Gold Rush of 2020

/in Education, Intermediate, Investing /by Phillip Law

In 1848, thousands of people grabbed their shovels and crossed land and sea to Sutter’s Mill with hopes of striking gold. Almost 150 years later in 2020, a similar parallel is happening not in San Francisco, but rather in the investable market for this hot commodity.

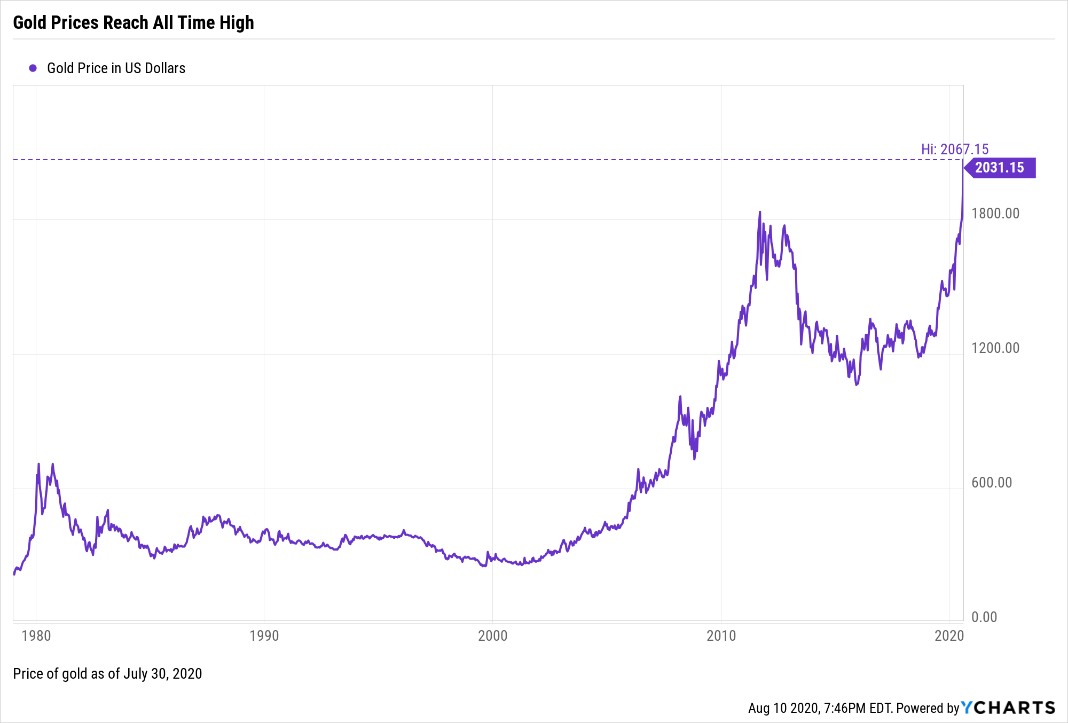

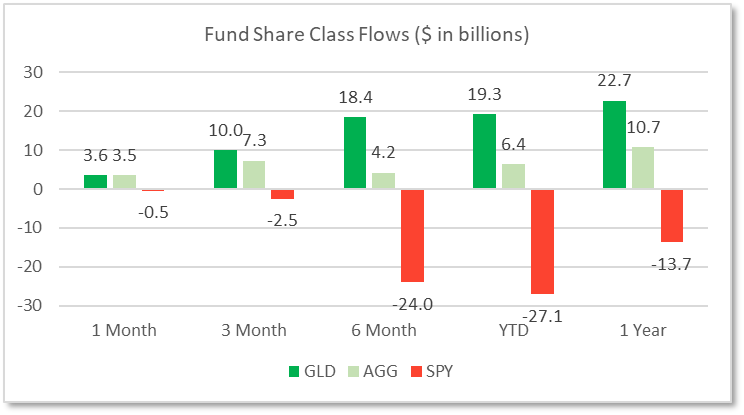

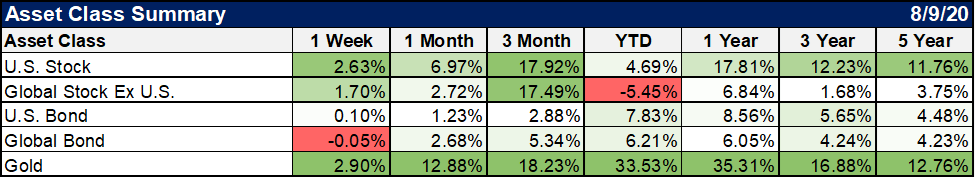

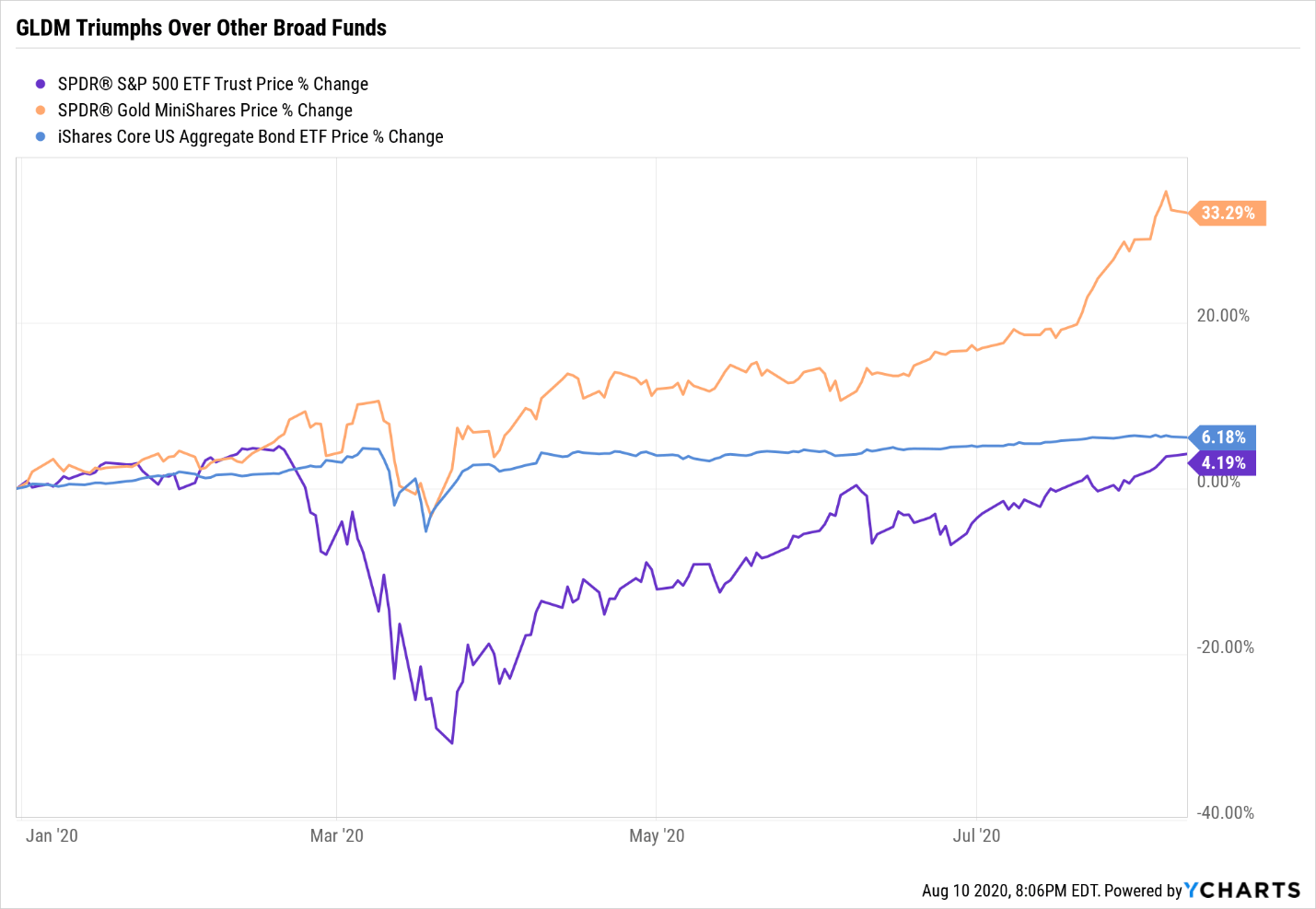

Year-to-date (YTD), gold has experienced more inflows than other broad stock and bond funds, including SPY and AGG which track the S&P 500 and Barclay’s Aggregate Bond Index, respectively. Amongst a myriad of asset classes, investors are choosing gold as their choice for safekeeping, thus driving gold prices to an all-time high. This year alone, gold is up 33.53% YTD compared to U.S. Stocks at 4.69% YTD and U.S. bonds at 7.83% YTD. But why exactly is a gold rush taking place in 2020?

Source: YCharts

Data as of 8/05/2020

You may attribute the surge in gold prices to the pandemic, but mine deeper and you will find more.

Source: YCharts

Data as of 8/05/2020

Source: YCharts

Low Yield Environment: Earlier in March, the Federal Reserve cut the federal funds rate to 0 – 0.25% to stimulate the economy amid an economic crisis. As a result, treasury yields fell drastically. The 10 Year Treasury rate started the year at 1.88% and now only yields an all-time low of 0.52%, or -1.05% adjusted for inflation. Although treasuries are often used as a safe haven during uncertain times, negative real yields alongside inflation expectations might make gold a more attractive store of value.

Inflation Expectations: Fiscal stimulus through a $2.2 trillion package, rapid money printing, and unprecedented quantitative easing has prompted investors to seek gold as an inflation hedge. Current levels of inflation, however, do remain low at 1.19% year-over-year relative to the Fed’s target of 2.0%, and are likely to stay low in the short term (due to aggregate demand and supply shocks). While there is no tell-all sign indicating future long-term inflation is upon us, the following is certain: whether gold investors are overreacting or whether U.S. inflation is a ticking time bomb remains to be seen.

