2026 Outlook: Beyond AI & Mega-Cap Tech

“Is AI a bubble?” my uncle asked as I put my fork down mid-bite on New Year’s Eve. I’d wager that this question dominated dinner tables and family gatherings across the country this holiday season. Even my sister, whose focus lies entirely within the arts and creative pursuits, managed to put the two words “AI” and “Bubble” together.

This tells me two things: 1) Concern around AI and “bubble-ness” is virtually inescapable and 2) this question is dominating the audience’s perception of markets, perhaps even more so than the meteoric rise of silver and gold as we enter 2026.

Why Does AI Deserve So Much Attention?

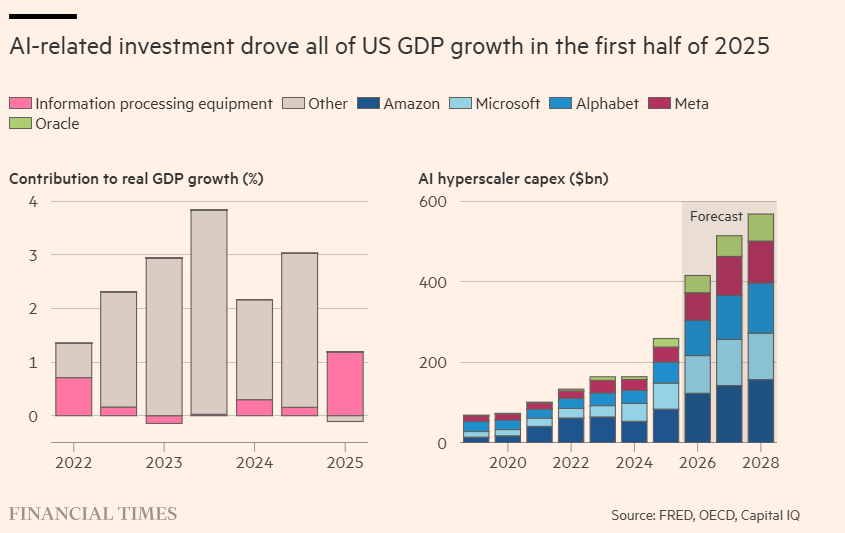

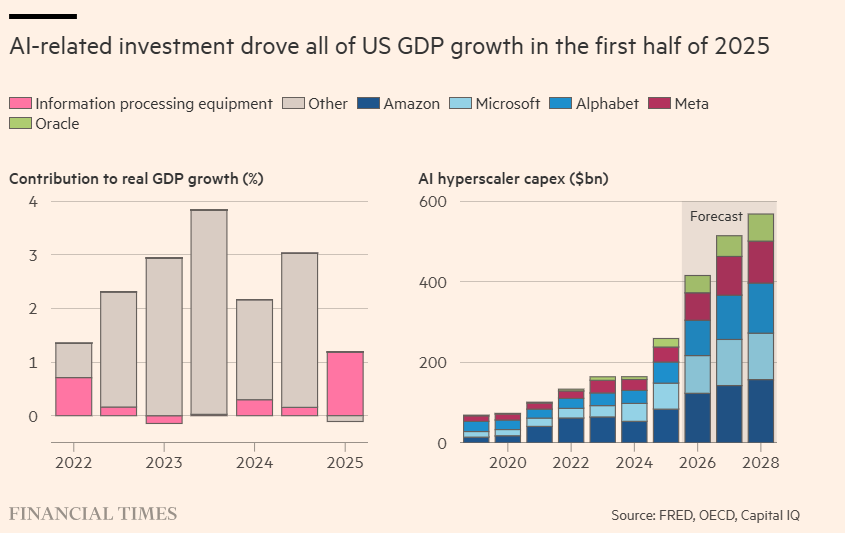

In 2025, AI-related names drove ~60% of the increase in the S&P 500’s value. Furthermore, AI spending from the “Hyperscalers” (Google, Microsoft, etc.) accounted for the lion’s share of our economy’s growth. Without the spending on data center infrastructure—servers, GPUs, and the centers themselves—some estimates suggest US GDP would have grown at a measly 0.1% in the first half of 2025. It’s safe to say that AI alone kept the economy afloat for most of last year.

The robust figures above underscore why AI rightfully commands significant attention. However, fixating on the bubble label can be a trap, much like timing the market. Instead, we should look at bubble psychology and how those excesses may be extending into the AI ecosystem.

