Turmoil in China, Oil, and the US Markets

Why is the turmoil in China and the drop in oil prices depressing the U.S. markets?

Marcia Clark, CFA, MBA, Senior Research Analyst & Wealth Advisor, Warren Street Wealth Advisors

January 25, 2016 10:43am Pacific time

In case you’ve been enjoying an extended holiday season, you may not realize that January 2016 is on track to become the worst January for the U.S. stock market since 2009. How worried should you be? Based on my analysis, my opinion is that the stock market has over-reacted to both the turmoil in the Chinese stock market and the drop in oil prices. Investments in companies other than oil producers, particularly those that benefit from cheaper oil prices, may deliver good results in the coming year.

S&P 500 February 1st, 2015 – January 2nd, 2016

Source: http://www.bloomberg.com/quote/SPX:IND

And the bond market hasn’t been immune. Yields on below-investment grade bonds in particular spiked to levels not seen since 2012.

https://research.stlouisfed.org/fred2/series/BAMLH0A0HYM2

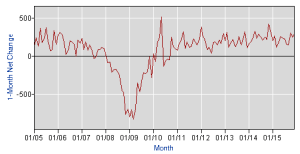

But why have the U.S. markets reacted so strongly to the Chinese market and oil prices? Has the U.S. economy encountered an unexpected pothole? Have an excessive amount of U.S. businesses or homeowners declared bankruptcy? Have scandals erupted in key corporations? Has the U.S. Congress threatened to shut down the government rather than pass a budget? No, none of these things has happened. Yes, industrial production and corporate profits have hit a bit of a slump. But the U.S. job market – probably the best indicator of imminent recession – continues to rebound with 292,000 new jobs in December and 2.7 million new jobs for the past year, according to the Bureau of Labor Statistics.

http://data.bls.gov/timeseries/CES0000000001?output_view=net_1mth

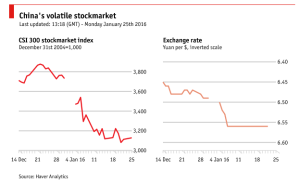

To recap the past few months in the Chinese stock market, as reported by The Economist (January 25, 2016), in early July 2015 China’s stock market crashed with share prices dropping by a third, wiping out some $3.5 trillion in wealth (more than the total value of India’s stock market).

A further plunge on August 24 followed by a fall of similar proportions the next day sent share prices down over 40% below their 2015 peak.

Since the summer, the Chinese stock market had rebounded approximately 20%, so one hoped that the worst was over. Unfortunately, on January 4th and again on January 7th the CSI 300 index of ‘blue chip’ Chinese stocks fell approximately 7% and fears of a serious economic decline were renewed.

Given that that Chinese stock market has indeed experienced a challenging 6 months, how can we extrapolate the severity of the problem to U.S. investors? Ultimately, the value of any stock market should reflect the profitability of domestic businesses.

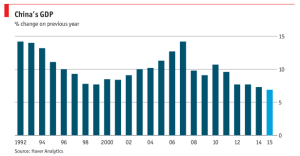

On January 19th, China reported its official annual GDP growth figure for 2015 at 6.9%, just a shade lower than 2014’s 7.3%, and much stronger than average global forecast GDP of 2.8%, reported by the Conference Board.org in November 2015.

The worry seems to be that the official GDP figure may be manipulated by the Chinese government and that much worse lies ahead.

But how much of the decline in the Chinese economy should legitimately be reflected in the U.S. economy? It is difficult to calculate a precise figure, but for context see the table below.

| Country | Exports | Imports | Total Trade | Percent of Total |

| China | 106.1 | 443.9 | 549.9 | 16.0% |

| Canada | 259.0 | 271.6 | 530.6 | 15.4% |

| Mexico | 217.8 | 271.6 | 489.4 | 14.2% |

| Japan | 57.7 | 119.8 | 177.5 | 5.1% |

| Germany | 45.9 | 113.4 | 159.3 | 4.6% |

| South Korea | 40.1 | 66.4 | 106.5 | 3.1% |

| United Kingdom | 52.0 | 53.7 | 105.7 | 3.1% |

| France | 27.6 | 43.7 | 71.3 | 2.1% |

| India | 20.0 | 41.7 | 61.7 | 1.8% |

| Taiwan | 24.0 | 37.5 | 61.5 | 1.8% |

https://www.census.gov/foreign-trade/statistics/highlights/top/top1511yr.html

As of November 2015, China was indeed the largest trade partner with the U.S., so changes in their economy could definitely impact ours. However, note that exports – which bring profits to U.S. businesses – are much smaller than imports. This should buffer the impact of the Chinese decline somewhat. So troubles in the Chinese economy can indeed impact the U.S., though by how much is very difficult to say.

But what about falling oil prices?

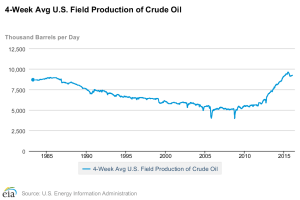

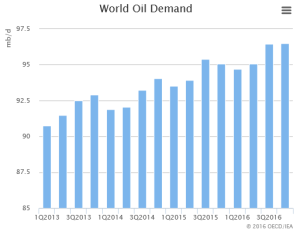

As an input to so much of what we consume, lower oil prices depress final goods prices – including gasoline – which leaves more money in consumers’ pocket to buy other things. Yes, a severe drop in oil prices driven by a lack of demand would definitely indicate a recession, but that’s not what’s happening these past months. The problem is an overabundance of supply.

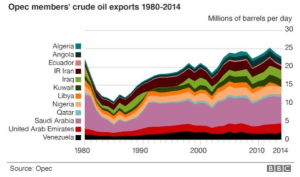

With the widespread use of hydraulic fracturing in the U.S., crude oil production in the U.S. has spiked to levels not seen in the last 30 years. With OPEC countries maintaining production near historic levels, and global demand growth increasing only modestly, basic laws of economics indicate that the market price of oil must fall.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=4

So where does that leave us? Yes, we should be concerned about the market turmoil in China as that country adjusts to a slower, but still strong, growth rate of their economy. Declining oil prices caused by excess supply is a good thing for consumers, but will depress profits of oil producers which can be a large component of stock market indexes.

On balance, the U.S. economy remains on an upward trajectory. Recent declines in the stock market should be viewed as a buying opportunity. But be selective! Companies whose revenues are strongly tied to the price of oil may continue to struggle until supply and demand reach a new equilibrium.