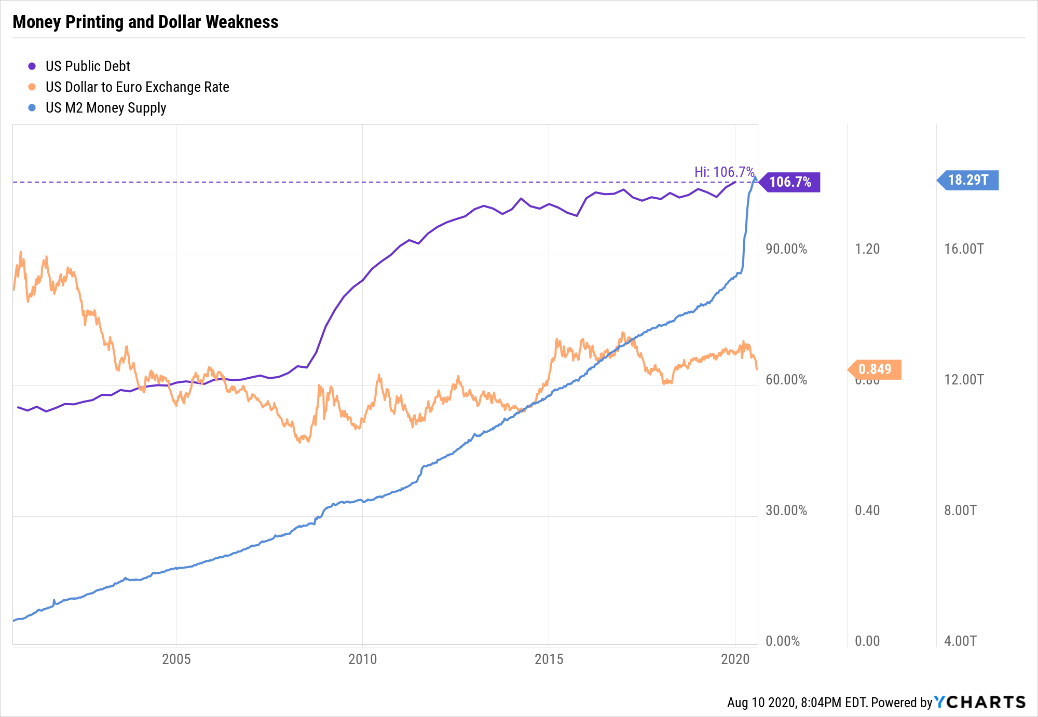

A Weakening U.S. Dollar: With fiscal debt as a percentage of GDP and M2 Money Supply at an all-time high, confidence in the U.S. dollar is diminishing relative to other currencies including the Euro. This comes at a time where the European Union appears to maintain a tighter grasp on COVID-19 outbreaks, alongside newfound unity in the form of a centralized stimulus package and debt mutualization. Overall, supposed weakness in the U.S. dollar has turned investors towards gold to maintain the purchasing power of their greenbacks.

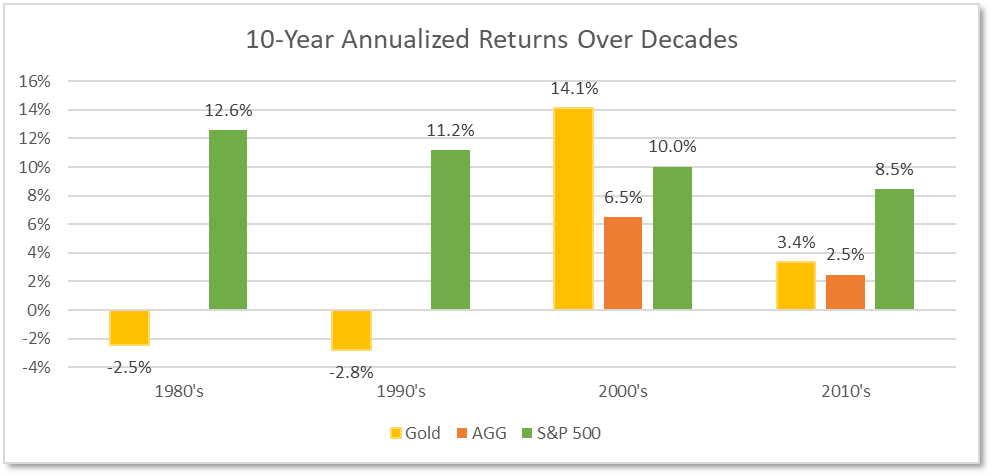

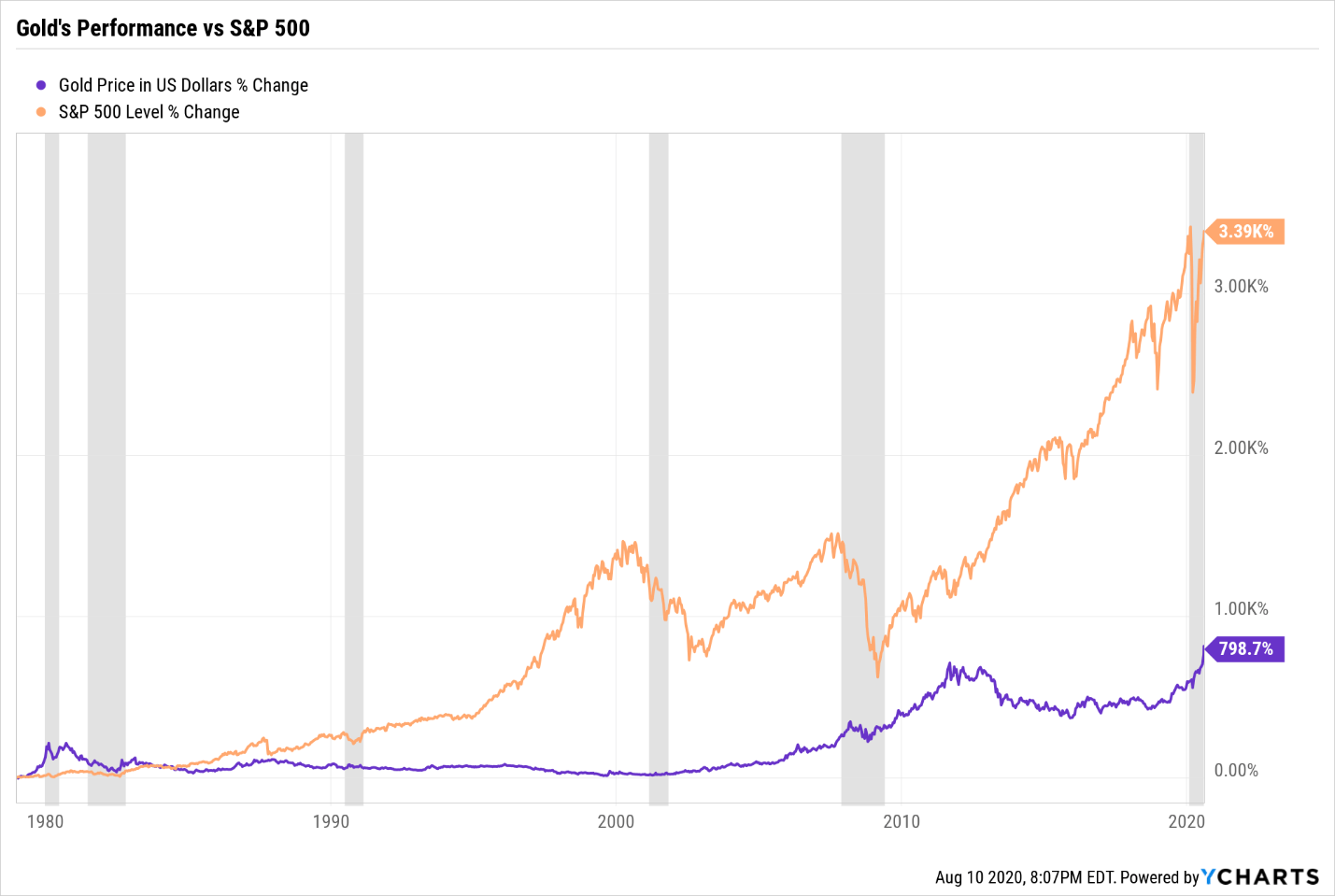

With this context, it seems like anyone would jump at the chance to own gold; but to avoid grabbing a handful of pyrite (fool’s gold), let’s evaluate gold’s performance and properties as an asset class. During the 1980’s and 1990’s, gold yielded less than ideal returns. In the late 2000’s, the metal’s performance accelerated as investor confidence faltered during the Great Recession, but subsequently dipped in the 2010’s when the U.S. economy proceeded onto its longest economic expansion.

Source: YCharts

Data spanning 1/01/1980 to 12/31/2019

Based on history, we can draw two conclusions: 1) gold’s volatile nature indicates that its current run may not be sustainable over long periods of time and 2) gold’s performance suffers when investors regain confidence and begin to adopt a risk-on posture. To see gold’s performance coming out of recessions, see Appendix A. (link)

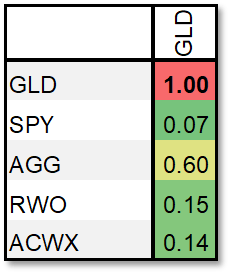

5-Year Correlation Matrix (Rolling Monthly Returns)

Data as of 8/07/2020

Source: YCharts

Gold generates zero passive income, so why do investors hold it? One reason is simply because it’s different and provides a diversification benefit. This metal exhibits less correlation compared to broader asset classes, meaning it simply behaves differently. A correlation of 1 indicates that the assets’ return behaviors are identical, while a correlation of -1 means they move in completely opposite directions. Given gold’s weaker correlations, it is likely to thrive when stocks or other asset classes experience large drawdowns. In other words, gold zigs while others zag.

Having understood the nuances of gold as investable asset and its diversification benefit over a long-time horizon, Warren Street Wealth Advisors previously made the decision to maintain gold exposure through Gold Minishares (GLDM) in our Diversifiers sleeve. Our investment strategies are now reaping the benefits of gold’s recent rally and allow for different courses of action. For example, with current gold prices bid up relative to historical levels, we can trim profits to invest in cheaper assets classes with higher potential for appreciation. This in essence, is buying low and selling high.

