to be more akin to Treasury Bonds or cash, not responding negatively to volatility much, if at all.

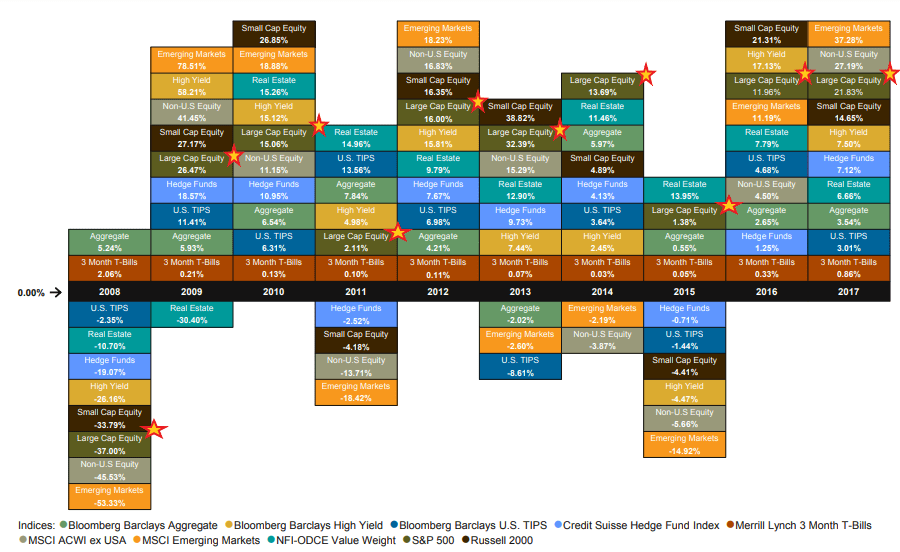

I’m far from the first person to think of investments in this way, in-fact there is deep history in what many refer to as the “Callan Chart” or “Periodic Table of Returns”. Below you’ll see a large majority of the world’s major asset classes and their returns relative to zero:

The most striking thing from this chart is that after a disastrous 2008 for everything except U.S. Bonds (argon), the only asset class that is yet to have a negative year is Large Cap ($10B+) U.S. Stocks (starred).

Winners and Losers

This freedom from negative returns and the compounding of large year-to-year gains has led to outsized outperformance from Large U.S. stocks. Over the last 10 years, Large U.S. stocks have produced cumulative total returns of 158%. Developed Foreign Country stocks have produced 19% and Emerging Markets only 16%.

Two takeaways from this are: the power of compounding positive returns but even more important is the force of losses and the time it takes to make them up. In addition, one recurring theme of study and practice in investing is that asset prices move in cycles. While U.S. outperformance seems like an unbreakable cycle, it’s just a matter of time.

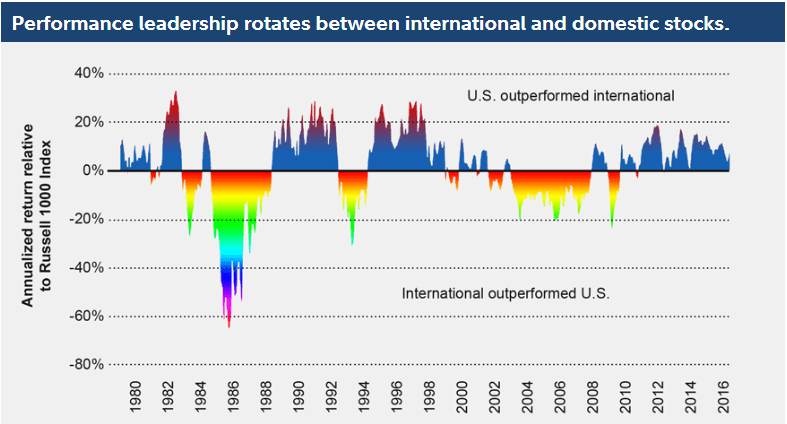

Trading Places

Take a look below at how U.S. and international stock market leadership has traded off over time. Most recently international stocks outperformed from 2003-2009, and the U.S. finds itself on its longest stretch of outperformance since 1979.

