August market commentary

In an uncertain market environment, which is better?

The U.S. stock market feasts on recession fears before regaining its risk appetite in late August

Key Takeaways

- President Trump added, then delayed, another tariff on Chinese goods, exacerbating trade tensions and concerns about the strength of the global economy. As talks with China resume, Britain’s new prime minister attempts to achieve a ‘hard Brexit’, and the Eurozone PMI index falls into contraction territory.

- The U.S. economic menu included something for everyone: for the pessimist, softer than expected gain in overall jobs with only 130,000 payroll growth in August. For the optimist, the broader measure of civilian employment surged by 590,000. Manufacturing remains a worry as contraction in that sector continues. Despite the generally stable U.S. economy, the Fed cut rates by -0.25% in July and is expected to cut again in September.

- Conclusion: Tariffs and political uncertainty are depressing an already delicate global appetite for risk. The U.S. is buffered by its large domestic market and expanding trade with alternative suppliers, but isn’t immune to a global slowdown. Lower interest rates may provide a brief energy boost, but won’t develop core strength in business investment. With no political solution in sight, prudent investors should diversify exposure to provide a steady diet of modest returns while avoiding the binge/purge cycle of ‘chasing yield’.

Stocks are near record levels, but investors are uneasy

4Q2019 repeats 4Q2018?

As reported in the Wall Street Journal on September 9, despite a buoyant stock market so far this month, some investors fear the market may repeat the ‘binge and purge’ cycle experienced in 2018.

Looking as far back as 1928, September is historically the worst month of the year.[1] Given that most of the tensions which led to the market tumble last year are still present – trade tensions, global manufacturing slowdown, falling growth of corporate profits, and political uncertainty at home and abroad – concern may be warranted. Combine these headwinds with diminishing marginal returns from accommodative monetary policy, and we might finally be nearing the end of the longest economic expansion in recent memory. Not that we’re calling for a recession! Just that the growth engines of the global economy are beginning to run out of fuel.

[1] https://www.wsj.com/articles/stocks-are-back-near-records-but-memories-of-2018-leave-investors-uneasy-11568021402

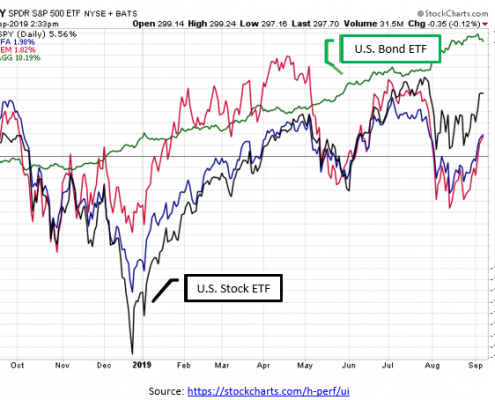

Bonds have been a dietary staple during stock market volatility in recent quarters.

Despite the S&P 500 posting a year-to-date return of nearly 20% as of August 31st, bonds have actually outpaced stocks for the trailing 12-months. The severe tumble of the stock market in late 2018 and again in late July/early August gobbled up more losses than the 2019 recovery has been able to replenish. This despite continuing strength in the U.S. economy and corporate earnings generally surprising on the upside of – admittedly cautious – analyst expectations.

The Fed’s rate cut at the end of July sparked an increase in recession fears, though economic data remains modestly positive.