Gold prices will likely stay in the headlines and continue to gain traction in coming months. Regardless, we encourage you to start with your long-term asset allocation in mind and refrain from overthinking market entry/exit timing on any specific asset class. Preventing permanent capital impairment and building portfolios for your short term and long-term needs remains our top priority. We will diligently tax loss harvest and perform recurring rebalances along the way to take advantage of tactical long-term opportunities we see appropriate. That to us, is striking gold in 2020.

Appendix A:

Phillip Law

Portfolio Analyst, Warren Street Wealth Advisors

Warren Street Wealth Advisors, a Registered Investment Advisor. The information contained herein does not involve the rendering of personalized investment advice but is limited to the dissemination of general information. A professional advisor should be consulted before implementing any of the strategies or options presented. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss.

PPP Flex Act

/in Education, Financial Planning, Taxes /by Emily Balmages, CFP®There was some good news for our small business owners as the Paycheck Protection Program Flexibility Act of 2020 was signed into law today (aka PPP Flex Act). The PPP Flex Act amends certain provisions of the CARES Act relating to PPP loans. You can view the full text here: Text – H.R.7010 – 116th Congress (2019-2020): Paycheck Protection Program Flexibility Act of 2020

Highlights include:

1. Minimum PPP loan maturity of 5 years, and an allowance that lenders and borrowers can mutually agree to modify loan terms.

2. Borrowers now have until the earlier of 24 weeks after loan origination or 12/31/20 to spend potentially forgivable loan proceeds (the original deadline was 8 weeks after loan origination).

3. Borrowers may qualify for loan forgiveness without regard to reduction in full-time employees if they can document: inability to hire or rehire employees OR inability to return to normal business activities due to HHS, CDC, or OSHA guidance or requirements.

4. To qualify for forgiveness, 60% of loan proceeds must be used for payroll costs (the original requirement was 75%). This means that up to 40% of the forgivable loan proceeds can be used for mortgage payments, rent, or utilities.

5. Small businesses that receive PPP loan forgiveness can also now defer the Employer portion of Social Security taxes from 3/27/20 through 12/31/20.

6. Notably, the PPP Flex Act did not fix the issue of expenses paid by forgiven loan proceeds being non-tax-deductible. We do expect this technical fix to come eventually.

We expect more clarification as additional legislation is passed this year, so stay tuned. Please reach out to us with any questions as to how these changes apply to your business.

As such, before proceeding, please consult with us and other appropriate professionals, such as your accountant, and/or estate planning attorney on any details specific to you. Please don’t hesitate to reach out to us with your questions and comments. It’s what we are here for.

Emily Balmages, CFP®, CRTP

Director of Financial Planning, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

If you have questions about any of this or would like to schedule a complimentary review you can Contact Us or call 714-876-6200 to book a free consultation.

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Update: Relief Is On The Way: A CARES Act Overview

/in Education, Financial Planning, Retirement, Taxes /by Emily Balmages, CFP®This is a follow up to our first piece https://warrenstreetwealth.com/relief-is-on-the-way-a-cares-act-overview/ so if you have not yet read this first blog, please do so as this is a follow up to it.

With frequent updates from Washington and elsewhere regarding the policy response to COVID-19, we will continue to provide you with summary updates. Please reach out to us with any questions you might have.

CHECKS

Many of you have received your stimulus checks via direct deposit. If not, here is some additional information.

If you did not file a 2018 or 2019 tax return, but are still eligible for a stimulus check, you can enter your information into this IRS website to receive your check:

Non-Filers: Enter Payment Info Here

If you did not request direct deposit on your 2018 or 2019 tax return, but you would like to receive your stimulus check via direct deposit, you can enter your direct deposit information on this IRS website:

It has been reported that both of the websites above have experienced technical issues since being launched, so patience and perseverance may be required.

If you prefer to receive your stimulus payment by paper check, you may have to wait several weeks for the payment to arrive.

TAXES

The Treasury Department and IRS have delayed the Federal tax filing deadline for 2019 taxes to July 15, 2020.

California, along with most states (though not all), has conformed to the Federal deadline.

2020 Q1 and Q2 Federal estimated taxes are also now due July 15th.

SMALL BUSINESSES

There are several updates regarding small business relief offered in the CARES Act.

1. EIDL

Originally the CARES Act called for the SBA to offer one-time emergency grants of $10k per business through the EIDL (Economic Injury Disaster Loan) program. Many of our small business owner clients applied. Recently, the SBA released an email to EIDL grant applicants, announcing that due to high demand, they’ve limited the one-time EIDL grant to $1k per employee (with a maximum of $10k total).

2. PPP

The demand for PPP (Paycheck Protection Program) loans has been extremely high. So high, in fact, that just 14 days after the program opened, the SBA announced that it had committed all of the originally allotted $349 billion. As of Friday, April 24th, Congress and the President approved an additional $310 billion in funds for the program which offers potentially forgivable loans for small businesses and non-profits. We expect this second round of funding to go quickly, so please reach out to us for guidance if you have not yet applied. $60 billion of the new funding was specifically set aside for loans made by smaller institutions like credit unions and community banks, so we recommend considering one of these options first.

3. Main Street Lending Program

Another relief option for small to medium sized businesses (up to 10,000 employees) may be the Federal Reserve’s new Main Street Lending Program:

Details of the program are still being clarified, but as of this writing, here are some highlights:

- Borrowers who received SBA PPP loans are eligible to apply for the MSLP as well.

- Unlike PPP loans that can be potentially forgiven, MSLP loans do not offer a forgiveness provision.

- Current proposed terms are 4 year repayment, $1 million minimum loan size, principal and interest payments are deferred for one year, relatively low interest rates.

- Several other restrictions apply. If you are a small or medium size business owner in need of funding, please reach out to us for further discussion.

CHARITABLE GIVING AND WAYS TO HELP

Food banks around the country have seen increased demands over the last several weeks. If you are looking for a way to help, you might want to check with your local food bank.

The Red Cross is also reporting a severe blood shortage as a result of donor cancellations across the country.

This concludes our quick update. News is flowing rapidly and changes to some of this information are inevitable. We will continue to provide updates, but please contact us with any questions, comments or concerns. Wishing you health and safety during these unprecedented times.

As such, before proceeding, please consult with us and other appropriate professionals, such as your accountant, and/or estate planning attorney on any details specific to you. Please don’t hesitate to reach out to us with your questions and comments. It’s what we are here for.

Emily Balmages, CFP®, CRTP

Director of Financial Planning, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

If you have questions about any of this or would like to schedule a complimentary review you can Contact Us or call 714-876-6200 to book a free consultation.

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Relief Is On The Way: A CARES Act Overview

/in Education, Financial Planning, Retirement, Taxes /by Emily Balmages, CFP®Last Friday, in response to the COVID-19 pandemic, President Trump signed into law The CARES Act, a $2 trillion economic stimulus bill.

This bill, which appears to be the largest ever of its kind, will be studied and analyzed for months to come.

Every Warren Street client will be impacted in some way. Accordingly, we are reviewing every client situation to determine what proactive steps you can take to maximize the benefits available within this legislation. We will provide some highlights here, and will be following up with each of you directly over the coming weeks. As always, please reach out to us at any time with questions.

In General

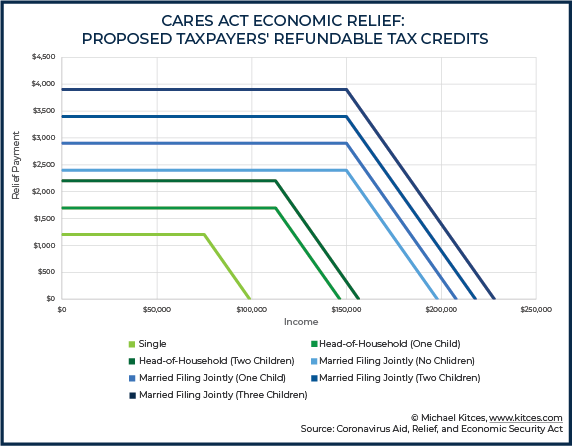

- CHECKS! : Most Americans can expect to receive rebates from Uncle Sam. Depending on your household income, expect up to $1,200 per adult and $500 per dependent child under age 17. To calculate your payment, the Federal government will look at your 2019 Adjusted Gross Income (AGI) if it is available, or your 2018 AGI if it is not. However, you will receive an extra 2020 tax credit if your 2020 AGI ends up lower than the figure used to calculate your rebate.

- Taxpayers with Adjusted Gross Income (AGI) above certain thresholds start to lose benefits. The phaseouts start at:

Married Joint: $150,000

Head of Household: $112,500

All Other Filers: $75,000

- This Nerd’s Eye View illustration offers a great overview:

From Michael Kitces at Nerd’s Eye View; reprinted with permission.

- The reported plan is to send the rebates to direct deposit accounts linked to Social Security payments or the most recent tax return on file. Paper checks will be sent to last known mailing addresses.

- ****TWO TIPS:

- If your 2019 income is lower than 2018 and moves you below the phaseout range, file your 2019 tax return ASAP.

- If you have recently moved, notify the IRS via this form: Form 8822 (Rev. October 2015)

- Retirement account distributions for coronavirus-related needs: You can tap into your retirement account prior to age 59.5 in 2020 for a coronavirus-related distribution of up to $100,000, without incurring the usual 10% penalty or mandatory 20% Federal withholding. You will still owe income tax on the distributions, but you can prorate the payment of these taxes across 3 years. You also can repay distributions to your account within 3 years to avoid paying income taxes, or to claim a refund on taxes paid.

***If cash flow is a problem right now, please reach out to us and we will help you strategize.

- Various healthcare-related incentives: For example, certain over-the-counter medical expenses previously disallowed under some healthcare plans now qualify for coverage. Also, Medicare restrictions have been relaxed for telehealth and other services (such as COVID-19 vaccinations, once they become available). Other details apply.