Settling the AI Bubble Talk

It’s been over 20 years since we’ve seen such a transformative, general-purpose technology with the potential to deliver productivity gains eclipsing the internet era. This fervor has already minted a class of early winners, leaving everyone else watching with a potent mix of envy and regret. It’s the classic setup for FOMO, where the “AI train” starts looking less like a sound, technological investment and more like a high-speed shortcut to a cushy nest egg.

The danger is that the faster this train moves, the easier it is to speed right past the following flags:

- Starting Valuations: We pay prices regardless of whether reasonable returns can be generated.

- Risk/Reward Profiles: We stop asking if we’re actually being compensated for the layers of risk we’re adding to our broader portfolio.

- Lofty Narratives: AI’s newness unrestrains the imagination to justify price tags that reality can’t yet support.

Behind the Excitement: What’s Different This Time?

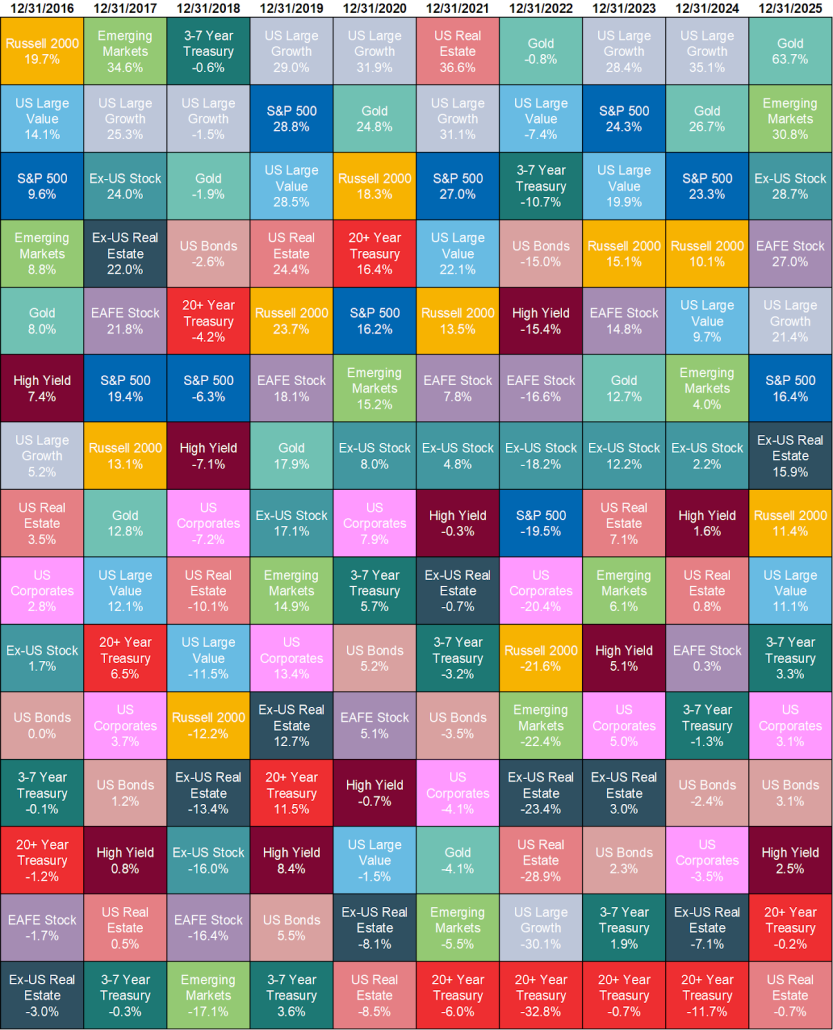

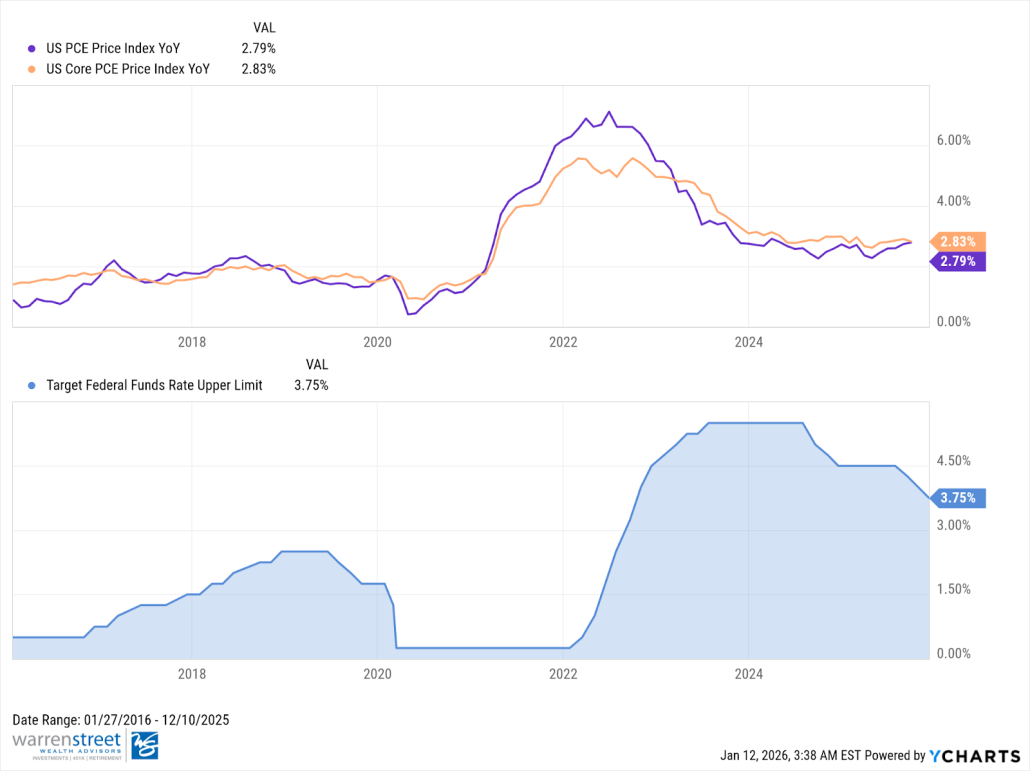