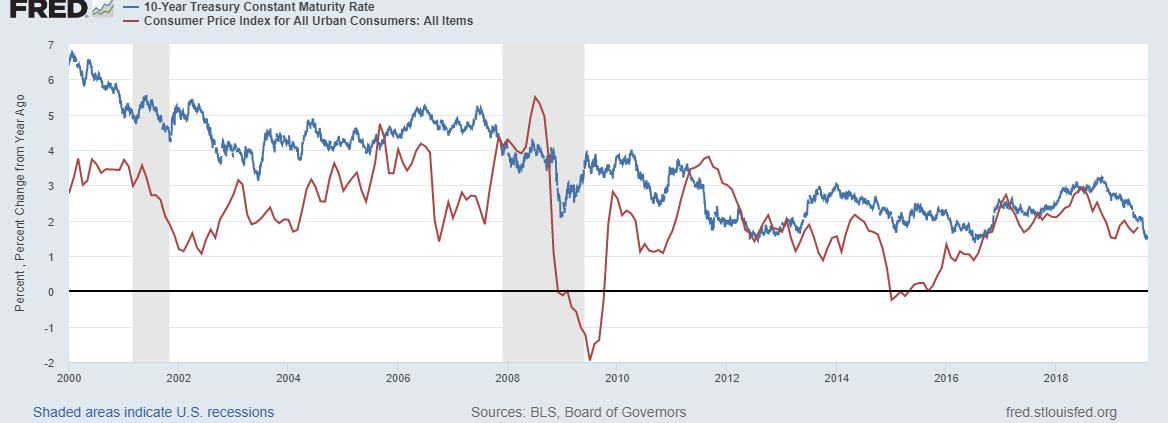

10-year Treasury yield barely above inflation

Decreasing short-term interest rates are unlikely to spark business appetites for borrowing or lending. While 2% short-term rates are great for speculators, they aren’t that much more enticing than 2.25% or 2.50% interest rates for strategic business investments. In fact, 10-year Treasury bond yields dropped so low in September that they provided no more than 0.25% returns above inflation. While marginal borrowers may consume more debt at these rates, long-term investors will need to look beyond the safest assets for a risk/reward balance that preserves purchasing power while promoting healthy growth.

Manufacturing businesses suffer from a restrictive diet of trade tariffs and global uncertainty.

While the U.S. economy overall remains on solid footing, trade-related businesses are hungry.

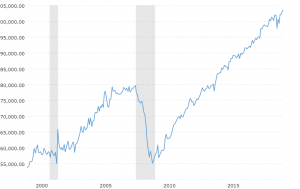

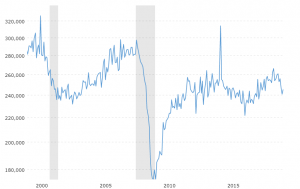

Housing starts stabilize

Jobless claims remain low

Retail sales rebound

Housing starts are stable, retail sales have rebounded, and initial claims for unemployment are the lowest in more than a decade…

…but U.S. manufacturers are in desperate need of an economic shot of Red Bull.

Rising global trade tensions in the wake of U.S. tariffs on steel, aluminum, and lumber imports, as well as those targeted specifically at China, are directly impacting manufacturing activity. According to the National Association for Business Economics (NABE)[1], 76% of goods-producing sector panelists and 42% of TUIC (transportation, utilities, information, communications) panelists reported negative net tariff impacts at their companies.

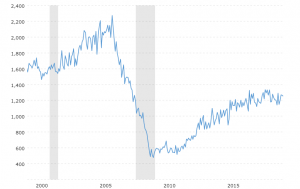

This impact is illustrated by the significant drop in durable goods orders over the past year or so.

Durable goods orders fall sharply

[Preceding charts source www.macrotrends.net]

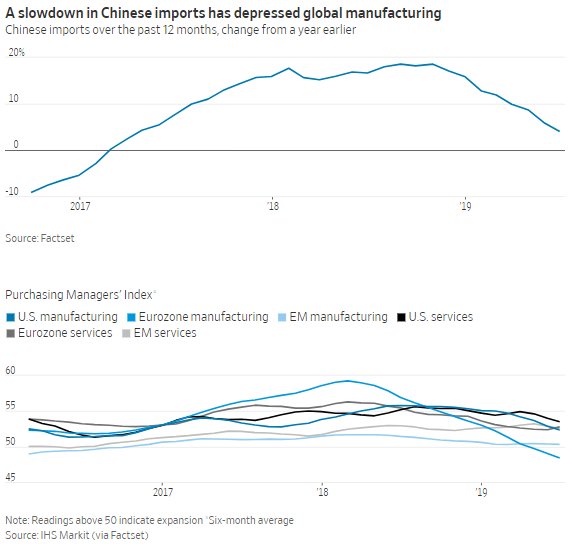

Increasing tariffs are not just eating the lunch of U.S. manufacturing companies. Global exporters are suffering greatly from decreased trade around the world. If we look back at the recovery from the Great Recession, emerging economies such as China are credited with helping the developed world get back on its feet. China in particular built roads, airports, and housing developments with abandon, which boosted earnings for global manufacturing companies, particularly steel and machinery.