For Retirees (and Retirement Account Beneficiaries)

- RMD relief: Required Minimum Distributions (RMDs) go on a holiday in 2020 for retirees, as well as beneficiaries with inherited retirement accounts. If you have not yet taken your 2020 RMD, don’t! If you have, please be in touch with us to explore potential remedies.

For Charitable Donors

- “Above-the-line” charitable deductions: Deduct up to $300 in 2020 qualified charitable contributions (excluding Donor Advised Funds) if you are taking the standard deduction.

- Donate all of your 2020 AGI: You can effectively eliminate 2020 taxes owed, and then some, by donating up to, or beyond your AGI. If you donate more than your AGI, you can carry forward the excess up to 5 years. Donor Advised Fund contributions are excluded.

For Business Owners (and Certain Not-for-Profits)

- Paycheck Protection Program loans (potentially forgivable): The Small Business Administration (SBA) Paycheck Protection Program is making loans available for qualified businesses and not-for-profits (typically under 500 employees), sole proprietors, and independent contractors. Loans for up to 2.5x monthly payroll, up to $10 million, 2-year maturity, interest rate 1%. Payments are deferred and, if certain employment retention and other requirements are met, the loan may be forgiven.

- Economic Injury Disaster Loans (with forgivable advance): In coordination with your state, SBA disaster assistance also offers Economic Injury Disaster Loans of up to $2 million to qualified small businesses and non-profits, “to help overcome the temporary loss of revenue they are experiencing.” Interest rates are under 4%, with potential repayment terms of up to 30 years. Applicants also are eligible for an advance on the loan of up to $10,000. The advance will not need to be repaid, even if the loan is denied.

- Payroll tax credits and deferrals: For qualified businesses who are not taking a loan.

- Employee retention credit: An additional employee retention credit (as a payroll tax credit), “equal to 50 percent of the qualified wages with respect to each employee of such employer for such calendar quarter.” Excludes businesses receiving PPP loans, and may exclude those who have taken the EIDL loans.

- Net Operating Loss rules relaxed: Carry back 2018–2020 losses up to five years, on up to 100% of taxable income from these same years.

- Immediate expensing for qualified improvements: Section 168 of the Internal Revenue Code of 1986 is amended to allow immediate expensing rather than multi-year depreciation.

- Dollars set aside for industry-specific relief: Please be in touch for a more detailed discussion if your entity may be eligible for industry-specific relief (e.g., airlines, hospitals and state/local governments).

For Employees/Plan Participants

- Retirement plan loans and distributions: Maximum amount increased to $100,000 on up to the entire vested amount for coronavirus-related loans. Delay repayment up to a year for loans taken from March 27–year-end 2020. Distributions described above in In General.

- Paid sick leave: Paid sick leave benefits for COVID-19 victims are described in the separate, March 18 H.R. 6201 Families First Coronavirus Response Act, and are above and beyond any benefits received through the CARES Act. Whether in your role as an employer or an employee, we’re happy to discuss the details with you upon request.

For Employers/Plan Sponsors

- Relief for funding defined benefit plans: Due date for 2020 funding is extended to Jan. 1, 2021. Also, the funding percentage (AFTAP) can be calculated based on your 2019 status.

- Relief for facilitating pre-retirement plan distributions and expanded loans: As described above for Employees/Plan Participants, employers “may rely on an employee’s certification that the employee satisfies the conditions” to be eligible for relief. The participant is required to self-certify in writing that they or a direct dependent have been diagnosed, or they have been financially impacted by the pandemic. No additional evidence (such as a doctor’s release) is required.

- Potential extension for filing Form 5500: While the Dept. of Labor (DOL) has not yet granted an extension, the CARES Act permits the DOL to postpone this filing deadline.

- Exclude student loan pay-down compensation: Through year-end, employers can help employees pay off current educational expenses and/or student loan balances, and exclude up to $5,250 of either kind of payment from their income.

For Unemployed/Laid Off Americans

- Increased unemployment compensation: Federal funding increases standard unemployment compensation by $600/week, and coverage is extended 13 weeks.

- Federal funding covers first week of unemployment: The one-week waiting period to start collecting benefits is waived.

- Pandemic unemployment assistance: Unemployment coverage is extended to self-employed individuals for up to 39 weeks. Plus, the Act offers incentives for states to establish “short-time compensation programs” for semi-employed individuals.

For Students (or those with student loans)

- Student loan payments deferred to Sept. 30, 2020: No interest will accrue either. Important: Voluntary payments will continue unless you explicitly pause them. Plus, the deferral period will still count toward any loan forgiveness program you’re in. So, be sure to pause payments if this applies to you, lest you pay on debt that will ultimately be forgiven.

- Delinquent debt collection suspended through Sept. 30, 2020: Including wage, tax refund, and other Federal benefit garnishments.

- Employer-paid student loan repayments excluded from 2020 income: From the date of the CARES Act enactment through year-end, your employer can pay up to $5,250 toward your student debt or your current education without it counting as taxable income to you.

- Pell Grant relief: There are several clauses that ease Pell Grant limits, while not eliminating them. It would be best if we go over these with you in person if they may apply to you.

For Estates/Beneficiaries

- A break for “non-designated” beneficiaries: 2020 can be ignored when applying the 5-year rule for “non-designated” beneficiaries with inherited retirement accounts. The 5-Year Rule effectively ends up becoming a 6-Year Rule for current non-designated beneficiaries.

You’re now familiar with much of the critical content of the CARES Act! That said, given the complexities involved and unprecedented current conditions, there will undoubtedly be updates, clarifications, additions, system glitches, and other adjustments to these summary points. The results could leave a wide gap between intention and reality.

As such, before proceeding, please consult with us and other appropriate professionals, such as your accountant, and/or estate planning attorney on any details specific to you. Please don’t hesitate to reach out to us with your questions and comments. It’s what we are here for.

Emily Balmages, CFP®, CRTP

Director of Financial Planning, Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

If you have questions about any of this or would like to schedule a complimentary review you can Contact Us or call 714-876-6200 to book a free consultation.

DISCLOSURES

Reference Materials:

- DWC News Update, The CARES Act: Federal Coronavirus Relief. March 30, 2020.

- Financial Planning, “Major changes in RMDs and retirement contributions in $2T stimulus plan,” Ed Slott, March 27, 2020.

- H2R CPA, “Cares Act will provide billions of dollars of relief,” March 27, 2020.

- H.R. 748: Coronavirus Aid, Relief, and Economic Security (CARES) Act.

- Nerd’s Eye View, “Analyzing The CARES Act: From Rebate Checks To Small Business Relief For The Coronavirus Pandemic,” Jeffrey Levine, March 27, 2020.

- The Wall Street Journal, “How the Coronavirus Paid Leave Rules Apply to You,” Charity L. Scott, March 27, 2020.

- ThinkAdvisor, “3 Stimulus Bill Provisions Advisors Should Act On Now: Jeff Levine,” Jeff Berman, March 30, 2020.

- ● U.S. Chamber of Commerce, “Coronavirus Emergency Loans Small Business Guide and Checklist.”

- U.S. Small Business Administration, Paycheck Protection Program and Disaster Assistance.

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

Coronavirus: Here’s a Portfolio Treatment Plan

/in Education, Financial Planning, General, Investing, Uncategorized /by Blake StreetWow! Our last published piece on the blog was “2019: A Year for the Record Books”. Two months later and the peace and quiet of yesteryear seem a distant memory. Scary days have arrived, thanks to the concern over how coronavirus might impact our global economy. As we draft this update, headlines are reporting the biggest weekly stock market losses since 2008.

We do not know whether the current correction will deepen or soon dissipate. It is important to remember that what was good advice in mild markets remains good advice today. Given the current climate, let’s take a look at a sound unemotional treatment plan for your nest-egg.

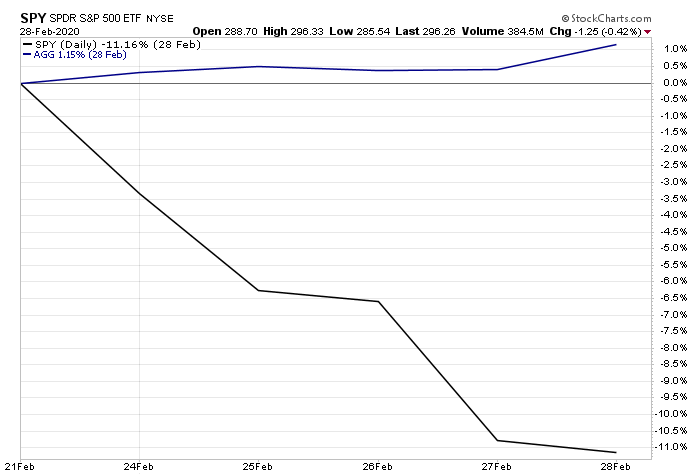

We continue to advise against panicked reactions to market conditions, or trying to predict an unknowable future. That being said, we are aggressively looking for ways to help our clients make lemonade out of this week’s lemons – such as through disciplined portfolio rebalancing and strategic tax loss harvesting. On Friday February 28th, we executed both on behalf of our private wealth clients.

Other lemonade ideas include refinancing your mortgage as interest rates have hit historic lows or executing a ROTH conversion while your portfolio is down, turning the recovery into tax free growth. More than anything, as you’ll see below, a long term perspective during an epidemic pays.

