Your Best Interest is our Top Priority

At Warren Street, we build personal relationships with clients, so we can share our experience, collaborate, and ultimately provide them peace of mind.

This has been our philosophy since day one, and it continues to this day! Just ask founders Cary Facer and Blake Street, featured in the video at right. After spending nearly a decade each in the financial services industry, Cary and Blake found themselves disillusioned with the impersonal nature of larger firms and set out to join forces. Just like that, Warren Street Wealth Advisors was born in 2015.

Whether you are looking to improve your current financial plan, need a second opinion on your portfolio, want to retire today, or are simply planning for the what-ifs, the Warren Street team is here to guide you every step of the way. Through it all, we stand by our promise to put our clients first in every decision — and strive to clearly demonstrate this commitment in every client interaction.

A True “Ensemble” Structure

As a client of Warren Street, you benefit from the experience of our entire firm. You’ll receive a designated four-person team with specific roles, so you can be confident that we are constantly monitoring every aspect of your financial plan and investments. Your team is always just a phone call or email away for any questions or concerns you might have.

Meet the Team

Each of our team members is committed to providing financial advice that is transparent, unbiased, and completely in our clients’ best interest. Get to know them below!

Advisors

Operations

Business Development

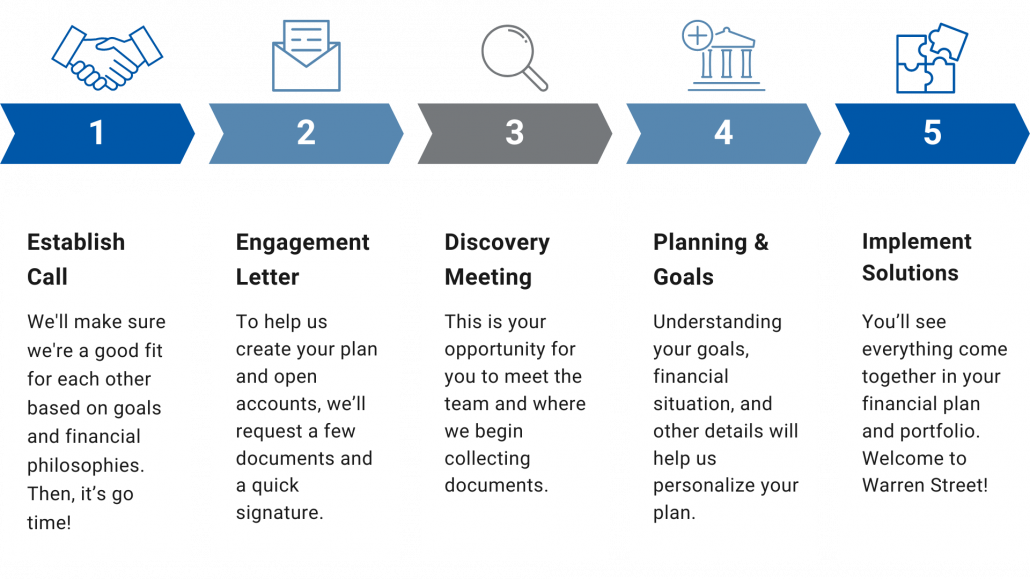

Our Process

Being an independent investment advisor means we can make recommendations to you based on what we believe is best for your personal financial situation. We do not earn commissions for any of the investments we recommend. Whether it is an individual retirement account (IRA), a corporate 401(k), a trust, or an individual account, we have the experience to tailor and manage your portfolio to help you reach your goals.

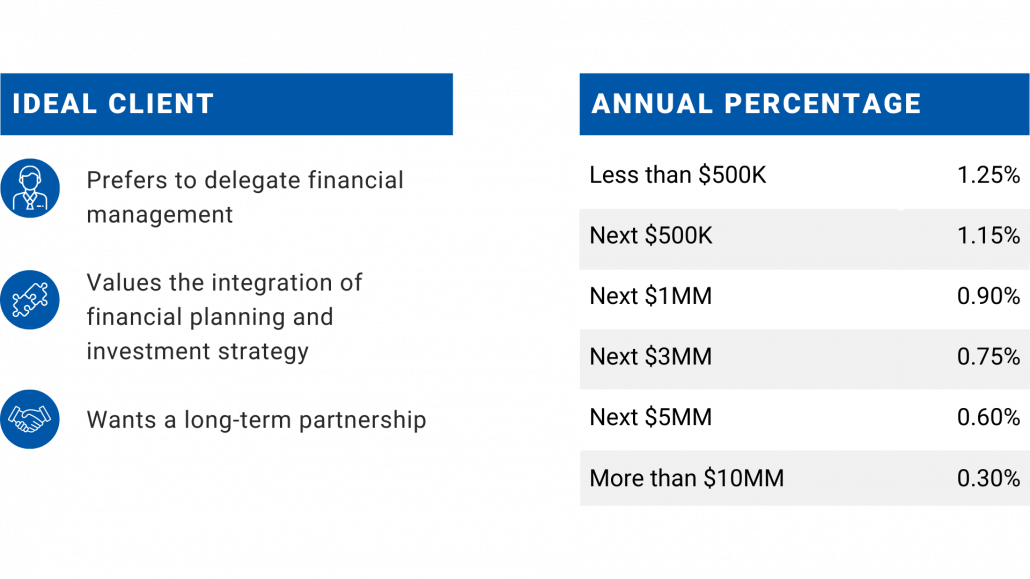

Services & Fees

Once you engage with Warren Street, we’ll share a custom quote for you based on your asset size and planning needs.

Our minimum fee is $5,000 per family per year, which can be reached through planning, investments, or a combination of both. All clients receive our same standard of care, regardless of account size or planning experience, so you can be confident you’re in good hands!

These are unpaid testimonials from Warren Street clients.