Will Your Vote Move the Market?

Election seasons are highly polarized and leave investors from both sides of the political aisle paralyzed by what-ifs and fear of the other. This seems more true now than ever. Given COVID-19, supreme court implications, and an incredibly divided nation in terms of policy wishes, we expect a volatile finish to 2020. Due to an expected record number of mail-in ballots due to the election, it’s even possible the results aren’t known for days or even weeks. It’s normal to be concerned, but does the data support it? Does taking investment action make sense?

Believe it or not, I wrote the above days before President Trump and the First Lady contracted COVID-19. Can 2020 have any more twists and turns? Our team at Warren Street sends our thoughts and well wishes to them both, their families, and their staff. We hope a speedy and full recovery ensues. The diagnosis for President Trump is undoubtedly troubling given his age and possible pre-existing conditions, it’s sure to inject additional doubt into investors’ minds. CDC data however is still dramatically in his favor and it’s safe to assume he’ll receive best-in-class care. Historically, election seasons have in-fact provided for increased volatility in the markets. In addition, the dispersion in results and returns has been all over the map especially in the short term. You should find comfort however in the fact that long term returns have generally been positive regardless of who’s been at the Presidential helm or a split vs. unified congress. More details to come.

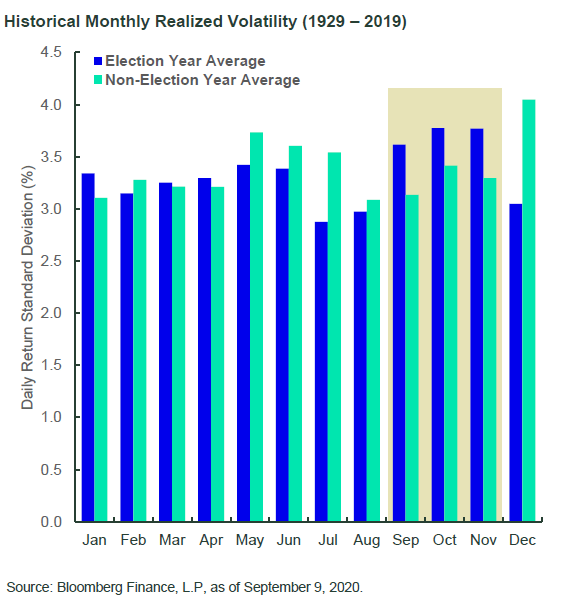

Let’s start with volatility (chart below). Taking a look back to 1929 you’ll see that the election year realized volatility exceeds non-election year volatility in September-November by a rather dramatic amount as measured by daily standard deviation in returns. I can’t say whether the current September 2020 volatility is caused or simply correlated to this phenomena. With U.S. stocks down over 7% 9/1-9/23 there’s plenty going on in the world to not simply chalk this up to election hysteria.

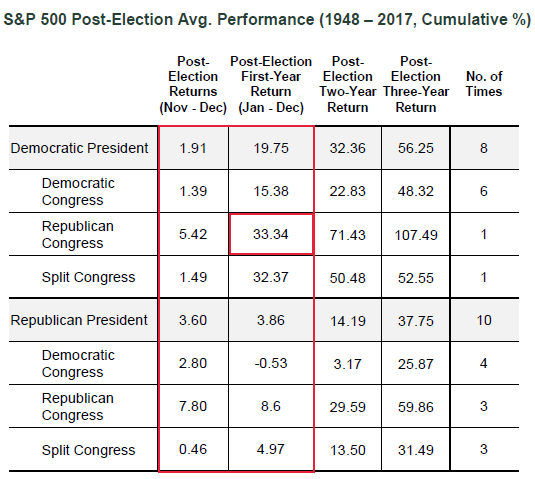

Now that volatility is out of the way, let’s talk returns, starting with short term returns. It is abundantly clear what investors prefer, and it isn’t what you’d think. The President is less significant than the balance of power. Returns tend to be best with a split congress, or in the best performing case a Democrat for President with a Republican congress. Why might that be? Gridlock. Investors love the status quo, but more so corporations love the predictability that comes with it. The ability to invest, forecast, and produce without the prospects of a changing playing field often lends itself to unimpeded growth.

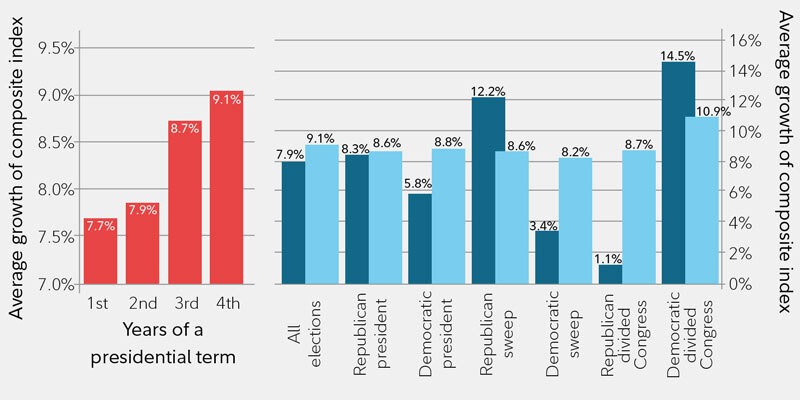

We all learned in 2016 that polling is VERY fallible. Here we find ourselves again with a rapidly changing landscape of polling results, and most of which seem to be consolidating into the margin for error. Meaning both the Presidential and the Congressional races can go any which way. If we were betting, we’d likely expect a blue wave (Biden win and Democrats take over the Senate). Most of this is because incumbents just simply don’t win while in a recession, it’s only happened once in the last 100 years. The bad news, a Democratic sweep is actually one of the worst outcomes for investment markets historically over the corresponding 2 years (blue below) post election. The good news, you can barely tell a difference after 4 years (light blue below) regardless of who is in office, Presidential or Congressional.

So what do we do now? Proceed with caution. Obviously this election is unparalleled in so many ways, and because of that we can’t solely rely on historical data to give us permission to proceed with blinders on. Having said that, you can make a bullish case for U.S. and Global securities regardless of who wins. What types of companies and which geographies you favor might look very different however. Each party has a different impact on tax code, currency stability, trade relations, etc. It’s important to construct your portfolio with these varied outcomes in mind and not be married to one outcome to succeed.

If you want to review your current investment posture as we head toward the stretch of election season 2020, please don’t hesitate to reach out to our team.

Blake Street, CFA, CFP®

Wealth Advisor, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.