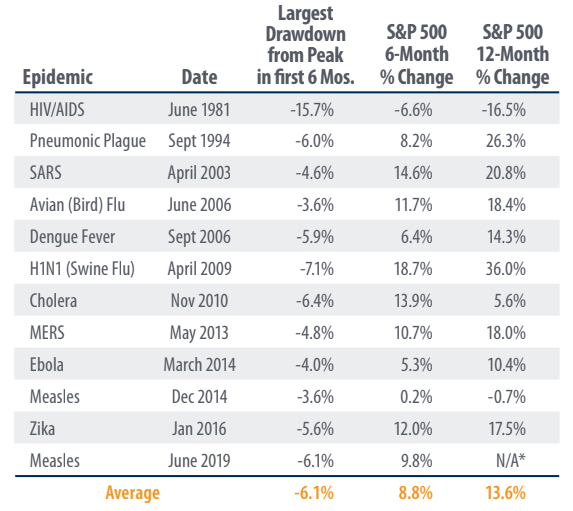

In 11 of the 12 cases above, the U.S. Stock Market was positive 6 months after an epidemic broke out, with an average return of 8.8%. In 9 of the 11 cases the U.S. Stock Market was positive 12 months after with an average return of 13.6%. It’s also important to note diversification worked last week with U.S. Bonds actually netting a positive return while U.S. stocks were down 11.5%.

If we can be of assistance or you want to talk through any of this, please do not hesitate to reach out to our team. In the meantime, here are 10 things you can do right now while markets are at least temporarily tanking.

1. Don’t panic (or pretend not to). It’s easy to believe you’re immune from panic when the financial sun is shining, but it’s hard to avoid indulging in it during a crisis. If you’re entertaining seemingly logical excuses to bail out during a steep or sustained market downturn, remember: It’s highly likely your behavioral biases are doing the talking. Even if you only pretend to be calm, that’s fine, as long as it prevents you from acting on your fears.

“Every time someone says, ‘There is a lot of cash on the sidelines,’ a tiny part of my soul dies. There are no sidelines.” – Cliff Asness, AQR Capital Management

2. Redirect your energy. No matter how logical it may be to sit on your hands during market downturns, your “fight or flight” instincts can trick you into acting anyway. Fortunately, there are productive moves you can make instead – such as all 10 actions here – to satisfy the itch to act without overhauling your investments at potentially the worst possible time.

“My advice to a prospective active do-it-yourself investor is to learn to golf. You’ll get a little exercise, some fresh air and time with your friends. Sure, green fees can be steep, but not as steep as the hit your portfolio will take if you become an active do-it-yourself investor.” – Terrance Odean, behavioral finance professor

3. Remember the evidence. One way to ignore your self-doubts during market crises is to heed what decades of practical and academic evidence have taught us about investing: Capital markets’ long-term trajectories have been upward. Thus, if you sell when markets are down, you’re far more likely to lock in permanent losses than come out ahead.

“Do the math. Expect catastrophes. Whatever happens, stay the course.” – William Bernstein, MD, PhD, financial theorist and neurologist

4. Manage your exposure to breaking news. There’s a difference between following current events versus fixating on them. In today’s multitasking, multimedia world, it’s easier than ever to be inundated by late-breaking news. When you become mired in the minutiae, it’s hard to retain your long-term perspective.

“Choosing what to ignore – turning off constant market updates, tuning out pundits purveying the latest Armageddon – is critical to maintaining a long-term focus.” – Jason Zweig, The Wall Street Journal

5. Revisit your carefully crafted investment plans (or make some). Even if you yearn to go by gut feel during a financial crisis, remember: You promised yourself you wouldn’t do that. When did you promise? When you planned your personalized investment portfolio, carefully allocated to various sources of expected returns, globally diversified to dampen the risks involved, and sensibly executed with low-cost funds managed in an evidence-based manner. What if you’ve not yet made these sorts of plans or established this kind of portfolio? Then these are actions we encourage you to take at your earliest convenience.

“Thus, the prudent strategy for investors is to act like a postage stamp. The lowly postage stamp does only one thing, but it does it exceedingly well – it adheres to its letter until it reaches its destination. Similarly, investors should adhere to their investment plan – asset allocation.” – Larry Swedroe, financial author

6. Reconsider your risk tolerance (but don’t act on it just yet). When you craft a personalized investment portfolio, you also commit to accepting a measure of market risk in exchange for those expected market returns. Unfortunately, during quiet times, it’s easy to overestimate how much risk you can stomach. If you discover you’re miserable to the point of breaking during even modest market declines, you may need to re-think your investment plans. Start planning for prudent portfolio adjustments, preferably working with an objective advisor to help you implement them judiciously over time.

“Our aversion to leverage has dampened our returns over the years. But Charlie [Munger] and I sleep well. Both of us believe it is insane to risk what you have and need in order to obtain what you don’t need.” – Warren Buffett, Berkshire Hathaway

7. Double down on your risk exposure – if you’re able. If, on the other hand, you’ve got nerves of steel, market downturns can be opportunities to buy more of the depressed (low-price) holdings that fit into your investment plans. You can do this with new money, or by rebalancing what you’ve got (selling appreciated assets to buy the underdogs). This is not for the timid! You’re buying holdings other investors are fleeing in droves. But if can do this and hold tight, you’re especially well-positioned to make the most of the expected recovery.

“Pick your risk exposure, and then diversify the hell out of it.” – Eugene Fama, Nobel laureate economist

8. Tax-loss harvest. Depending on market conditions and your own circumstances, you may be able to use tax-loss harvesting during market downturns. A successful tax-loss harvest lowers your tax bill without substantially altering or impacting your long-term investment outcomes. This action is not without its tricks and traps, however, so it’s best done in alliance with a financial professional who is well-versed in navigating the challenges involved.

“In investing, you get what you don’t pay for.” – John C. Bogle, Vanguard founder

9, Revisit this article. There is no better time to re-read this article than when the going gets tough, when yesterday’s practice run is no longer an exercise but a real event. Maybe it will take your mind off the barrage of breaking news.

“We’d never buy a shirt for full price then be O.K. returning it in exchange for the sale price. ‘Scary’ markets convince people this unequal exchange makes sense.” – Carl Richards, Behavior Gap

10. Talk to us. We didn’t know when. We still don’t know how severe it will be, or how long it will last. But we do know markets inevitably tank now and then; we also fully expect they’ll eventually recover and continue upward. Since there’s never a bad time to receive good advice, we hope you’ll be in touch if we can help.

“In the old legend the wise men finally boiled down the history of mortal affairs into the single phrase, ‘This too will pass.’”

– Benjamin Graham, economist, “father of value investing”

Blake Street, CFA, CFP ®

Founding Partner

Chief Investment Officer

Warren Street Wealth Advisors

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications. Form ADV available upon request 714-876-6200.

2019: A Year for the Record Books

/in Education, General, Investing, Quarterly Economic Update /by Marcia ClarkKey Takeaways

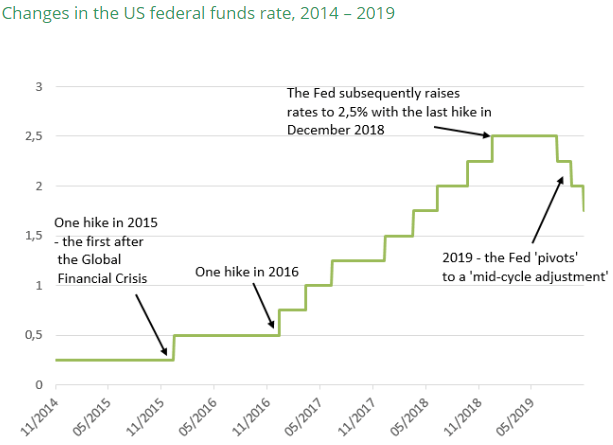

2019 turned out to be one of the best years for the financial markets in recent history. To understand how we got there, it’s helpful to consider where we began. Factset did a very good job of this on its website insight.factset.com: “As we began 2019, the big economic stories were the Fed’s series of interest rate hikes (four in 2018), the ongoing U.S. government shutdown, the December 2018 stock market drop (S&P 500: -9.2%, DJIA: -8.7%), and the escalating U.S.-China trade war. As the year progressed, we saw movement on all fronts.” The bullet points below provide a useful summary:

- The Fed’s 2018 interest rate hikes were partially reversed as the FOMC cut rates three times in the second half of the year in reaction to a growing number of signals flashing recession.

- The 35-day U.S. government shutdown, which ended on January 25, 2019, was the longest U.S. government shutdown in history. With many federal agencies closed and federal employees across the country furloughed or working without pay, the Congressional Budget Office estimates that the shutdown cost the economy $11 billion, $3 billion of which was permanently lost.

- The ups and downs of U.S.-China trade negotiations sent global stock markets on a roller coaster ride throughout the year. As the year comes to a close, the U.S. has reached a so-called “Phase 1” trade agreement with China that reduces some of the tariffs imposed over the last 18 months and stops the imposition of a new set of tariffs set to go into effect on December 15. For its part, China has agreed to purchase more U.S. agricultural products. While the agreement helps to diffuse global anxiety surrounding the growing trade tensions, it fails to address significant concerns around technology and intellectual property rights. Still, equity markets have responded positively to the news, surging to new highs.

With this context in mind, how did the markets do in 2019?

