Should I Be Using a Health Savings Account?

Choosing a health care plan at work can be a bit of a headache—charts comparing premiums, copays and deductibles isn’t exactly light reading. One option you might have encountered in this process is the high-deductible health plan (HDHP). The name might sound intimidating. After all, who really wants to pay high deductibles? But when paired with a health savings account (HSA), an HDHP can be a powerful tool to help you save for your health care now and your future.

What is an HDHP?

An HDHP is a type of health insurance plan that comes with lower monthly premiums but higher out-of-pocket costs. In other words, you’ll pay less each month, but you’ll be on the hook for more when you actually visit a doctor. These plans shift more financial risk to you in exchange for upfront savings—and they often come with access to an HSA.

An HSA allows you to set aside pre-tax money to pay for qualified medical expenses like doctor visits, prescriptions, dental care and vision services. Unlike a flexible spending account (FSA), which is “use it or lose it,” the money in an HSA is yours to keep. It rolls over from year to year, stays with you if you change jobs and often has investment options.

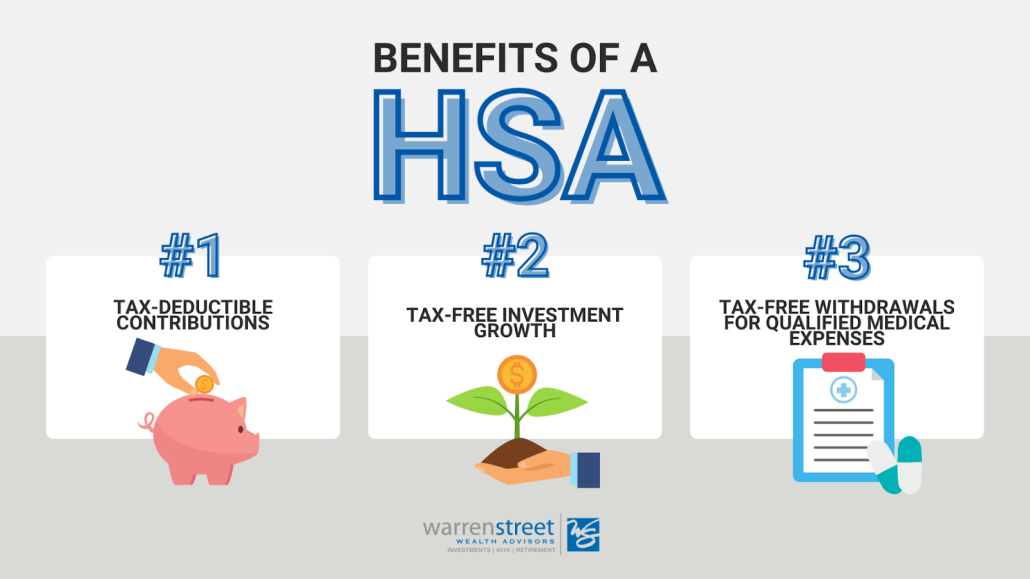

What makes HSAs especially appealing are their triple tax benefits:

- Tax-deductible contributions.

- Tax-free growth on investments inside the HSA.

- Tax-free withdrawals at any time if the money is used for qualified medical expenses.

These features make HSAs one of the most tax-efficient savings vehicles available. But there’s another way to get more from your HSA: It can serve as a powerful retirement savings vehicle.

Should You Use a High-Deductible Health Plan?

Before we get to the benefits of an HSA as an investment vehicle, how do you decide whether to use an HDHP in the first place? Choosing between a traditional plan and an HDHP depends on a few key factors.

First, compare the total potential cost under each plan. That means looking at monthly premiums, deductibles, coinsurance and out-of-pocket maximums. HDHPs typically offer significantly lower monthly premiums but come with higher deductibles. If you’re generally healthy and don’t expect to need much medical care, this tradeoff could work in your favor.

But be honest with yourself about your cash flow. If you had a sudden medical emergency, would you be able to cover the high out-of-pocket costs until your insurance kicks in? For people with chronic health conditions or frequent doctor visits, a traditional plan might offer more predictable costs.

Using an HSA as a Retirement Account

Once you’ve maxed out your traditional retirement accounts, an HSA becomes an excellent next stop. HSA contribution limits are $4,300 for self-only coverage and $8,550 for family coverage in 2025. You can leave that money in cash or invest it. You can, of course, use it to pay for qualified out-of-pocket medical expenses at any time. But you can also leave it in the account untouched, letting it grow and enjoy the power of tax-advantaged compounding—just as you would with an IRA or 401(k).

Health care is one of the biggest expenses in retirement. So building a tax-free fund dedicated to future medical needs makes a lot of sense. According to recent estimates, a 65-year-old retiring in 2024 can expect to spend around $165,000 on health care in retirement—and that number is only expected to rise.

Here’s the kicker: When you turn 65, you aren’t limited to using your HSA for medical expenses. You can make withdrawals for non-medical expenses, and these will simply be taxed as income, just like withdrawals from a traditional IRA or 401(k). In short, your HSA can function like a traditional retirement account with the added perk of tax-free withdrawals for medical expenses at any age.

Your HSA as Part of Your Investment Strategy

Your HSA is a financial asset, whether it’s sitting in cash or invested in the market. As such, it can play an important role in your strategies for long-term asset allocation, diversification and rebalancing. Managed well, it can contribute meaningfully to your future financial security.

You can manage your HSA investments on your own. Or, depending on your HSA provider, we may be able to manage the assets within the account on your behalf. Even if direct management isn’t possible, we’re here to help you evaluate your options, choose appropriate investments and determine how best to incorporate your HSA into your long-term plan.

If you’re not sure whether an HDHP and HSA are right for you, let’s talk. Together, we can evaluate your health needs, cash flow and retirement goals to determine the best path forward.

Bryan Cassick, MBA, CFP®

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.