Rate Cut vs. Reality: Making Sense of Powell’s Mixed Signals

Investors finally got the interest rate cut they were waiting for last month, but comments from the Federal Reserve Chair have some of them scratching their heads. Let’s see if we can make sense of these mixed signals.

Jerome Powell Brings Investors Up Short

The Fed reduced its target federal funds rate by 0.25% on September 17. Rate cuts tend to make equity investors optimistic: They figure lower interest rates will reduce borrowing costs, goosing economic activity and hopefully boosting corporate earnings and stock prices. This time around, investors may think the Fed cut helps validate the S&P 500’s nearly 35% gain since it bottomed in early April.

Then, a week after cutting rates, Fed Chair Jerome Powell uttered these words:

“By many measures…equity prices are fairly highly valued.”

Powell’s seemingly innocuous statement sounded like a loud needle scratch to some investors. Fed chairs don’t often comment on stock prices, so the fact that he chose this moment to highlight steep valuations raised questions.

Is Powell—a renowned economist with more and better information than just about anybody—saying stocks are too highly valued? Are prices about to drop? Should you sell before it’s too late?

Are Stocks Expensive Right Now?

On the surface, it’s hard to quibble with Powell’s take. The most common way to gauge the broad stock market’s valuation is to look at the price-to-earnings (P/E) ratio of the S&P 500. And it’s high: As of September 26, the S&P 500’s P/E was 20% above the average of the past 10 years.1

But the topic deserves a little more context. Certain parts of the stock market are driving up the average, so it’s probably more accurate to say that some equity prices are fairly highly valued.

Specifically, tech stocks have risen on investor optimism about the potential for AI to drive future earnings. The tech sector had a P/E ratio over 30 as of October 1, compared to about 23 for the S&P 500 as a whole. By contrast, the energy, financials, health care, materials and utilities sectors all had P/Es in the teens.2

Should You Sell When Stocks Are Pricey?

Everybody knows the investing adage “Buy low, sell high.” However, applying this in practice isn’t always straightforward. Fact is, pricey stocks can get more expensive, such that exiting stock positions solely based on valuations can materially harm portfolio outcomes in the short-term. In fact, a study by LPL Financial comparing historical stock market valuation to returns over the next 12 months found “no relationship whatsoever.”3

Just ask another renowned Fed Chair, Alan Greenspan. Almost 30 years ago, he famously described “irrational exuberance” in the stock market—and the S&P 500 surged more than 100% over the following four years.4

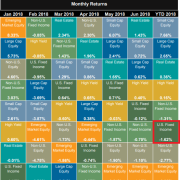

While valuations are a poor short-term timing tool, it’s true that high valuations can temper future returns.5 To address this, we have recently implemented a rebalancing strategy across our client accounts. This essential process automatically takes profits from assets that have become highly valued and redirects those funds to areas we believe have better forward-looking potential, ensuring your allocation stays on target.

Run-ups in the prices of some investments can throw off your asset allocation—the percentage of your portfolio you have devoted to specific investment types. That’s why we periodically rebalance your portfolio, resetting your allocations to your long-term targets. This process automatically reduces how much you have in assets that have gained the most and redirects those resources toward assets that have lagged.

Your financial plan is designed to weather the short term so you can focus on the long term. But if there’s ever a news story that gives you pause, you can always reach out to us to help put it into perspective.

Phillip Law, CFA

Senior Portfolio Manager, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Sources:

- FactSet Earnings Insight, September 26, 2025. P/E based on forward earnings.

- Yardeni Research, October 2, 2025. P/Es based on forward earnings.

- LPL Financial, “Valuations Aren’t Great Timing Tools,” March 6, 2024.

- “Back in the ‘90s a Fed chief warned about ‘irrational exuberance’ in the markets. Stocks rose 105% over the next four years.” Fortune, September 30, 2025

- LSEG, “Do valuations correlate to long-term returns?” January 23, 2025