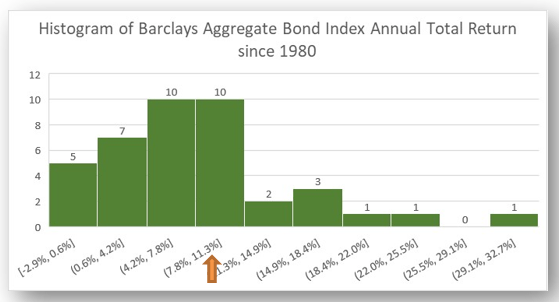

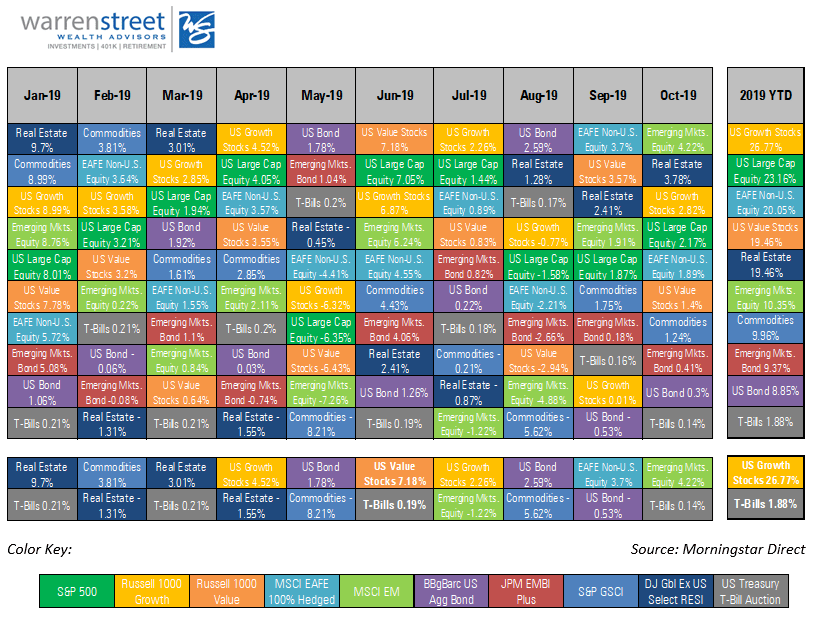

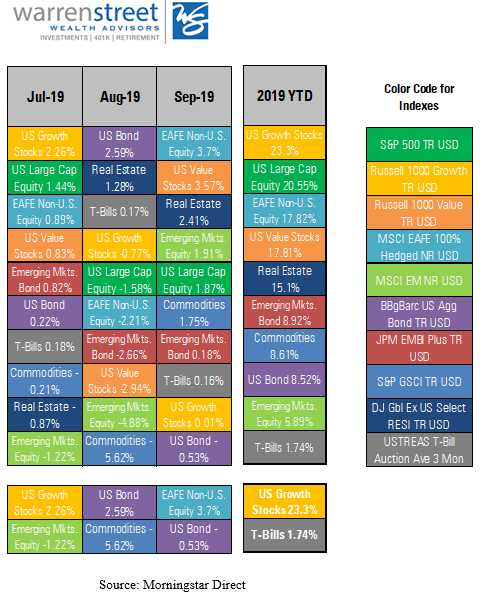

Risk assets powered forward in December. After a rocky ride of positive and negative returns during the year, emerging markets stocks charged to the front of the pack in December. EM Equity crossed the finish line in the middle of the field with a return of 18.4%, about half the return of the winning asset class, U.S. Growth stocks (36.4%). U.S. Large Cap was 2nd at 31.5%, U.S. Value stocks came in 3rd at 26.5%, and International stocks were 4th at 24.63%. Though bonds trailed the field at 8.7%, this is more than twice the 10-year average for the Barclay’s Aggregate Bond Index, which was supercharged by falling Treasury yields as the Fed repeatedly lowered its short-term interest rate target.

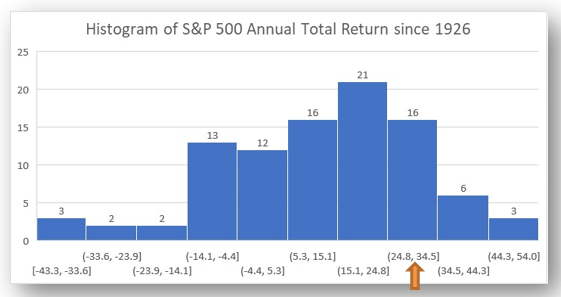

The S&P500 total return for 2019 was the 18th best since 1926, 8th best since 1970, and 4th best since 1990[1]. The Barclays Aggregate bond index had its 13th best year since 1980[2].

What can we expect from the markets in 2020?

An era of the ‘haves’ and ‘have nots’. Technological innovations from industrial automation to ‘fracking’ to high speed data connections and the ‘internet of things’ has brought the world out of scarcity and into surplus. But this abundance is not felt by all – perhaps not even by most. Those with access to these technologies, either via infrastructure or financial resources, unlock a brave new world of possibilities. Those without such access are left behind. While wages generally have begun to increase, median incomes are not rising fast enough, causing the gap between economic winners and losers to widen. This situation has sparked political protests and dissatisfaction among working-class people around the world. Combined with the uncertain outcome of the presidential election in the U.S., never-ending Brexit negotiations in the U.K., and military conflicts and political posturing around the world, the global economy could stumble if government agents make a serious misstep.

Despite these risks, the IMF continues to forecast stronger global economies in 2020 and beyond. According to the latest update to the IMF World Economic Outlook[3], global growth is forecast to improve from 2.9% in 2019 to 3.3% in 2020 and 3.4% in 2021 due to easing trade tensions, strong labor markets and service sectors, and accommodative monetary policy. IMF economists also see welcome indications that the global slump in manufacturing and trade may have bottomed out.

This positive outlook is contingent on the recovery of less-developed countries currently dealing with stressed political and/or economic conditions: Argentina, Iran, Turkey, Brazil, India, and Mexico. Advanced economies such as Europe and the U.S. are likely to continue to grow less than 2% per year.

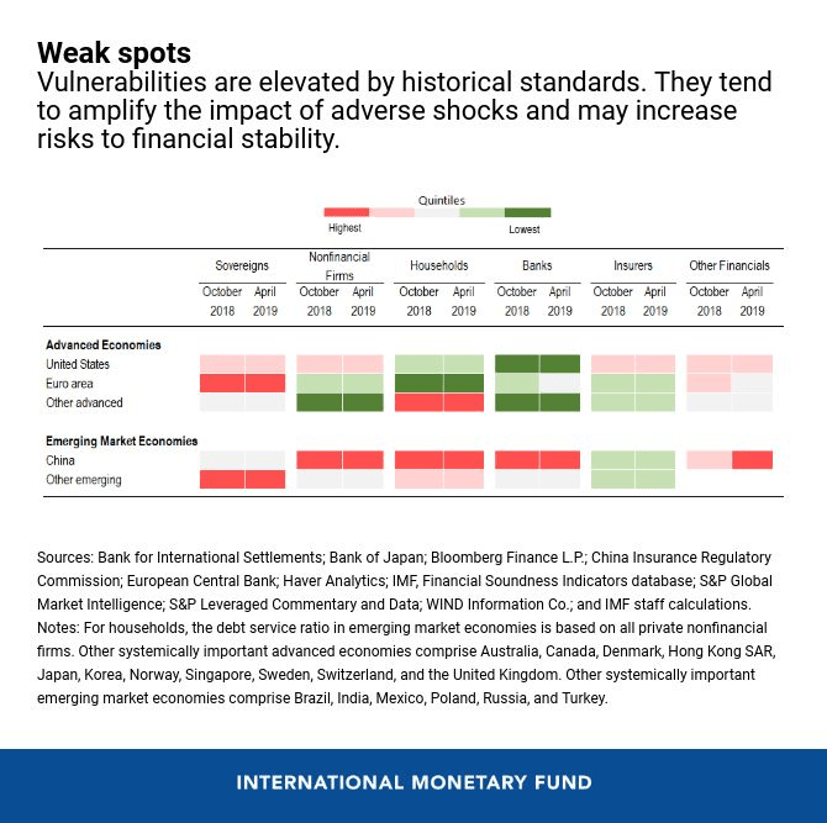

This outlook could change quickly if new trade tensions emerge or social unrest around the world intensifies. The IMF ‘vulnerabilities’ table below reports that the financial condition of sovereign nations is vulnerable to economic shocks. This vulnerability is due in part to a lack of room for fiscal or monetary agents to maneuver given high budget deficits and the very low level of government interest rates in many countries. Businesses and households in developed economies are generally solid, but households in emerging economies remain insecure.

Bottom line: Economic expansions don’t die of old age. U.S. and international economies successfully navigated a year full of social and political tensions and uncertainty, despite being in the late stage of a record-setting expansion. Low interest rates and muted inflation are enabling businesses and households to take on new ventures where they see a suitable potential reward. And unlike the expansion which preceded the financial crisis of 2008-2009, ‘asset bubbles’ and excessive risk-taking have been limited due to the many disruptions experienced during 2019 and the uncertain future outlook.

While risks to this outlook are clear and present, we are cautiously optimistic that policymakers and financial markets will continue to thread the needle between crisis and excess, and that 2020 will be a relatively peaceful and prosperous new year.

Marcia Clark, CFA, MBA

Senior Research Analyst, Warren Street Wealth Advisors

DISCLOSURES

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications.

Form ADV available upon request 714-876-6200

[1] https://www.slickcharts.com/sp500/returns

[2] https://www.thebalance.com/stocks-and-bonds-calendar-year-performance-1980-2013-417028

[3] https://blogs.imf.org/2020/01/20/tentative-stabilization-sluggish-recovery/

You, Your Retirement, and the SECURE Act

/in Education, Financial Planning, Retirement, Taxes /by Emily Balmages, CFP®‘Risk On’ trades take the lead in October

/in Education, Intermediate, Investing /by Marcia Clark‘Risk On’ trades take the lead in October

Key Takeaways

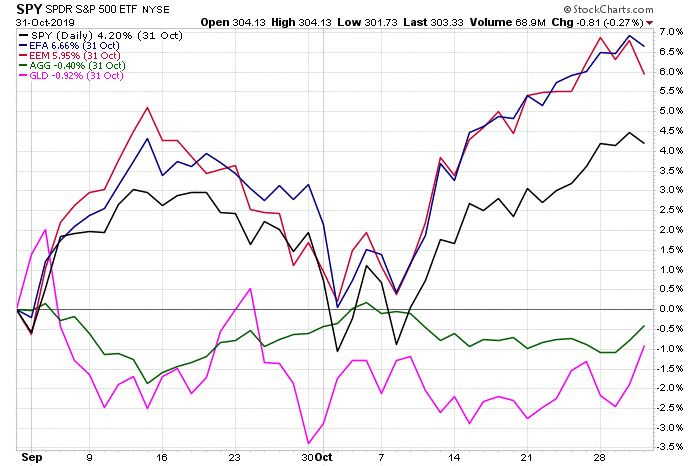

- U.S. growth stocks and emerging markets jump-started the 4th quarter with returns of 2.82% and 4.22% respectively as investors shifted away from ‘risk off’ assets such as defensive stocks and U.S. Treasury bonds

- The FOMC dropped its federal funds interest rate target for the 3rd time in 2019 to 1.5% – 1.75%. Chairman Powell indicated this cut was the last of the ‘midcycle adjustments’, causing investors to speculate about a pause in rate changes for the next few FOMC meetings.