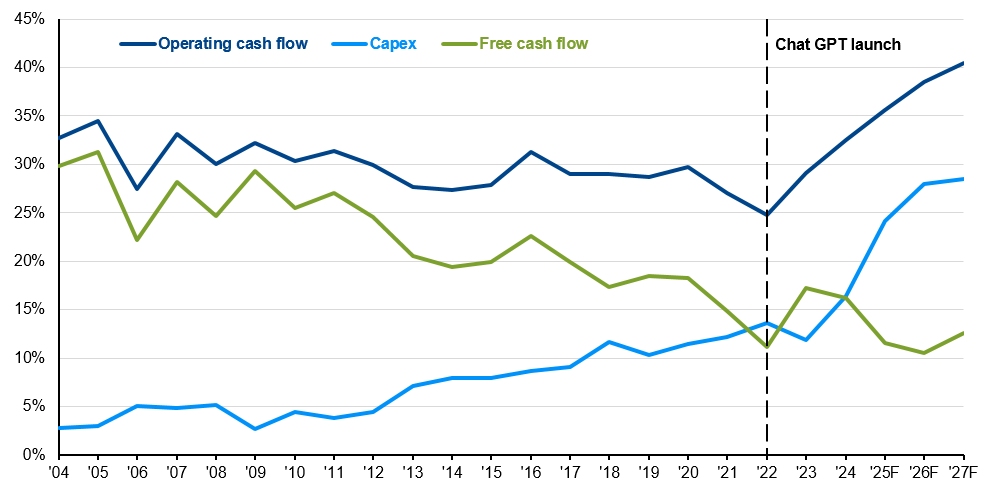

A Stronger Starting Line-Up Unlike the fragile startups of the dotcom era, today’s main AI spenders are profitable, cash-printing businesses. They are self-funding a massive AI arms race with capital expenditures set to leap by 60%, from $250bn in 2025 to over $400bn in 2026. Operating cash flows continue to outspace AI spend as a percentage of sales, allowing this historic investment to feel like a strategic augmentation of their core businesses rather than a reckless gamble.

Justified Valuations While Forward P/E ratios look expensive, today’s multiples are anchored by real-world profit. Take Nvidia: its stock price increased 14x over the last five years, but earnings grew 20x. Today’s titans aren’t as frothy as the dotcom class of 2000 because they are delivering healthy bottom-line results. However, this optimism hinges on perfection. While bulls argue we are buying “cheaper” growth today than at any point in the decade, that narrative leaves a near zero margin for error if adoption slows.

