Warren Street Sits Down with Partner Genene Dunn

At Warren Street, we want to ensure we are continuing our education to give our clients a financial edge. This applies to all aspects of their overall financial picture.

We recently had the opportunity to sit down with one of the partners of the law firm Hunsberger Dunn, LLP, Genene Dunn. During our conversation, we had the chance to talk with her about estate planning, and specifically, building a trust.

Here are some of the issues we discussed, our key takeaways, and some of the nuances we learned regarding trusts and avoiding the probate process.

Who needs a trust and what does it do?

A trust’s primary objective is to avoid probate for the client. Period.

The threshold for probate is $150,000 of real assets, which are defined as physical assets that have value due to their substance. Real assets can be things such as: precious metals, commodities, real estate, land, machinery, or oil, so estate with $150,000 in real assets or more without a trust is subject to probate.

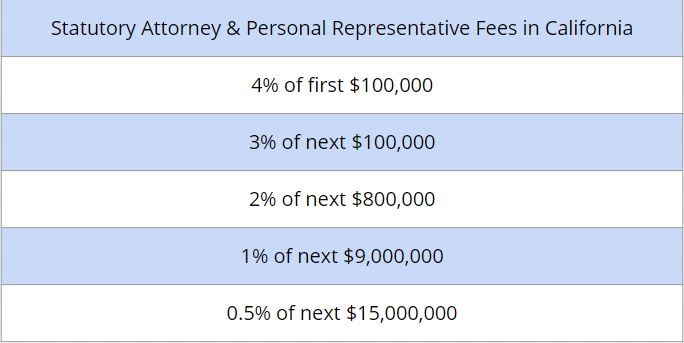

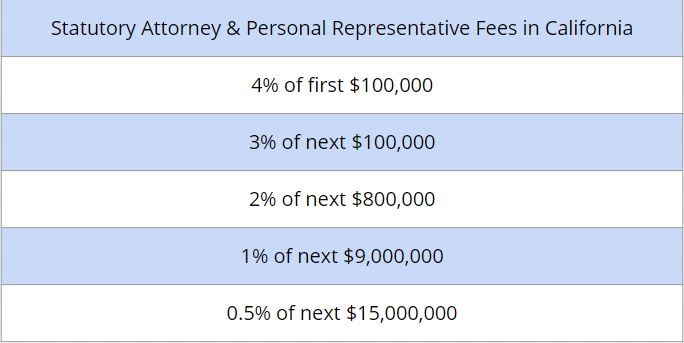

Genene gave the example of $500,000 in real assets with no trust. In this instance, you can expect to pay approximately $26,000 in fees.

Going through probate, both the lawyer and the personal representative (administrator), the person named by the court to handle the estate, are paid according to the fee schedule below. This is why probate can be so expensive.

Not only is probate an expensive process, but it is lengthy as well. The probate system in Orange County is significantly backed up, it could take up to a year to complete the process.

If you have real assets in excess of $150,000, it might be time to start thinking about building your own trust and avoiding the probate process all together.

How do I handle creditors when the trustee has passed?

If the deceased person had debt in their names, then these become debts of the trust. They do not become debts of the beneficiaries.

When handling credit card collections, the collectors have 4 months after the announcement of the death of the trustee to file for a claim for their debt. An announcement of death can be placed in the local newspaper of the trustee. If the credit card companies do not file their claims through the appropriate process within this 4-month window, their claim becomes void and does not need to be paid by the trust.

If there is real property inside the trust, such as real estate, Genene suggested to continue paying the bills that “keep the lights on”, such as utilities and house maintenance services (pool cleaning, gardening, etc.). The reason for this is that the property may eventually be sold and you want it to remain presentable to a prospective buyers.

What about my 401(k) or other outside accounts?

Genene will sometimes gets asked about placing a 401(k) or retirement account inside a trust. This is something that is probably not recommended as these types of accounts have listed beneficiaries. Probate can be avoided if the beneficiaries are named and appropriate forms are completed.

On the other hand, non-retirement or brokerage accounts can be placed inside the trust to then be distributed according to the wishes of the grantor, the person who established the trust.

Another interesting topic was Transfer on Death (TOD) bank accounts. If a TOD is in place, then you can present your bank branch with a Death Certificate, which typically can take 10-12 days to process, before being allowed access to funds. However, if they accounts are held in trust, there would be no delay since a spouse is typically the co-trustee and would be able to act on the account immediately upon death. If there is not a Transfer on Death established or a trust account, then the assets would be subject to probate.

Special Needs Beneficiaries

One of the most interesting things we learned from our conversation was with regard to children or beneficiaries that have special needs. Some of these people receive assistance from the government for their condition, and they can become disqualified from that assistance if they have an interest in the assets of a trust.

It is imperative if you have someone in your life with special needs whom you want to ensure receives assets from your estate, that a special needs trust is established and that it is set up correctly to avoid disqualifying them from government assistance in the future.

As we had mentioned earlier, the main objective of establishing a trust is to avoid probate and the wasted time and expense associated with it. A trust usually runs between $2,000-$3,000 depending on the complexity, but the amount of time and money saved by going through the process can be 8-10x the cost of the trust itself. Not to mention not having to waste time in an Orange County probate system that is already significantly backed up.

If you are concerned about your current estate planning situation, including your current assets, trusts or other aspects of your plan, please feel free to contact us to discuss.

Joe Occhipinti

Joe Occhipinti

Wealth Advisor

Warren Street Wealth Advisors

Joe Occhipinti is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information. A professional advisor should be consulted before implementing any of the strategies or options presented.

Warren Street Wealth Advisors and its representatives are not attorneys and all information herein should be verified via qualified legal opinion.

Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance, strategy, and results of your portfolio.Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results.Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.

Joe Occhipinti

Joe Occhipinti