But the Chinese economy has had its fill of infrastructure spending, reducing its appetite for imported goods going forward. Combined with the trade war between China and the U.S., exporters have lost a major customer. Eurozone manufacturers have already fallen into ‘contraction’ territory (PMI below 50), and the rest of the world isn’t much better.[3] And Fed Chairman Powell, if you’re listening, lower interest rates won’t have any effect on this trend! No matter how low rates go, businesses won’t go back to the buffet table when demand for their products is already satisfied.

[3] https://www.wsj.com/articles/chinas-power-to-boost-global-economy-is-fading-11564738205?mod=article_inline

Slowdown in China depresses global manufacturing

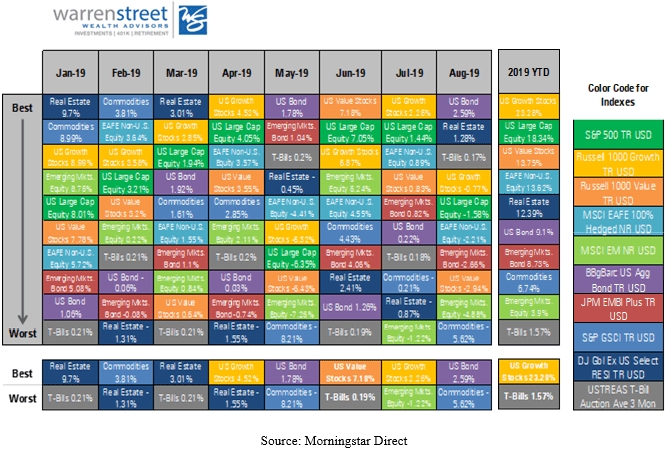

In an uncertain global economic environment with a reactionary U.S. stock market, diversification is even more important.

Barring major disruptions in trade negotiations, a disorderly ‘Brexit’, or increases in geopolitical unrest, the U.S. stock and bond markets could continue on their upward path for the rest of the year.

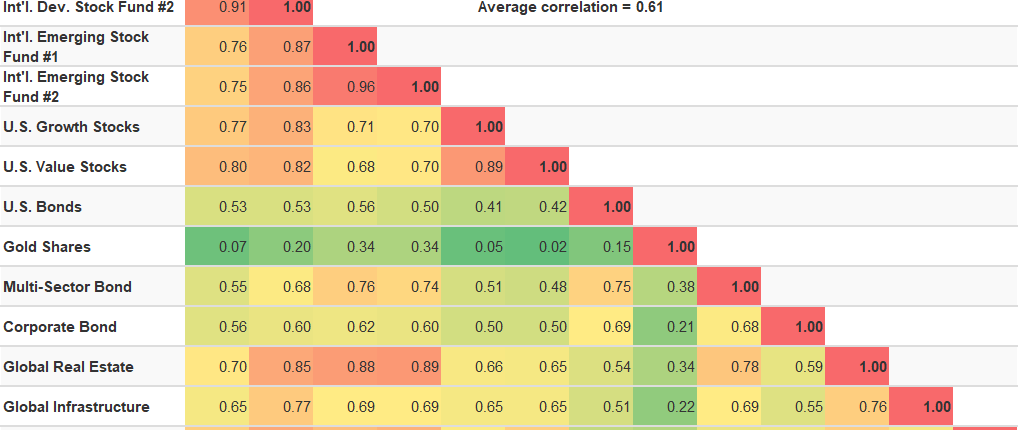

That being said, the chance of one of these elements going wrong is significant. Investors should continue to make healthy investment decisions to navigate this uncertain period. The best way to do this is to diversify.

Source: www.portfoliovizualizer.com

A balanced menu of stocks, bonds, and alternative asset classes such as natural resources can provide welcome reduction in volatility while still supporting the pursuit of gains suitable for most investors’ appetites. Which isn’t to say even the most well-diversified investors won’t experience some indigestion along the way! But putting your investment eggs in several market baskets can avoid catastrophic losses and help you achieve a healthy balance of risk and return over the long term.

Marcia Clark, CFA, MBA

Senior Research Analyst, Warren Street Wealth Advisors

DISCLOSURES

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications.

Form ADV available upon request 714-876-6200