Did the Fed make a mistake? – “A Few Minutes with Marcia”

Welcome back to A Few Minutes with Marcia. My name is Marcia Clark, senior research analyst at Warren Street Wealth Advisors.

Today we’re going to spend a few minutes considering the pros and cons of the Federal Reserve Open Market Committee holding short-term interest rates steady at its June meeting. Most of my comments today are based on the FOMC announcement published on June 19, the press conference with Chairman Jerome Powell shortly thereafter, and remarks by Federal Reserve Governor Lael Brainard on June 21st.

Watch:

On June 19, the Federal Reserve Open Market Committee announced its decision to keep short-term interest rates unchanged at 2.25%-2.5%. Did they make a mistake?

To answer this question, let’s put ourselves in the shoes of the Fed and attempt to base our opinion on the available data. The Fed should reduce rates if they see the economy struggling. Is that what they see?

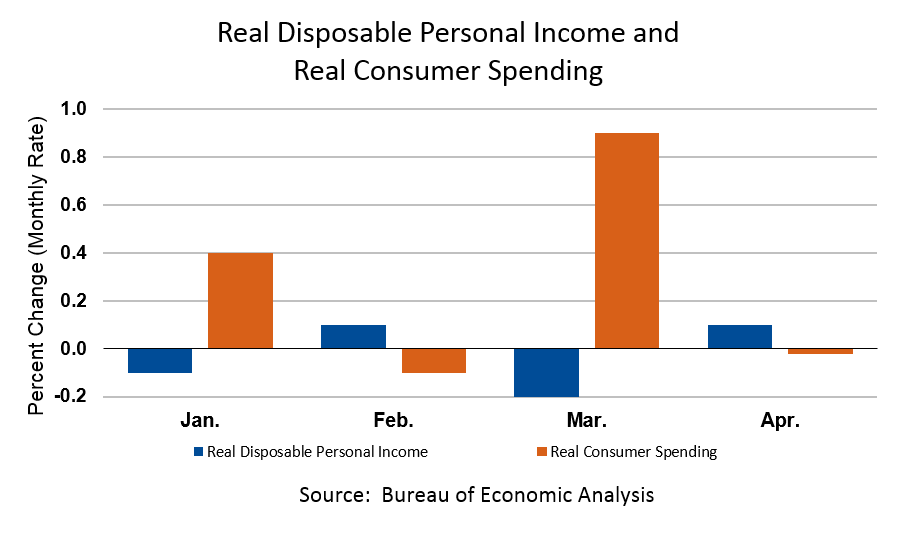

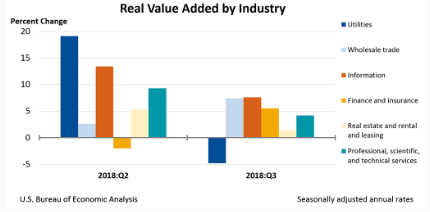

During a speech in Cincinnati on June 21st, Fed Governor Lael Brainard stated his assessment that the most likely path for the economy remains solid. He noted strength in consumer spending and consumer confidence, as well as unemployment at a 50-year low.

He did note a few areas of concern: cautious business investment due to policy uncertainty, slow growth overseas, and muted inflation.

- Mr. Brainard said: “The downside risks, if they materialize, could weigh on economic activity. Basic principles of risk management in a low neutral rate environment with compressed conventional policy space would argue for softening the expected path of policy when risks shift to the downside.” But what does he mean by ‘compressed conventional policy space’?

The Fed has limited room to maneuver because interest rates are already low, and inflation and employment have not responded to changes in interest rates as predictably as they have in the past.

- On the plus side, this means the labor market can strengthen a lot without an acceleration in inflation

- On the other hand, this low sensitivity along with already low interest rates gives the Fed less ability to buffer the economy in a downturn

If the Fed doesn’t get their interest rate call right, the economy could begin to spiral too far up or too far down.