Infrastructure Demand In contrast to the fiber-optic mania of the 90s, the demand for AI build-outs can’t seem to catch a break. Data center vacancy rates are at a record low of 1.6%, and ~75% of pre-construction builds are already pre-leased. Additionally, past infrastructure bubbles saw spending peak between 2% and 5% of GDP, whereas today’s AI investment sits at roughly 1%. This suggests the build-out still has room to run.

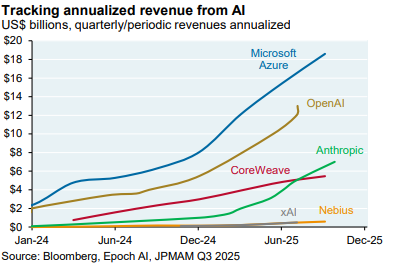

Show Me the Money Revenues are skyrocketing. Alphabet’s Q3 2025 results proved that AI-driven features are accelerating search and ads, with generative AI product revenue surging into the triple-digit percentage range year-over-year. Beyond the titans, some industry participants have grown revenues nearly ninefold since ChatGPT launched. For now, the receipts are keeping the optimism alive.

AI Is Running Fast… But Will it Trip a Wire?

We are in a high-stakes arms race on both a micro level (hyperscalers) and a macro level (US vs. China). Businesses are pouring trillions into this effort to secure US leadership in a technology that will change the fabric of society. But in this race to the top, it’s easy to overlook the blind spots.

Revenues & Profits: Can We Reach the Promised Land? Despite the growth, there is a staggering gap between spending and earning. Analyst Azeem Azhar points out that AI companies are projected to generate $60bn in revenue against $400bn in spending for 2025. That’s a 6-7x gap—far wider than the dotcom bubble (4x) or the railroad boom (2x). Even if revenue catches up, will it translate to profit, or will we see a “race to the bottom” where large language models (LLMs) become commoditized?

