Joe Occhipinti

Wealth Advisor

Warren Street Wealth Advisors

As we continue our Rate Watch 2017 series, we see new fluctuations in rates as the fall approaches. If you have missed any of our previous Rate Watch Articles, you can find them here:

Rate Watch – April

Rate Watch – May

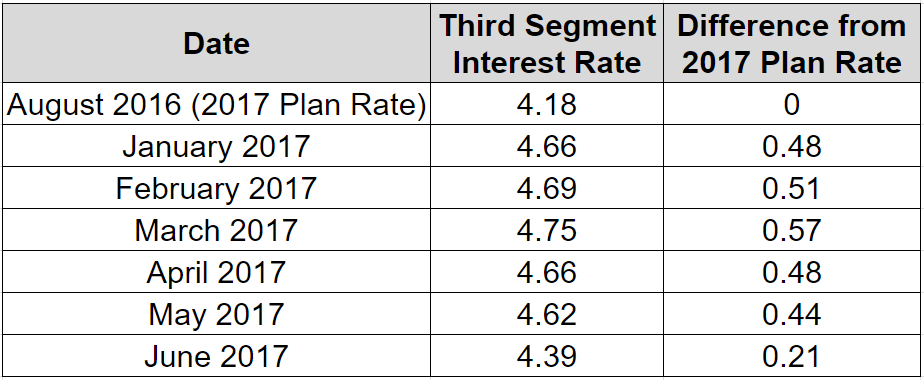

Let’s start by looking at the numbers:

We see a large decrease in rates from May to June, but there is not much to be taken from this mark just yet as it is not the official rate from Edison and 2 more months remain. The prime take away should be: with the June rate getting closer to the 2017 official plan rate of 4.18, what happens if the rate stays flat or relatively the same?

If the 2018 rate comes out exactly the same as the previous year, then you gain even greater control of deciding when you want to retire since the lump sum value would theoretically be unchanged. You get to retire on your terms.

Concerned about retirement from Edison? Worried about your money?

Warren Street Wealth Advisors has helped 100’s of Southern California Edison Employees retire with confidence. Contact us for a free retirement consultation and learn what your options are in retirement.

*These are not current plan rates for Southern California Edison’s pension plan, they are minimum present value third segment rates from the IRS. Official plan rates are derived from the minimum present value segment rates table. Plan rate changes are made by Southern California Edison on an annual basis.

Joe Occhipinti is an Investment Advisor Representative of Warren Street Wealth Advisors, a Registered Investment Advisor. The information posted here represents his opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this commentary is a solicitation to buy, or sell, any securities, or an attempt to furnish personal investment advice. We may hold securities referenced in the blog and due to the static nature of content, those securities held may change over time and trades may be contrary to outdated posts.