2023 Investment Update

Every January, it’s typical to reflect on market data from the year past. You’ll see the results in your own quarterly reports, as well as across the usual flurry of broad market analyses.

Even when the numbers aren’t what we’d prefer—which has certainly been the case for 2022—we look at them anyway. It’s good to keep an eye on your annual investment returns, as they are one consideration among many that guide your financial plans.

However, whether the numbers are up or down in any given year, we caution against letting them alter your mood, or as importantly, your portfolio mix. When it comes to future expected returns, a year’s performance is among the least significant determinants available.

To illustrate, consider what happened in 2022, and how global markets reacted.

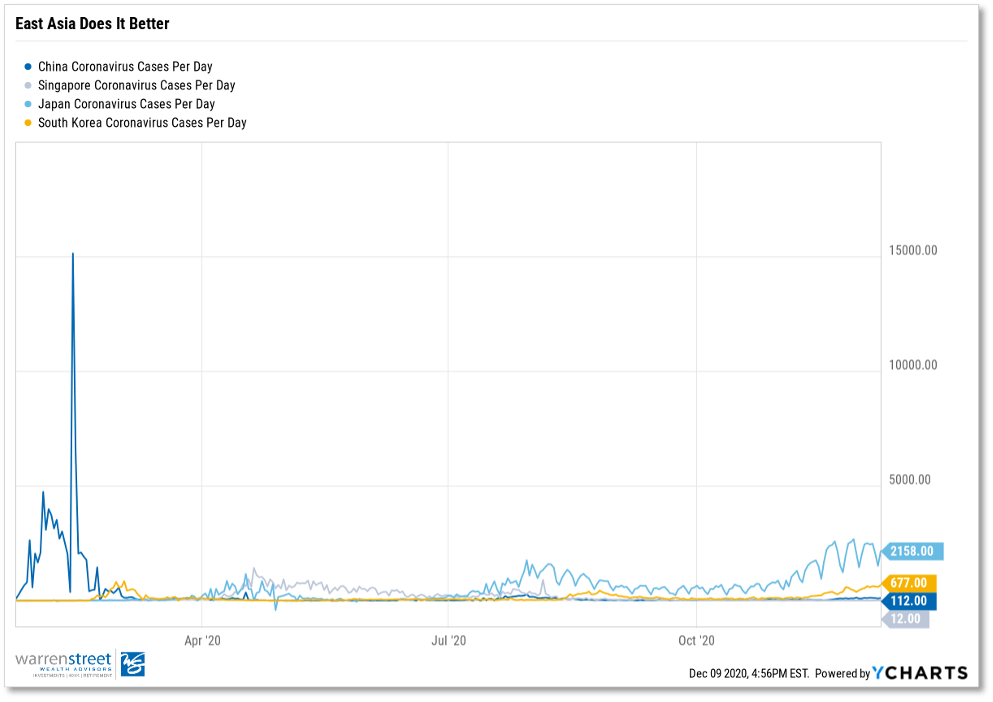

In the thumbs-down category, U.S. stock market indexes turned in annual lows not seen since 2008, with most of the heaviest big tech stocks taking a bath. Bonds fared no better, as the U.S. Federal Reserve raised rates to tamp down inflation. The U.K.’s economic policies resulted in Liz Truss becoming its shortest-tenured prime minister ever, while Russia’s invasion of Ukraine and China’s continued COVID woes kept the global economy in a tailspin.

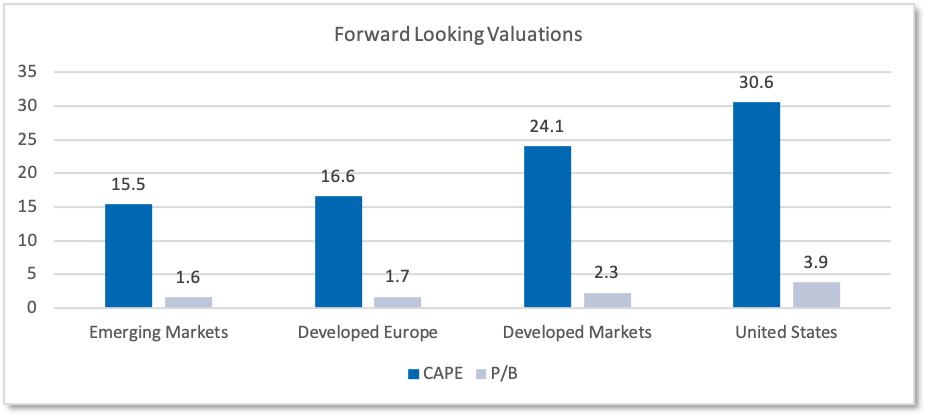

On the plus side, inflation has appeared to be easing slightly, and so far, a recession has yet to materialize. A globally diversified, value-tilted strategy has helped protect against some (certainly not all) of the worst returns. An 8.7% Cost-of-Living Adjustment (COLA) for Social Security recipients has helped ease some of the spending sting, as should some of the provisions within the newly enacted SECURE 2.0 Act of 2022 here.

Now, how much of this did you see coming last January? Given the unique blend of social, political, and economic news that defined the year, it’s unlikely anything but blind luck could have led to accurate expectations at the outset.

In fact, even if you believe you knew we were in for trouble back then, it’s entirely possible you are altering reality, thanks to recency and hindsight bias. The Wall Street Journal’s Jason Zweig ran an experiment to demonstrate how our memories can deceive us like that. Last January, he asked readers to send in their market predictions for 2022. Then, toward year-end, he asked them to recall their predictions (without peeking). The conclusion: “[Respondents] remembered being much less bullish than they had been in real time.”

In other words, just after most markets had experienced a banner year of high returns in 2021, many people were predicting more of the same. Then, the reality of a demoralizing year rewrote their memories; they subconsciously overlaid their original optimism with today’s pessimism.

Where does this leave us? Clearly, there are better ways to prepare for the future than being influenced by current market conditions, and how we’re feeling about them today. Instead, everything we cannot yet know will shape near-term market returns, while everything we’ve learned from decades of disciplined investing should shape our long-range investment plans.

We wish you and yours a happy and healthy 2023, come what may in the markets. Please let us know of any new ways we can further your financial interests at this time. This, and every year, we remain grateful for your business.

Blake Street, CFA, CFP®

Founding Partner & Chief Investment Officer, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.