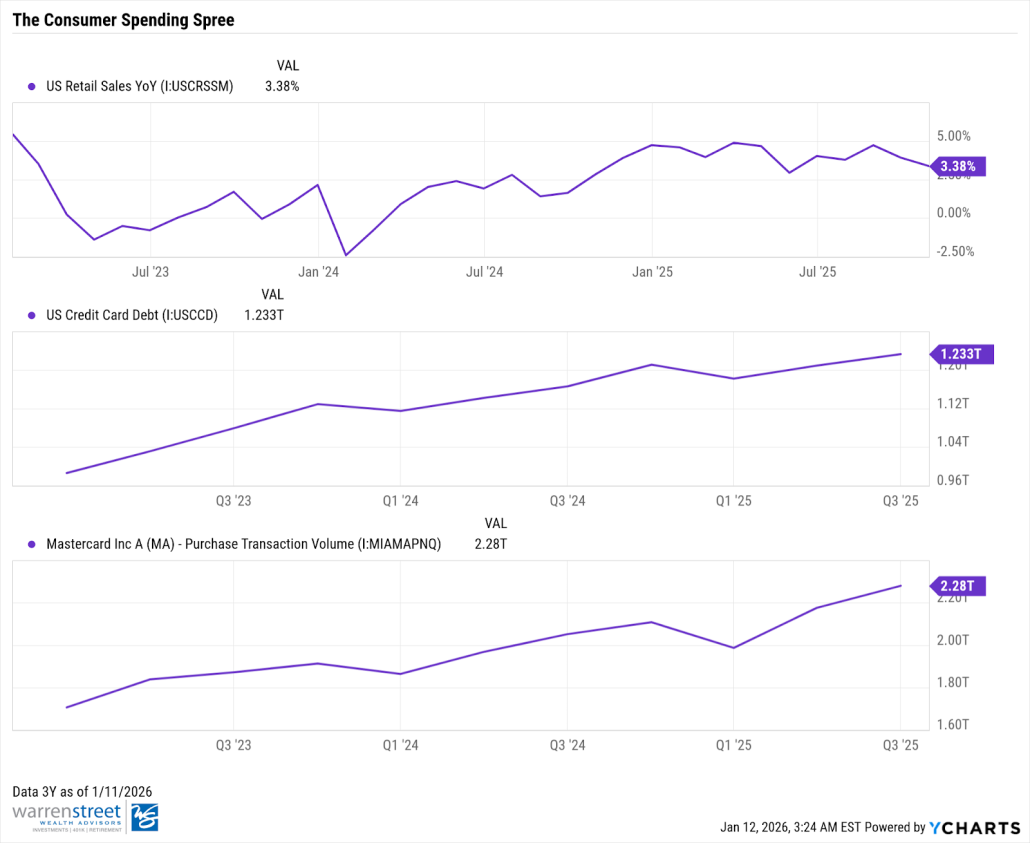

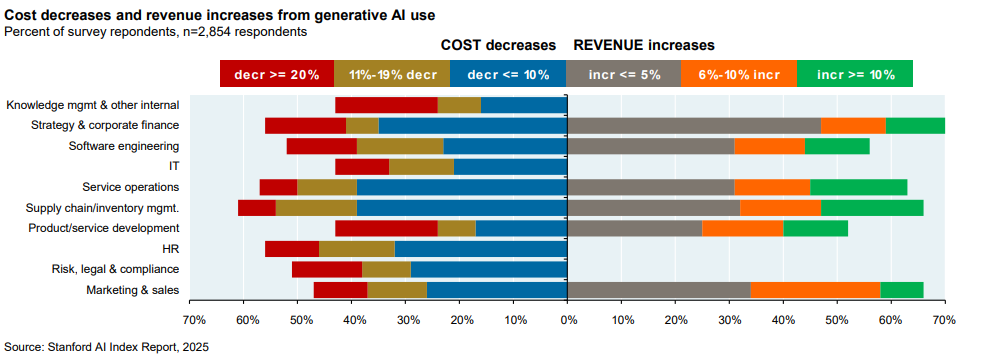

Is Demand Real? Adoption is still in its awkward early stages. Only roughly 10% of firms are using AI to produce goods, though 45% pay for LLM subscriptions. According to the Stanford AI Index and McKinsey, the majority of firms are seeing only modest cost savings (≤10%) and negligible revenue gains (≤5%). Will AI adoption ever truly scale into broad, durable profit expansion?

How Long is Your (Useful) Life? Hyperscalers like Microsoft and Google have boosted profits by extending the “useful life” of their AI assets in their books. If innovation renders chips obsolete in 24 months, these companies will face massive write-downs. More importantly, they are funding this short-lived hardware with 30-year debt, leaving investors holding the bag for “obsolete” infrastructure that won’t be paid off for decades.

The AI Ouroboros There is an increasingly circular dance where Microsoft invests in OpenAI and then books cloud revenue from them. Nvidia buys stakes in the startups they sell chips to. This means a chunk of today’s “booming” revenue is an internal recycling of capital where true economic profit from external customers remains hypothetical.

Cloudy with a Chance of IOUs: While the biggest players usually use cash, we’re seeing a pivot toward the bond market. Oracle and Meta have emerged as outliers, using long-term bonds and project finance to bankroll their data centers. As free cash flow wilts under the weight of AI spend, their stock prices are feeling the gravity. Furthermore, the industry is using Special Purpose Vehicles (SPVs) to hide this leverage off-balance sheet, adding a layer of obscurity to the trillions being spent.

Conclusion: A Massive Collection of What-Ifs

Ultimately, the AI story comes down to “what-ifs.” What if AGI finally shows up and productivity explodes? Or, what if demand never materializes and the hyperscalers finally blink? With cracks showing—like OpenAI’s recent “Code Red”—it’s impossible to say if we’re headed for a minor correction or a systemic burst.

Our 2026 Recommendations:

- Keep a seat at the table: Exposure to market-cap weighted indices allows you to benefit if the “promised land” materializes.