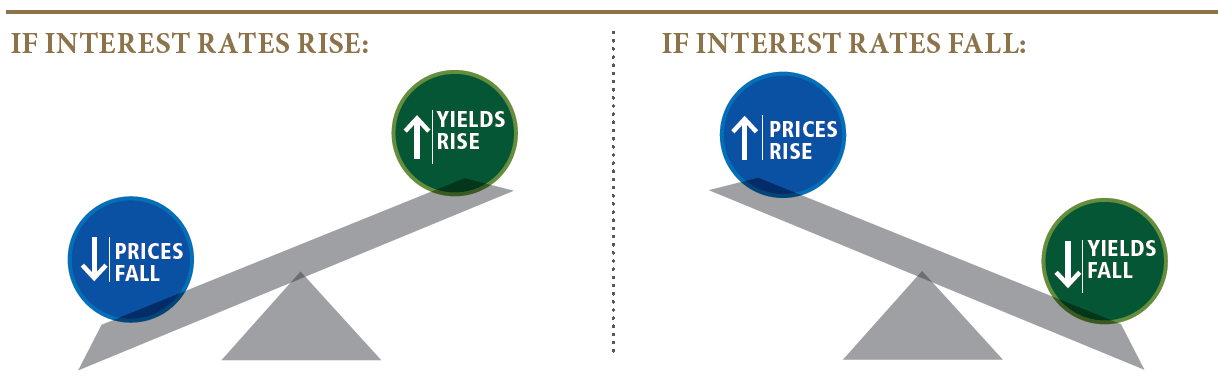

Let’s take a deeper look at why low interest rates present a challenge for the Fed.

- In the past, the Federal Reserve has cut interest rates 4 to 5 percentage points in order to combat past recessions

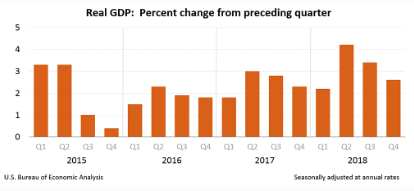

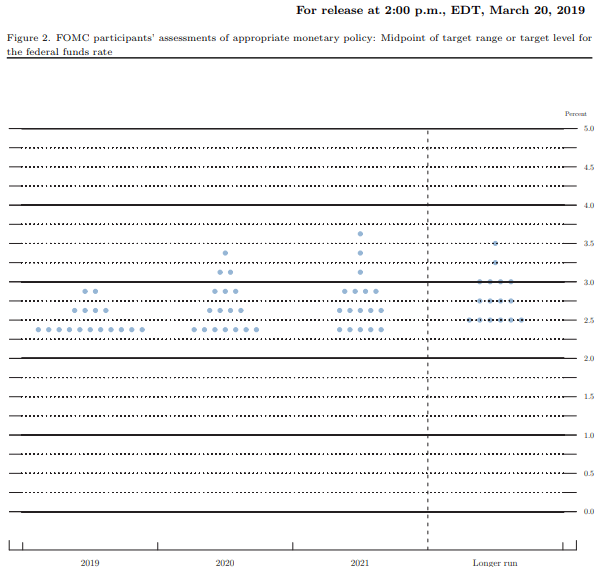

- The chart on slide 6 shows the current Fed Funds rate sitting at less than half where it was before the last two recessions.

- Clearly there is less room to run if a recession hits

The chart also shows GDP beginning to stabilize at the end of 2016. With GDP on a more steady path, back in 2017 the Fed started raising short-term interest rates toward a more normal level in order to have some ‘dry powder’ for the next recession.

How did we get to this delicate balance point?