- The U.S. and China made progress toward a trade resolution, though the pace and magnitude of the agreement is unclear. Global economies seem to be successfully navigating geopolitical tensions in Hong Kong, unrest in Chile, water wars in Egypt, and the never-ending Brexit saga, among others.

- Conclusion: Barring a major geopolitical misstep, the U.S. stock market could end the year with a return in the top 25% since 1998. U.S. bonds may end with their best return since 2010.

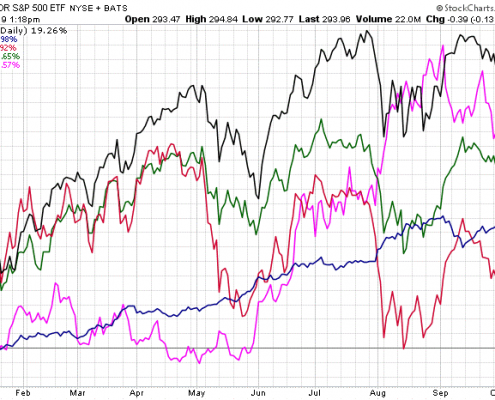

Global stocks begin to close the gap with the U.S.

The 4th quarter is off to a great start! Despite a sharp decline the first few days of the month, global stock markets were very strong in October. Emerging Markets equity beat the S&P 500 for the second month in a row, up 4.22% versus 2.17%[1]. In typical ‘risk on’, ‘risk off’ fashion, bonds and gold lagged the field in October. Commodities stayed within sight of the leaders at +1.24% for the month, but U.S. and Emerging Markets bonds were far behind at +0.41% and +0.30%, respectively. For the year-to-date, Europe, Australasia, and Far East (EAFE) is picking up the pace with a return of 20.05% versus 23.16% for the S&P 500. The year-to-date leader as of October 31st is U.S. growth stocks at 26.77%.

https://stockcharts.com/h-perf/ui

This strong start to the 4th quarter can be attributed to progress with China/U.S. trade negotiations and no significant negative news about the other international worries facing the markets: Brexit, political uncertainty in the U.S. and overseas, tensions between Hong Kong and China, and soft business confidence around the world. If none of these go terribly wrong, 2019 is on track to be in the top 25% of S&P 500 stock market returns since 1988[2].

Amid this backdrop of relative stability, the Federal Open Market Committee (FOMC) lowered its short-term target interest rate for the third time in 2019 to a range of 1.5% to 1.75%[3]. Fed Chairman Jerome Powell stated that U.S. economic growth is steady despite continued weakness in business investment and exports, and core inflation is running below the Fed’s 2% target. The October rate cut was characterized as the final ‘midcycle adjustment’ to help support the maturing U.S. economic expansion. Chairman Powell indicated the FOMC will continue to monitor economic activity to determine the appropriate level of the federal funds rate going forward. His remarks did not include previous language about the Fed acting “as appropriate to sustain the expansion”, causing market watchers to expect a pause in rate changes going forward.

Source: BNP Paribas Asset Management, Bloomberg as of 11/4/2019

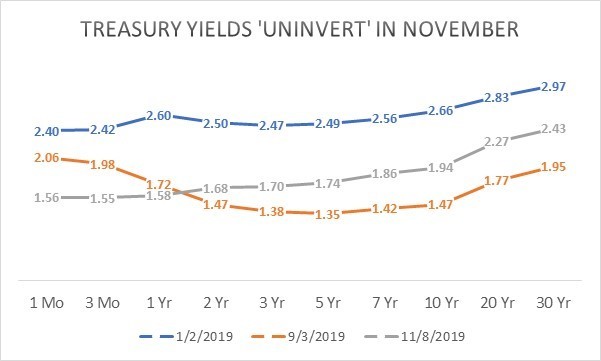

In the days following the rate cut, intermediate and longer-term Treasury yields rose, reversing the yield curve inversion seen for much of 2019 and signaling diminishing investor expectations for a near-term recession.

The return to an upwardly-sloping yield curve is a relief to market watchers. A healthy banking system requires short term rates to be lower than long term rates for banks to maintain consistent profit margins. Higher long-term yields encourage investors to take a longer-term perspective and make more strategic investments. Institutions such as pension plans also have a better chance of satisfying their obligations to future retirees. In general, financial markets do a much better job allocating capital when short-term interest rates are lower than long term rates.

Source: www.treasury.gov

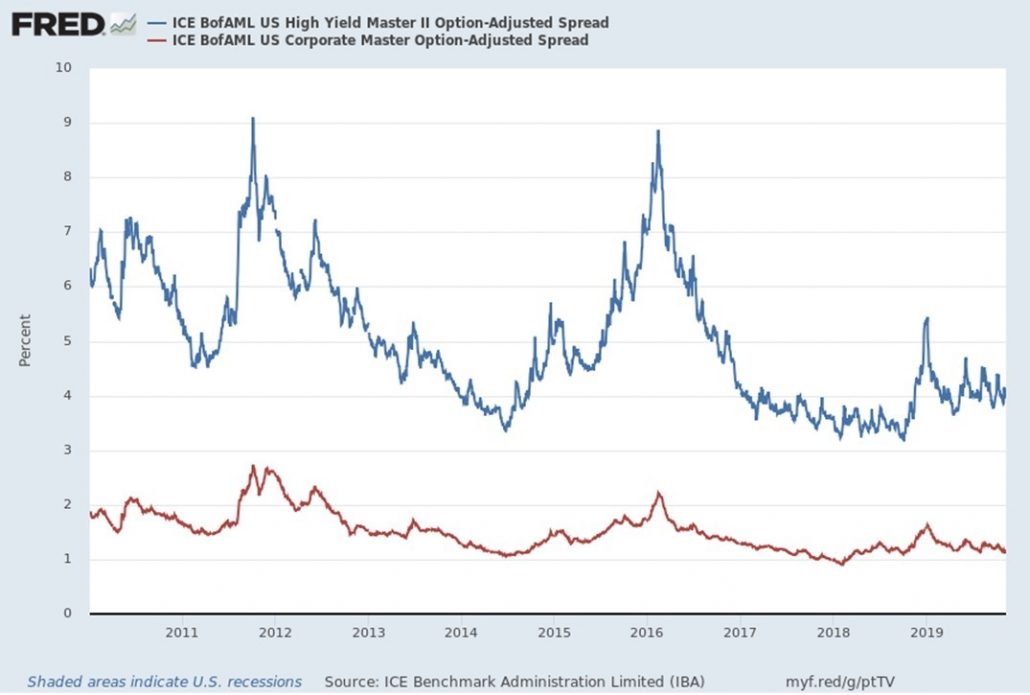

Looking beyond Treasuries, corporate bond yield spreads have drifted back toward the extremely low levels seen in early 2018. This is another indication that investors are comfortable taking risk right now. At Warren Street Wealth Advisors, we’re watching for excessive risk taking which could mean an asset price ‘bubble’ and potentially the end of the stock and bond rally. The occasional drops in market prices we see from time to time are a healthy sign that investors are making rational decisions rather than reckless speculation.

Corporate bond risk premiums drift near historic lows

Let’s not forget the global economy, which the Fed has often mentioned as one reason for reducing interest rates this year. Though the data remains mixed, the International Monetary Fund is forecasting global GDP to close 2019 up 3%, with the U.S. at 1.7% and Emerging and Developing Economies up nearly 4%[4]. The IMF expects global growth to improve in 2020 to 3.4% as Europe adjusts to the new tariff landscape and political uncertainties diminish.

Global GDP projected to remain low but positive

A global recession is highly unlikely through the end of 2020 and probably longer, but there are significant risks to this outlook! The IMF is urging political leaders to defuse trade tensions and reinvigorate multilateral cooperation, rather than focus solely on accommodative monetary policy to keep the world economy afloat.

Bottom line: The U.S. economic expansion remains on track and should end the year well, barring significant missteps in the global economic and political landscape. Though it’s been a bumpy ride, investors are likely to close the books on 2019 with healthy profits from both stocks and bonds, and meaningful progress toward achieving their financial goals.

Marcia Clark, CFA, MBA

Marcia Clark, CFA, MBA

Senior Research Analyst, Warren Street Wealth Advisors

DISCLOSURES

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications.

Form ADV available upon request 714-876-6200

Growth stocks take the lead year-to-date

[1] Performance represented by ETFs designed to track various market segments: SPY (S&P 500), AGG (Barclay’s Aggregate Bond index), EEM (emerging markets equity), EFA (developed international equity), GLD (gold prices)

[2] Source: www.stockcharts.com

[3] https://www.federalreserve.gov/monetarypolicy/files/monetary20191030a1.pdf

[4] https://www.imf.org/en/Publications/WEO/Issues/2019/10/01/world-economic-outlook-october-2019

September 2019 Market Review

/in Education, General, Investing, Quarterly Economic Update /by Marcia Clark

With competing economic data, where should investors turn?

Oil shocks, impeachment, and Brexit – Oh My!

Key Takeaways

- U.S. stock and bond markets closed the 3rd quarter with an impressive – though volatile – year-to-date return. The S&P 500 index ended September up nearly 19%, the best 3-quarter return since 1997, while the Barclays Aggregate Bond index posted an outstanding return near 8%.

- Economic data remained mixed. The U.S. Consumer Confidence index fell by -9.1%, much more than expected, but unemployment fell to 3.5%, the lowest in 50 years.

- The House of Representatives initiated an impeachment investigation of President Trump after a ‘whistleblower’ leaked information about the President asking Ukrainian officials to investigate Democratic candidate Joe Biden’s son.

- Drone strikes on Saudi Arabian oil installations shut down 50% of Saudi oil production, about 5% of world production, briefly sending oil prices off the rails and adding to recession fears.

