Claiming Social Security: What’s a Break-Even?

When you’re deciding when to start claiming Social Security benefits, you’re facing a trade-off. Claim as early as age 62, and you’ll receive a larger number of smaller payments. Delay as late as age 70, and you’ll receive a smaller number of larger payments. To weigh your options, it’s helpful to find your “break-even” point—the age at which waiting longer to claim Social Security will result in a greater lifetime benefit.

Picking the Right Horse

To begin, here’s a little scenario to help illustrate what a break-even is. Imagine a race between two horses—Early Bird (No. 62) and Late Breaker (No. 70). Late Breaker is a faster horse than Early Bird, no question. So to keep the competition interesting, Early Bird gets a half-lap head start.

We know that, given enough time, Late Breaker will eventually catch up to Early Bird. Let’s call that moment the break-even. If the race ends any time after that break-even point, Late Breaker is a sure thing. If the race ends any time before the break-even, all the smart money is on Early Bird.

We can think of the way Social Security benefits accumulate in a similar way. Claiming early gives you a head start in accumulating benefits, but they come at a slower pace. Claiming later can earn you bigger checks, but it will take time before it catches up to the total accumulated benefits of claiming earlier. If you live past that break-even point, you will ultimately receive more income by claiming later. If you don’t, you will receive more by claiming earlier.

A Concrete Example

In reality, there are more than two horses in a race, and there are more than two options for when to start claiming Social Security benefits. In fact, you can choose any point after you reach your early retirement age of 62. For every year between the ages of 62 and 70, your monthly benefits will increase. (You can wait longer than age 70, but your benefits won’t continue to grow.) Any two points between ages 62 and 70 will have their own break-even.

Let’s consider three scenarios:

- 1. You claim your benefits at age 62.

- 2. You wait until full retirement age (67 for anyone born in 1960 or later) to claim.

- 3. You wait until age 70 to claim.

If you claim at 62—60 months before you reach full retirement age (FRA)—your checks will be 30% smaller than your full Social Security benefit. If your full monthly benefit is $2,000, your checks will be pared back to $1,400.

If you claim at full retirement age (67), you will receive the full $2,000 every month.

If you delay your claims until age 70, your checks will be 24% larger than your full benefit. Instead of $2,000, you receive $2,480.

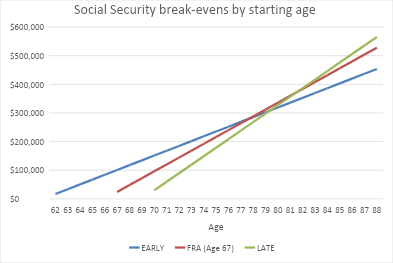

If you chart the accumulated benefits of those three scenarios on a line graph, you’ll find the break-evens where the lines intersect:

You’ll notice that the break-even between claiming at 62 and claiming at 67 is around age 78. Meanwhile, the break-even between claiming at 67 and claiming at 70 is around age 82, and the break-even between claiming at 62 and claiming at 70 is around age 80.

There’s a lot of math to consider—including a key variable we haven’t discussed: how long you expect to live. If you expect to live past 78, claiming benefits at full retirement age may be worth more over time than claiming at 62. If you expect to live past 83, then claiming benefits at age 70 may be worth more over time than claiming at 67. If you expect to live past 80, then claiming benefits at age 70 may be worth more over time than claiming at 62.

Of course, none of us can predict our life expectancy with any certainty. But we can make some educated guesses based on factors like our current health and our family medical history. For instance, if both of your parents lived well into their 90s, you might have more confidence in your own life expectancy.

Other Important Considerations

Break-evens are a useful tool in deciding when to start claiming Social Security benefits, but they aren’t the only factor. For example, you may prefer to have more money in the early part of your retirement so you can spend more on the experiences money can buy. Coming out ahead in the final tally may be less important to you.

Depending on your specific circumstances, there may be strategic reasons to claim early or claim late—say, to reduce your tax burden or to fill in a necessary income gap. These reasons make this decision about more than simply pitting your expected longevity against different break-even points.

We don’t expect you to calculate break-evens for every possible scenario. Understanding the concept of break-even will help you take a more informed approach to this important decision on your retirement journey. We’re happy to work with you to do the math for different claiming strategies and how they might fit in with your larger financial picture and retirement goals. As always, the best choice is the one that makes the most sense for you.

Justin D. Rucci, CFP®

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.