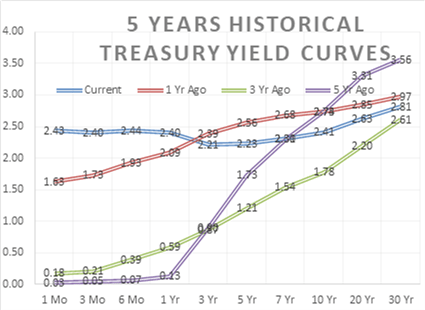

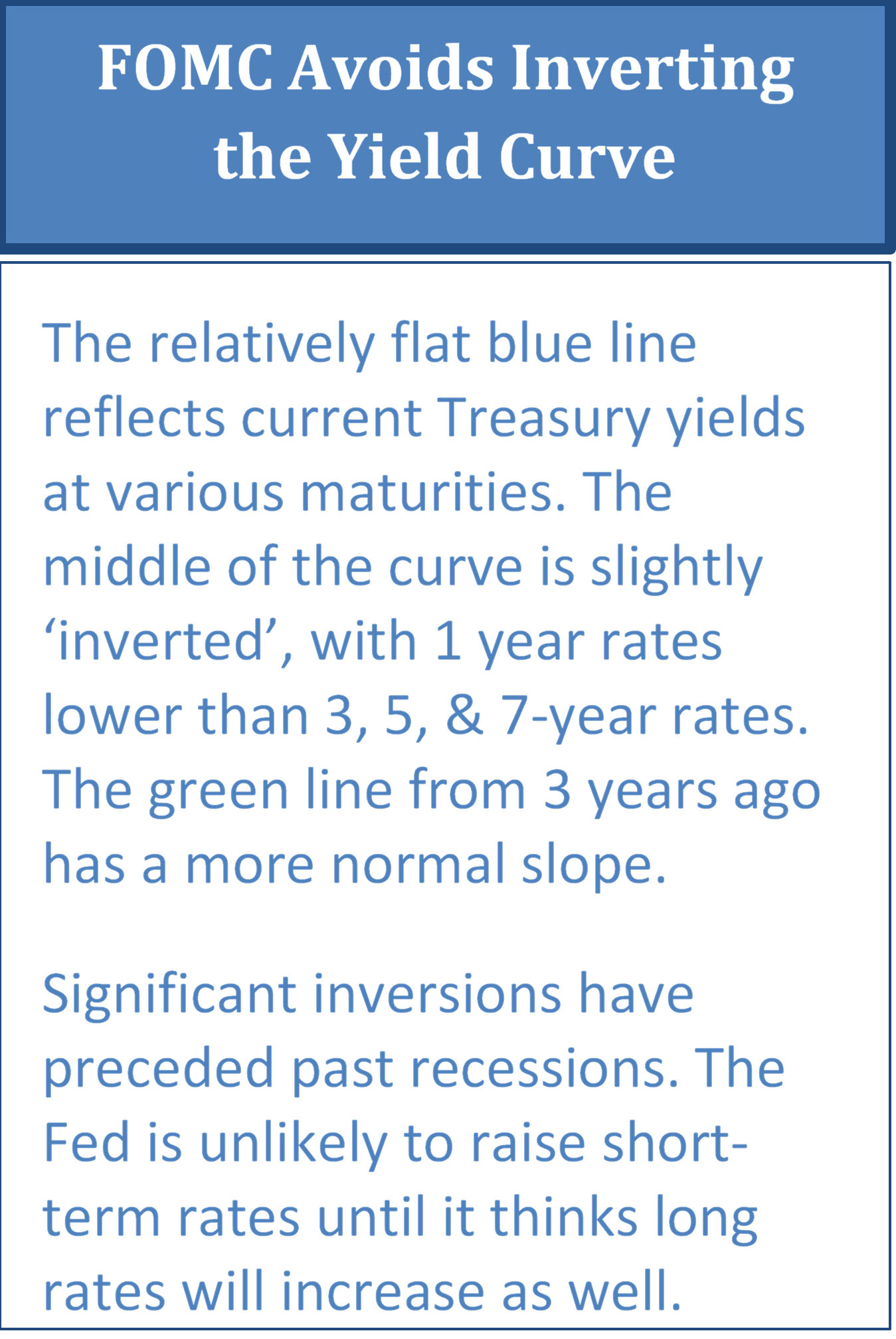

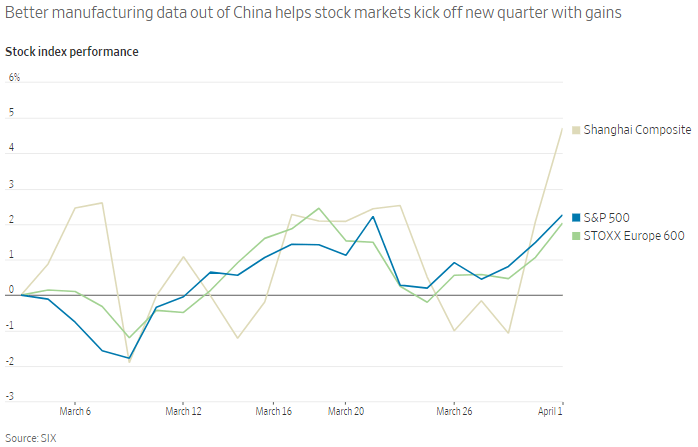

In December 2018, the Fed said more rate hikes were appropriate given the strengthening economy. The stock market reacted badly as at the same time trade talks with China were going nowhere and portions of the Treasury yield curve were inverted. Recession fears were on everyone’s mind.