- Prime Minister Boris Johnson was deemed to have acted illegally by shutting down the U.K. Parliament, putting pressure on him to come to a Brexit resolution with the European Union.

- Conclusion: The U.S. economy remains on track for a good year. Despite the markets’ willingness to shrug off trade wars and geopolitical uncertainty, significant challenges are still out there. Investors should prepare for renewed market turbulence as these issues resolve themselves over the coming months.

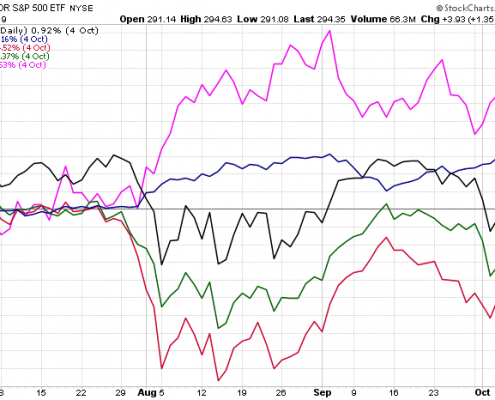

Stock and bond markets rebound from August’s slump

The 3rd quarter was quite a roller coaster ride! Gold and other ‘safe’ assets were the go-to market segments for the quarter. Gold led the way with a return of +4.26%[1], despite a slip in late September. U.S. bonds took second place, edging out U.S. stocks with a return of 2.34% versus 1.75%. International stocks were the top performers in September at +3.7%, but continued to lag the U.S. for the quarter at -0.79%. Emerging markets equities were in second place for the month at +1.91%, but are far behind for the year and quarter, losing -4.75% between July 1st and September 30th.

Market returns 7/1/2019 – 10/4/2019

https://stockcharts.com/h-perf/ui

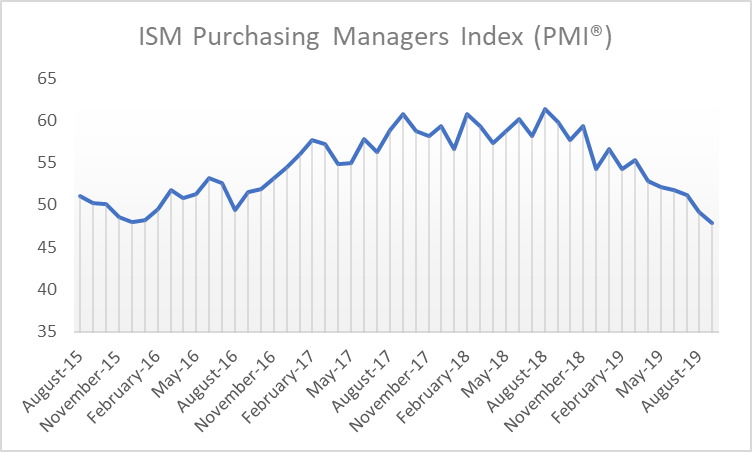

The financial markets continued to react strongly to economic news and geopolitical events, though the magnitude of the swings began to subside. This moderation is a bit surprising given the unexpected -9% drop in Consumer Confidence and the Purchasing Manufacturers Index falling to its lowest level since June 2009. But investor fatigue is bound to set in sooner or later, and current events just seem to build on a base with which investors have become wearily familiar.

Source: https://ycharts.com/indicators/us_pmi

The economy created only 136,000 new jobs in September – certainly nothing to brag about, but good enough this late in the expansion. At the same time, the unemployment rate fell to 3.5% – the lowest in half a century – and the overall employment ratio increased to 61%, the highest since December 2008. Apparently, the U.S. job market is alive and well…at least for the time being.

Despite competing political and economic pressures, U.S. and developed international stock markets are on track for a very strong year. As of October 7, the S&P 500 was up more than 19%, gold was up over 16%, and the Europe, Australasia, and Far East index was up nearly 12%. But be wary of another 4th quarter slump like we saw in 2018! Given mixed economic data, the impeachment inquiry of President Trump, and continuing trade tensions, any of these could derail the markets – at least temporarily – between now and December 31st.

Market returns 1/1/2019 – 10/4/2019

https://stockcharts.com/h-perf/ui

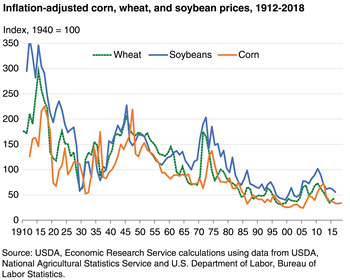

One of the less-reported casualties in the U.S.-China trade war is the agricultural sector. Inflation-adjusted prices for corn, wheat, and soybeans have been declining for decades, largely due to increased productivity and reduced global population growth. Add trade tariffs and the wettest 12 months on record[3], and farmers are facing a ‘perfect storm’ of negative events. Smaller farms are going out of business, and the number of farms in the U.S. is heading below 2 million, the lowest in nearly a century.

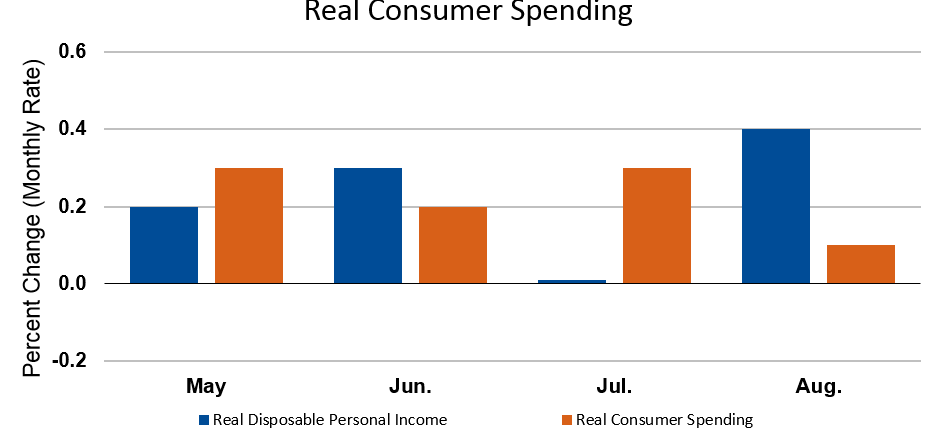

But despite the significant challenges facing the agriculture and manufacturing sectors, the U.S. economy is holding steady. Personal income and consumer spending rose in August for the second month in a row. Retail sales were good, and housing showed signs of renewed activity.

As reported by the Wall Street Journal on September 25, U.S. home-price growth is slowing and mortgage rates are historically low at around 4%[4]. With such low interest rates, home price affordability remains within reach as indicated by the sharp drop in the Case-Shiller Home Price Index in 2019, shown on the chart above.

Forecasters expect housing to contribute slightly to GDP for the first time since 2017 as home sales and construction increased in August.

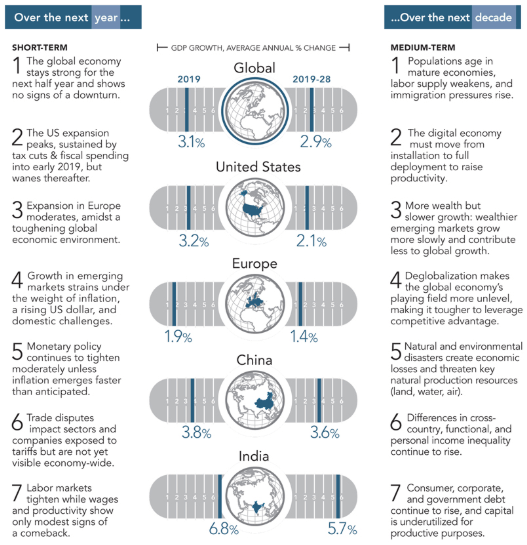

With so much going on in the world, it’s hard to know which direction to turn! For a straightforward summary of the likely impact of these competing economic factors on global growth, we refer you to the graphic below prepared by The Conference Board (publisher of the Leading Economic Indicator index.)

The Conference Board economic outlook

Bottom line: the U.S. economy is on track for solid growth in 2019, slowing somewhat thereafter. A recession is not in the forecast for the next 12 months, though demographic factors point to slower growth worldwide in the coming years.

Given the myriad challenges facing the global economy right now, negative surprises are definitely a possibility as we navigate the final quarter of 2019. Investors may just have to close their eyes, hold on tight to a prudent investment plan, and ride out the inevitable turbulence in the coming months.

Marcia Clark, CFA, MBA

Senior Research Analyst, Warren Street Wealth Advisors

DISCLOSURES

Investment Advisor Representative, Warren Street Wealth Advisors, LLC., a Registered Investment Advisor

The information presented here represents opinions and is not meant as personal or actionable advice to any individual, corporation, or other entity. Any investments discussed carry unique risks and should be carefully considered and reviewed by you and your financial professional. Nothing in this document is a solicitation to buy or sell any securities, or an attempt to furnish personal investment advice. Warren Street Wealth Advisors may own securities referenced in this document. Due to the static nature of content, securities held may change over time and current trades may be contrary to outdated publications.

Form ADV available upon request 714-876-6200

[1] Performance represented by ETFs designed to track various market segments: SPY (S&P 500), AGG (Barclay’s Aggregate Bond index), EEM (emerging markets equity), EFA (developed international equity), GLD (gold prices)

[2] Performance represented by ETFs designed to track various market segments: SPY (S&P 500), AGG (Barclay’s Aggregate Bond index), EEM (emerging markets equity), EFA (developed international equity), GLD (gold prices)

[3] https://www.wsj.com/graphics/us-farmers-miserable-year/?mod=article_inline&mod=hp_lead_pos5

[4] https://blogs.wsj.com/economics/2019/09/25/newsletter-housings-maybe-rebound-chinas-decoupling-warning-and-consumers-cloudy-crystal-ball/?guid=BL-REB-39607&dsk=y

Contact Us

As a Registered Investment Advisor, Warren Street Wealth Advisors, LLC is required to file form ADV to report our business practices and conflicts of interest. Please call to request a copy at 714-876-6200.