Fed Raises Questions, not Rates.

Blake Street, CFP®

Chief Investment Officer

Warren Street Wealth Advisors

If not now, when?

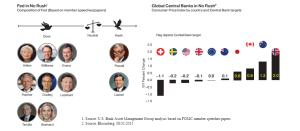

Yesterday, the Federal Open Market Committee opted to keep interest rates in check. Lower oil, a stronger dollar, and the Chinese slowdown all play into a weak global inflation picture that gave the Federal Reserve pause. 13 of 17 FOMC participants still think its appropriate to raise rates this year. Federal Reserve Dove’s (aggressive monetary policy) continue to dominate Hawks (restrictive). Global growth is still well below central bank targets (see below). Even if rates rise this year, we expect a slow and steady trajectory.

A common misconception that rates have nowhere to go but up, and fast, has been countered once again. While rising rates are a viable concern for any investor, especially in fixed income and high dividend yielding stocks, it is important to understand the broader role these positions play in diversification. In addition, rates are determined by market forces, not just a Federal Reserve decision and if global growth appears anemic, investors will continue to settle for low yields in return for protection of principal.

One practical application for how to use lower rates to improve your position is how rising rates may impact lump-sum pension payouts and your own personal retirement timeline, as well refinancing your own personal debt. Restructuring liabilities like mortgages, credit cards, and auto loans can free up cash flow for growth and savings opportunities.

As always, we are here to help. Let us know how we can be of service.

Respectfully yours,

Blake Street, CFP®