In March 2019, Federal Reserve officials reassure markets that they will be “patient” with increasing short-term interest rates. To quote the FOMC statement after the March meeting: “the case for raising rates has weakened…” Notice that they didn’t say the case for cutting rates has strengthened.

And in June, the FOMC held interest rates steady and stated that the current level of interest rates is consistent with its mission to promote full employment and price stability. In its post-meeting statement, the committee said that the timing and size of future adjustments will be based on economic conditions relative to these two objectives.

After the announcement, both stocks and bonds reacted positively to the decision, with the stock market indexes touching new highs before falling back a bit at the end of the week.

Commentators speculated that the markets reacted well because a rate cut could be imminent. Equally likely, however, is that the markets reacted to the lack of a rate hike and prospects that a recession is not around the corner.

During a press conference after the announcement, Fed chairman Jerome Powell responded to a question by saying that being independent of political pressure or market sentiment has served the country well and would do so in the future. He stated that the FOMC will react to data and trends that are sustainable rather than individual data points that can be volatile.

But despite all the evidence, as we approach the end of June an astonishing 100% of futures investors are betting on a rate cut in July. These investors are wrong.

Why am I so sure they won’t cut rates when commentators and the futures market clearly think differently?

You may have heard the expression ‘pushing on a string’. What this means is that applying force to something with no rigidity won’t have any impact – the string absorbs the force and the force doesn’t go any further. This is the current situation with monetary policy.

Imagine pushing a sofa across your carpeted living room versus pushing a mattress across the same room.

Once the feet of the sofa get out of the dent they made in the carpet, the sofa will move fairly easily. That’s because the sofa is rigid – when you apply force at one end, the sofa moves away from the force.

But a mattress is much more resistant to shifting. That’s because much of the force you apply is absorbed by the cushioning already in the mattress. The mattress will often bend before it will move. The force doesn’t go anywhere or accomplish anything.

The current U.S. economy is like the mattress in this example. The U.S. economy has plenty of available capital and interest rates are already low. Reducing the Fed Funds target from 2.375% to 2.00% is unlikely to accomplish much other than encouraging unwise borrowing and ultimately sparking inflation.

Yes, bad things can happen to our economy and the Fed needs to guard against a recession. But a recession overseas is much more likely than in the U.S., and no U.S. recession has ever been caused by a recession overseas. Dropping interest rates to ease market concerns or satisfy political sentiment is not the Fed’s mandate and would be counterproductive.

Barring some catastrophic political event or natural disaster, the U.S. economy is unlikely to falter between now and mid-July.

Recognizing the Fed’s dual mandate of stable prices and full employment are both being met at the current level of short-term interest rates, right now the downside risk of lowering rates outweighs the potential stimulus benefit. The FOMC should keep the Fed Funds rate steady when they meet in July.

This has been ‘A Few Minutes with Marcia’. I hope you are a bit clearer on how to assess the likelihood of Fed policy decisions going forward. As always, comments and questions are welcome!

Sources:

- https://www.federalreserve.gov/newsevents/pressreleases/monetary20190619a.htm

- https://www.federalreserve.gov/newsevents/pressreleases/monetary20190619b.htm

- https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

- https://www.youtube.com/watch?v=67o-Nu4zCVQ

- https://www.federalreserve.gov/newsevents/speech/brainard20190621a.htm

Marcia Clark, CFA, MBA

Senior Research Analyst

Warren Street Wealth Advisors

Warren Street Wealth Advisors, a Registered Investment Advisor. The information contained herein does not involve the rendering of personalized investment advice but is limited to the dissemination of general information. A professional advisor should be consulted before implementing any of the strategies or options presented. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss.

DISCLOSURES

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications.

Form ADV available upon request 714-876-6200