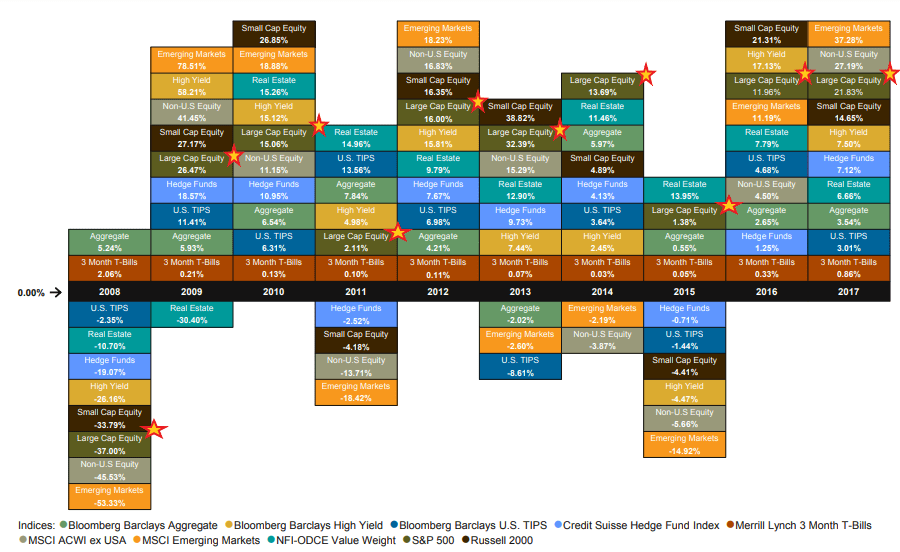

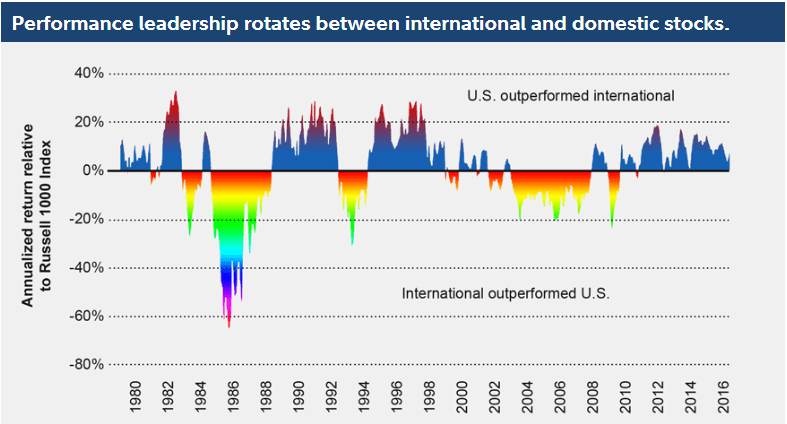

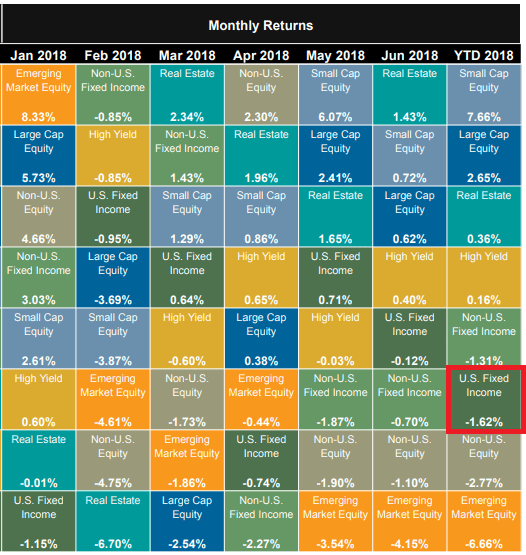

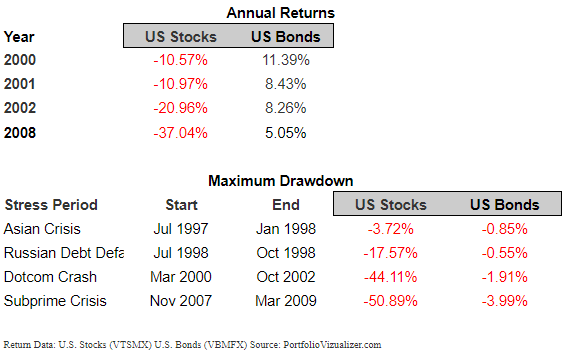

- Diversify your sources of risk: Anchor beyond US tech. Gold, international markets, and bonds offer a necessary buffer if signs of excess turn into a choppy ride.

Rebalance systematically: Rebalancing is a controllable hedge. When sector weights become excessive, returning to target allocations helps lock in gains and reduce concentration risk.

Phillip Law, CFA

Senior Portfolio Manager, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.