Beyond the Market: Understanding Your Investment Performance

Sometimes, it pays to strive for greener grass. But as an investor, second-guessing a stable strategy can leave you in the weeds. Trading in reaction to excitement or fear tricks you into buying high (chasing popular trends) and selling low (fleeing misfortunes), while potentially incurring unnecessary taxes and transaction costs along the way.

Still, what do you do if you’re unsure about how your investments stack up?

Compared to the Stocks du Jour?

It’s easy to be dazzled by popular individual stocks or sectors that have been earning more than you have and wonder whether you should get in on the action.

You might get lucky and buy in ahead of the peaks, ride the surges while they last, and manage to jump out before the fads fade. Unfortunately, even experts cannot foresee the countless coincidences that can squash a high-flying holding or send a different one soaring. To succeed at this gambit, you must correctly—and repeatedly—decide when to get in, and when to get out … in markets where unpredictable hot hands can run anywhere from days to years.

Remember, too, just by investing your money in the global stock market overall and sitting tight, you’ll probably already own some of today’s hot holdings. You’ll also automatically hold some of the next big winners, before they surge (effectively buying low).

Rather than comparing your investments to the latest sprinters, be the tortoise, not the hare. Get in, stay in, and focus on your own finish line. It’s the only one that matters.

Compared to “The Market”?

What if your investments seem to be performing differently not just from the high-flyers, but from the entire market? Maybe you’re seeing reports of “the market” returning a different amount than what you are experiencing.

Remember, when a reporter, analyst, or other experts discusses market performance, they’re usually citing returns from the S&P 500 Index, the DJIA, or a similar proxy. These popular benchmarks often represent one asset class: U.S. large-cap stocks. As such, it’s highly unlikely your own portfolio will always be performing anything like this single source of expected returns.

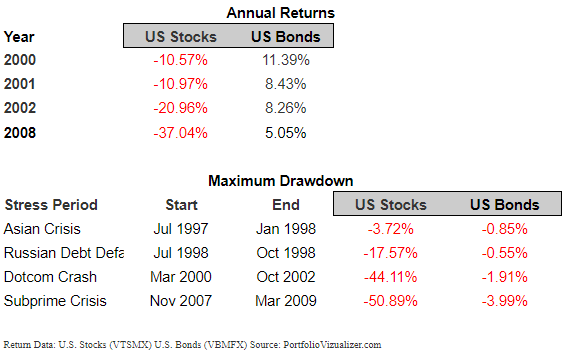

Most investors instead prefer to balance their potential risks and rewards. For example, if your portfolio is a 50/50 mix of stocks and bonds, you should expect it to underperform an all-stock portfolio over time. But it also should deliver more dependable (if still not guaranteed) returns in the end, along with a relatively smoother ride along the way.

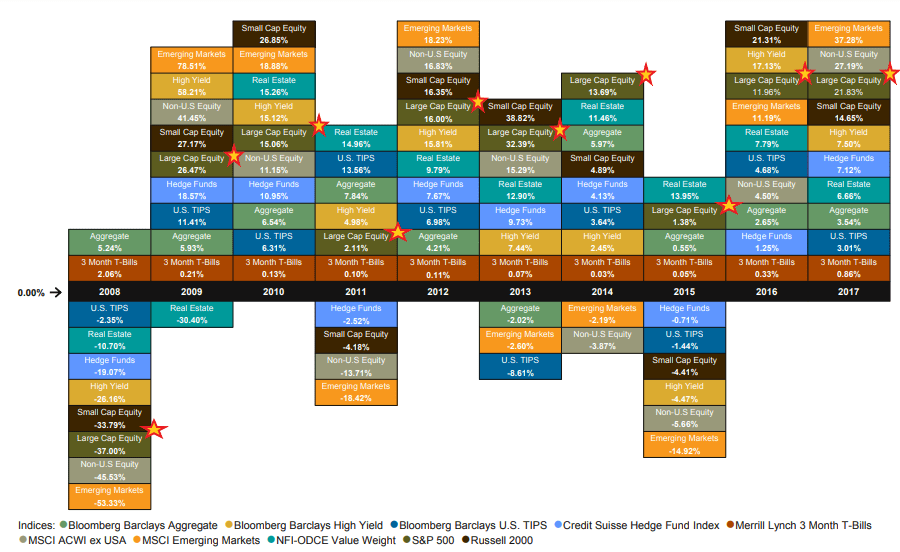

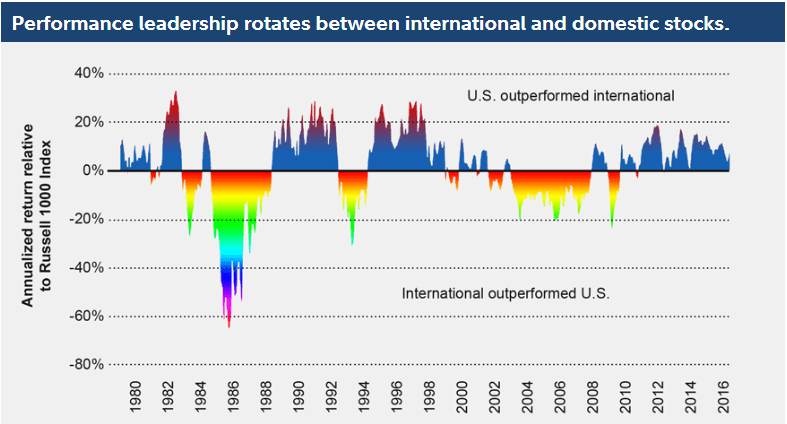

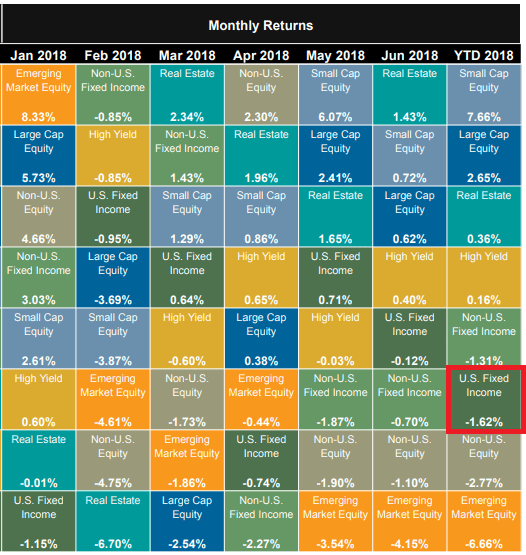

Even if you’re more heavily invested in stocks than bonds, a well-diversified stock portfolio will typically include multiple sources of risks and returns, such as U.S., international, and emerging market stocks; small- and large-cap stocks; value and growth stocks; and other underrepresented sources of expected return.

Thus, we advise against comparing your portfolio’s performance to “the market.” Usually, any variance simply means your well-structured, globally diversified portfolio is working as planned.

In Summary

Admittedly, it can be easier said than done to avoid inappropriate performance comparisons across shifting times and unfolding events. But your portfolio should be structured to reflect your financial goals and your ability to tolerate the risks involved in pursuing your desired level of long-term growth.

In roaring bull and scary bear markets alike, we team up with you to address these critical questions about your investments. That way, you can accurately assess where you stand and where you’d like to go from here.

Please reach out to your advisor if you’d like to discuss further. We are always here for you!

Warren Street Wealth Advisors

Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.