We have been incrementally positioning our clients’ portfolios for this eventual inflection since 2015. Last year we looked right, this year thus far we look wrong. Personally, I just consider myself patient as I wait for a multi-year trend to unfold.

Whether it’s high prices and valuation concerns or much of the low hanging fruit in our U.S. economic recovery is out of the way, we have a firm conviction in our posture of reducing U.S. stock market exposure. Having said that, we do not have a proverbial crystal ball, therefore we diversify and avoid throwing all of our eggs into the international basket.

Don’t Give up on Bonds

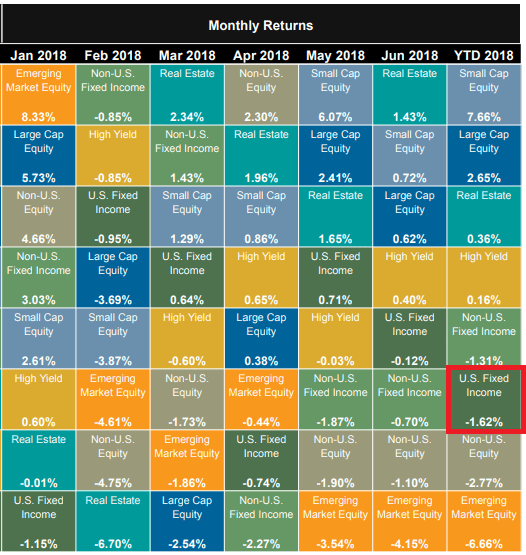

In addition, we haven’t given up on bonds, which have been tough to own this year, with U.S. Bonds down on average -1.62%.

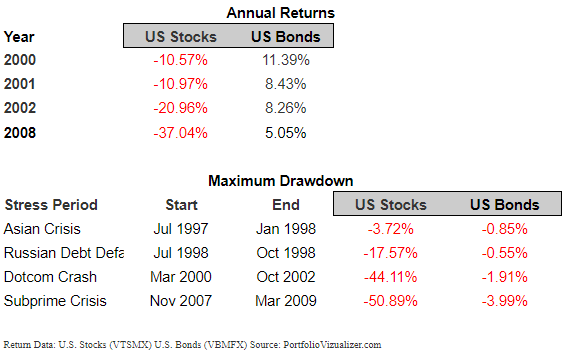

It’s important to keep in mind how bonds have performed during down years for the stock market, something that is potentially in the cards this far into an extended bull market.

One does not need to own the entire U.S. bond market via an index fund or otherwise. We currently prefer shorter term bonds, typically corporate bonds, and even in some cases inflation protected bonds. With a recent uptick in short-term government bonds, they aren’t nearly as painful to hold as in years past when yields hovered near zero. The 2-year treasury currently yields 2.829%, at the time of writing this article.

Late Cycle Playbook

With a backdrop of rising inflation globally, rising rates here in the U.S., accommodative monetary policy globally, and stretched valuations in U.S. equity markets, we continue to prefer assets that tend to outperform late in the economic cycle and when the factors above are present.

These assets include:

- International and Emerging Market stocks

- Industrials, Metals, Energy

- Shorter Term Bonds, TIPS

Signing Off

While we realize this year has been far less exciting than the last, we remain firm in our convictions on how we want to combine elements from the “Periodic Table of Returns” moving forward. We stand at the ready to buy into recent market weakness and will not capitulate to chasing what has done well. We appreciate your continued trust and patience while we navigate through what’s been an unstable first half of 2018. Don’t hesitate to contact our office should you have any questions or concerns about how we are approaching your investments.

Respectfully yours,

Blake Street, CFA, CFP®

Blake Street, CFA, CFP®

Blake Street, CFA, CFP®

Chief Investment Officer

Founding Partner

Warren Street Wealth Advisors

Blake Street is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information. A professional advisor should be consulted before implementing any of the strategies or options presented.

Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance, strategy, and results of your portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.

Contact Us

As a Registered Investment Advisor, Warren Street Wealth Advisors, LLC is required to file form ADV to report our business practices and conflicts of interest. Please call to request a copy at 714-876-6200.